Unemployment benefits in Utah serve as a crucial safety net for individuals facing job loss or temporary unemployment. Administered by the Utah Department of Workforce Services (DWS), this program provides financial assistance to eligible workers without a job through no fault. Unemployment benefits help individuals cover their basic living expenses while they search for new employment opportunities, ensuring economic stability during uncertain times in the United States.

Utah Unemployment Services

| Website | https://jobs.utah.gov/ui/home |

| Private Website | Utah Unemployment |

| Phone | 888-848-0688 |

| dwscontactus@utah.gov | |

| Apply Online | https://jobs.utah.gov/ui/home/initialclaims |

| Weekly Certification | File a Weekly Claim |

| Appeal a Denial | https://jobs.utah.gov/appeals/index.html |

| Find a Local Office | https://jobs.utah.gov/jsp/officesearch/#/map |

| Report Fraud | https://jobs.utah.gov/department/contact/fraud.html |

| Coronavirus Updates | https://jobs.utah.gov/covid19/covidui.html |

Eligibility Requirements for Utah Unemployment Benefits

Utah’s unemployment benefits program operates under specific eligibility criteria that individuals must meet to qualify for support. This ensures that the program assists those who genuinely need it while maintaining the system’s integrity. Here are some requirements to receive unemployment insurance benefits:

- Work History

Applicants must have a sufficient work history to be eligible for unemployment benefits in Utah. This includes having earned a minimum wage during their base period, typically consisting of the first four of the last five completed calendar quarters. Every quarter in the calendar is a three-month interval concluding on March 31st, June 30th, September 30th, and December 31st.

- Reason for Job Separation

One of the critical eligibility factors is the reason for job separation. Individuals must have lost their jobs through no fault of their own. This encompasses various situations, such as layoffs due to economic downturns, company closures, or reductions in work hours. Conversely, those who voluntarily left their jobs without reasonable cause or were terminated for misconduct may not qualify for typical unemployment benefits.

- Availability for Work

Applicants must be able and available for suitable employment. This means they should actively seek Work and be prepared to accept suitable job offers. Demonstrating a genuine intent to return to the workforce is a fundamental requirement for eligibility.

- Registration with Workforce Services

Claimants must register with the Utah Department of Workforce Services, the agency responsible for administering unemployment benefits. Additionally, if directed by the department, they may be required to actively participate in reemployment services, including job search assistance and training programs.

Understanding these eligibility requirements is essential for individuals considering unemployment benefits in Utah. Meeting this criterion ensures that applicants have a strong foundation for their claims and increases their chances of receiving the financial assistance they need.

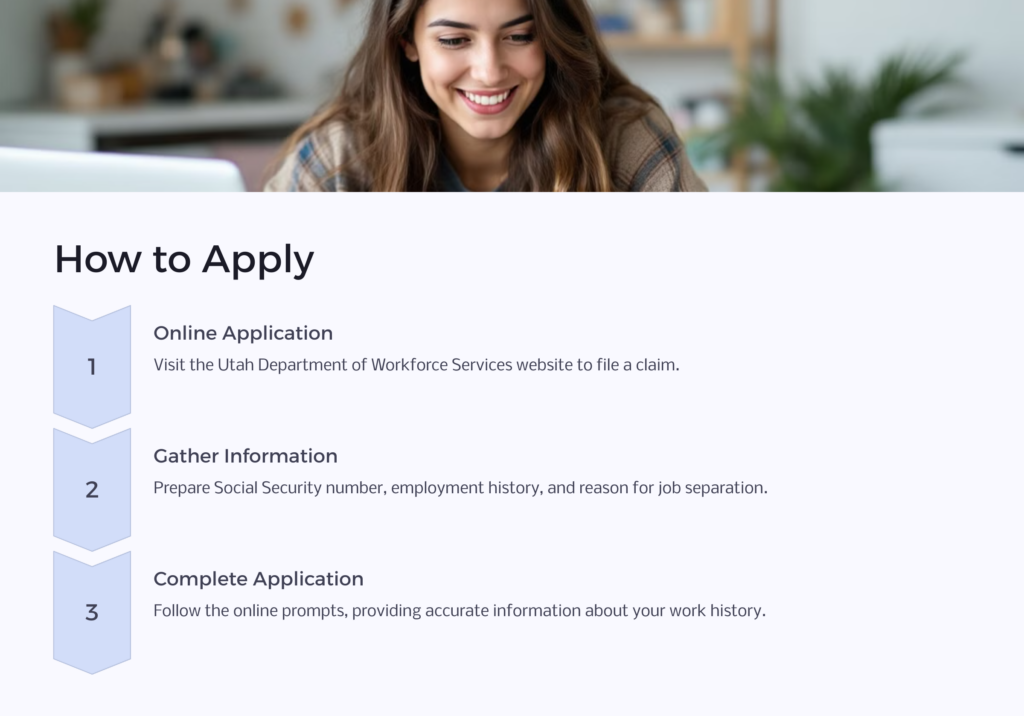

How to Apply for Unemployment Benefits in Utah

Applying for unemployment benefits in Utah requires following a series of steps designed to streamline the application and ensure eligible individuals receive timely assistance. Here are the steps:

- Online Application

The most accessible and efficient way to apply for Utah unemployment insurance is through the Utah Department of Workforce Services website. Navigating to the “File a claim” section allows applicants to begin the application process online.

