New York Disability Services provides New Yorkers with access to both state and federal benefits. Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are federal programs that provide financial assistance to individuals who are unable to work due to a disability.

Though these benefit programs are federally funded, eligibility is determined at the state level by the Division of Disability Determinations in Albany, a branch of the Office of Temporary and Disability Assistance (OTDA). New York has 67 Social Security offices throughout the state, as well as eight Offices of Hearings and Appeals (OHA).

In addition to federal benefits and services, New York residents may also qualify for state unemployment benefits, short-term disability, paid family leave, Medicaid, or workers’ compensation for total and partial disability claims.

Facts About New York

New Yorkers with disabilities make up nearly 25% of the state’s population, with most conditions being mobility-related or a mental disability. New Yorkers with disabilities are more likely than their non-disabled counterparts to be obese and over twice as likely to have diabetes, heart disease, and smoke.

New York state has a relatively high approval rating for first-time disability claims, with around 57% receiving benefits with their initial application. Those who don’t receive SSI or SSDI benefits on the first round can appeal the decision as well as pursue short-term disability coverage with the state.

How To Qualify for SSDI in New York

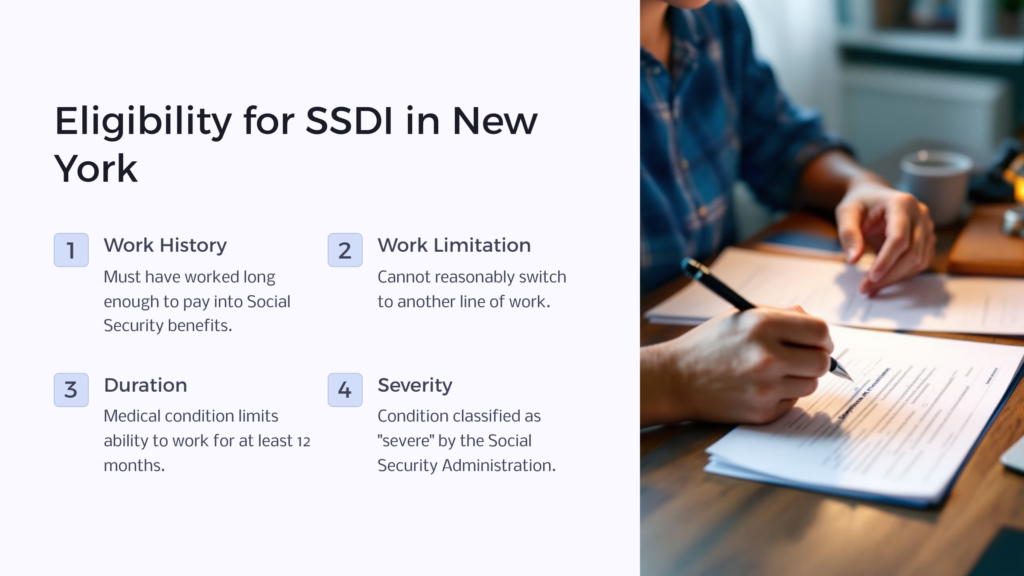

New Yorkers must meet the following federal disability criteria to qualify for a monthly benefit from SSDI:

- Have worked long enough to pay into your Social Security benefits

- You cannot reasonably switch over to another line of work. Note however that if you are working, your current employer is required to make a reasonable accommodation to assist you in performing your job.

- Your medical condition limits your ability to work for at least 12 months. This can be a physical, intellectual, or developmental disability.

- Your condition is classified as “severe” by the SSA. They have compiled a comprehensive list that outlines all acceptable conditions. It is highly recommended you consult this list to ensure your disability is included or else you will not be approved for benefits.

Meeting the criteria does not guarantee you disability insurance coverage. Your disability claim will still be reviewed by the Division of Disability Determinations.

