Here are the answers to some common questions about SSDI eligibility.

- Do I have to be permanently disabled to get Social Security Disability benefits?

- Do I have to be completely incapacitated to get Social Security Disability?

- I am 60% disabled. Will I get a partial Social Security Disability benefit if I am approved for Social Security?

- Can I get disability benefits from Social Security if my family or I have income and assets?

- If I can’t do physical work and can’t find a non-physical job, will my Social Security Disability application be approved?

- What are the Social Security Disability requirements for non-citizens to receive a check?

Do I have to be permanently disabled to get Social Security Disability benefits?

One of the most common misconceptions about Social Security Disability is that to get Social Security disability benefits, you must be permanently disabled. This is not true. Some people incur serious injuries in an accident that require serial surgeries, but they recover and return to work in little over a year. Others have experienced medical recovery many years into disability when a new treatment has become available. In any event, Social Security law only requires you to be disabled for twelve consecutive months. So, you definitely are not promising to be disabled forever.

Advantages of Applying for SSDI When Disability Is Not Permanent

Even if you expect to be disabled for only a little longer than twelve months and even if you have other income, it can be helpful in the long run to have applied and been approved for Social Security Disability because of the disability freeze. Any year that you have little or no earnings due to disability and you are entitled to Social Security Disability in those months, the low or no earnings year will be omitted from the calculation of your Social Security Retirement (SSR) benefit. This means that after you have returned to work and reached retirement age, your SSR benefit will not be dragged down by a period of disability.

Medical Recovery

If you recover medically, you are responsible for reporting recovery, and your benefits will stop. For that reason, if you are released to return to work or otherwise become aware of recovery, it is important to report the change right away to avoid overpayment. Benefits can also be terminated when medical recovery is determined as the result of a Continuing Disability Review (CDR), which can occur after three, five, or seven years of benefits or after a much shorter period of time if recovery is expected to be soon after approval.

Working One’s Way Off Disability

If after twelve months of disability, you have not recovered fully but want to try to work, you may be eligible for one of Social Security’s several work incentives, which allow work while receiving benefits and hopefully assist you in transitioning back into full employment.

Do I have to be completely incapacitated to get Social Security Disability?

Contrary to word often heard on the street, you do not have to be completely incapacitated to get Social Security Disability benefits. Many people getting Social Security Disability payments are able to take care of some of their home and their personal needs and are able to engage in some enjoyable activities.

Working While Disabled

Some people whom Social Security has found to be disabled are even able to do a bit of volunteer work or part-time paid work. What is key to an approval for benefits is the inability to perform what Social Security calls “substantial gainful activity.” You may not be able to earn $1,260 monthly, which is generally considered substantial, but you may be able to work a handful of hours a week. Similarly, if you are blind, you may not be able to earn $2110 monthly, which is generally considered substantial gainful activity for blind individuals, even though you can earn some money.

Social Security Work Incentive Programs

If you are already receiving benefits and you are thinking about working, Social Security has many work incentive programs, some of which allow you to get Social Security Disability benefits and Medicare for some months in which you are performing substantial work.

I am 60% disabled. Will I get a partial Social Security Disability benefit if I am approved for Social Security?

Social Security does not pay partial Social Security Disability benefits. Some other benefit programs such as workers compensation and the Veteran’s Administration will pay a partial benefit if they determine you are partially disabled. Either you are disabled as Social Security defines disability and you receive a full benefit or you are not and no benefits are paid.

What “Disabled” Means to Social Security

You do not have to be completely incapacitated to get Social Security Disability. You can even work and get benefits, as long as your work falls within the parameters of Social Security’s definition of disability or one of Social Security’s liberal work incentive programs. If you are eligible, you get full benefits, even in months, you are working.

An Exception

Certain income you may have, such as Worker’s Compensation or certain government pensions, may cause a reduction in your Social Security benefit while you are receiving both benefits, but the partial Social Security Disability benefit you receive in such a circumstance is not related to your degree of disability.

What to Do

Social Security’s rules including the definition of disability are different from other benefit programs. Accordingly, it is better to err on the side of caution; that is, even if another agency has determined you to be only partially disabled, it is best to file a Social Security Disability claim to get a formal decision. You can start a claim by calling Social Security at 1-800-772-1213 to request an appointment or by visiting ssa.gov and clicking on Disability to file your claim online.

Can I get disability benefits from Social Security if my family or I have income and assets?

You may wonder if you can get disability with money in the bank. The answer is yes; what you and your family own (your assets) never affects your eligibility for Social Security disability benefits or the amount of benefits payable to you.

How Income May Affect Your Disability Payments

The question of whether family income affects the amount of your disability benefit is a little more complicated. First, the easy part: your spouse’s and children’s income does not affect your benefit amount. However, some types of income you receive can affect your or your dependents’ payment amounts.

