The Department of Veterans Affairs (VA) provides an array of benefits to veterans and their dependents, one being the Dependency and Indemnity Compensation (DIC) program. DIC is a tax-free monetary benefit you can get as a surviving spouse, child, or parent of servicemembers who died while on active duty (including active/inactive duty training or vets who later died from their service-related disabilities).

Unfortunately, many people don’t end up receiving the benefits they deserve. Because the system is so complex and information is scare, navigating DIC and other VA benefits can feel like wading through murky water. That’s why we’ve compiled this guide to increase understanding about the mechanics of DIC and its importance, along with the benefits that can help veterans’ families long after their sacrifice.

Understanding VA DIC

The VA’s DIC is a survivor benefit plan for eligible dependents of military service members who have died as a result of service connected disability or disease. These benefits are delivered in regular tax-free payments; they’re meant to help offset family loss of income that comes with the death of a veteran.

Eligibility and amounts depend on the relationship to the deceased veteran, marital status, and the presence of dependent children or disabled adult children within the family.

In addition to the monthly tax-free payments, DIC may also provide additional benefits such as educational assistance for dependent children, healthcare benefits through the Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA), and access to the VA’s home loan program. These benefits aim to provide support and resources to the surviving spouse, children, and parents of the deceased servicemember or veteran.

Eligibility for VA DIC

In addition to the servicemember dying while on active duty or as a result of service-related injuries or diseases, here are requirements that each type of beneficiary should meet:

Spouse: A surviving spouse must have been married to the servicemember at the time of death and not be remarried. Currently, a spouse’s monthly payment rate starts at $1562.74, with several hundred more dollars available based on service connected disability, number of children, and other factors. The number’s is subject to change annually, so it’s important to stay updated on the latest requirements.

Also, some expenses, such as medical expenses, can be deducted from the spouse’s income, potentially allowing them to meet the eligibility criteria for disability benefits even if their total income exceeds the maximum threshold.

Children: In the case of a surviving child, they need to be under the age of 18, or a full-time student between ages 18 and 23 at a VA-approved school. Also, a surviving child must be financially dependent on the veteran at the time of death (see also spouse’s income limit above).

Parents: Parents’ qualifications include being the biological or adoptive parent(s) of the veteran, not having remarried, and meeting income limitations.

The maximum monthly income for parents to qualify for DIC is based on a sliding scale that increases if income is lower, and decreases if it’s higher. There are also separate measurements depending on how many surviving parents the veteran has. However, like the spouse’s income limit, this threshold is subject to change annually, so check VA.gov for the most up-to-date amounts and requirements.

Parents also must fill out form 21P-535 instead. It serves the same purpose as the 543a and 534EZ, except it’s specifically for parents.