How To Apply for SSDI in New York

You can apply for Social Security Disability in one of three ways: online, over the phone, or in person. To apply online, submit your application by creating an account on SSA.gov. You can also call the Social Security office directly at 800-772-1213 and a representative will walk you through the application process.

If you prefer to make your application in person, contact your closest New York field office to set up an appointment.

It will speed up the process to gather any relevant information and documents ahead of time. Below is a general list of requirements, but you may be asked to provide more or less based on your specific case:

- Personal information: birth certificate or permanent resident card, marriage or divorce records, military records, vital details about any minor children

- Current employment or self-employment information

- Bank account information for direct deposit

- Personal or professional references like a doctor or family member who can certify your conditions

- Medical history about your disability like records of physical and mental health, tests, and names of doctors

- Job and education history for at least the last two years

How To Appeal a Denial in New York

Although New York has a high initial approval rating (58%), this still means roughly 42% of applicants are denied the first time. This could happen if you don’t meet the federal criteria, but also if you failed to provide enough evidence to support your claim.

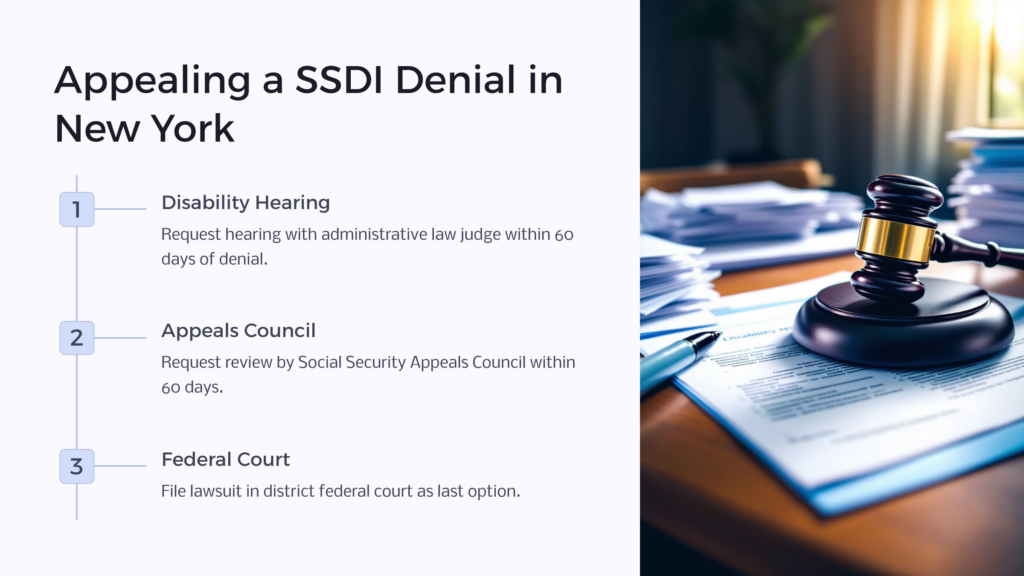

There are four levels of the appeal process, but New York is unique in that applicants can skip the first step (reconsideration) and go straight to a disability hearing.

Step 1: Reconsideration – This step is unnecessary for those seeking New York disability. If you wish to appeal your denial, proceed directly to step 2.

Step 2: Disability Hearing – The first step for New Yorkers is to request a hearing with an administrative law judge. This request must be made within 60 days of your first denial, and your hearing will be scheduled in person at your closest SSA Hearing Office.

You will likely be asked to bring additional documentation about your disability, and many people choose to obtain legal advice at this point. Unfortunately, these hearings can sometimes take more than a year to be scheduled, making it imperative you take this step as soon as possible.

Step 3: Appeals Council – If your hearing was unsuccessful, you have 60 days to request the Social Security Appeals Council review your case. A judge on the council will look at the previous ruling to see if an error was made and will either remand the case to the prior ruling or make a new determination.

Step 4: Federal Court – Your last option is to file a lawsuit by appealing to the district federal court. There are four district federal courts in New York representing the Northern, Eastern, Southern, and Western districts. It’s a good idea to retain the counsel of an experienced disability attorney.

