The U.S. Government and other organizations provide housing assistance to qualifying individuals and families. These programs often take the person or household’s income and the local housing market into account when eligibility and benefits are considered.

We’ve compiled a list of the most useful housing assistance programs available to you, so read on below!

The U.S. Department of Housing and Urban Development (HUD)

The U.S. Department of Housing and Urban Development (HUD) offers various housing assistance programs to help individuals and families access safe, affordable housing. These housing programs are designed to assist low income households, seniors, people with disabilities, and other vulnerable populations.

Eligibility criteria and program details can vary depending on factors such as income limits, family size, and local housing market conditions. To access these housing programs, individuals and families typically need to apply through their local public housing agency (PHAs) or another designated public housing authority. It’s important to note that these housing programs are subject to budgetary constraints, and waiting lists for assistance can be long in some areas due to high demand.

Here are some of the key housing assistance programs administered by HUD:

Section 8 Housing Choice Voucher Program

This program provides rental assistance to eligible low-income families and individuals. Participants receive vouchers that they can use to rent privately-owned housing of their choice. The Section 8 Housing Choice Voucher covers a portion of the rent, making it more affordable for participants. The exact amount of assistance through the housing voucher is based on income and local rental market conditions.

Public Housing

HUD oversees public housing agencies (PHAs) across the country that manage and operate public housing developments. Public housing assistance provides affordable housing options for low income families, seniors, and individuals with disabilities. These are usually rental housing and rent is typically based on income.

Project-Based Rental Assistance (PBRA)

Under this program, the HUD provides subsidies to property owners who designate a portion of their affordable rental housing for low-income tenants. Tenants pay a reduced rent based on their income, and the property owner receives a subsidy from HUD to make up the difference.

Housing for the Elderly (Section 202)

This program provides funding to develop and subsidize housing for low-income seniors. These subsidized housing developments usually includes rental housing and often offer supportive housing services to help elderly residents age in place.

Housing for Persons with Disabilities (Section 811)

Similar to the Section 202 program, this initiative provides funding for the development of affordable housing for people with disabilities. It supports both rental housing and homeownership opportunities.

Homeownership Assistance Programs

The HUD offers various programs to help low- and moderate-income individuals and families achieve homeownership, including Federal Housing Administration (FHA) loans, which provide mortgage insurance to make it easier for borrowers to qualify for home loans with lower down payments.

Emergency Solutions Grants (ESG)

ESG funds are provided to local governments and service organizations to assist homeless individuals and families, prevent homelessness, and provide essential services such as shelter, outreach, and case management.

Community Development Block Grants (CDBG)

CDBG grants are provided to state and local governments to support a wide range of community development activities, including affordable housing development, infrastructure improvement, and economic development projects.

HOME Investment Partnerships Program (HOME)

HOME grants are awarded to state and local governments to create affordable housing opportunities for low income families, often through the construction, rehabilitation, or preservation of affordable rental and homeownership units.

Fair Housing Assistance Program (FHAP)

While not a direct housing assistance program, FHAP helps enforce fair housing laws by providing funding to state and local agencies to investigate and address housing discrimination complaints.

The Federal Housing Administration (FHA)

The Federal Housing Administration (FHA) is a government agency that operates under the Department of Housing and Urban Development (HUD). The FHA’s primary purpose is to provide mortgage insurance on loans made by approved lenders to qualified borrowers. Here is some key information about the FHA:

Mortgage Insurance

The FHA does not directly originate or provide mortgages to homebuyers. Instead, it insures loans made by private lenders, such as banks and mortgage companies. This insurance protects the lender in case the borrower defaults on the loan.

Low Down Payment

One of the most significant advantages of FHA loans is the lower down payment requirement. Borrowers can typically put down as little as 3.5% of the home’s purchase price, making homeownership more accessible for individuals who may not have a large down payment saved.

Credit Requirements

FHA loans are known for being more lenient with credit requirements compared to conventional mortgages. While borrowers with lower credit scores can qualify, better credit scores may result in better terms and interest rates.

Loan Limits

FHA loan limits vary by location and are subject to change annually. These limits are designed to ensure that FHA-insured loans are available for homes in a range of price categories across different regions.

Fixed and Adjustable Rate Options

Borrowers can choose between fixed-rate and adjustable-rate FHA loans. Fixed-rate loans have a stable interest rate throughout the loan term, while adjustable-rate loans may have lower initial rates that can adjust over time.

FHA Mortgage Insurance Premiums

Borrowers are required to pay both an upfront MIP and an annual MIP as part of their FHA loan. The upfront premium is typically rolled into the loan amount, while the annual premium is paid monthly. The purpose of these premiums is to fund the insurance program and protect the lender against losses.

Property Requirements

FHA loans have specific property requirements. The home being purchased must meet certain safety and quality standards established by the FHA. This ensures that the property is safe and habitable.

Debt-to-Income Ratio

Lenders consider a borrower’s debt-to-income ratio when approving FHA loans. This ratio compares the borrower’s monthly debt payments to their gross monthly income and helps determine their ability to repay the loan.

