Acceptable Medical Source

Before making a determination of a claimant’s disability, the SSA evaluates any medical evidence provided by a relevant “acceptable medical source.” Social Security defines “acceptable medical source” as a licensed physician, psychologist, optometrist, speech pathologist, podiatrist, and some therapists and nurse practitioners depending on their licenses. Naturopaths, chiropractors, and other alternative practitioners are not included in the definition of “acceptable medical source.” If you have received treatment from such a provider and want their input considered, you will need to obtain and submit their records or reports because Social Security will not request them. If received they will review them, but they will not weigh them as heavily as records and reports from “acceptable medical sources.”

Activities of Daily Living (ADL)

Activities of Daily Living are activities that most people do on a daily basis to maintain self-care. They include such tasks as personal hygiene and grooming, shopping, walking, meal preparation, house cleaning, and bill-paying. If you have difficulty with any of these tasks, describe your limitations to the SSA or to the Disability Determination Services.

Administrative Law Judge (ALJ)

Administrative law judges are appointed by the federal government to hear and decide Social Security disability second-level appeals at locations throughout the U.S. Puerto Rico and the U.S. Virgin Islands.

Disabled Adult Child

A disabled adult child is an adult who became disabled before the age of twenty-two. SSD benefits may be paid to a disabled adult child if one or both parents are receiving Social Security retirement or disability benefits or are deceased and were insured at the time of their death. The disabled adult child need not have worked and paid into the system. With only one exception, the adult child must also be unmarried.

Affective Disorders

Affective disorders are mental illnesses that involve altered mood, such as depression, anxiety, and bipolar disorders. Affective disorders may be disabling depending on their degree of severity and responsiveness to treatment.

Alleged Onset Date (AOD)

This is the date you claim you became disabled.

Anxiety Related Disorders

Anxiety disorders are mental illnesses such as generalized anxiety, panic attacks, phobias and post-traumatic stress disorder (PTSD). Anxiety disorders may be disabling depending on their degree of severity and responsiveness to treatment.

Appeal

An appeal is a request to have your claim reviewed again after a denial or after an only partially favorable decision. Social Security law offers the opportunity to appeal three times within the Social Security system, if needed. Additionally, if you are still denied you have the right to file suit in federal district court. If you have to appeal, it is a good idea to get help from an SSD-qualified attorney.

Appeals Council

The Appeals Council is a component of Social Security’s appeal process. If a claim has been denied three times, the claimant can request an Appeals Council review. The Appeals Council may 1) decline to review the hearing judge’s decision, 2) conduct a thorough review of the hearing and either overturn the denial due to a previous error or 3) send (remand) the case for a second hearing review.

Applicant

Anyone who applies for Supplemental Security Income.

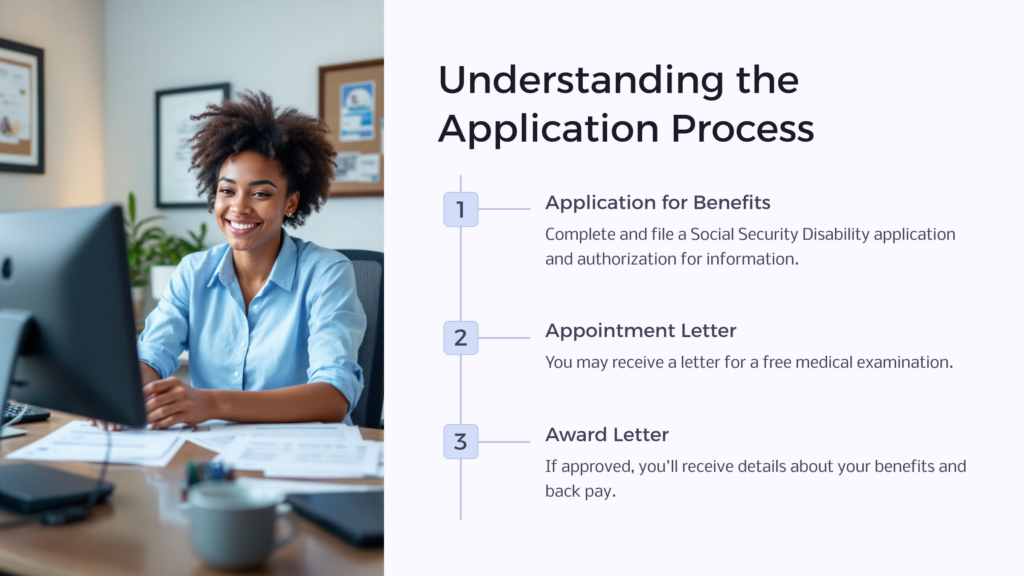

Application for Benefits

To apply for SSD benefits, you need to complete and file-in person, by mail, over the phone, or via the Internet-a Social Security Disability application and an authorization for the SSA to obtain information to process your claim.

