Social Security disability benefits are available for Minnesotans who meet certain requirements. The Social Security Administration (SSA) provides disability benefits to Americans who are unable to work due to their disability. There are two Social Security benefits programs available for residents of Minnesota.

The first Social Security program is the Social Security Disability Insurance (SSDI). SSDI benefits are available for people with disabilities who have paid Social Security taxes. Supplemental Security Income (SSI), on the other hand, is available for low-income Americans who are disabled, pregnant, or over age 65.

Facts About Minnesota

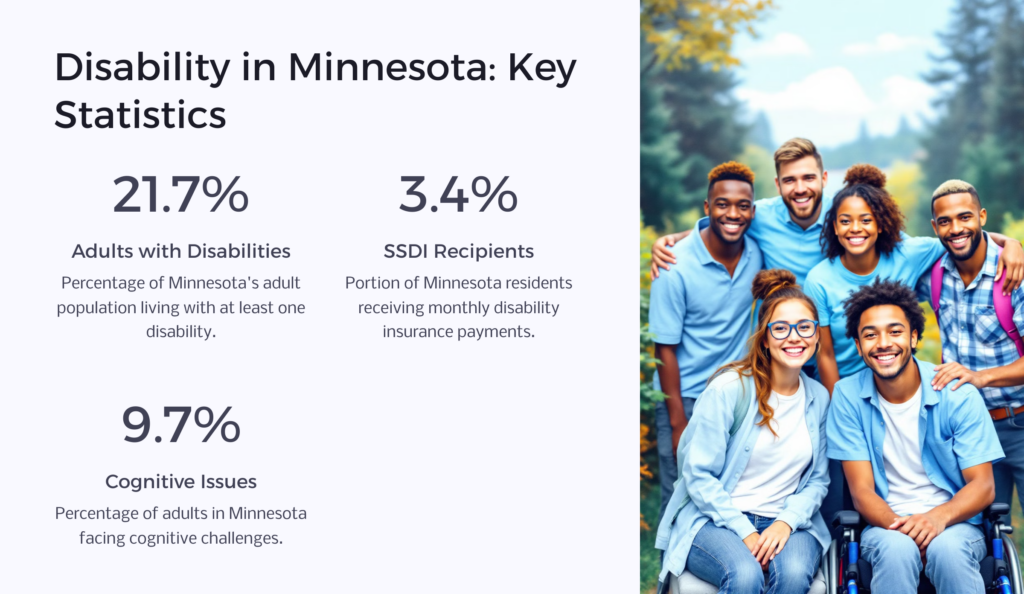

There are over 3 million residents in Minnesota. Approximately 3.4% receive monthly checks from the Social Security Administration in the form of disability insurance payments. The SSA and Minnesota’s Disability Determination Services work together to process disability claims and disability payments.

According to the CDC, about 21.7% of the Minnesota adult population live with one disability or the other. 9.5% of the adults in Minnesota have mobility issues, while 9.7% of the adults in the state have problems with cognition. 4.9% of the adults in Minnesota have problems living independently, while another 6.1% have hearing disabilities.

Approximately 3% of Minnesota’s adult population have visual impairment disabilities, and 2.7% of the adult population of Minnesota have self-care disabilities. To take care of these members of the population, the state has different resources, including Disability Hub MN, an online resource for the disabled.

How To Qualify for SSDI in Minnesota

Every employee or self-employed resident of Minnesota who paid into the Social Security trust fund through payroll taxes can benefit from SSDI. Such a person should have paid into the trust fund for five years within the last ten years or have enough work credits to qualify for SSDI.

There are also some medical requirements for Social Security disability benefits, according to federal disability law. A developmental disability, a long-term disability, mental illness, and other limiting medical conditions qualify you for SSDI in Minnesota.

To qualify for SSDI, a person must show proof that their disability will last for at least a year or result in death.

If a disabled employee of an organization can continue to work under reasonable accommodations, the employee might not qualify for SSDI. Also, SSA does not provide short-term disability insurance.

