Millions of Americans rely on Social Security benefits to make ends meet. Retired employees are the biggest beneficiaries, but disabled people, spouses, and children might also receive these payments from the government.

COLAs vary annually with inflation, and the Social Security COLA for 2026 is 2.8%. While we don’t know the official CalPERS COLA yet, it will go into effect May 1st, and we expect it to reflect COLA numbers.

The cost-of-living-adujstment (COLA) is an increment made to Supplemental Security Income (SSI) and Social Security benefits to offset the effects of increasing inflation.

The cost-of-living adjustment is based on the lesser of two numbers: the compounded COLA provision contracted by the employer or the inflation rate. Further, if a member’s COLA increment is less than 1% in a year, CalPERS won’t apply any COLA increase in their retirement income that year. Retirees with a 2% COLA provision can’t have an adjustment of more than 6% of their base allowance. At the moment, 95% of CalPERS members have a 2% COLA provision, and the other 5% have a 3%, 4%, or 5% COLA provision.

CalPERS retirees are eligible for cost-of-living adjustments and will collect more benefits as inflation persists. But pensions like CalPERS limit the increment. CalPERS caps COLA to a maximum of 2%, compounded yearly for school and state retirees. But public companies can contract for a higher CalPERS COLA.

Besides COLA, some CalPERS retirees receive a purchasing power protection allowance (PPPA) adjustment. This is a supplemental benefit created to maintain the initial purchasing power of CalPERS members to a specific limit when COLA hasn’t kept pace with the inflation rate.

The Retirement Law stipulates for the payment of a cost-of-living adjustment to be paid every May. CalPERS COLA helps retirees manage rising prices of essential products like energy, housing, and food. A cost of living adjustment for retirees isn’t based on promotions or job performance. Instead, the income and Social Security increase are given to counteract inflation rates and help retirees maintain their purchasing power.

With inflation rates continuing to impact the economy in 2024 significantly, CalPERS and other retirement systems have seen a need to implement cost-of-living increases.

Factors Affecting the CalPERS COLA Adjustment

The reason a COLA might be lower than the current inflation rate depends on how SSA calculates the figure.

First, the SSA relies on the inflation index, which differs from the consumer price index that economists and the Federal Reserve use to determine pricing trends. Instead, the agency bases its COLA on the Consumer Price Index for Clerical Workers and Urban Wage Earners (CPI-W), which some argue doesn’t accurately mirror the spending of elderly Americans.

CPI is one of the critical factors that affect CalPERS COLA adjustments. It determines the inflation rate and is calculated annually. CalPERS uses it when you retire to determine what your value of compensation will be when adjusted for COLA. The BLS calculates CPI, the standard estimate CalPERS uses to calculate the cost-of-living adjustment.

Next, CalPERS bases its COLA on the employer-contracted COLA percentage. Many schools and all state agencies use a COLA of 2% yearly, while public agencies can use a COLA of 2%, 3%, 4%, or 5% annually. If the inflation rate since your retirement is more than the employer-contracted COLA percentage, then CalPERS uses the lesser of the two.

Ultimately, COLA relies on two factors: the employer-contracted cost-of-living adjustment percentage and the CPI-W. CPI determines the inflation rate and is compared per year. If consumer prices decline or inflation is low enough to warrant a COLA increase, beneficiaries don’t receive COLA. If the CPI-W doesn’t increase, then there’s no COLA increase.

Impact of Economic Trends on CalPERS COLA 2026

In 2021, the SSA announced a 5.9% COLA for 2022, the biggest increase since 1982. The inflation rate quickly outpaced that adjustment, though, and in 2022, the Social Security Administration enacted an even higher COLA.

Typically, the COLA is close to the same annual inflation.

However, the next two COLAs were out of sync with the rate of inflation. For instance, the 2023 COLA was too big, while the 2022 COLA was too small.

The rate of inflation rose to 7.8% in 2021, yet the cost-of-living adjustment for 2022 was just 5.9%. And that was because the administration was looking backward. Then, the rate of inflation declined to 6.3% in 2022, and yet that year, we got a high COLA because the administration was looking back on the quarters or months when inflation was relatively high.

2025’s COLA of 2.5% was on par with the annual inflation rate.

Although the 2.5% COLA was lower than the 8.7% implemented in 2023, the highest cost-of-living adjustment in more than forty years, it’s right around the average COLA in the last two decades—which was 2.6%.

A minor adjustment isn’t bad. A big COLA shows there was a ton of inflation, and you’re being compensated for a year and a quarter after the fact. But you’ve suffered a lot in the meantime. Thus, a minor adjustment means there is minimal disruption in terms of price fluctuation, which is good news.

