If you have lost your job recently in Nevada because of reasons outside your control, you may qualify for unemployment benefits. Unemployment benefits are payments available to employees who have lost their jobs for reasons beyond their control. However, the basic requirements for unemployment insurance benefits, including the eligibility rules, benefits amount, past earnings requirements, and other details, vary significantly across various states. This article will discuss the unemployment insurance benefits you can receive in Nevada.

What Are Unemployment Benefits in Nevada?

Nevada unemployment benefits offer temporary economic aid to employees who have lost their jobs through no fault of their own.

You might be entitled to Nevada unemployment benefits if you’re forced to quit or lose your job. Typically, you’re entitled to unemployment insurance benefits if you’re laid off from work because your employer doesn’t have enough work for you or if it’s not your fault that you lost your job. However, you may still receive unemployment benefits in some scenarios, even when you’re at fault for losing work.

Who Is Eligible for Unemployment Benefits in Nevada?

To qualify for this compensation program, you must live in Nevada and meet the following:

Lost your job for reasons beyond your control per Nevada law.

Worked in the state of Nevada during the last year (this base period might be longer in some cases), and

Your total wages during the last 12 months must be at least 150% that of your income during your highest-earning quarter.

Actively searching for a job every week.

How Do You Apply for Unemployment Benefits in Nevada?

You can file for your unemployment insurance (UI) benefits online at detr.nv.gov. First, however, you must create an account with the CSS (Claimant Self-Service) portal. The Employment Security Division (ESD) recommends applying for unemployment insurance benefits online whenever possible because claimants often have to wait longer if they make their applications over the phone. However, you can also file your unemployment benefits claim over the phone using the following numbers:

Southern Nevada: (702) 486-0350

Northern Nevada: (775) 684-0350

Out-of-State and rural claimants: (888) 890-8211

You must provide the following:

Your Alien or Social Security registration number.

Contact information.

Details about your last two workstations.

That includes the address and name of your employers, when you started working, when you stopped working, and why you stopped working there.

Then you’ll receive a determination notice informing you about your eligibility for unemployment benefits, the amount of the benefits, and your schedule. To maintain your eligibility, you must file your weekly claims on time, even though your application is subject to an appeal or pending approval. Otherwise, you may lose your weekly payments.

If you successfully secure a job, you can end your unemployment Nevada claim by stopping your weekly claims. You don’t need to contact the Employment Security Division (ESD) because they automatically assume you no longer require your payments.

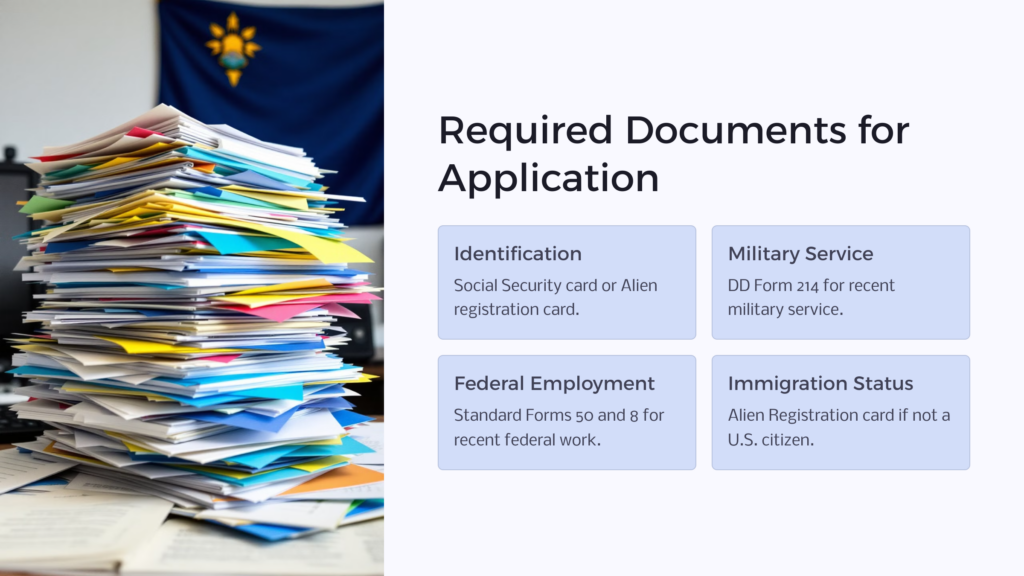

What Documents Do You Need to Apply for Unemployment Benefits in Nevada?

