Emergency financial assistance for veterans addresses urgent, short-term financial crises that could lead to devastating consequences if left unaddressed. These programs are designed to assist veterans and other service members of the armed forces facing financial hardships. By providing targeted support, they play a crucial role in improving the quality of life for at risk veterans who are vulnerable to losing their housing, employment, or health due to sudden emergencies. Unlike routine expense support, these programs focus on situations where immediate intervention can prevent homelessness, utility disconnections, or other severe hardships, and they offer important resources for veterans and their families.

Types of Emergency Financial Aid Available

Housing Assistance: The most critical need for many veterans, housing assistance, includes:

- Urgent rent or mortgage payments to prevent eviction or foreclosure

- Security deposits for new housing arrangements

- Temporary shelter for homeless veterans

- Emergency housing repairs and modifications

Utility Support: When essential services face disconnection, emergency funds can cover:

- Electricity, water, and heating bills

- Internet and phone services necessary for employment

- Past-due utility payments and overdue bills to restore services

- Utility bills, including assistance with paying essential and overdue utility bills

Medical and Healthcare Costs: Healthcare-related financial emergencies include:

- Unexpected medical bills and prescription costs

- VA copayment assistance

- Emergency dental and vision care expenses

- Medical equipment and accessibility modifications

Food and Basic Necessities: Direct relief for basic needs and essential expenses:

- Grocery assistance and food vouchers

- Essential clothing and personal items

- Baby formula and supplies for veteran families

- Household necessities and cleaning supplies

Transportation Aid: Critical for maintaining employment and accessing healthcare:

- Emergency travel for family crises

- Vehicle payments, insurance, and car repairs

- Public transportation assistance

- Fuel cards for medical appointments

Government Programs Providing Emergency Financial Help

Department of Veterans Affairs (VA) Programs

VA Financial Hardship Assistance Program:

This financial assistance program helps veterans struggling with healthcare expenses by providing payment plans, financial hardship waivers, and assistance with unpaid VA medical bills. Veterans enrolled in VA healthcare who face significant financial hardship can apply through their local VA medical center or the My HealtheVet portal.

VA Home Loan Assistance:

For veterans with VA-backed home loans facing foreclosure, the VA collaborates with lenders to provide benefits including loan modifications, forbearance agreements, and customized repayment plans to help prevent home loss. Only eligible veterans can access these VA home loan assistance services.

VA Homeless Veterans Programs:

These support services include:

- National Call Center for Homeless Veterans: Available 24/7 at 1-877-4AID VET (877-424-3838), providing immediate assistance and connections to VA services

- HUD-VASH Program: A partnership between VA and HUD providing housing vouchers with support services

- Supportive Services for Veteran Families (SSVF): Case management and financial assistance for rent and utilities to prevent homelessness, with some programs offering grant assistance for emergency housing or basic needs

Major Nonprofit Organizations Offering Emergency Aid

Comprehensive Emergency Assistance Programs

- Guardian Community

- Operation Homefront’s Critical Financial Assistance Program

- Veterans of Foreign Wars (VFW) Unmet Needs Program

Specialized Support Organizations

- Coalition to Salute America’s Heroes

- Project: VetRelief

- Operation First Response

Branch-Specific Emergency Assistance

Military Branch Organizations

Air Force Aid Society offers interest-free loans and grants to active-duty Air Force personnel for immediate needs including basic living expenses, emergency travel, vehicle expenses, and medical costs. The program supports both active duty service members and those transitioning from active military service, ensuring assistance is available during and after active military service.

Army Emergency Relief (AER) provides emergency financial assistance to active and retired soldiers and their dependents for any valid financial need, maintaining flexibility in addressing various crisis situations.

Navy-Marine Corps Relief Society (NMCRS) offers both interest-free loans and grants to active-duty and retired sailors, Marines, and their families for emergency expenses including food, housing, utilities, home repairs, and medical costs.

