Medicaid is a vital healthcare program that helps millions of Americans access essential medical services. As we move ahead in 2025, it’s important to understand how income limits may change and affect eligibility. This article will explore the expected Medicaid income limits for 2025 and what they mean for you and your family.

Medicaid income limits are set to ensure that those who need financial assistance the most can receive healthcare coverage. These limits are based on the Federal Poverty Level (FPL), which is updated annually to account for inflation and changes in the cost of living. While exact figures for 2025 are not yet available, we can make educated predictions based on current trends and policies.

It’s crucial to note that Medicaid eligibility and income limits can vary by state, as each state has some flexibility in how they implement the program. Some states have expanded Medicaid coverage, while others have not. This means that where you live can significantly impact your eligibility and the Medicaid income limit that applies to you.

Factors Influencing Medicaid Income Limits in 2025

Several factors will influence Medicaid income limits this year. One of the most significant is the potential for policy changes at the federal level. Health care reform efforts and budget decisions can have a substantial impact on funding and financial eligibility criteria for Medicaid benefits.

Economic conditions also play a role in determining income limits. If there’s significant inflation or changes in the cost of living, we may see adjustments to the Federal Poverty Level, which in turn affects Medicaid income limits.

Additionally, state-level decisions will continue to be important. States that have expanded their Medicaid program under the Affordable Care Act typically have higher income limits than those that have not. In 2025, more states may choose to expand their programs, potentially increasing income limits on Medicaid services for many Americans.

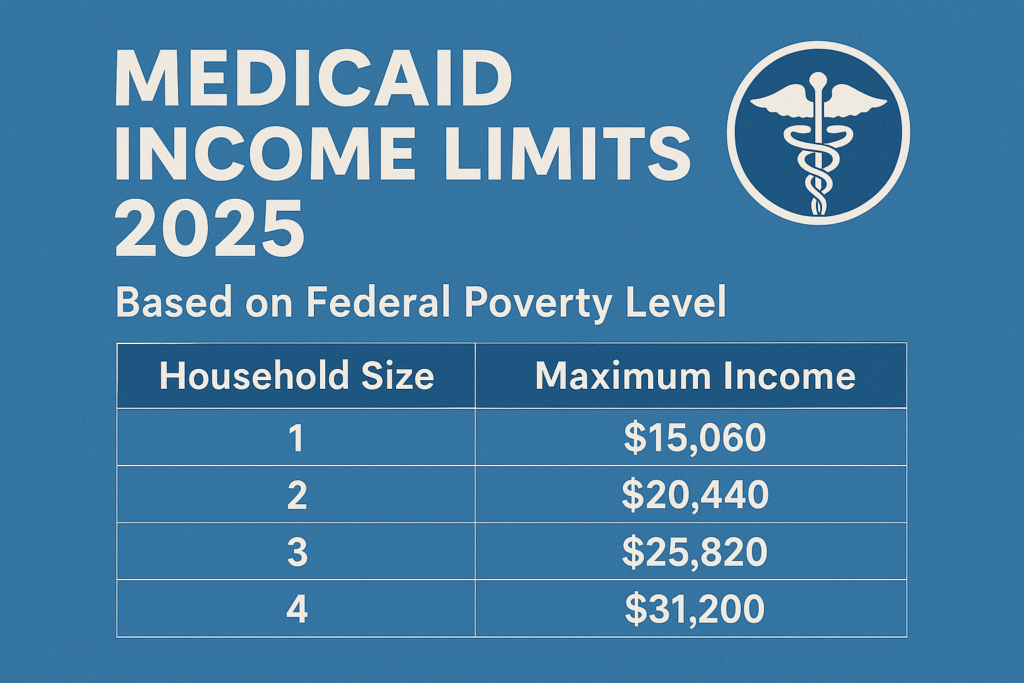

Projected Income Limits for Different Household Sizes

While we can’t provide exact figures for 2025, we can estimate based on current trends. Here’s a general idea of what Medicaid income limits might look like for different household sizes:

– For a single individual: Approximately 138% of the FPL in expansion states

– For a family of two: Around 138% of the FPL in expansion states

– For a family of three: Roughly 138% of the FPL in expansion states

– For a family of four: About 138% of the FPL in expansion states

In non-expansion states, these limits may be lower, often around 100% of the FPL or less, depending on the specific state and category of eligibility.