More New York Benefits

SSI

Supplemental Security Income (SSI) is another federal disability program run by the SSA. SSI provides monthly cash benefits for low-income New York residents who are either disabled or over age 65. All applicants must meet income eligibility requirements.

New York Medicaid

You must be receiving SSI benefits in New York to qualify for New York Medicaid. Medicaid is a health insurance subsidy program for low-income residents, those with qualifying disabilities, pregnant women, families with dependent children, and seniors 65 and older who meet the income requirements.

To qualify for New York Medicaid, an individual’s income can be no more than $10,600 annually. If you currently have health coverage with a private insurance carrier, you should not cancel it as sometimes Medicaid can help pay this premium.

Temporary Disability Benefits

New York state also offers temporary disability benefits (sometimes called statutory disability) for eligible employees who are unable to work due to a non-work related illness or injury. New York State Insurance Fund (NYSIF) provides these benefits only to the worker who is disabled, and it does not carry over to an ill family member. Additionally, to receive this disability benefits insurance, you must be working for a “covered employer,” which is any private sector employer with one or more employees.

There may also be disability retirement benefits available to those who are unable to continue working and must take retirement early, or those who have become disabled due to performing their work duties (known as Performance of Duty Disability). The New York State & Local Retirement System (NYSLRS) provides both these disability retirement benefits as well as an accidental disability benefit to those who have become disabled due to an on-the-job accident.

There are additional Paid Family Leave (PFL) benefits that are available for those who need time to bond with a new child, take care of an ill family member, or manage the transition of a military spouse who has been deployed abroad.

Cash benefits can be collected for up to 26 weeks and are based on the employee’s average weekly wage over the last eight weeks. The weekly payments cannot exceed $170. PFL beneficiaries can receive up to 67% of their average weekly wage for up to 12 weeks

New York Unemployment

New York Unemployment benefits provide temporary benefits to those who have lost their job through no fault of their own. The program is run through the New York Department of Labor and is funded through employer contributions. The maximum weekly benefit is $504 and can be collected for up to 26 weeks.

New York Social Security Offices

| SSA Field Office Locations in New York | ||

| NY Midtown SSA Office | 237 W 48Th Street 5th Floor New York, NY 10036 | (866) 964-0783 |

| Syracuse SSA Office | 100 S Clinton St Fed Bldg 4th Floor Syracuse, NY 13261 | (866) 755-4884 |

| Albany SSA Office | 11 A Clinton Ave Rm 430 Federal Bldg Albany, NY 12207 | (866) 253-9183 |

| Buffalo SSA Office | 186 Exchange Street Suite 100 Buffalo, NY 14204 | (855) 881-0213 |

| Binghamton SSA Office | 2 Court Street Suite 300 Binghamton, NY 13901 | (866) 964-3971 |

| Schenectady SSA Office | One Broadway Center 8th Floor Schenectady, NY 12305 | (866) 964-1296 |

| Boro Hall SSA Office | 195 Montague St 7Th Floor Brooklyn, NY 11201 | (877) 531-4725 |

| Rochester SSA Office | 2nd Floor 200 E. Main St Rochester, NY 14604 | (866) 964-2045 |

| NY Downtown SSA Office | 123 William St 4th Floor New York, NY 10038 | (866) 335-1089 |

| Utica SSA Office | 10 Broad Street Federal Building Utica, NY 13501 | (877) 405-6750 |

| Jamestown SSA Office | 321 Hazeltine Ave Jamestown, NY 14701 | (877) 319-3079 |

| South Bronx SSA Office | West, 3rd Fl 820 Concourse Village Bronx, NY 10451 | (855) 531-1684 |

| Yonkers SSA Office | 20 South Broadway Ste 1000 Yonkers, NY 10701 | (866) 331-6404 |

| Horseheads SSA Office | Suite 19 3345 Chambers Rd Horseheads, NY 14845 | (866) 964-1715 |