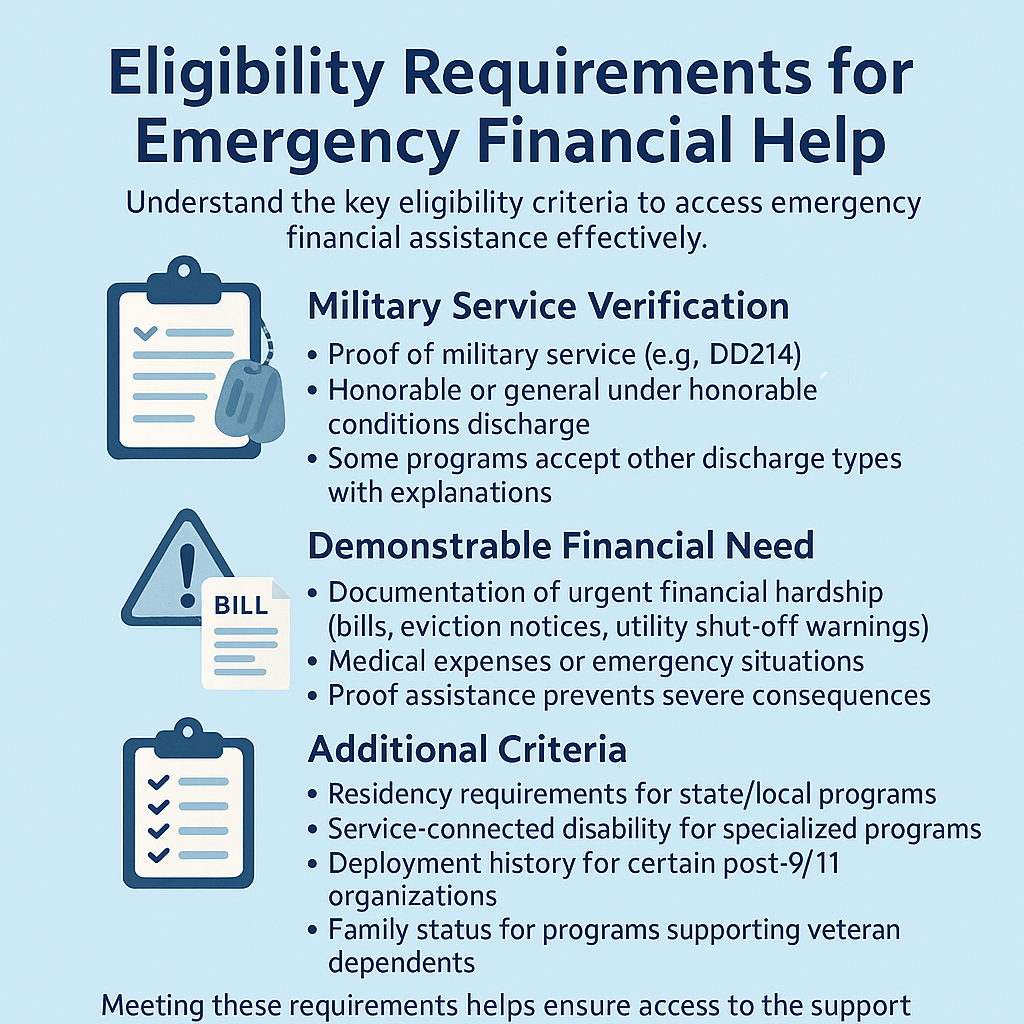

Eligibility Requirements for Emergency Financial Help

While specific criteria vary, common eligibility requirements for assistance include:

Military Service Verification

- Proof of military service (DD214)