Appointment Letter

At some point during the claim or appeal review process, you may receive a letter from your state’s Disability Determination Services (DDS) or the Office of Disability Adjudication and Review asking you to report for a free medical examination to help determine your eligibility for benefits. To avoid jeopardizing your claim, if you receive an appointment letter, acknowledge receipt of the letter promptly and be sure to appear for the exam on time.

Award Letter

If your claim for disability benefits is approved, you will receive an award letter from the SSA entitled “Important Information,” which details the amount of benefits you will receive each month and the amount of any back pay. If your claim is approved in a reconsideration appeal, the letter will be titled “Notice of Reconsideration Decision.” If you are approved at a hearing, you will receive two letters. The first will come from the hearings office and will be titled “Notice of Fully Favorable Decision” or “Notice of Partially Favorable Decision.” The letter explains how it was decided you are disabled and when they found your disability to begin. You will also receive a letter entitled “Important Information” with payment information. If you were represented by a law firm, it’s important to notify them when both your award letter and your first payment are received. (Sometimes your first benefit check will be deposited to your bank account before you get an award letter.)

Back Pay (Past-Due Benefits)

If you have been disabled more than six full calendar-months on the date your first benefit is sent to you, you will be eligible for back pay. Past-due benefits can be paid for a maximum of twelve months prior to the date of your application.

Beneficiary

A beneficiary is an individual who receives Social Security benefits.

Benefits

Benefits are the monthly Social Security cash payments sent by the SSA either in a paper check mailed to your home, in an electronic transfer to a bank account designated by the claimant, or loaded electronically to an Direct Express debit card issued by the SSA.

Blindness

Social Security law defines blindness as either total loss of sight or legal blindness. “Legally blind” means that vision cannot be corrected in their better eye to at least 20/200 or the sight-impaired individual has a restricted field of vision in his or her best eye such that the widest diameter of the visual field subtends an angle no greater than 20 degrees. Sight-impaired individuals must qualify for SSD benefits under the same definition of disability as sighted individuals. However, “substantial gainful work” is defined differently and if they are found to be blind or legally blind, they qualify for special work incentives for the blind.

Blue Book

The Blue Book is the informal name for Disability Evaluation Under Social Security. The book describes each of the disability programs administered by the SSA and includes the List of Impairments, which is a list of adult and childhood medical conditions and corresponding findings considered severe enough to be disabling.

Child

Social Security law defines “child” as a biological or adopted child, a dependent stepchild, or in some situations a grandchild. A child is also either under age eighteen or under age nineteen and enrolled in elementary or high school.

Claimant

Anyone who files a Social Security claim.

Closed Period

A closed period is a limited period of time for which you are eligible for Social Security Disability benefits. If you are found to be disabled for a limited period of time longer than twelve months, you will be approved for a closed period of disability. You will receive one payment to cover the closed period and will not receive ongoing benefits. You have the right to appeal this partially favorable decision if you believe you continue to be disabled.

Compassionate Allowances Conditions

Compassionate Allowance Conditions are physical and mental conditions that are so severe that the SSA has determined they are always disabling. The only requirement for approval is verification that the claimant suffers from the condition, so a claim based on one of these conditions is fast-tracked, sometimes being approved within days.

Consultative Examination

A consultative examination is a medical or psychological evaluation performed by an independent physician or psychologist hired by Social Security. The examination is for evaluation purposes only. The examiner, who is asked to render an opinion about your diagnoses and severity of symptoms and limitations, sends a report to the Disability Determination Services, where the report is considered along with the rest of the information in the claim file when making a decision about eligibility.

Contingency Basis

In the context of Social Security Disability claims, “contingency basis” means that, when a law firm agrees to represent you in your claim for SSD benefits, they will charge a fee for their professional services only if they win your case and you are awarded benefits. If you do not receive benefits, you will not be responsible for any payments to the firm except possibly for a modest amount of attorney out-of-pocket expenses, such as photocopying and court fees, if any.

Continuing Disability Review (CDR)

A Continuing Disability Review is a review of your eligibility for disability benefits that occurs after you have been receiving benefits for a while. Reviews can be conducted anywhere from six months to seven years after approval.