| Niagara Falls SSA Office | 6540 Niagara Falls Bvd Niagara Falls, NY 14304 | (877) 480-4992 |

| Ogdensburg SSA Office | 101 Ford Street Ogdensburg, NY 13669 | (866) 572-8369 |

| NY Uptown SSA Office | 4th Floor 302 West 126th Street New York, NY 10027 | (866) 964-1301 |

| Newburgh SSA Office | 3 Washington Center Suite 301 Newburgh, NY 12550 | (866) 504-4801 |

| Rego Park SSA Office | 6344 Austin Street Rego Park, NY 11374 | (877) 255-1506 |

| Jamaica SSA Office | 155-10 Jamaica Ave 3rd Fl District Office Jamaica, NY 11432 | (866) 592-0802 |

| Staten Island SSA Office | 2391 Richmond Avenue Staten Island, NY 10314 | (866) 331-5288 |

| Gloversville SSA Office | 13 N Arlington Ave Gloversville, NY 12078 | (888) 528-9446 |

| Oswego SSA Office | 17 Fourth Ave Oswego, NY 13126 | (866) 964-7593 |

| Plattsburgh SSA Office | 14 Durkee St Suite 230 Plattsburgh, NY 12901 | (866) 964-7430 |

| Queensbury SSA Office | 17 Cronin Rd Suite 1 Queensbury, NY 12804 | (877) 405-4875 |

| Brooklyn Flatbush SSA Office | 2250 Nostrand Ave Brooklyn, NY 11210 | (866) 563-9461 |

| New Rochelle SSA Office | 85 Harrison St Street Level New Rochelle, NY 10801 | (855) 210-1026 |

| Watertown SSA Office | 156 Bellew Ave South Watertown, NY 13601 | (866) 627-6995 |

| Troy SSA Office | 500 Federal St Suite 101 Troy, NY 12180 | (866) 770-2662 |

| North Bronx SSA Office | 2501 Grand Concourse 2nd Floor Bronx, NY 10468 | (877) 619-2852 |

| Poughkeepsie SSA Office | 332 Main St Poughkeepsie, NY 12601 | (877) 405-6747 |

| Inwood Hill SSA Office | 4941 Broadway New York, NY 10034 | (877) 445-0838 |

| Brooklyn Bushwick SSA Office | 785 Flushing Ave Third Floor Brooklyn, NY 11206 | (888) 327-1276 |

| Patchogue SSA Office | 75 Oak Street Patchogue, NY 1 772 | (866) 771-1991 |

| Brooklyn New Utrecht | 7714 17 Avenue Brooklyn, NY 11214 | (866) 585-9320 |

| Mineola SSA Office | 211 Station Rd 5Th Floor Mineola, NY 11501 | (866) 758-1318 |

| Cypress Hills | 3386 Fulton Street Brooklyn, NY 11208 | (866) 613-2767 |

| Corning SSA Office | 200 Nasser Civic Ctr Corning, NY 14830 | (866) 591-3665 |

| Geneva SSA Office | 15 Lewis St Geneva, NY 14456 | (866) 331-7759 |

| Olean SSA Office | 1618 W State St Olean, NY 14760 | (877) 319-5773 |

| Batavia SSA Office | 571 East Main Street Batavia, NY 14020 | (866) 931-7103 |

| Melville SSA Office | 1121 Walt Whitman Rd Suite 201 Melville, NY 11747 | (866) 964-0165 |

| Oneonta SSA Office | 31 Main St Suite 1 Oneonta, NY 13820 | (877) 628-6581 |

| East Bronx SSA Office | 1380 Parker Street 2nd Floor Bronx, NY 10462 | (866) 931-2526 |

| White Plains SSA Office | 297 Knollwood Rd Suite 4A White Plains, NY 10607 | (866) 331-8134 |

| West Nyack SSA Office | 240 West Nyack Road West Nyack, NY 10994 | (866) 755-4334 |