This year’s adjustment of 2.8% is an accurate reflection of the easing inflation rate in the post-pandemic economy, ensuring consumers’ purchasing power.

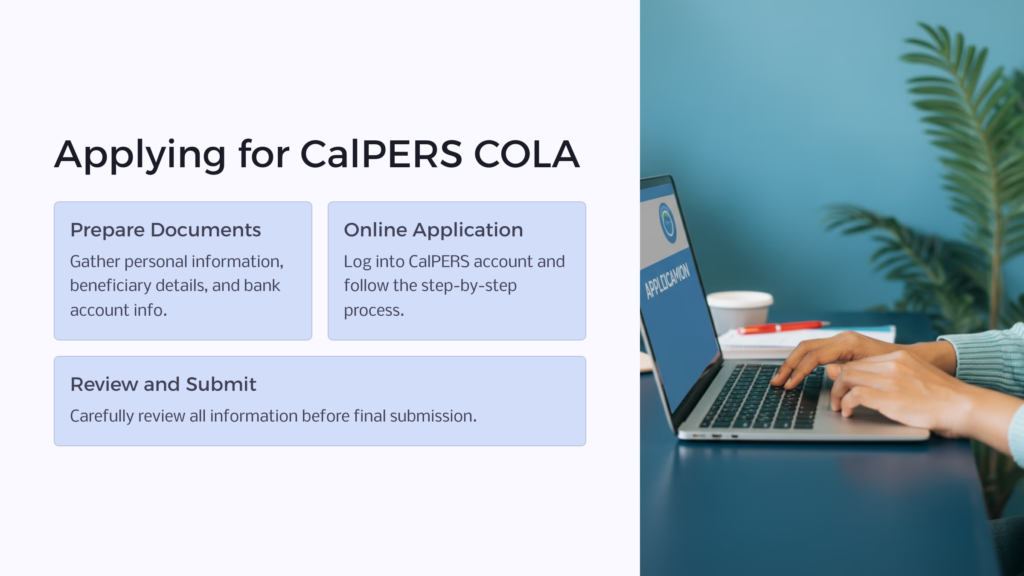

Navigating the Application Process

There are certain things you should have ready before completing your application. These include complete mailing addresses, beneficiaries’ dates of birth, and Social Security numbers. Also, you should have your bank account details to set up direct deposit.

Remember that CalPERS won’t accept your paper or online application more than 120 days before your retirement date, so plan accordingly.

Strategies for Maximizing CalPERS COLA 2025 Benefits:

Three key dates might have a significant effect on your benefits: your birthday quarter, the fiscal year, or the first year of your COLA benefits. To receive maximum employee benefits, you must pick the date that best suits your needs.

Fiscal Year Significantly Affects Service Credit

If you start working in April, you can earn one year of service credit by July (ten months) because employees earn service credit in tenths, not twelfths. A fiscal year runs from July 1 to June 30.

During a fiscal year, to earn a full year of service credit, you have to work at least:

- 215 days for a daily pay employee

- 1,720 hours for an hourly pay worker

- Ten months full-time for monthly pay workers

It’s crucial to note that service credit for retirement purposes might differ from service credits employers use for accrual of leave time.

Birthday Quarters

Your COLA factor increases every three months, depending on your birthday. For instance, you qualify to retire at 50 years old with a multiplier of 1.1%, based on the State Miscellaneous and Industrial member’s 2 percent at 55 formula. This multiplier increases each quarter after your birthdate and reaches the maximum at age 63. So, if you’re below 63, your birthday quarter can help increase your CalPERS COLA benefits.

COLA: January 1 vs. December 31

The exact COLA percentage depends on the annual calculation of the Consumer Price Index for All Urban Workers. It starts the second year of your retirement, up to a specific limit, depending on your contract.

For example, if you retire on December 31, 2025, your COLA payment will depend on the CPI for 2025, and you’ll get your first COLA benefits on May 1, 2027. But if you retire on January 1, 2026, the one-day difference can delay your first eligibility for COLA by up to a year, and you won’t receive your first COLA payment until May 1, 2028. Retirees get an annual COLA compensation on May 1 every year.

To maximize your retirement benefits, you should retire on your birthday or a subsequent birthday quarter to increase your benefit factor. However, if you plan to retire at the beginning of the year, you should consider the COLA when picking a retirement date. CalPERS applies COLA yearly to the retirement allowance on May 1st retirement checks, beginning with the second year after the retirement date.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.