Applying for VA DIC

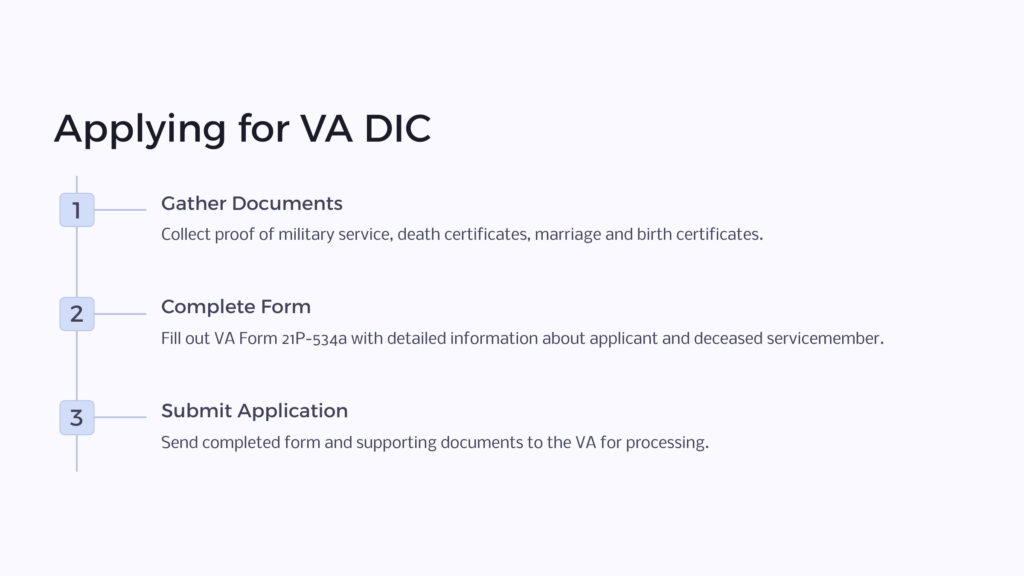

Applying for DIC benefits requires meticulous preparation. When applying, you should furnish required documents, including proof of the servicemember’s military service and death, and marriage and birth certificates for spouses and dependent children, respectively.

With those documents, you can then fill out and submit VA Form 21P-534a, where you’ll list information that’s necessary to qualify.

VA Form 21P-534a

VA Form 21P-534a is an essential document required during the application process for VA DIC. This form, officially known as Application for Dependency and Indemnity Compensation by a Surviving Spouse or Child, captures detailed information about the applicant and deceased servicemember. It is a crucial document that assists the VA in determining eligibility and calculating payable disability benefits.

Filling Out VA Form 21P-534a

To fill out VA Form 21P-534a, you will need to provide detailed information about yourself and the deceased servicemember. This includes personal information such as your name, address, and contact information, as well as information about the servicemember’s military service, including their branch, rank, and service number. You will also need to provide documentation such as marriage and birth certificates, as well as any relevant medical records or evidence of the servicemember’s cause of death. It is important to be thorough and accurate when filling out the form to ensure a smooth processing of your application.

Differences between 21P-534a and 21P-534EZ

Form 21P-534a is a more comprehensive application form used by surviving spouses and children to apply for DIC benefits. It requires detailed information about the applicant and the deceased service member. Be ready to include personal information, military service details, and supporting documentation.

Form 21P-534EZ is a simplified version to streamline the process. It may be used for a broader range of benefits, including DIC, death pension, and accrued benefits.

When deciding whether to use Form 21P-534a or Form 21P-534EZ, consider the complexity of your situation. If you’re a surviving spouse or a dependent child and have detailed information and supporting documents, 21P-534a is recommended. However, if your situation is straightforward and you’re applying for multiple benefits, 21P-534EZ may be more suitable.

But overall, both forms serve the same purpose—to establish eligibility for DIC benefits.

Frequently Asked Questions

Q: What documents are required to apply for DIC benefits?

A: Required documents for DIC benefits include proof of military service and death, marriage and birth certificates for spouses and dependent children.

Q: How long does the application process take?

A: The application process for VA DIC benefits can vary in duration, but it often takes several months. The timeline depends on the individual circumstances and the complexity of the case.

Q: Can I check the status of my DIC claim?

A: Yes, you can check claim status at any time. Either visit the eBenefits portal, call their number, or contact your local VA office.

Q: What should I do if my claim is denied?

A: f your claim for DIC benefits is denied, you have the right to appeal the decision. You can seek assistance from a Veterans Service Organization (VSO) or an attorney specializing in VA benefits to navigate the appeals process. It’s crucial to gather any additional evidence or documentation that may support your claim and present a strong case for reconsideration. Remember to review the denial letter thoroughly to understand the specific reasons for the denial and address them effectively in your appeal.

Find Help With Benefits.com

The VA Dependency Indemnity Compensation program is a great support to families of veterans who give their lives. Seek out benefits available to you, and let the VA help you through your adjustment period. Benefits.com has information about all the benefits you deserve, and we can set you up for the most successful application, starting now. Check your eligibility on our site, and begin your journey to receiving the help to which you are entitled!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.