Cost of Living Adjustment (COLA)

If, at the start of each year, the Consumer Price Index shows there has been inflation in the prior year, recipients of Social Security benefits, including disability benefits, will receive an increase in their ongoing benefit equal to the percentage of increase in the Consumer Price Index.

Decompensation

As defined by the SSA, “episodes of decompensation are exacerbations or temporary increases in symptoms or signs accompanied by a loss of adaptive functioning, as manifested by difficulties in performing activities of daily living, maintaining social relationships, or maintaining concentration, persistence, or pace.” Depending on their severity and frequency, episodes of decompensation may qualify a claimant for SSD benefits.

Denial Letter

If your claim or appeal for SSD is denied, you will receive a Notice of Denial. You have the right to appeal the denial. The letter will explain the reasons for denial, how to appeal if you think the decision is wrong, and the deadline for appealing.

Diagnosis

A diagnosis is the name given to an illness or injury. In most cases, having a diagnosis—that is a certain medical or mental condition—does not necessarily mean that you are disabled. Accordingly, unless your diagnosis is among those that have been identified as always disabling (see Compassionate Allowance Conditions), your diagnosis or diagnoses are only part of the information the SSA considers in deciding whether you meet Social Security’s definition of disability.

Direct Deposit

Direct deposit is the payment of funds directly into one’s bank, savings and loan, credit union, or brokerage account. Whenever possible the SSA pays via direct deposit, eliminating the cost of printing checks and reducing the incidences of lost payments.

Disability

The SSA defines disability for adults including disabled adult children as a physical or mental condition that has lasted or is expected to last at least 12 months or can result in death and that prevents a person from engaging in substantial gainful employment.

For children, who may qualify for Supplemental Security Income disability payments, disability means having a physical or mental condition or combination of conditions that have lasted or will last least one year or result in death and that results in marked and severe functional limitations that seriously limit his or her activities.

Disability Determination Services (DDS)

Disability Determination Services is a state agency contracted by the SSA to decide whether Social Security claimants are disabled as defined by the SSA. Each state has one or more DDS offices, staffed by claim examiners and physicians who are trained in Social Security law. Disability applications are reviewed in the SSA field offices to see if the claimants meet the non-medical eligibility requirements. If so, the claim is sent to the DDS for review.

Disability File

This is an electronic file of a claimant’s medical and non-medical record pertaining to his or her SSD claim. This file is available for review on a CD-ROM by the claimant, his or her attorneys, and physicians, DDS examiners, administrative law judges and certain others involved in the SSD review process.

Earnings Record

An earnings record is a record of a worker’s Social Security-taxed earnings throughout his or her lifetime.

Established Onset Date

The established onset date is the date that the DDS establishes that the claimant became disabled as supported by evidence in the claim file. This date determines the start of the unpaid five-month benefit waiting period and, together with the application filing date, determines the date benefits begin.

Exertional Capacity

Exertional capacity is the claimant’s ability to engage in physical activities such as sitting, standing, walking, lifting, pushing, pulling and carrying. This capacity is then compared to the exertion required to perform occupations the claimant has done before and, if the claimant is under age fifty, required in other occupations for which the claimant is qualified.

Family Benefits

Family benefits are secondary benefits that are paid to an eligible spouse or ex-spouse, eligible children, and disabled adult children of a worker who is receiving Social Security disability or retirement.

Family Maximum Benefit

Family Maximum Benefit is the maximum amount of benefits payable to an entire family (including the worker) on any one Social Security earnings record.

FICA Tax

FICA is an abbreviation of Federal Insurance Contributions Act. It is the federal tax withheld from salaries that funds the Social Security and Medicare programs. It’s counterpart for self-employed individuals is the self-employment tax.

Federal Benefit Rate

The Federal Benefit Rate is the maximum amount payable by the federal government per month in Supplemental Security Income (SSI) payments. This maximum is reduced by other countable income. Increases in the Federal Benefit Rate are tied to increases in the Consumer Price Index. Some states supplement the federal amount.

Federal Court Review

A Federal Court Review is a court proceeding that occurs when you file suit for benefits in a Federal District Court. If your claim h

s been denied four times within the Social Security system—at initial claim, reconsideration, hearing, and Appeals Council review, you may, at your own expense, file such a suit.