FHA 203(k) Rehabilitation Loan

This is a special FHA loan program that allows borrowers to finance both the purchase of a home and the cost of repairs or renovations into a single loan.

Streamlined Refinancing

FHA offers streamlined refinancing programs, such as the FHA Streamline Refinance, which can make it easier for existing FHA borrowers to refinance their loans with reduced documentation and minimal underwriting.

Assistance for First Time Homebuyers

The FHA offers programs and initiatives specifically designed to assist first-time homebuyers in achieving homeownership. These programs may include down payment assistance and educational resources.

It’s important to note that while FHA loans offer advantages such as lower down payments and more lenient credit requirements, they also come with certain limitations and costs, including mortgage insurance premiums. Borrowers should carefully consider their financial situation and explore other mortgage options to determine which type of loan is best for their particular housing need. Additionally, FHA loan programs and requirements may change over time, so it’s advisable to consult with a qualified lender or mortgage professional for the most up-to-date information and guidance.

Department of Veterans Affairs

The VA (Department of Veterans Affairs) housing allowance refers to a financial benefit provided to eligible veterans or active-duty service members who are using their GI Bill educational benefits to attend a college, university, or other approved educational institution. This housing allowance is also known as the Basic Allowance for Housing (BAH) for veterans or the Post-9/11 GI Bill housing allowance.

Here are some key points about the VA housing allowance:

Eligibility

To be eligible for the VA housing allowance, you generally need to meet specific criteria, including having served a minimum period of active duty in the military and being eligible for the Post-9/11 GI Bill. Eligibility criteria may vary depending on the specific GI Bill program you are using.

Calculation

The VA housing allowance is calculated based on the zip code of the educational institution you are attending and your enrollment status (full-time, half-time, etc.). It is intended to help cover the cost of housing and is generally equivalent to the BAH for an E-5 with dependents in the same location.

Payment

The VA typically pays the housing allowance directly to the eligible student or veteran on a monthly basis. The amount may be prorated for partial months of attendance.

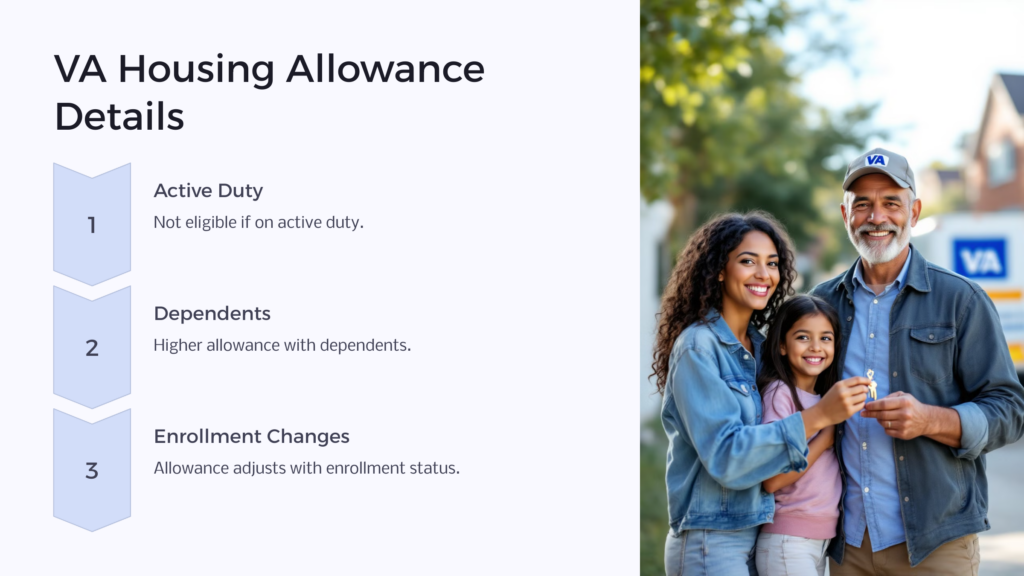

Active Duty

If you are on active duty while using the Post-9/11 GI Bill, you will not receive the housing allowance, as active-duty service members already receive housing allowances as part of their military compensation.

Dependents

The VA housing allowance is usually based on the presence of dependents. If you have dependents, you may receive a higher housing allowance.

Changes in Enrollment

The housing allowance can change if your enrollment status changes. For example, if you switch from full-time to part-time enrollment, your housing allowance may be adjusted accordingly.

Yellow Ribbon Program

Some educational institutions participate in the Yellow Ribbon Program, which can help cover tuition and fees not fully covered by the GI Bill. This can affect the overall financial support you receive for housing and education.

It’s important to note that the specific details and eligibility requirements for the VA housing allowance may change over time, so it’s advisable to check with the VA or the educational institution’s veterans’ affairs office for the most up-to-date information and guidance on how to apply for and receive this benefit.

Read more about how the HUD and VA can help disabled veterans secure housing.

Don’t Miss Out: Join Us at Benefits.Com

There are plenty of different types of housing assistance available for individuals in need. The different programs offer various types of benefits and have different eligibility criteria. Speak to us at Benefits.com to find out what your best options are.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.