| Flushing SSA Office | 138-50 Barclay Ave Flushing, NY 11355 | (877) 457-1735 |

| Freeport SSA Office | 84 N. Main Street Freeport, NY 11520 | (866) 964-0028 |

| Ithaca SSA Office | 127 W State Street 2nd Floor Ithaca, NY 14850 | (866) 706-8289 |

| Hudson SSA Office | 747 Warren Street Hudson, NY 12534 | (877) 828-1691 |

| Monticello SSA Office | 60 Jefferson St Suite 4 Monticello, NY 12701 | (855) 794-4728 |

| NY East Harlem SSA Office | 4th Floor 345 E 102 Street New York, NY 10029 | (877) 445-0836 |

| Bronx Hunts Point SSA Office | 1029 E 163rd Street 3rd Floor Bronx, NY 10459 | (866) 220-9777 |

| Bedford Heights SSA Office | 1540 Fulton Street Brooklyn, NY 11216 | (866) 592-4845 |

| Rockaway Park SSA Office | 11306 Rockaway Bch Blvd Rockaway Park, NY 11694 | (866) 331-2310 |

| Riverhead SSA Office | 526 East Main Street Riverhead, NY 11901 | (888) 397-9819 |

| Laconia Avenue | 3247 Laconia Ave Bronx, NY 10469 | (866) 347-0054 |

| Peekskill SSA Office | One Park Place 3rd Floor Peekskill, NY 10566 | (877) 840-5778 |

| East Village | 650 East 12th St New York, NY 10009 | (877) 405-1447 |

| Ridge Road SSA Office | 1900 Ridge Rd Suite 120 West Seneca, NY 14224 | (800) 647-9195 |

| West Babylon SSA Office | 510 Park Avenue West Babylon, NY 11704 | (866) 964-7375 |

| Long Island City | 31-08 37Th Avenue Ground Floor Long Island City, NY 11101 | (866) 837-1096 |

| Dunkirk SSA Office | 437 Main St Suite 2 Dunkirk, NY 14048 | (888) 862-2139 |

| West Farms SSA Office | 1829 Southern Blvd Bronx, NY 10460 | (866) 964-2558 |

| Canarsie SSA Office | 1871 Rockaway Parkway Brooklyn, NY 11236 | (866) 667-7342 |

| Hylan Blvd SSA Office | 1510 Hylan Blvd 2nd Floor Staten Island, NY 10305 | (877) 457-1736 |

| Greece SSA Office | 4050 W Ridge Rd 2nd Floor Rochester, NY 14626 | (866) 331-2204 |

New York Hearing and Appeal Offices

New York is in Region 2 (New York), which services New Jersey, New York, Puerto Rico, and U.S. Virgin Islands.

| Region 2 – SSA Office of Hearing Operations in New York | ||

| SSA Hearing Office – New York | 26 Federal Plaza Room 34-102 New York, NY 10278 | (212) 264-4036 |

| SSA Hearing Office – Albany | 12 Corporate Woods Blvd 2nd Floor Albany, NY 12211 | (866) 643-3035 |

| SSA Hearing Office – Bronx | 220 East 161st Street Suite 200 Bronx, NY 10451 | (866) 563-9573 |

| SSA Hearing Office – Buffalo | 130 Delaware Avenue 2nd Floor Buffalo, NY 14202 | (866) 348-5819 |

| SSA Hearing Office – Central Islip | 730 Federal Plaza Central Islip, NY 11722 | (866) 931-4494 |

| SSA Hearing Office – New York | 26 Federal Plaza Room 2909 New York, NY 10278-0035 | (877) 405-6744 |

| SSA Hearing Office – New York | 201 Varick Street Room 315 New York, NY 10014-9998 | (866) 964-9971 |

| SSA Hearing Office – Jamaica | 155-10 Jamaica Ave 2nd Floor Jamaica, NY 11432 | (866) 931-6092 |

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.