To apply for unemployment insurance (UI) benefits in Nevada, you must have the following documents:

Social Security card

If you aren’t a United States Citizen, you must provide an Alien registration card.

If you were on active duty in the military for the past 18 months, you must provide a DD Form 214.

If you’ve worked for the federal government during the past 18 months, you must provide a Standard Form 50 and Standard Form 8.

How Long Does It Take to Get Unemployment Benefits in Nevada?

Once you file your weekly claim, you’ll receive your unemployment insurance benefits for an eligible week within two business days.

How Much Can You Get in Unemployment Benefits in Nevada?

If you qualify to receive unemployment benefits in Nevada, your weekly benefit amount will be 4% of your total wages during the highest-paid quarter of the base period. That amount is subject to a maximum of $496 every week.

Nevada’s maximum weekly benefit amount is half of your average weekly income. This amount is adjusted every July 1st. Therefore, you may be eligible for unemployment benefits for six months.

Click here to learn more about temporary disability benefits.

How Are Unemployment Benefits Calculated in Nevada?

When you file an unemployment benefits claim, your weekly payment is your “weekly benefit amount.” You can calculate that figure by taking 4% of your wages in your highest-earning quarter.

The maximum weekly benefit rate is approximately $483. You can’t receive more than, no matter your total earnings. The minimum weekly benefit rate is around $16.

For instance, if your highest-earning quarter total wages were $9,000, your weekly benefit rate will be 4% x $9,000 = $360.

How Long Can You Receive Unemployment Benefits in Nevada?

When you file for unemployment insurance benefits, your insurance claim is valid for 12 months, starting from when you file your claim. However, you can only receive unemployment benefits in Nevada for six months or 26 weeks during one year.

What Happens If You Refuse Work While Receiving Unemployment Benefits in Nevada?

Did you refuse an offer of employment? Or did you refuse to go back to work? Employers should report these scenarios to the Nevada Department of Employment Training and Rehabilitation (DETR). Nevada law forbids unemployed workers from receiving unemployment insurance benefits if they turn down offers of suitable work or quit their jobs without a good cause. So, again, employers should offer information concerning work refusals or workers who turn down offers to return to employment to the Nevada DETR.

Suitable work is work a claimant has the abilities and ordinary skills to perform and pays a normal amount for that occupation within the job market. Refusing offers of suitable work could lead to denial of Nevada unemployment benefits.

Can You Work Part-Time and Still Receive Unemployment Benefits in Nevada?

Yes, you can have part-time work and still receive Nevada unemployment benefits. However, to be eligible for these benefits, you must look for full-time employment and report any wage you earn during the week. Once your gross weekly wage exceeds your weekly benefit rate by 150%, the ESD will deem you re-employed, and you’ll no longer qualify to receive Nevada unemployment insurance benefits.

Are Unemployment Benefits Taxed in Nevada?

Yes, you must pay a federal income tax on any payment from the Nevada unemployment benefits program. However, you can choose to have the state withhold 10% of your weekly benefit rate and send it to the Internal Revenue Service (IRS) on your behalf.

But unemployed workers don’t have to pay state taxes on unemployment benefits in Nevada because Nevada doesn’t have a state income tax. Every January, the Nevada Department of Employment, Training, and Rehabilitation will send you an IRS Form 1099-G showing your compensation from the Nevada unemployment insurance program.

It’s your responsibility to report accurately and pay the right amount of taxes to the IRS.

How Do You Appeal a Denial of Unemployment Benefits in Nevada?

If your claim for Nevada unemployment benefits is denied, file an appeal with the Appeals Office of the Nevada Department of Employment Training and Rehabilitation. The determination letter denying your unemployment benefits claim will outline how and where you should file your appeal. You have 11 days from the day you received the determination letter to file an appeal.

In your appeal, you must state you’re appealing the decision and say why you feel you’re eligible for unemployment benefits. For instance, if the determination letter stipulates you were denied unemployment insurance benefits because you voluntarily quit your job, you may say: “Even though my employer reported that I quit work, I was informed I had to quit or be laid off the following day.”

After filing an appeal, continue filing weekly claims for Nevada unemployment benefits, searching for work, and recording your job search, just like your claim had been approved. If you win the appeal, you’ll be eligible for unemployment benefits retroactively from the day your claim was denied—but this will only happen if you’ve been filing weekly claims and looking for work every week.

Don’t let these processes overwhelm you. Benefits.com is here to help! Sign up to join our community, and take a look at the information we offer on unemployment benefits in other states such as New Jersey and Kentucky. Find the help you deserve!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.