The number of credits you need to qualify for certain Social Security benefits depends on your age and the type of benefit. Without enough credits, you may not be eligible for retirement benefits at all, regardless of your age.

How Many Credits for Social Security Retirement Are Required?

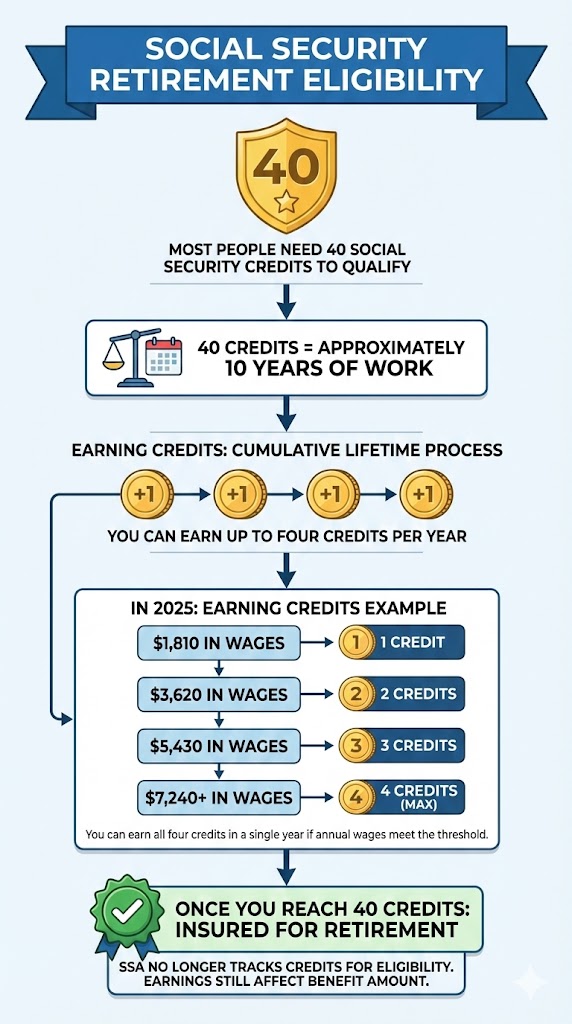

Most people need a minimum number of 40 Social Security credits to qualify for Social Security retirement benefits.

- 40 credits = approximately 10 years of work

- You can earn up to four credits per year

- Credits are cumulative over your lifetime

You can earn all four credits in a single year if your annual wages meet the required threshold. In 2025, you earn one credit for every $1,810 in wages, up to four credits per year.

Once you reach 40 credits, you are considered insured for retirement, meaning you meet the basic SSA retirement eligibility requirement. At that point, the SSA no longer tracks credits for eligibility purposes, although your earnings will still affect your benefit amount.

How to Earn Social Security Credits

Covered Employment

You earn credits only through covered employment, meaning work where you pay Social Security taxes (FICA taxes). This typically includes:

- Most private-sector jobs

- Government jobs covered by Social Security

- Self-employment where Social Security taxes are paid

- Domestic work (such as housekeeping or caregiving) that meets reporting requirements

- Farm work, if properly documented and subject to Social Security taxes

The federal government sets special rules for certain types of work, including domestic work, farm work, and some nonprofit or religious organization jobs, which can affect how credits are earned.

Some jobs—such as certain state or local government positions—may not be covered by Social Security if the employee participates in a separate pension system.

Credit Calculation Social Security Rules

The credit calculation Social Security system changes slightly every year because the amount of earnings required for one credit increases with national wage levels. Social Security credits are earned based on your total wages within a calendar year, and you can earn up to four credits per calendar year.

For example:

- If one credit requires $1,700 in earnings for the year

- You would need $6,800 in earnings to earn all 4 credits

While credits are based on your total wages in a calendar year, your Social Security benefit amount is calculated using your average wages over your working years, not just the number of credits earned.

