Long-term disabilities alter lives and in some cases cause a medical leave. They may impact every aspect of an individual’s life. It often necessitates a significant shift in one’s daily routines and financial stability. To provide support to any individual facing these challenges, social security systems offer different forms of disability benefits for those in need. We hope to shed light on long-term disability classification criteria. We’ll talk about some of the most common long-term disabilities and long-term disability benefits available. As always, we are here to offer advice on receiving Social Security Disability Insurance (SSDI).

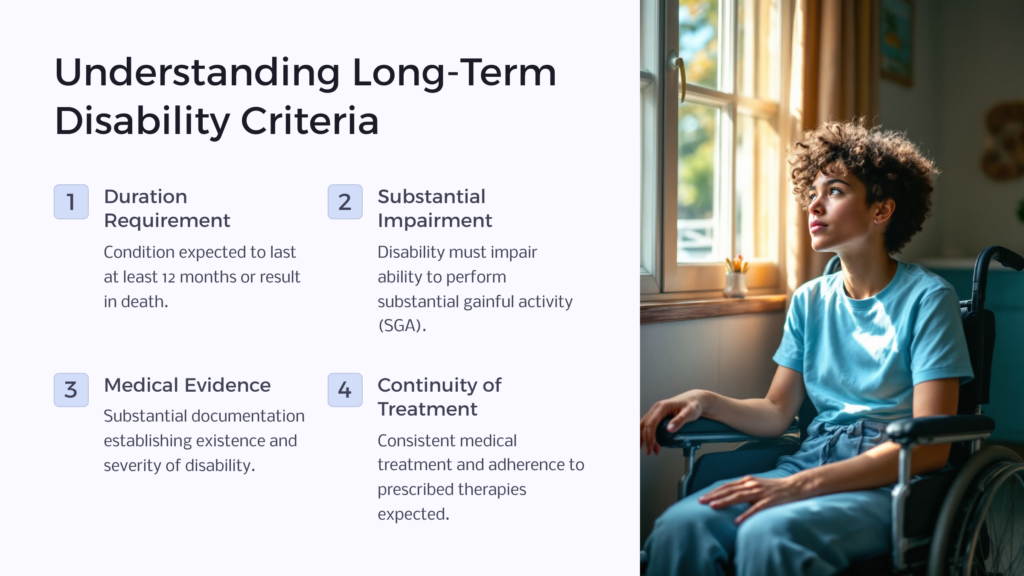

Understanding Long-Term Disability Criteria

Before delving into the specifics of long-term disability, it is crucial to understand what makes a disability long-term. This classification is important in determining eligibility for various benefits and support systems.

To qualify as long-term, a medical condition needs to meet the following criteria:

- Duration Requirement: The condition must be expected to last for at least 12 months or result in death.

- Substantial Impairment: The disability must impair the individual’s ability to perform substantial gainful activity (SGA). SGA refers to the capacity to perform work that earns a certain level of income. The Social Security Administration (SSA) annually reviews this amount. As of 2023, the SGA threshold is $1,470 per month for non-blind individuals and $2,460 for blind individuals.

- Medical Evidence: Substantial medical evidence establishes the existence and severity of the disability. This may include medical records, test results, doctor’s statements, and other relevant documentation.

- Continuity of Treatment: Consistent medical treatment and adherence to prescribed therapies are expected. Gaps in treatment could raise doubts about the severity of the disability.

Fifteen Common Long-Term Disabilities

Now that we understand the criteria for long-term disability, let’s explore the most commonly approved medical conditions that can receive maximum benefit:

- Musculoskeletal Disorders: Conditions like osteoarthritis, rheumatoid arthritis, and severe back injuries often qualify.

- Cardiovascular Conditions: Severe heart conditions such as congestive heart failure or coronary artery disease may qualify.

- Neurological Disorders: Conditions like multiple sclerosis (MS), epilepsy, and Parkinson’s disease can be debilitating.

- Respiratory Disorders: Chronic obstructive pulmonary disease (COPD) and severe asthma can limit an individual’s ability to work.

- Mental Health Disorders: Severe depression, bipolar disorder, and schizophrenia may qualify if they impair daily functioning.

- Cancer: Advanced or recurrent cancers may qualify for long-term disability benefits.

- Autoimmune Disorders: Conditions like lupus and Crohn’s disease, when severe and persistent, can lead to long-term disability.

- HIV/AIDS: Individuals with advanced stages of HIV/AIDS may qualify due to the significant impact on their health.

- Kidney Disease: End-stage renal disease (ESRD) and other severe kidney conditions may meet the criteria for long-term disability.

- Digestive Disorders: Inflammatory bowel disease (IBD) and other gastrointestinal conditions can be debilitating over time.

- Vision and Hearing Impairments: Severe vision or hearing loss can lead to long-term disability, especially if it hinders the ability to work.