It’s important to remember that these are estimates and the actual figures may vary. Always check with your state’s Medicaid office for the most up-to-date and accurate information on the Medicaid program in your area.

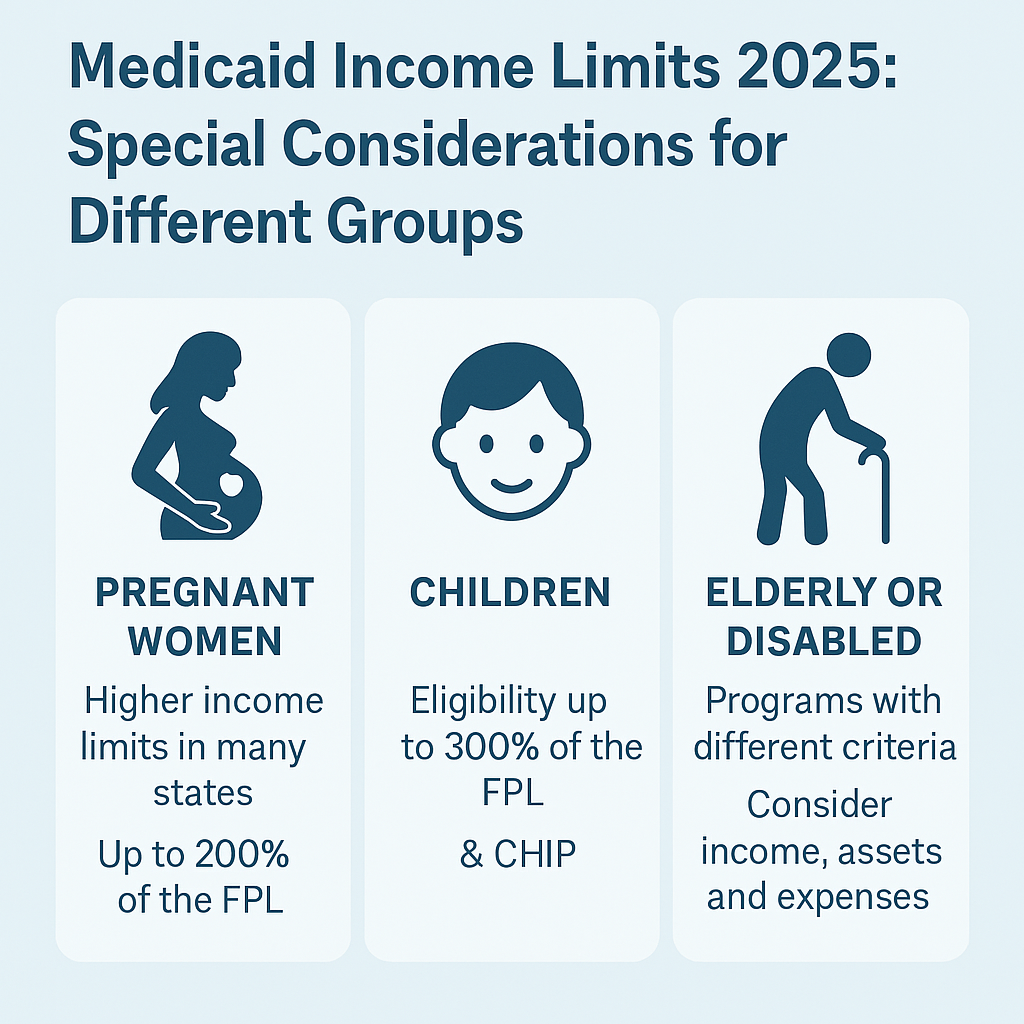

Special Considerations for Different Groups

Medicaid income limits in 2025 will likely continue to have special considerations for certain groups. Pregnant women, children, and elderly or disabled individuals often have a higher Medicaid income limit or different financial eligibility criteria.

For pregnant women, many states offer higher income limits to ensure proper prenatal care. In 2025, we may see more states expanding Medicaid coverage for this group, potentially allowing eligibility up to 200% of the FPL or higher.

Children’s eligibility for Medicaid benefits or the Children’s Health Insurance Program (CHIP) typically has higher income limits than adult eligibility. This trend is likely to continue, with many states potentially offering coverage for children in families with incomes up to 300% of the FPL or more.