- Gather Required Information

Before initiating the application, gathering the necessary documents and information is essential. This includes your Social Security number, employment history, dates of employment, and the reason for job separation. Having these details ready will expedite the application process.

- Complete the Application

The online application guides applicants through the necessary steps, prompting them to input accurate information about their work history and job separation circumstances. Providing truthful and comprehensive responses is crucial to ensure a smooth application process for the unemployment insurance program.

- Weekly Certification

Once the initial claim is filed and approved, applicants must submit a weekly certification confirming their continued eligibility and ongoing job search efforts to the federal government. This weekly claim is vital to continue receiving unemployment benefits through the Utah system.

- Receive Benefit Payments

Upon approval, eligible individuals receive benefit payments through direct deposit to a designated bank account or via a debit card. The funds received are intended to assist with covering essential expenses during the period of unemployment.

Understanding this application process, from the initial claim to weekly certifications, is essential for individuals seeking unemployment benefits in Utah. Adhering to the outlined steps ensures applicants can access the financial support they need promptly.

Calculating Utah Unemployment Benefits

The unemployment benefits individuals receive in Utah are determined using a formula that considers their earnings during the base period. This formula aims to provide a fair representation of an individual’s pre-unemployment income while maintaining the program’s sustainability.

To be eligible for benefits, it’s necessary to have earned a minimum of $4,800 during what’s referred to as the “base period.” This base period should encompass a total wage amount at least 1.5 times greater than the highest wage earned by the worker in any calendar quarter within that same base period.

If an employee’s earnings don’t meet the 1.5 times requirement, an alternative base period can be utilized to assess eligibility for benefits. This alternative base period in Utah consists of the four most recently completed calendar quarters.

Weekly unemployment insurance benefits are determined by dividing the earnings from the highest quarter within your base period by 26 and then deducting $5.00. Utah’s maximum weekly benefit amount (WBA) stands at $712, and the overall maximum benefit amount (MBA) for the entire year is $18,512.

Benefit Payments and Duration

| Base Period | First 4 of the last 5 completed quarters |

| Alt Base Period | Last 4 completed quarters |

| Duration of Benefits | Weekly Payment | Maximum Benefits Amount (1 year) | |

| Min | Max | ||

| 10-26 weeks | $32 | $580 | $15,080 |

Potential Deductions

While the formula serves as the foundation for benefit calculations, there are potential deductions to consider:

- Federal Income Tax: Utah unemployment benefits may be subject to federal income tax. Claimants can opt to withhold taxes from their benefit payments to prevent a tax liability at the end of the year.

- Other Income: Receipt of different forms of income, such as severance pay or pensions, may affect the amount of unemployment benefits received. Individuals may sometimes experience reduced benefits based on these additional income sources.

Understanding how Utah calculates unemployment benefits, including the formula used and potential deductions, helps individuals manage their finances effectively while receiving support during unemployment.

Maintaining Utah Unemployment Benefits

Receiving unemployment benefits in Utah comes with specific responsibilities and obligations that claimants must fulfill to continue receiving financial assistance.

- Job Search Requirements

To maintain eligibility, individuals are required to seek suitable employment actively. This involves conducting a systematic job search, which includes applying for positions, attending interviews, and keeping a record of job search activities. Demonstrating a genuine effort to rejoin the workforce is crucial to continue receiving unemployment compensation while unemployed.

- Reporting Income

Claimants must report any income earned during their benefit weeks accurately. This includes income from part-time Work, self-employment, gig work, or any other source. Accurate reporting ensures that benefit payments align with the individual’s financial situation and helps prevent overpayments or penalties.

- Work Search Review

Individuals receiving unemployment benefits may be scheduled for work search reviews or reemployment services with a Utah Department of Workforce Services representative. Attendance at these appointments is mandatory, and individuals must actively engage in the provided services.

- Compliance with Workforce Services

Claimants must comply with all guidelines and requirements the Utah Department of Workforce Services sets forth. This includes providing accurate information, promptly responding to requests for documentation, and adhering to any additional obligations related to the receipt of benefits.

- Potential Disqualifications

Failure to meet the discussed obligations can lead to disqualification from unemployment benefits. Engaging in misconduct, refusing suitable job offers, or not fulfilling the job search requirements can result in the suspension or termination of benefits.

Understanding these responsibilities and obligations is essential for individuals receiving unemployment benefits in Utah. Complying with these requirements ensures continued eligibility and the uninterrupted receipt of financial support during unemployment.

Additional Resources and Support Services

In addition to unemployment benefits, Utah offers a range of resources and support services to assist individuals in their journey toward reemployment and financial stability.

