The Trial Work Period (TWP) is one of the most important work incentives offered by the Social Security Administration (SSA) for SSDI beneficiaries. This program allows individuals receiving disability benefits to work and earn any amount of money for up to nine months without affecting their SSDI payments. The purpose is simple yet powerful: to provide a risk-free opportunity to assess your ability to work and determine whether you can sustain employment despite your medical condition. The TWP allows you to test your ability to work for at least 9 months while still receiving benefits.

Unlike other benefit programs with strict income limits, the work trial period consists of 9 months (which do not have to be consecutive) within a rolling 60-month period. These months are specifically designed to let you test your ability to work. Whether you earn $500 or $5,000 in a month, your SSDI benefits will continue unchanged during your trial work months.

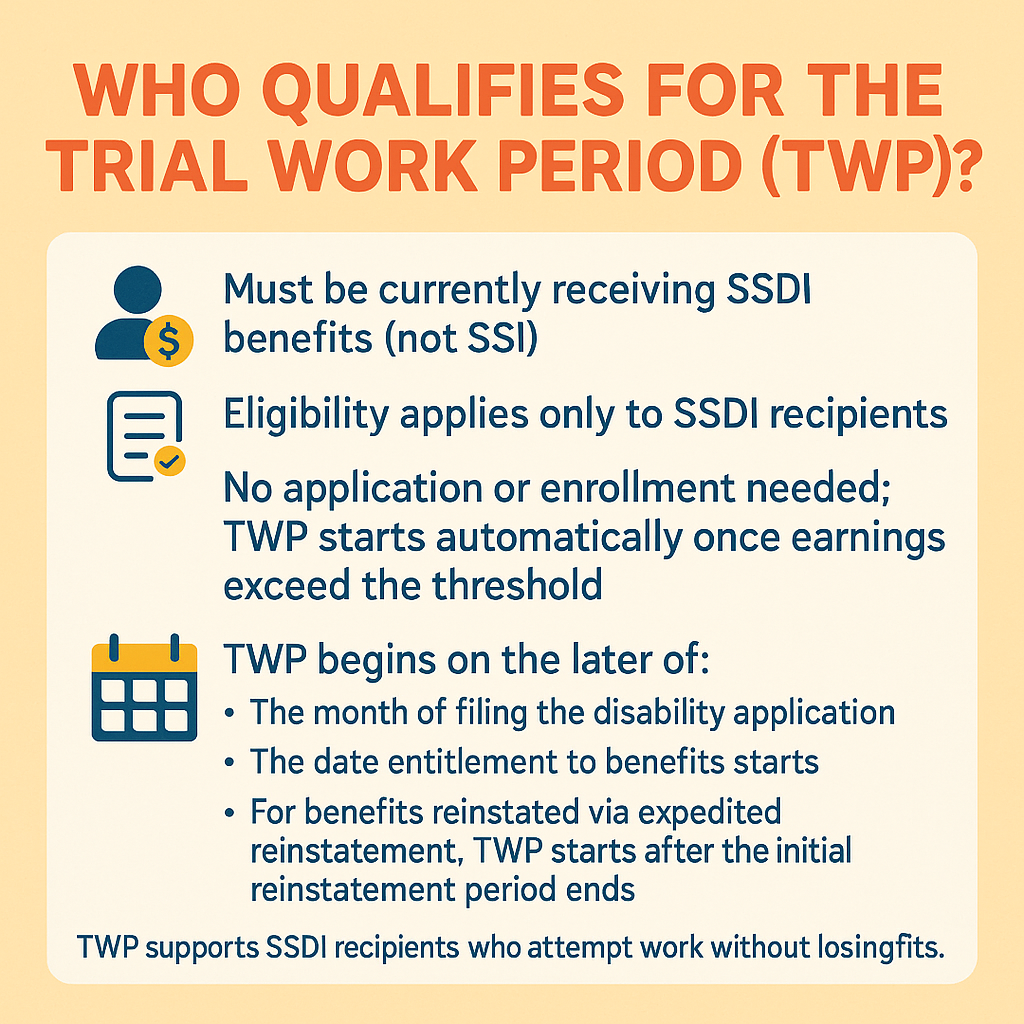

Who Qualifies for the Trial Work Period?

