The Warrior Dividend was announced by President Donald Trump in December 2025 as a patriotic bonus in honor of the nation’s founding. This program delivers a one-time payment of exactly $1,776 to eligible military personnel—a figure deliberately chosen to commemorate the nation’s founding in 1776 and the 250th anniversary of the United States.

The initiative is a one-time Basic Allowance for Housing supplement, not a bonus or gift from the president, and is funded through a $2.9 billion Congressional appropriation within the One Big Beautiful Bill. Congress appropriated $2.9 billion to the Department of War to supplement the Basic Allowance for Housing entitlement, and the Defense Department and Department of Homeland Security are responsible for disbursing the funds.

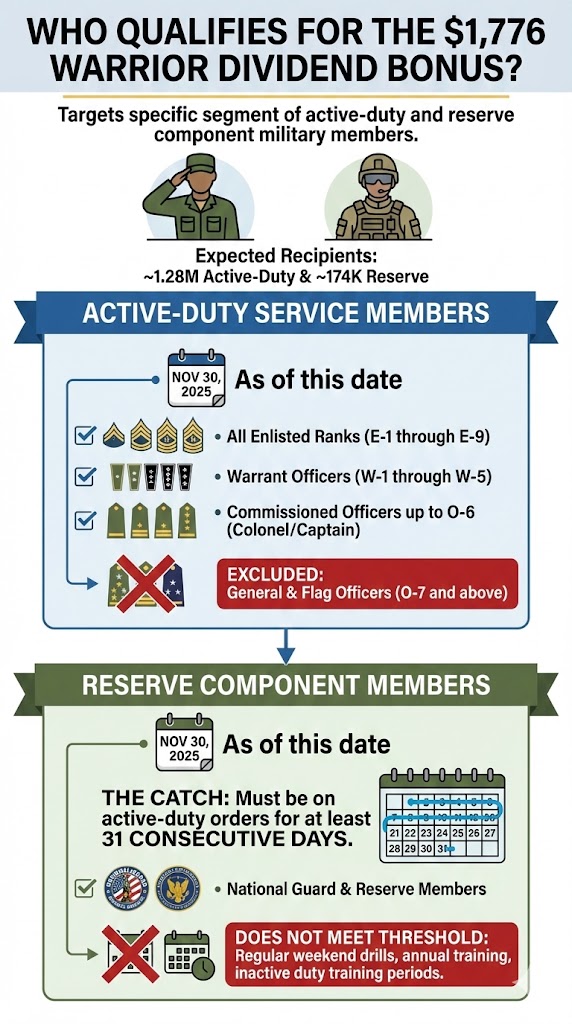

Who Qualifies for the $1,776 Warrior Dividend Bonus?

The warrior dividend bonus targets a specific—but broad—segment of the military population, including both active-duty and reserve component military members.

Approximately 1.28 million active-duty and 174,000 reserve component military members are expected to receive the Warrior Dividend.

Active-Duty Service Members

Eligible service members, specifically active-duty component military members in pay grades O-6 and below as of November 30, 2025, are the primary recipients. This includes:

- All enlisted ranks (E-1 through E-9)

- Warrant officers (W-1 through W-5)

- Commissioned officers up to O-6 (Colonel in the Army, Air Force, Marine Corps, and Space Force; Captain in the Navy and Coast Guard)

Importantly, general and flag officers (O-7 and above) are explicitly excluded from receiving the bonus.

Reserve Component Members

Reserve component military members, including National Guard and Reserve members, can also qualify, but there’s a catch: they must have been on active-duty orders for at least 31 consecutive days as of November 30, 2025.

A total of 174,000 reserve component military are expected to receive the payment.

Regular weekend drills, annual training, or inactive duty training periods typically don’t meet this threshold.

When and How Will Payments Be Distributed?

Service members won’t need to lift a finger to receive the warrior dividend bonus. The Department of Defense is responsible for disbursing the one time warrior dividend, ensuring all eligible service members receive this benefit. The payment is a nontaxable supplement issued alongside the regular monthly housing allowance, and funds will be deposited directly into service members’ bank accounts.

Payment Timeline

During a prime time address to the nation from the White House, President Trump announced the warrior dividend before Christmas, stating that “the checks are already on the way,” with distribution anticipated before Christmas 2025. The specific target date is December 20, 2025, giving military families access to these funds during the holiday season.