- Diabetes: When diabetes leads to complications like peripheral neuropathy or kidney disease, it may qualify as a long-term disability.

- Autoimmune Disorders: Conditions like lupus and rheumatoid arthritis, when severe and persistent, can lead to long-term disability.

- Neurodevelopmental Disorders: Autism spectrum disorders and severe cases of attention-deficit/hyperactivity disorder (ADHD) can qualify.

- Amputations: Loss of limbs, such as an arm or leg, can be considered a long-term disability, significantly affecting one’s ability to work and engage in daily activities.

It is important to note that the SSA evaluates each disability claim individually. The severity and duration of the condition, as well as its impact on an individual’s ability to work, may vary.

Types of Benefits Available

Social security systems offer various benefits and support programs to individuals with long-term disabilities, such as a monthly benefit or disability coverage as an eligible employee. You’ll want to apply for either Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) if you have a qualifying disability. Let’s look at how they can help:

Social Security Disability Insurance (SSDI)

SSDI is a federal program with open enrollment for eligible employees to apply for aid. They provide financial aid to disabled individuals who have paid into the Social Security system through payroll taxes. To be eligible for SSDI, you must meet the following requirements:

- Work Credits: You must have earned a sufficient number of work credits by paying Social Security taxes over the years. The exact number of required credits depends on your age at the time of disability onset.

- Medical Eligibility: You must have a qualifying long-term disability, as defined by the SSA’s criteria.

- Waiting Period: There is typically a five-month waiting period from the onset of the disability before you can start receiving SSDI benefits.

The amount of SSDI benefits you receive is based on your average lifetime earnings before your disability. These benefits can help provide financial stability during a challenging time.

Supplemental Security Income (SSI)

SSI is another federal program that provides financial assistance. They can help disabled individuals with limited income and resources, regardless of their work history. To qualify for SSI, you must meet the following criteria:

- Limited Income: Your income and resources must be below certain limits set by the SSA.

- Disability Status: You must have a qualifying long-term disability, similar to the criteria for SSDI.

- Citizenship or Eligible Noncitizen Status: You must be a U.S. citizen or an eligible noncitizen to receive SSI benefits.

SSI benefits are intended to cover basic living expenses, including food, shelter, and clothing. The amount of SSI payments may vary depending on your income and living arrangements.

Navigating the SSDI Application Process

Applying for Social Security Disability Insurance (SSDI) can be a time-consuming process. With careful preparation, it becomes much more manageable. Here’s a step-by-step guide to help you navigate the application process:

Step 1: Determine Your Eligibility

Before you start the application, make sure you meet the eligibility criteria for SSDI. This includes having a qualifying long-term disability and a sufficient number of work credits as an eligible employee.

Step 2: Gather Your Medical Evidence

Collect all documentation that supports your disability claim. This includes relevant medical records, test results, and doctor’s statements. The more comprehensive your medical evidence, the stronger your case will be.

Step 3: Complete the Application

You can apply for SSDI online through the Social Security Administration’s website or by visiting a local SSA office. Fill out the required forms. Be detailed when providing information about your disability, work history, and medical treatment.

Step 4: Submit Your Application

Once you’ve completed the application, submit it to the SSA. Make sure to keep copies of all documents for your records.

Step 5: Wait for a Decision

After submitting your application, the SSA will review your case to determine your eligibility. This process can take several months, so be patient.

Step 6: Appeal if Necessary

If your initial application is denied, don’t lose hope. Many SSDI applicants are initially denied Social Security disability benefits. You have the right to appeal the decision. Consult with an attorney or advocate who specializes in disability cases to guide you through the appeals process.

Seeking Legal Assistance and Appeals

Navigating the world of long-term disability benefits can be challenging. Unfortunately, it’s not uncommon for individuals to face denials for disability payments during the application process. In such cases, seeking legal assistance can be invaluable.

Here are some key points to consider:

- Consulting an Attorney: If you encounter difficulties with your SSDI application or appeal, consider consulting an attorney who specializes in disability cases. They can provide expert guidance and represent your interests throughout the process.

- Appeals Process: If your initial application is denied, you have the right to appeal the decision. This involves a series of stages, including reconsideration, a hearing before an administrative law judge, and, if necessary, further appeals to higher levels.

- Medical Evidence: Strong medical evidence is critical at every stage of the appeals process. Continue to gather and submit relevant medical documentation to support your case.

- Patience and Persistence: The appeals process can be lengthy. Be prepared to wait for hearings and decisions, but stay strong! This is part of the path to the benefits you deserve.

Conclusion

Dealing with long-term disability is a challenge. Getting help can seem daunting, but don’t let it overwhelm you. Remember that you are not alone on this journey. Support networks, advocacy groups, and legal professionals will guide you through the process. With determination and the right resources, you can access everything you need to regain stability and improve your quality of life. Get started today with Benefits.com.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.