Elderly or disabled individuals may qualify for Medicaid through different programs with varying income limits. These programs often consider factors beyond just income, such as assets and medical expenses.

How to Calculate Your Income for Medicaid Eligibility

Understanding how to calculate your income for Medicaid eligibility is crucial. In 2025, the process may become more streamlined, but the basic principles are likely to remain similar.

Medicaid typically uses Modified Adjusted Gross Income (MAGI) to determine eligibility. This includes most types of income, such as wages, self-employment income, unemployment benefits, and Social Security benefits. However, some types of income are not counted, like certain child support payments or veterans’ benefits.

1. Gather all income information for your household

2. Determine which income sources count towards MAGI

3. Add up the countable income

4. Compare your total to the Medicaid income limits for your state and household size

Remember, Medicaid looks at monthly income, so you may need to divide annual figures by 12 to get an accurate monthly amount.

What to Do If You’re Over the Income Limit

If you find that your income is over the Medicaid limit for 2025, don’t lose hope. There may still be options available to help you access affordable health care:

1. Check for a “medically needy” program in your state, which allows you to deduct medical expenses from your income to qualify

2. Look into your state’s Health Insurance Marketplace for subsidized plans

3. Explore charity care programs at local hospitals or clinics

4. Consider adjusting your income through legal means, such as contributing to a retirement account

It’s also worth noting that some states have “spend-down” programs that allow individuals to qualify for Medicaid by incurring medical expenses that bring their income below the eligibility threshold.

The Impact of Assets on Medicaid Eligibility

While income is a primary factor in Medicaid eligibility, assets can also play a role, especially for certain programs. The asset limit may change, but will likely still be a consideration for some applicants.

For many Medicaid programs, there are limits on the amount of assets an individual or family can have. The asset limit will often exclude certain types of assets, such as a primary residence or a vehicle used for transportation.

It’s important to understand that asset rules can be complex and vary by state and program. Some long term care Medicaid programs, for example, have stricter asset limits and may look back at asset transfers made in the past five years.

If you’re concerned about asset limits, consider speaking with a Medicaid planning professional who can help you understand your options and plan accordingly.

Changes in Medicaid Expansion and Their Effect on Income Limits

The landscape of Medicaid expansion could look different in 2025, potentially affecting income limits for many Americans. As of now, not all states have expanded Medicaid under the Affordable Care Act. However, this could change in the coming years.

If more states choose to expand Medicaid, we could see income limits increase to 138% of the FPL in those states for most adults under 65. This would represent a significant increase in eligibility for many individuals and families.

Additionally, there may be federal efforts to encourage or require Medicaid expansion in all states. If successful, this could lead to more uniform income limits across the country, potentially simplifying the eligibility process for many applicants.

Preparing for Potential Changes in Medicaid Income Limits

It’s wise to prepare for potential changes in Medicaid income limits. Here are some steps you can take:

1. Stay informed about healthcare policy changes at both the federal and state level

2. Regularly check your state’s Medicaid website for updates on income limits and eligibility criteria

3. Keep accurate records of your income and assets

4. Consider consulting with a healthcare navigator or Medicaid specialist for personalized advice

5. Explore all healthcare options, including Medicaid, marketplace plans, and employer-sponsored coverage

By staying informed and prepared, you can better navigate any changes to Medicaid income limits that may occur in 2025.

Resources for Further Information

While we’ve covered a lot of ground regarding Medicaid income limits for 2025, you may still have questions or need more specific information. Here are some valuable resources to help you stay informed:

– Your state’s Medicaid office website

– The official Medicaid.gov website

– Healthcare.gov for information on marketplace plans and subsidies

– Local community health centers or social services offices

– Non-profit organizations that focus on healthcare access and advocacy

Remember, healthcare policies and programs can change, so it’s important to check these resources regularly for the most up-to-date information on Medicaid income limits and eligibility criteria.

By understanding Medicaid income limits and staying informed about potential changes, you can better prepare for your healthcare needs. Whether you’re currently on Medicaid, anticipating a need for coverage, or simply want to be informed, knowledge is power when it comes to navigating the healthcare system.

At Benefits.com, we are here to help you navigate the process and receive the benefits you deserve. Begin today by taking our free eligibility quiz.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.