Once you earn enough in a year to reach the maximum 4 credits, earning additional income does not generate extra credits for that year.

Social Security Work Credits vs. Benefit Amounts

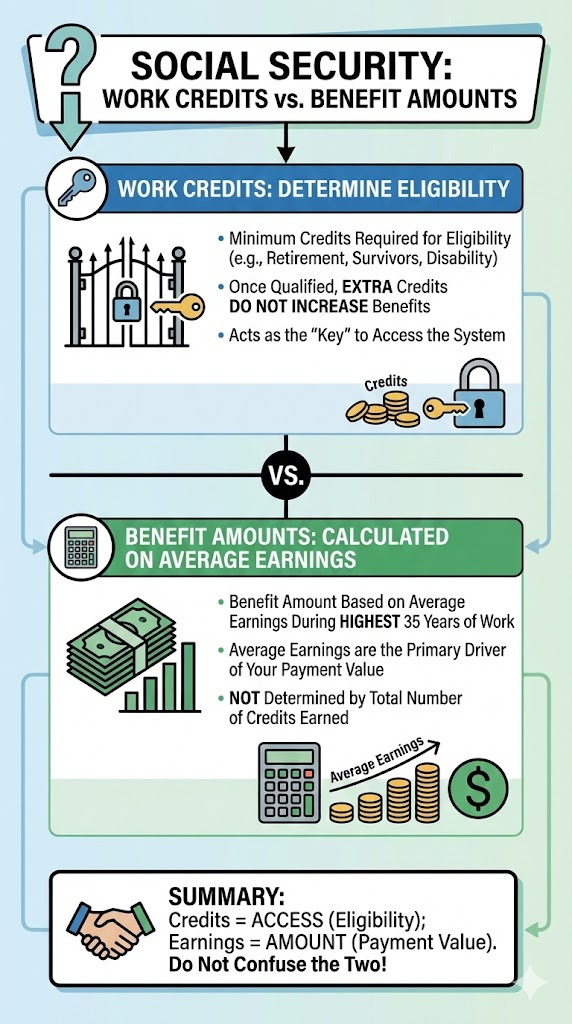

A common misunderstanding is that earning more credits increases your monthly retirement payment, but that’s not how Social Security works.

- Credits earned determine whether you are eligible for benefits: You must earn a certain number of work credits to be eligible for benefits such as retirement, survivors, or disability. Once you have enough credits to qualify, earning additional credits does not make you eligible for more benefits.

- Average earnings determine your future benefits: Your Social Security benefit amount is calculated based on your average earnings during your highest 35 years of work. These average earnings are what determine the amount of your future benefits, not the total number of credits earned.

Credits do not impact the amount of benefits you receive; they only determine eligibility for benefits.

When Can You Start Receiving Retirement Benefits?

Even after meeting the retirement credits requirement, you must still reach a certain age to claim retirement benefits.

- Age 62 – Earliest retirement (reduced benefits)

- Full Retirement Age (FRA) – Typically, 66–67 depending on birth year

- Age 70 – Maximum delayed retirement credits

Deciding when to start receiving benefits is an important part of your retirement plan, as the timing can affect your monthly payments and overall financial outcome. To begin receiving benefits, you must file a claim with the Social Security Administration (SSA).

Your Social Security credits determine whether you qualify, but your age and earnings history determine when and how much you are paid.

What If You Don’t Have Enough Social Security Credits?

If you do not reach 40 credits, you generally cannot receive retirement benefits on your own work record. However, you may be eligible for certain other benefits.

- Spousal benefits (based on a spouse’s earnings record)

- Divorced spouse benefits (if marriage lasted at least 10 years)

- Survivor benefits (based on a deceased spouse’s work record)

These benefits have different eligibility rules and may not require you to meet the 40-credit threshold personally.