How to Verify Your Payment

- Check your myPay account for Leave and Earnings Statement (LES) updates

- Look for a distinct entitlement line item confirming the deposit

- Funds will arrive via your existing direct deposit channels

No application, enrollment, or additional action is required. If you’re eligible based on the criteria, the payment will automatically process through DFAS.

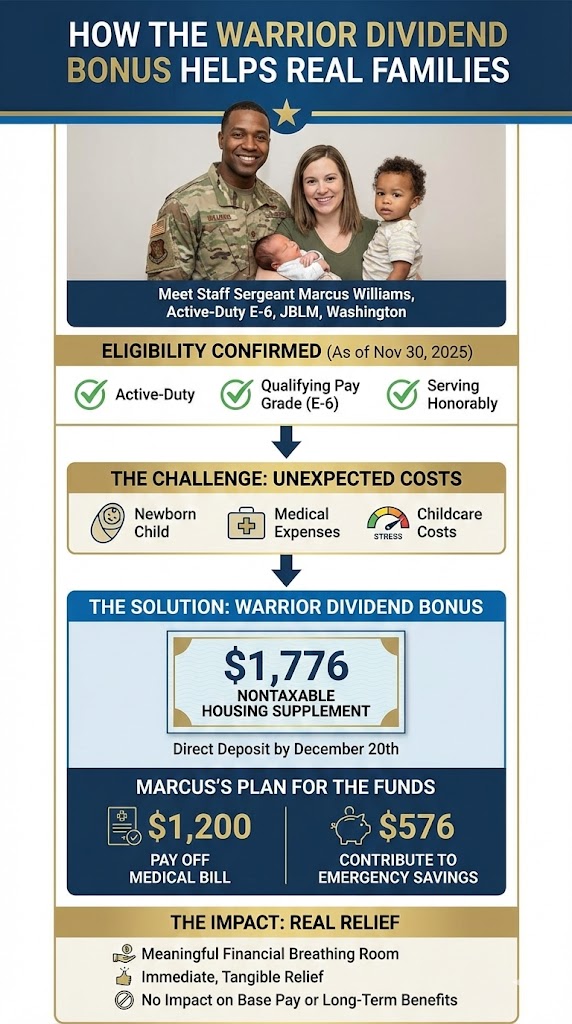

How the Warrior Dividend Bonus Helps Real Families

Meet Staff Sergeant Marcus Williams, an active-duty E-6 stationed at Joint Base Lewis-McChord, Washington. As of November 30, 2025, Marcus met all eligibility requirements for the warrior dividend bonus—he’s active-duty, in a qualifying pay grade, and serving honorably.

Marcus and his wife recently welcomed their second child, which brought unexpected medical expenses and increased childcare costs. The $1,776 nontaxable housing supplement, provided as part of the warrior dividend program for military members, will be deposited directly into his bank account by December 20th.

His plan? Use the funds to:

- Pay off $1,200 remaining on a medical bill

- Contribute $576 to his emergency savings fund

For Marcus’s family, this nontaxable supplement provides meaningful financial breathing room during an expensive time of year. It won’t change his base pay or long-term benefits, but it delivers immediate, tangible relief when his family needs it most.