- Job Search Assistance. The Utah Department of Workforce Services provides valuable job search assistance. This includes access to job listings, assistance with resume building, interview preparation, and career counseling. These services are designed to help individuals find suitable employment opportunities more efficiently.

- Retraining Programs. Some individuals may qualify for retraining programs aimed at helping them acquire new skills and transition into different industries or occupations. These programs can be instrumental in adapting to changing job markets.

- Emergency Financial Assistance. During times of crisis, individuals facing severe financial hardships may be eligible for emergency financial assistance programs. These programs temporarily relieve essential expenses when no other options are available.

Ready to File for Your Unemployment Benefits?

Utah’s unemployment benefits system is a critical lifeline for individuals navigating the challenges of job loss. Understanding the eligibility requirements, application process, benefit calculations, and responsibilities associated with receiving unemployment benefits is essential for those seeking financial support during difficult times.

Understanding the intricacies of Utah’s unemployment benefits system is vital for those facing job loss. It’s essential to meet eligibility criteria, adhere to the application process, and fulfill responsibilities to ensure continuous support.

For further assistance and resources in navigating financial challenges and filing an unemployment claim, consider Trajector, a company dedicated to aiding the underserved and at-risk disabled population in obtaining the Social Security disability benefits they rightfully qualify for. Their expertise in developing medical evidence can significantly improve the life trajectory of those in need.

Utah Unemployment Office Locations

| Beaver Unemployment Office | 875 North Main PO Box 1138 Beaver, UT 84713 | 866-435-7414 |

| Blanding Unemployment Office | 544 North 100 East Blanding, UT 84511 | 866-435-7414 |

| Brigham City Unemployment Office | 138 West 990 South Brigham City, UT 84302 | 866-435-7414 |

| Emery County Unemployment Office | 550 W. Hwy 29 Castle Dale, UT 84513 | 866-435-7414 |

| Cedar City Unemployment Office | 176 East 200 North Cedar City, UT 84720 | 866-435-7414 |

| Clearfield Unemployment Office | 1290 East 1450 South Clearfield, UT 84015 | 866-435-7414 |

| Delta Unemployment Office | 44 South 350 East Delta, UT 84624 | 435-864-3021 |

| Heber City Unemployment Office | 69 North 600 West Suite C Heber City, UT 84032 | 866-435-7414 |

| Junction Unemployment Office | 550 North Main PO Box 127 Junction, UT 84740 | 866-435-7414 |

| Kanab Unemployment Office | 468 East 300 South Kanab, UT 84741 | 801-435-7414 |

| Lehi Unemployment Office | 557 W State Street Lehi, UT 84043 | 866-435-7414 |

| Loa Unemployment Office | 18 South Main PO Box 267 Loa, UT 84747 | 435-836-2406 |

| Logan Unemployment Office | 180 North 100 West Logan, UT 84321 | 866-435-7414 |

| Manti Unemployment Office | 55 South Main Suite #3 Manti, UT 84642 | 866-435-7414 |

| Midvale Unemployment Office | 7292 South State Street Midvale, UT 84047 | 801-526-0950 |

| Moab Unemployment Office | 457 Kane Creek Boulevard Moab, UT 84532 | 866-435-7414 |

| Nephi Unemployment Office | 625 North Main Nephi, UT 84648 | 866-435-7414 |

| Ogden Unemployment Office | 480 27th Street Ogden, UT 84401 | 866-435-7414 |

| Panguitch Unemployment Office | 665 North Main PO Box 61 Panguitch, UT 84759 | 866-435-7414 |

| Park City Unemployment Office | 1910 Prospector #100 Park City, UT 84060 | 866-435-7414 |

| Price Unemployment Office | 475 West Price River Drive Price, UT 84501 | 866-435-7414 |

| Provo Unemployment Office | 1550 North 200 West Provo, UT 84604 | 801-526-0950 |

| Richfield Unemployment Office | 115 East 100 South Richfield, UT 84701 | 866-435-7414 |

| Roosevelt Unemployment Office | 140 West 425 South Roosevelt, UT 84066 | 435-722-6499 |

| Metro Unemployment Office | 720 South 200 East Salt Lake City, UT 84111 | 801-526-0950 |

| Spanish Fork Unemployment Office | 1185 North Canyon Creek Pkwy Spanish Fork, UT 84660 | 866-435-7414 |

| St. George Unemployment Office | 162 North 400 East Building B St. George, UT 84770 | 866-435-7414 |

| South County Unemployment Office | 5735 South Redwood Road Taylorsville, UT 84123 | 801-269-4700 |

| Tooele Unemployment Office | 305 North Main Street Suite 100 Tooele, UT 84074 | 866-435-7414 |

| Vernal Unemployment Office | 1050 West Market Drive Vernal, UT 84078-2399 | 435-781-4100 |

| South Davis Unemployment Office | 763 West 700 South Woods Cross, UT 84087 | 866-435-7414 |

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.