Eligibility for the TWP is straightforward:

- You must be currently receiving SSDI benefits

- The program applies only to SSDI recipients, not SSI

- You don’t need to apply or enroll – it starts automatically when your earnings meet the threshold

The trial work period (TWP) officially begins on the later date of either the month a person files their disability application or the date they become entitled to benefits. The TWP start date is determined by when a person files for disability benefits and when entitlement begins. For those whose benefits were reinstated through expedited reinstatement, the TWP starts after the initial reinstatement period concludes.

How Does the Trial Work Period Function?

The Nine-Month Framework

The work trial period consists of a total number of nine TWP months, also known as “service months,” that do not need to be consecutive. These TWP months are accumulated within a rolling 60-month (five-year) period, allowing individuals a grace period to re-enter the workforce and test their ability to work without risking their Social Security Disability Insurance. This flexibility is especially helpful for those whose health conditions fluctuate or who work intermittently.

Monthly Earnings Thresholds

A month counts as a trial work month when your gross earnings exceed specific SSA-set thresholds:

- 2024: $1,110 per month

- 2025: $1,160 per month

The SSA publishes a table each year that outlines the earnings level required for a month to count as a TWP month.

For self-employed individuals, a month also counts if you work more than 80 hours, regardless of income earned. The SSA automatically tracks these months based on your reported earnings, so accurate reporting is essential.

Key Benefits During TWP

During your nine trial work months:

- No limit on earnings

- People with disabilities continue to receive their full SSDI cash benefit (cash benefits) during the TWP

- Full SSDI benefits continue

- Medicare coverage remains intact

- No benefit reductions or suspensions

What Happens After the Trial Work Period?

The Extended Period of Eligibility (EPE)

Once you’ve completed your nine trial work months (TWP), you complete the Trial Work Period and then enter the Extended Period of Eligibility (EPE), which lasts 36 consecutive months. During this phase, your monthly SSDI eligibility depends on whether your earnings exceed the Substantial Gainful Activity (SGA) amount.

For 2025, the SGA amounts are:

- Non-blind individuals: $1,620 per month

- Statutorily blind individuals: $2,700 per month

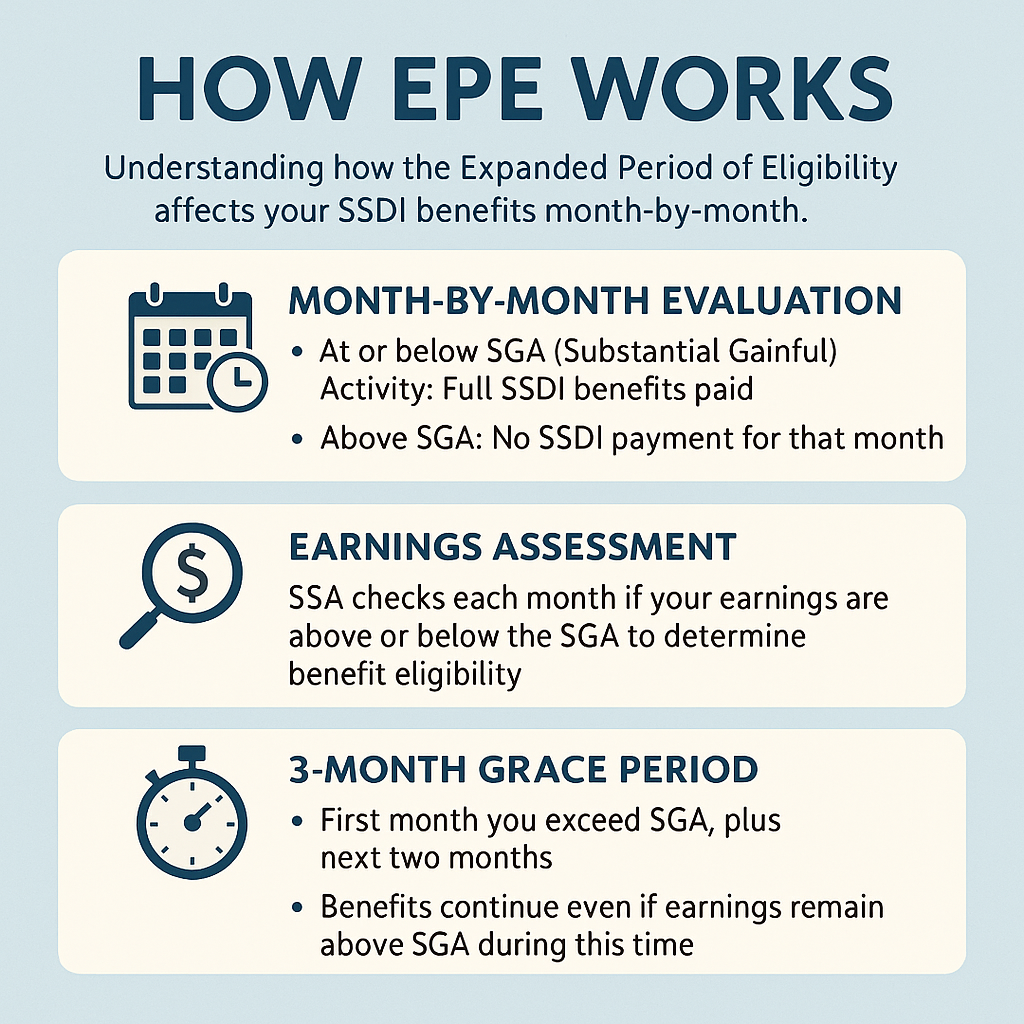

How EPE Works

The EPE operates on a month-by-month basis:

- At or below SGA: You receive your full SSDI benefit

- Above SGA: No SSDI payment for that month

Each month, the SSA will decide whether your earnings are above or below the SGA threshold to determine your benefit eligibility.

There’s also a three-month “grace period” at the beginning of your EPE. For the first month your earnings exceed SGA and the following two months, you’ll still receive benefits even if you continue earning above the threshold.

Income Deductions During EPE

The SSA allows certain deductions when calculating your countable income:

Impairment-Related Work Expenses (IRWEs):

- Special transportation costs

- Medical co-payments

- Personal care assistance

- Specialized equipment or services

These expenses can be deducted from your gross earnings.

Approved Subsidies:

- Extra employer support due to your disability

- Reduced work expectations

- Additional paid breaks

Wage subsidies can also be deducted from your gross earnings.

These deductions can help keep your countable income below the SGA threshold, allowing you to maintain benefits while working.

The Safety Net: Expedited Reinstatement (EXR)

Even with careful planning, returning to work may not always be sustainable. If you need to stop working due to your disability, you may be eligible for expedited reinstatement. The Expedited Reinstatement (EXR) program provides a crucial safety net for those whose benefits ended due to work activity.