Medicare

Medicare is a Federal health insurance program for individuals who are age sixty-five or older and individuals who have received twenty-four months of Social Security benefits based on disability. Individuals younger than sixty-five who may or may not be disabled are entitled to Medicare without a waiting period if they have a very serious illness such as kidney failure requiring regular dialysis or transplant or have amyotrophic lateral sclerosis (ALS aka Lou Gehrig’s Disease.)

Organic Mental Disorder

Organic mental disorders include such diagnoses as Alzheimer’s disease, autism, bipolar disorder, and obsessive-compulsive behavior.

Payments

Payments are the Supplemental Security Income monthly cash payments sent by the SSA either in a paper check mailed to the applicant’s home, in an electronic transfer to a bank account designated by the claimant, or loaded electronically to a Direct Express debit card issued by the SSA.

Personality Disorder

A personality disorder is a deeply ingrained, inflexible pattern of relating, perceiving, and thinking serious enough to cause distress or impaired functioning.

Physical Disorder

A physical disorder is a disruption of one of the body’s systems sufficient to affect one’s ability to perform some functions.

Presumptive Disability

Presumptive Disability is approval for temporary Supplemental Security Income (SSI) payments for up to six months while SSA investigates the claim. Presumptive Disability is granted when the claimant has a very severe physical or mental condition, such as total blindness, total leg amputation or total deafness. Presumptive Disability does not apply to claims for Social Security Disability.

Prognosis

A prognosis is a prediction of the course or outcome of an illness or injury, including likelihood of recovery.

Recipient

A recipient is a person who receives SSI benefits and payments.

Social Security Disability Attorney

Not all attorneys have the special training, credentials, hands-on experience and support team to expertly and effectively handle SSD and SSI initial claims, appeals, and court procedures. Those who do are often called Social Security Disability attorneys. These attorneys can offer an invaluable service to claimants at any step of the claim or appeal process.

Social Security Disability Insurance (SSDI)

SSDI is a federal disability program administered by the Social Security Administration (SSA). The program is financed with FICA taxes paid by employees, employers and the self-employed. The program is also known as Social Security Disability (SSD).

Social Security Program Operations Manual (POMS)

The POMS is a handbook of Social Security regulations and is the primary source of information used by SSA personnel and other professionals to help them uniformly process SSD claims and determine eligibility. A public version, minus sensitive content, is available from the SSA and online at https://secure.ssa.gov/poms.nsf/home!readform.

SSI

See Supplemental Security Income

Substantial Gainful Activity (SGA)

Substantial Gainful Activity (SGA) is part of Social Security’s definition of disability and is the level of work activity that indicates a claimant is not disabled as defined by the SSA. No matter how severe your condition may be, you are not eligible for SSD benefits if you are able to earn “substantial” income from part-time or full-time “gainful” activity. The amount of earnings the SSA considers substantial is subject to several factors. In 2020 “substantial earnings” for a blind SSD claimant is $2,110 per month; while for non-blind claimants, $1,260 per month is usually considered substantial. Other factors are considered for the self-employed and countable income may be reduced by work expenses before determination of whether earnings are substantial.

Supplemental Security Income (SSI)

Supplemental Security Income is a federal public assistance program for disabled adults and children and for individuals age sixty-five or over. SSI is administered by the Social Security Administration, but it is financed by general revenues, not by the Social Security Trust Fund. Work credits are not required for U.S. citizens and nationals and some legal aliens. Non-medical eligibility depends on having income and assets below a certain amount and on whether you live in an institution and, if so, who pays the bill.

Survivors or Family Benefits

Survivor benefits are benefits paid to the family of a deceased worker. Disabled survivor benefits are paid to disabled widows and widowers age fifty or older who became disabled within seven years of the death of the wage earner or within a specified time frame of being entitled on the wage earners account. Depending when re-marriage occurred, being married may be a barrier to eligibility. Survivor benefits are also payable to disabled adult children who became disabled before age twenty-two and with few exceptions are unmarried.

Wage Earner (Worker)

A wage earner is an individual who has worked in Social Security-covered employment and who has applied for benefits on his or her own earnings record.

Waiting Period

Social Security’s benefit waiting period is the period for which benefits are not paid. The waiting period is the first five full calendar-months of disability. If disability begins on the first or second day of a month, that month is counted as the first of the five months.

Work Credits aka Quarters of Coverage

The right to receive Social Security benefits for yourself and your family is earned by working in Social Security-taxed jobs and earning enough work credits to be covered for benefits. A certain dollar amount of earnings, which increases with increases in the Consumer Price Index, is required to earn one credit or quarter of coverage. The number of credits required for disability benefits depends on the age of the claimant.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.