- Honorable or general under honorable conditions discharge

- Some programs consider other discharge types with detailed explanations

Demonstrable Financial Need

- Documentation of urgent financial hardship

- Bills, eviction notices, or utility shut-off warnings

- Medical expenses or emergency situations

- Proof that assistance will prevent severe consequences

Additional Criteria

- Residency requirements for state and local programs

- Service-connected disability for specialized programs

- Deployment history for certain post-9/11 focused organizations

- Family status for programs supporting veteran dependents

- Income sustainability demonstrating ability to regain stability

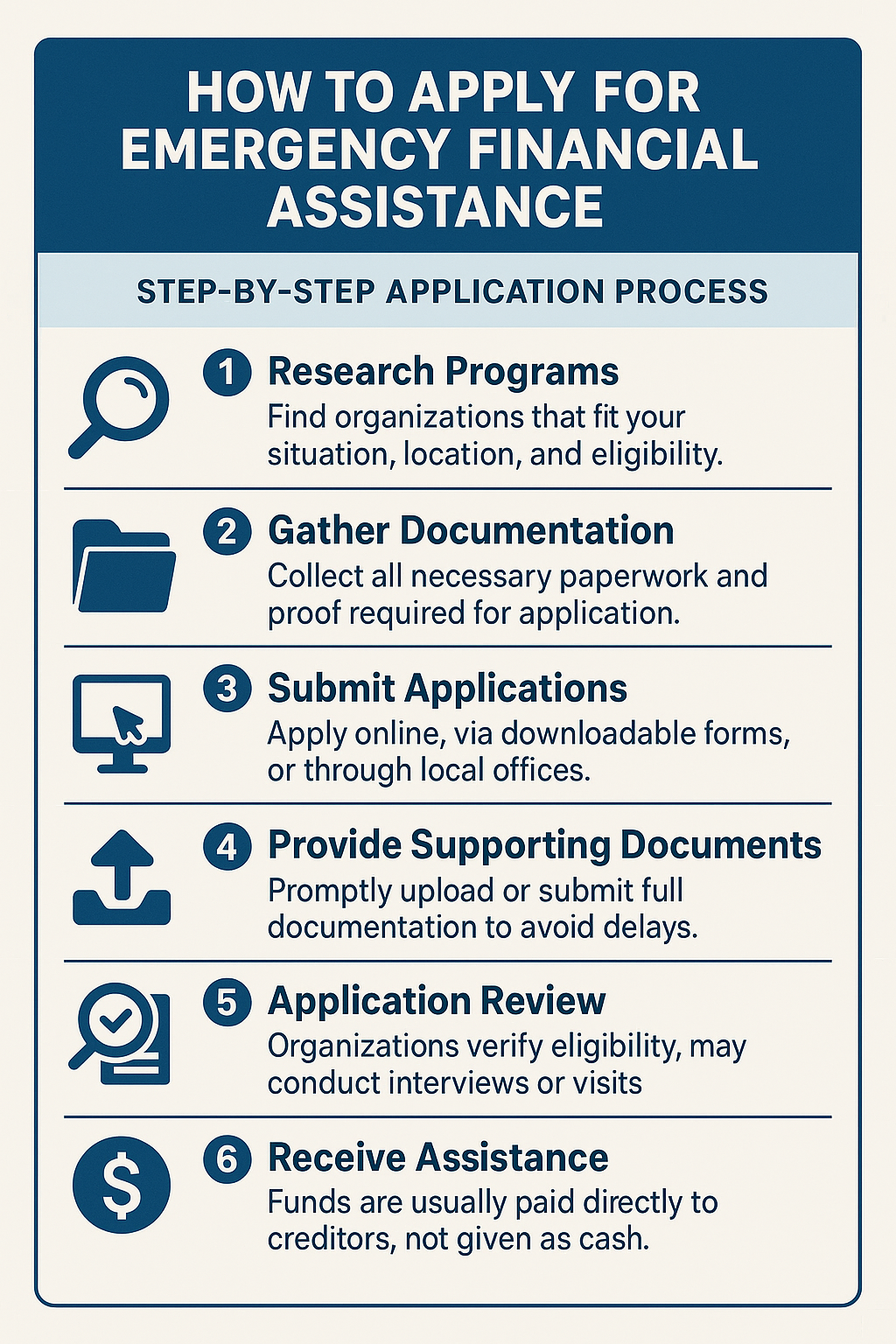

How to Apply for Emergency Financial Assistance

Step-by-Step Application Process

- Research Suitable Programs: Identify organizations matching your specific situation, location, and eligibility criteria.

- Gather Required Documentation

- Submit Applications: Most organizations offer online applications, while others require downloadable forms or direct contact with local offices.

- Provide Supporting Documents: Upload or submit all required documentation promptly, as incomplete applications often face rejection or delays.

- Application Review: Organizations review requests, verify eligibility, and may conduct personal visits or interviews.

- Receive Assistance: Approved funds are typically paid directly to creditors rather than issued as cash to applicants.

Taking Action: Your Next Steps

If you’re a veteran facing financial crisis, remember that help is available and you’ve earned the right to access these resources! It’s important to seek help not only for yourself but also for your loved ones, ensuring their well-being during difficult times.

Start by:

- Identifying your most urgent needs and gathering relevant documentation

- Researching programs that match your situation and location

- Applying to multiple organizations to maximize assistance opportunities

- Seeking professional guidance from VA representatives or veteran service organizations

- Building long-term financial stability through counseling and education resources

Emergency financial help can make all the difference for veterans struggling to make ends meet, providing crucial support when it’s needed most.

The network of support for veterans facing financial emergencies continues to grow and evolve. From immediate crisis intervention to long-term stability planning, these programs represent our nation’s commitment to those who have served with honor.

Let us help you at Allveteran.com. Start today by finding your rating with our free medical evidence screening!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.