As we face unprecedented times, many people have found themselves unemployed and struggling to make ends meet. If you are a resident of Alabama, you may be wondering what options are available for financial assistance during this difficult period. The answer may lie in unemployment compensation, which provides temporary financial support to those who have lost their jobs through no fault.

However, navigating the process of applying for and receiving these benefits can be overwhelming and confusing. That’s why we have created this comprehensive guide to employee rights and unemployment benefits in Alabama to help you understand everything you need to know.

Let’s explore the details of this Alabama unemployment insurance and prove how they can help you get back on your feet.

What Are Unemployment Benefits in Alabama?

Unemployment benefits in Alabama refer to temporary financial assistance provided to eligible workers who have lost their jobs and meet specific criteria set by the Department of Labor.

Circumstances such as job loss due to company downsizing, business closure, or economic downturn can leave individuals without a steady income to support themselves and their families. Unemployment benefits can alleviate financial stress and provide a safety net while unemployed workers search for new employment opportunities.

Who Is Eligible for Unemployment Benefits?

To be eligible for temporary financial aid in Alabama, you must have lost your job through no fault of your own. For example, if you were terminated for cause, you might not qualify for financial aid. Additionally, you must have earned certain wages during a “base period.” This is typically the most recent 12 months of the previous five completed quarters, starting when you file your claim.

Your earnings during the period need to be at least one and a half times the amount earned in your highest-earning quarter. Additionally, Alabama residents must make more per week than the amount they are eligible to receive in weekly financial aid to meet the eligibility requirements for unemployment insurance in Alabama.

There is also a job search requirement for unemployment benefits for people in Alabama. This means you must actively seek work to qualify for temporary financial aid.

How To Apply for Unemployment Benefits in Alabama

For income support in Alabama, you can apply online through the Alabama Department of Labor’s website. You will need to provide personal information, including your name, social security number, and contact information. You will also need to provide information about your most recent employer, including their name and address.

Documentation Needed To Apply for Unemployment Benefits

When applying for this assistance program in Alabama, you must provide certain documentation to support your application. This may include:

- Your social security number

- Your driver’s license or other government-issued identification

- Your most recent pay stubs or W-2 forms

- Your Alabama employer’s name and address

- The reason for your separation from your employer

Calculating Your Weekly Benefit Amount

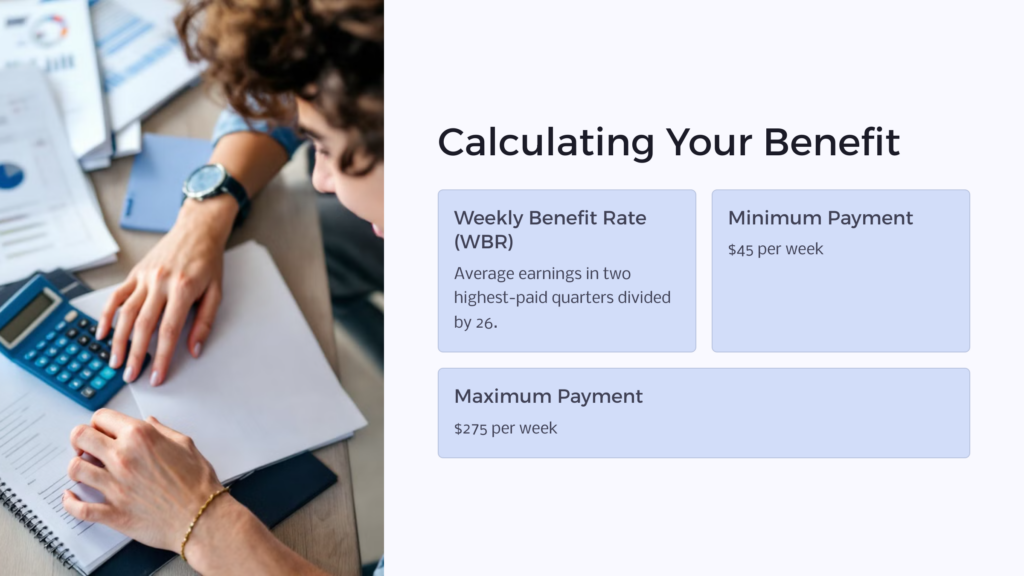

To determine your weekly benefit rate (WBR) in Alabama, your average earnings in the two highest-paid quarters of the base period are divided by 26. The minimum payment is $45, and the maximum is $275.

It’s important to note that your weekly benefit amount is not the only factor determining the unemployment compensation you may receive. Other factors like part-time earnings may also affect your eligible benefits.

It is important to declare all wages earned during the week you apply. Note that gross earnings should be reported during the week in which they were earned and not when they were received.

It’s also recommended that you review your earnings history and any other potential factors that may affect your eligibility for an unemployment claim before filing it. This will help ensure that you receive the maximum financial aid that you are entitled to under Alabama law.

Duration of Unemployment Benefits

The length of time you can receive this employee assistance program in Alabama depends on many factors, including how long you worked for your employer and how much you earned during the period. Generally, you can receive income support for up to 20 weeks, although this may be extended benefits during high unemployment.

Alabama’s Department of Labor has an online tool to track the status of your unemployment claim and access your benefits. The tool also provides information on how much workers can expect to receive and when the payment will arrive.

Process for Reopening a Previously Closed Unemployment Benefits Claim

To reopen a financial aid request in Alabama that was previously closed, you must access your UI account and select the option to reopen it. Claimants must provide all the necessary information and answer any questions the Department of Labor in Alabama asks to evaluate their eligibility.

After reviewing and submitting the details, you can check the status of your weekly certification for this compensation on the Alabama Claimant Portal. You can also contact the Alabama Department of Labor for your state unemployment benefits or call their toll-free helpline at 866-234-5382.

Take the First Step Towards Securing Your Financial Future

Alabama unemployment benefits can provide much-needed financial assistance during a difficult time. You may be eligible for financial support if you’re in Alabama and have recently lost your job. We hope this guide has provided you with the information you need to file your claim and receive the assistance you need. You may also check our guide about temporary disability benefits if you cannot work due to illness or injury.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.