Retiring is hard for everyone because it comes with many lifestyle changes, from finances to how you spend your time.

It’s even harder if you’re retiring from the military – so much happens in that line of duty that makes leaving it even harder.

As a veteran, it’s important to take advantage of all the benefits you’re eligible for to make the transition manageable.

In this blog post, we’ll focus on Combat Related Special Compensation (CRSC), including who’s eligible, what you need for application, how to apply, and all other nitty-gritty.

What is Combat-Related Special Compensation (CRSC)?

Combat Related Special Compensation (CRCR) is a tax-free monthly grant for any retired service member with a service connected disability. This VA disability compensation isn’t automatic, so veterans must apply for it through their uniformed service.

Keep reading to learn about the requirements, eligibility, and application process.

Who is Eligible for CRSC?

CRSC is available to eligible retired veterans with a combat related injury.

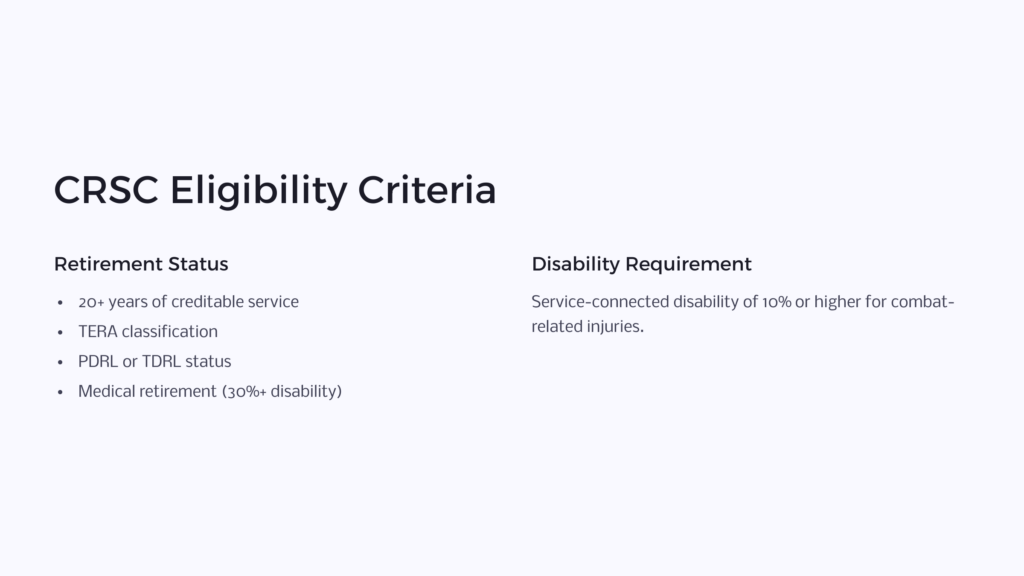

To begin with, you have to show that you qualify for CRSC through your retirement status. To do this, one of these statements must be true:

-

You served on active duty, in the Reserves, or National Guard for over 20 years with creditable service.

-

You’re classified under the Temporarily Early Retirement Act (TERA)

-

You’re on the Permanent Disability Retired List (PDRL)

-

You’re on the Temporary Disability Retired List (TDLR)

-

You’re retired for medical reasons and have a disability rating of 30% and above

After showing you qualify for the CRSC through your retirement status, you must show proof that you’ve got a service connected disability of 10% or higher with the VA for an injury under combat related injuries.

What Medical Conditions Qualify for CRSC?

For a medical condition to be considered for CRSC, it must be combat-related, meaning the injury must’ve happened while you were:

-

Engaged in hazardous duty like parachuting, flying, or demolition

-

Engaged in armed conflict in combat, a raid, or an occupation

-

Engaging in war stimulation activities like hand-to-hand combat training or live fire weapons

-

Exposed to instruments of war such as weapons, military vehicles, or chemical agent

-

Engaged in an act for which you received a Purple Heart.

How to Apply for CRSC

CRSC isn’t a Veterans Affairs benefit, so you can’t apply for it through Veterans Affairs. Instead, your eligibility for CRSC is made by the veteran’s respective military service branch.

To apply for CSRC, you’re required to fill out the DD form 2860 and submit it.

Along with the application of your CRSC claim, you must submit eligibility documents based on the factors we discussed earlier.

Read on to see the documents you need to apply for CRSC.

What Documentation is Needed to Support a CRSC Claim?

-

DD214

-

Retirement orders

-

20 years old or a statement of service

-

Service medical records or relevant pages from VA

-

Purple heart citations

After you send your application, the board will notify you by writing what they decide. If your request is approved, the service branch will forward the report to the Defense Finance and Accounting Service (DFAS). The DFAS will audit your payments and confirm whether you’re eligible for a retroactive award of CRSC.

If DFAS approves you for a retroactive award, you’ll receive a retro payment to the eligibility date in your award letter.

Retroactive aways can date as back as June 1, 2003 – the timing is determined by your retirement date or when you qualified for the award. However, if you’ve served less than 20 years, your retroactive date is limited to January 1, 2008.

Can Veterans Receive CRSC in Addition to Other Forms of Military Benefits?

CRSC allows veterans to access payments without offsetting their VA disability pay.

Previously, veterans were required to forgo an equal amount of retirement pay, to get a VA disability payment. Although this wasn’t ideal, it was still a better option since VA benefits aren’t taxed like retirement benefits.

However, as of 2004, eligible retired veterans can receive both disability and retired pay simultaneously. When this was first approved, only veterans with a disability rating of 50 or higher were qualified. Still, the United Status Code (USC) currently approves veterans with a 10-30% disability for the same benefits.

Frequently Asked Questions

Here are common questions about CRSC:

How long does it take to receive CRSC after applying?

It takes 30-60 days to process payments once you’re approved. Checks are issued on the first business day of the month and deposited to the same bank account as your military retirement pay or VA account.

However, sometimes DFAS might need more time for research and computation. In this case, it might take longer, and you might get a request to provide more information. If it takes longer than 90 days and you’ve not been asked to provide more details, you can call 1-888-276-9472 to verify your receipt.

Can veterans appeal a denial of CRSC benefits?

Yes. If you were previously denied CRSC benefits, you can appeal. When appealing, you need to write a letter about why you disagree with the agency’s decision and all their previous letters regarding your case.

Besides the letter, you’ll need to include evidence that you might’ve missed to include previously, such as proof of disability. Here are the circumstances under which you can ask for consideration:

-

Your disability rating that’s directly involved with your current CRSC changes

-

You receive a new rating for a combat related disability or injury

How does CRSC impact a veteran’s tax situation?

CRSC doesn’t affect a veteran’s taxes since it’s a non-taxable entitlement.

Get More Information on Combat-Related Special Compensation

Applying for anything that involves the government, especially benefits such as CRSC, can be very frustrating and daunting. It can drag on for too long, and the risk of being disapproved when you need the benefits is devastating.

If you’ve any questions regarding CSRC, contact us; we will be more than happy to answer your questions.

For free.

Sounds too good to be true? We know. We are just a team of professionals who educate folks on benefits because we believe everyone should get what they deserve.

And, no. There is no catch.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.