If you have been injured at work, the Minnesota Department of Labor and Industry administers a workers compensation program for people with work-related disabilities. The law mandates every employer to have workers’ compensation insurance or be self-insured to take care of work-related injuries and illnesses of their staff.

How To Apply for SSDI in Minnesota

If you want to make a disability claim in Minnesota, you must send your application to the SSA. You can apply by visiting any of the agency’s field offices, filling an online form, or via phone call.

In Minnesota, SSA is assisted by the Disability Determination Services (DDS), a division of Minnesota’s Department of Employment and Economic Development. Though the SSA provides all funding for the Social Security benefits programs, DDS examines every applicant for disabilities.

How To Appeal a Denial in Minnesota

In Minnesota, only 43.9% of initial SSDI applications get approved. The remaining 56.1% of applicants have to appeal in order to win their claim. If you are not approved, the first step is to request a reconsideration.

At this stage, another DDS employee will review your application. At the reconsideration stage, 11.5% of applicants get approval.

The next stage of the appeals process is the disability hearing. You can contact the Minnesota Office of Hearing Operations (formerly known as Office of Disability Adjudication and Review) to schedule a hearing before an administrative law judge.

The success rate for the hearing stage is high (51%), but not everyone gets approved. You can still proceed to two other stages. You first need to appear before an Appeals Council to state your claim. If that fails, you can then proceed to a U.S District Court.

The OHO will render any assistance if you need some but will not offer legal advice. If you feel you have any legal issues, you should employ the services of a disability attorney. The advocacy of a lawyer can help you avoid getting a rejection in the first stage so you can start receiving your SSDI benefits early.

Note that you won’t receive benefits until five months after the DDS approves your application.

More Minnesota Benefits

Minnesota residents who are unable to acquire their basic needs and pay for medical care can also get SSI, Medicaid, and unemployment benefits.

Apply for SSI in Minnesota

Supplemental Security Income, SSI, is available for low-income earners who are over 65, pregnant, disabled, or taking care of a family member who is disabled. The supplemental income is available for both children and adults.

The SSA pays $794 or $1,191 for qualified individuals living alone and couples, respectively.

In addition, Minnesota gives low-income earners who are disabled or elderly the Minnesota Supplemental Aid (MSA). With MSA, low-income individuals living alone receive $82, and couples receive $111 as supplemental income. People in care facilities also receive $72.

The Department of Welfare and Human Services administers MSA in Minnesota. Provision of housing, food, medical costs also come with MSA.

Minnesota Medicaid

Minnesota Medicaid is formally known in the state as Medical Assistance. Health care insurance is available for low-income earners just like SSI, though not all who qualify for SSI qualify for Medicaid in Minnesota.

After meeting SSI requirements, Medicaid applicants must also meet pre-tax yearly household income. Individuals must earn 17,131 or below yearly. $6,038 is added for every member of a household to arrive at the limit for families.

There is a waiver for people who surpass the limit but have unpaid hospital bills. The spend-down program deducts the person’s unpaid bills from his income to arrive at his MSA. The state also provides emergency funds for those who are eligible to take care of urgent medical expenses.

Minnesota Unemployment

Minnesota unemployment benefits assist Minnesota residents who lost their job through no fault of their own. If you meet the requirements, you can earn half of your previous weekly wages (maximum $762).

The program is only available for people who are unemployed and have worked in Minnesota for up to a year. The work duration might be longer for some positions. If you meet all the benefits, you can start receiving weekly cash benefits while actively searching for another job.

How Do Short-Term Benefits in Minnesota Work?

Minnesota provides both short-term and long-term benefits to eligible individuals. Short-term benefits (AKA temporary assistance) are designed to offer immediate support during a crisis or transition. In contrast, long-term benefits provide ongoing assistance to individuals who face more chronic or enduring challenges.

Short-term benefits in Minnesota typically include programs such as:

1. Minnesota Family Investment Program (MFIP)

This program offers temporary cash assistance and employment services to low-income families with children. Eligible families receive financial support while working towards self-sufficiency through employment and other resources.