My Social Security Credits: How to Check Your Progress

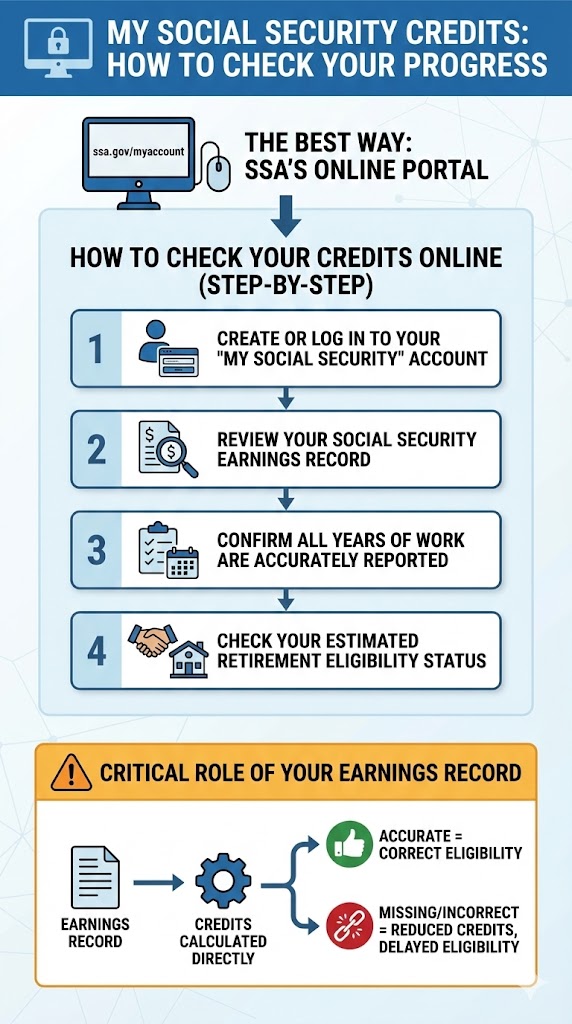

The best way to track My Social Security credits is through the SSA’s online portal. You can check your earned credits and earnings history online through your personalized Social Security statement at ssa.gov/myaccount.

How to Check Your Social Security Credits Online

- Create or log in to your My Social Security account

- Review your Social Security earnings record

- Confirm that all years of work are accurately reported

- Check your estimated retirement eligibility status

Your earnings record is critical because credits are calculated directly from reported earnings. Missing or incorrect earnings could reduce your credited work history and delay eligibility.

Why Your Social Security Earnings Record Matters

Your Social Security earnings record serves two major purposes during your working years:

- Determines your work credits

- Calculates your retirement benefit amount

Your working years—the total span of your employment—are used to determine both how many work credits you earn and the amount of your Social Security benefits.

If earnings are missing—due to unreported income, employer error, or name mismatches—you may lose credits you rightfully earned. This can affect both eligibility and payment amounts.

If you spot an error, the SSA allows you to submit documentation such as W-2 forms or tax returns to correct your record.

Key Takeaways: Social Security Credit Requirements

- Social Security credits for retirement measure whether you worked long enough to qualify

- Most people need 40 credits (about 10 years of work)

- You can earn up to 4 credits per year

- Credits are based on earnings, not hours worked

- Credits determine eligibility—not benefit amount

- Your credits stay on your record forever, even if you leave the workforce or change careers

- If you pass away, your immediate family members may be eligible for Social Security survivors benefits payments based on your credits

- Eligibility for survivors benefits can occur with fewer than 40 credits; the number of credits needed for family members to be eligible depends on your age at death

- You can check My Social Security credits online at any time

- Always verify your Social Security earnings record for accuracy

Many people assume Social Security benefits are automatic, only to discover later that they lack sufficient credits or have errors on their earnings record.

By regularly reviewing your earnings history and understanding Social Security credit requirements, you can protect your eligibility and ensure you receive the retirement benefits you have worked for over your lifetime.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.