EXR Eligibility Requirements

You can apply for expedited reinstatement if:

- Your benefits stopped due to work activity

- Your income falls below SGA or stops within five years after benefits ended

- You’re unable to perform substantial gainful activity

- Your disability is the same as or related to your original impairment

EXR Advantages

- Provisional benefits for up to six months while processing

- Faster process than filing a new application

- Burden of proof is on SSA to show medical improvement

- You typically keep provisional benefits even if ultimately denied

Protecting Your Healthcare Coverage

One of the biggest concerns for SSDI beneficiaries considering work is maintaining Medicare coverage. The good news is that Medicare protections extend well beyond your trial work period:

- Medicare Part A: Continues premium-free during TWP and for 93 additional months (nearly 8 years total)

- Medicare Part B: Can be maintained by continuing premium payments

- Long-term options: You may purchase both Parts A and B if you still have a qualifying disability

Critical Reporting Requirements

Accurate and timely reporting to the SSA is essential for avoiding problems with your benefits. It is important to provide accurate information about your earnings and work activity to the SSA to ensure your records are up to date and your benefits are correctly managed.

What to Report

- All gross monthly earnings

- Hours worked (especially if self-employed)

- Impairment-related work expenses

- Any employer subsidies or accommodations

Consequences of Non-Reporting

- Benefit overpayments that must be repaid

- Potential penalties or benefit suspensions

- Complications with future benefit calculations

Best Practices

- Report all income promptly to the Social Security Administration, even if unsure about its impact

- Keep detailed records of earnings and expenses

- Maintain documentation of work accommodations or subsidies

Common Mistakes to Avoid

Assuming One Trial Work Period Per Lifetime

While you generally get one TWP per period of disability, exceptions exist. If your benefits cease due to work and you later become entitled again through a new application or expedited reinstatement, you may qualify for a new trial work period.

Neglecting to Track Service Months

Many beneficiaries lose track of how many trial work months they’ve used, especially with sporadic work attempts. Keep careful records of when your earnings exceeded the monthly threshold.

Misunderstanding Self-Employment Rules

Self-employed individuals should remember that working more than 80 hours in a month counts as a service month regardless of actual earnings.

Failing to Plan for EPE Transition

The transition from TWP to EPE represents a significant change in how earnings affect benefits. Plan ahead and understand how the SGA threshold will impact your specific situation.