If you receive a public pension based on work that was not covered by Social Security taxes, the amount of the Social Security benefits that you receive may be affected because there is a limit to the total amount you can receive from the two benefits. If you receive workers’ compensation benefits, both your and your family’s benefits may be reduced. Reduction for workers’ compensation is applied first to your dependents’ Social Security benefits. If the amount of your workers’ compensation offset is greater than the amount of your dependents’ benefits, then your Social Security benefit will also be reduced.

How Work Income May Affect Your Dependents’ Benefits

If your spouse or children are receiving dependents’ benefits because of your disability and they work, there are limits on how much they can earn and still receive their full benefits. In 2020, if a dependent earns more than $18,240 gross wages or net self-employment, their annual Social Security benefit will be reduced by $1 for every $2 earned over the limit.

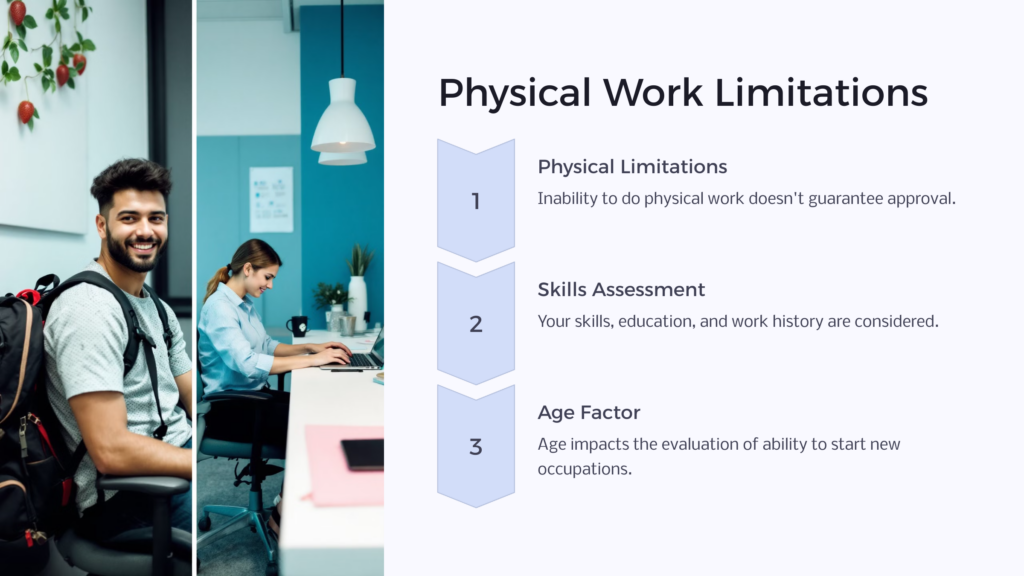

If I can’t do physical work and can’t find a non-physical job, will my Social Security Disability application be approved?

It is fairly common for workers to become injured or to develop an illness that limits them from working in a physically demanding occupation. It is also fairly common that people in this situation have trouble finding a non-physical or less physically demanding job. In such circumstances, whether or not your Social Security Disability application is approved depends upon your physical limitations, your work history, your age, and your education, training, and transferable work skills. If you have the skills and health to work in a sedentary or light job, your claim will not be approved. On the other hand, if your education, training, and experience are limited so that you don’t have the skills to perform lighter occupations, your claim could be approved even though you are physically able to do such jobs.

How Age and Work History Fit In

If you are able to perform an occupation that you have performed in the past, then your disability claim will likely be denied, even if you cannot find a job. On the other hand, if you are unable to perform any occupations that you have done in the past, your ability to work in a new occupation will be evaluated considering your education, training, or transferable skills from past work as well as your physical or mental limitations. Age is also considered in determining whether you have the ability to begin a new occupation with different criteria applying to older workers age fifty through fifty-four and age fifty-five and older.

File an Application and Get a Claim Determination

If you aren’t sure about your eligibility, it’s a good idea to play it safe and get a formal decision by filing a Social Security Disability application with the Social Security Administration or, at least get the input of a skilled Social Security Disability attorney.

What are the Social Security Disability requirements for non-citizens to receive a check?

You may be able to get a Social Security Disability check each month even if you are not a U.S. citizen or a U.S. national. If you are an alien, to get Social Security Disability benefits, you must meet the same disability and work-credit rules as a citizen.

Other Rules for Disabled Aliens

Additionally, you have to meet two other eligibility requirements. First, if you were assigned a Social Security number on or after January 2, 2004, the number must have been assigned based on your authorization to work in the United States or you must have been admitted to the United States at any time as a non-immigrant visitor for business with a B-1 status or as an alien crewman with a D-1 or D-2 status.

Second, for any month you are claiming disability, before you will be paid a Social Security Disability check, you must show that you were legally present in the United States for that benefit month.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.