2. General Assistance (GA)

GA provides short-term financial assistance to adults without dependent children who cannot work due to a disability or other barriers. It helps individuals meet their basic needs, such as housing, food, and clothing, during difficult time.

3. Emergency Assistance (EA)

EA offers immediate aid to families facing an emergency that jeopardizes their health. This may include assistance with housing, utilities, or other critical needs.

These short-term benefits temporarily relieve individuals or families during challenging circumstances. To apply for short-term benefits, individuals typically need to provide documents such as proof of income, identification, and information about their household composition.

While short-term benefits offer immediate support during crises or transitions, long-term benefits provide ongoing aid to individuals with chronic challenges or disabilities. It’s essential to follow the specific application procedures for each program and provide the necessary documents to support your eligibility. Consulting with professionals, such as disability attorneys, social workers, or application advisors, can help you navigate the process and increase your chances of receiving the necessary benefits.

Minnesota Social Security Offices

| SSA Field Office Locations in Minnesota | ||

| Minneapolis SSA Office | 1811 Chicago Ave Suite 1 Minneapolis, MN 55404 | (855) 257-0982 |

| Duluth SSA Office | 130 W Superior St Ste 400/U S Bank Bg Duluth, MN 55802 | (855) 863-3560 |

| St Paul SSA Office | 332 Minnesota St Ste N650 St Paul, MN 55101 | (866) 667-7481 |

| Mankato SSA Office | 12 Civic Cntr Plaza Ste 1550 Mankato Pl Mankato, MN 56001 | (877) 457-1734 |

| St Cloud SSA Office | 3800 Veterans Drive Suite 100 Saint Cloud, MN 56303 | (877) 405-1446 |

| Winona SSA Office | 53 E Third St Choate Bldg Ste 307 Winona, MN 55987 | (877) 600-2853 |

| Marshall SSA Office | 507 Jewett Street Suite B Marshall, MN 56258 | (855) 210-0122 |

| Bemidji SSA Office | 2900 Hannah Ave NW Bemidji, MN 56601 | (866) 258-6345 |

| Hibbing SSA Office | 1122 E 25th Street Hibbing, MN 55746 | (866) 964-4320 |

| Austin SSA Office | 404 2Nd Street NW Austin, MN 55912 | (866) 504-5010 |

| Rochester SSA Office | 2443 Clare Ln NE Suite 100 Rochester, MN 55906 | (877) 405-3631 |

| Fairmont SSA Office | 400 S. State St Suite 70 Fairmont, MN 56031 | (877) 405-0414 |

| Brainerd Lakes Area SSA Office | 8331 Brandon Road Baxter, MN 56425 | (866) 331-9087 |

| Brooklyn Center | 3280 Northway Drive Brooklyn Xng Ofc Park Brooklyn Center, MN 55429 | (866) 931-0341 |

| Bloomington | 6161 American Blvd W Ste 100 Bloomington, MN 55438 | (866) 964-7341 |

| Alexandria SSA Office | 2633 Jefferson St Suite 701 Alexandria, MN 56308 | (888) 224-8869 |

| Fergus Falls SSA Office | 1023 W Lincoln Ave Fergus Falls, MN 56537 | (877) 402-0827 |

Minnesota Hearing and Appeal Offices

Minnesota is in Region 5 (Chicago), which services Illinois, Indiana, Michigan, Minnesota, Ohio, and Wisconsin.

The Minneapolis Hearing Office services the Minnesota cities of Austin, Bloomington, Brooklyn Center, Duluth, Edina, Fairmont, Hibbing, Mankato, Minneapolis, Rochester, St. Cloud, St. Paul, and Winona.

| Region 5 – SSA Office of Hearing Operations in Minnesota | ||

| SSA Hearing Office – Minneapolis | 250 Marquette Avenue Suite 300 Minneapolis, MN 55401 | (877) 512-3856 |

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.