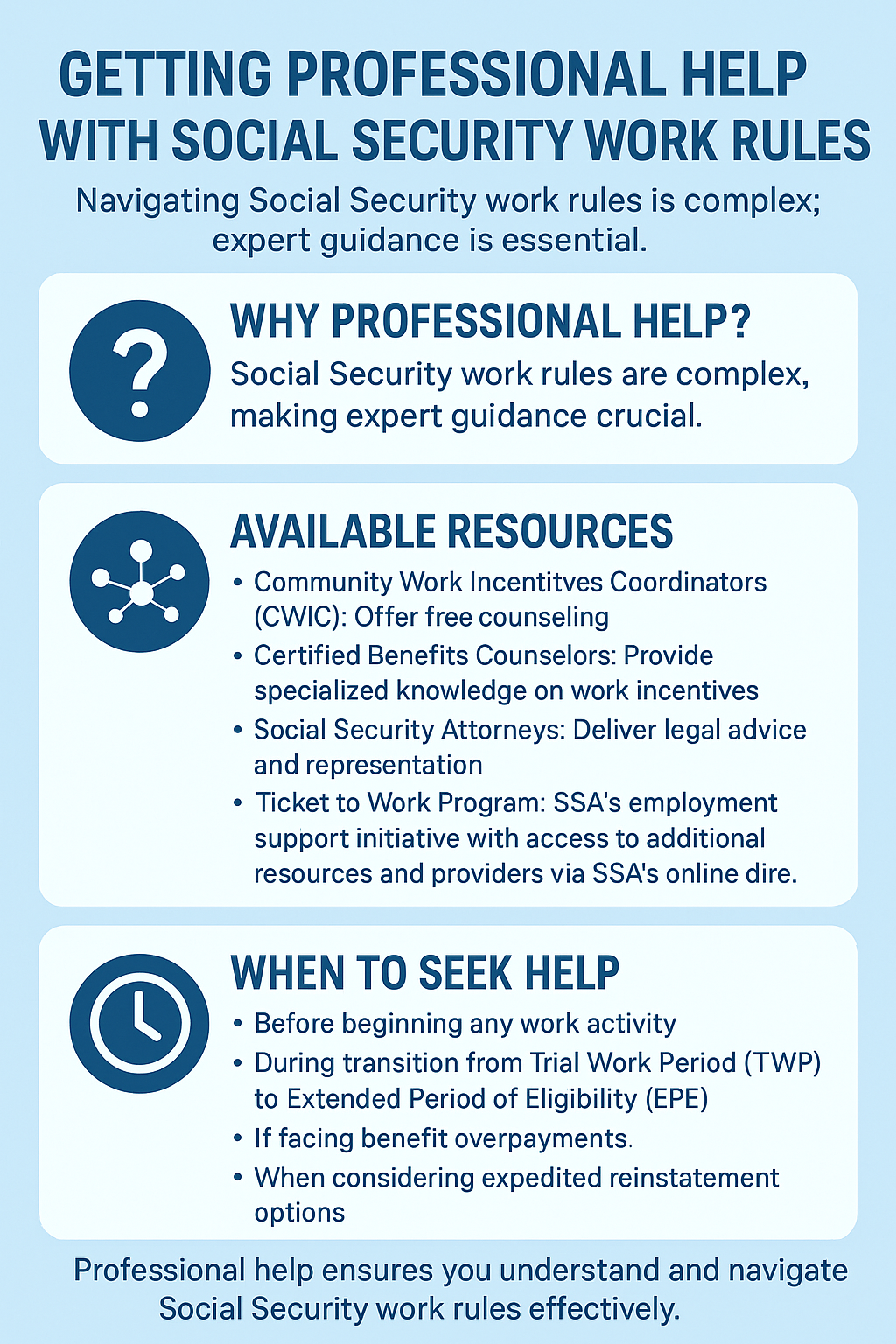

Getting Professional Help

The complexity of Social Security work rules makes professional guidance invaluable:

Available Resources

- Community Work Incentives Coordinators (CWIC): Free counseling services

- Certified Benefits Counselors: Specialized expertise in work incentives

- Social Security Attorneys: Legal representation and advice

- Ticket to Work Program: SSA’s employment support initiative. You can find additional resources and support providers through the Ticket to Work program or by using SSA’s online directories.

When to Seek Help

- Before starting any work activity

- When transitioning from TWP to EPE

- If facing benefit overpayments

- When considering expedited reinstatement

Planning Your Return to Work Strategy

Gradual Approach

Consider starting with part-time or temporary work to test your capabilities while conserving trial work months for when you’re more confident about sustained employment.

Financial Planning

Calculate how various income levels will affect your benefits during different phases, and plan for potential gaps in SSDI payments during EPE.

Health Considerations

Monitor how increased work activity affects your medical condition and maintain regular contact with healthcare providers. Additionally, keep track of whether your work activity impacts your status as a disabled individual under SSA rules, as this can affect your ongoing eligibility for benefits.

Documentation Strategy

Keep comprehensive records of all work-related expenses, accommodations, and medical costs that might qualify as IRWEs. Additionally, maintain documentation of prior work activity and earnings, as these may be relevant for future benefit evaluations.

Conclusion

The social security disability work trial period represents a remarkable opportunity for SSDI beneficiaries to explore their work potential without the immediate fear of losing essential benefits. The Trial Work Period (TWP) is a key work incentive under Social Security Disability Insurance, allowing beneficiaries to test their ability to work while retaining social security disability benefits. By understanding how the TWP, EPE, and EXR programs work together, you can make informed decisions about returning to work while maintaining crucial financial and healthcare protections.

The path back to work while on disability benefits doesn’t have to be navigated alone. With the right knowledge and support, the social security disability work trial period can be the first step toward a more financially independent future while maintaining the security of knowing your benefits remain protected.

Begin today with your benefits journey by taking our free eligibility quiz at Benefits.com.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.