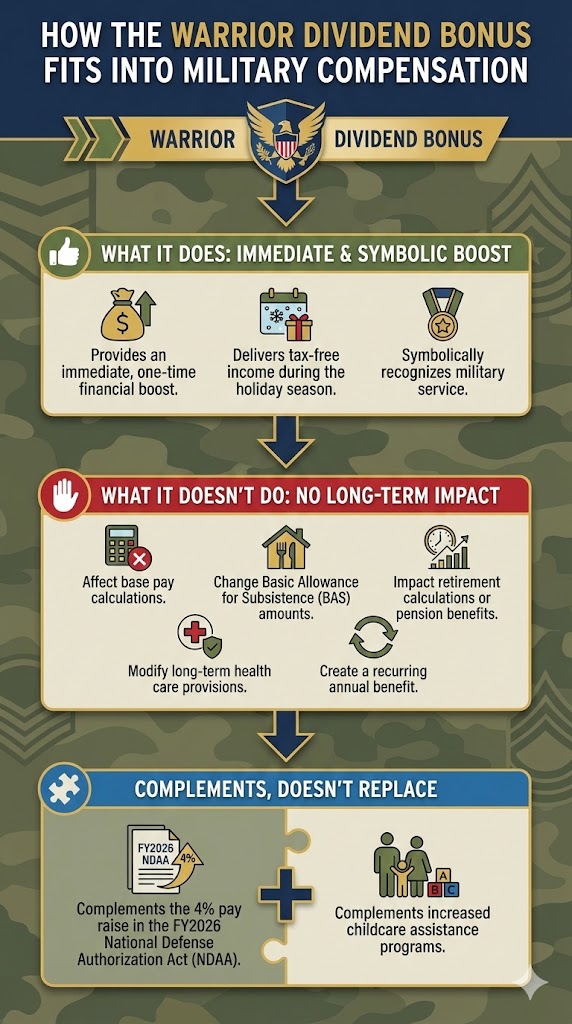

How the Warrior Dividend Fits Into Military Compensation

What It Does

- Provides an immediate, one-time financial boost

- Delivers tax-free income during the holiday season

- Symbolically recognizes military service

What It Doesn’t Do

- Affect base pay calculations

- Change Basic Allowance for Subsistence (BAS) amounts

- Impact retirement calculations or pension benefits

- Modify long-term health care provisions

- Create a recurring annual benefit

The warrior dividend bonus complements—rather than replaces—other military compensation initiatives, including the 4% pay raise included in the fiscal year 2026 National Defense Authorization Act (NDAA) and increased childcare assistance programs.

Frequently Asked Questions About the Warrior Dividend Bonus

Q1: What exactly is the warrior dividend bonus?

A: The warrior dividend bonus is a one-time, tax-free payment of $1,776 for eligible U.S. military service members, announced by President Donald Trump to honor the 250th anniversary of the U.S. military. A senior administration official confirmed that this payment is a one-time basic allowance supplement, not a presidential gift.

Q2: Who is eligible for the $1,776 warrior dividend bonus?

A: Eligible service members, including army personnel in pay grades O-6 and below as of November 30, 2025, qualify for the payment. Reserve component military members on active-duty orders for 31 days or more as of the same date are also included. General/flag officers, veterans, and retirees are excluded.

Q3: Is the warrior dividend bonus taxable?

A: No. The payment is a nontaxable supplement, structured as a one-time, tax-free bonus under the ‘Warrior Dividend’ program. This payment was established through recent government legislation as a gesture of appreciation for military service. No federal, state, or FICA taxes apply.

Q4: When will I receive the warrior dividend bonus?

A: The payment is expected by December 20, 2025—before Christmas. The checks were already processing before the announcement. Check your myPay Leave and Earnings Statement (LES) for confirmation.

Q5: Do I need to apply for the warrior dividend bonus?

A: No application is required. The department and Pentagon officials process warrior dividend payments automatically, using military pay and personnel records. Payments are disbursed through existing direct deposit channels without any action needed from service members.

Q6: Does this bonus affect my regular military pay or benefits?

A: No. The warrior dividend is a standalone, one-time basic allowance supplement, specifically appropriated by Congress to address housing cost issues. It does not affect base pay, annual raises, BAS, retirement calculations, or any other existing benefits.

Q7: Can National Guard and Reserve members receive the bonus?

A: Yes, but only if they were on active-duty orders for at least 31 consecutive days as of November 30, 2025. Regular weekend drills or inactive duty training don’t qualify. This means reserve component military members, such as those in the National Guard and Reserves, are eligible for the warrior dividend if they meet the active-duty requirement.

The warrior dividend bonus represents a meaningful, if one-time, financial gesture toward the men and women serving in America’s armed forces, highlighting the importance of supporting service members. With $1,776 arriving tax-free before Christmas 2025, approximately 1.45 million service members will receive a direct benefit that requires no paperwork, no applications, and no waiting.

Whether you’re planning to pay down debt, boost your emergency fund, or simply enjoy the holidays with a little extra cushion, this bonus delivers real value during a season when it matters most. Keep an eye on your myPay account, and if you meet the eligibility criteria, expect to see those funds hit your account by December 20, 2025.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.