The One Big Beautiful Bill (OBBB), also known as the Big Beautiful Bill Act, signed into law in early July 2025 (H.R. 1), was a signature achievement of President Trump’s administration, fulfilling President Trump’s promise to protect Social Security. The course of the bill involved comprehensive legislative development, debates, and implementation steps to deliver tax relief and economic benefits for seniors. President Trump’s leadership and legislative priorities were central to the passage of this bill. As a signature achievement, the OBBB stands out as a highlight of Trump’s legislative agenda, which focused on supporting seniors and strengthening Social Security.

After the signing of the new law, the IRS and Social Security Administration have issued guidance on its provisions, which are expected to support millions of seniors. In addition to targeted tax relief, the bill provides significant tax cuts for seniors. Although many headlines suggest it ended taxes on Social Security benefits, the law actually introduces an enhanced standard deduction—one key provision of the bill—that indirectly reduces taxable Social Security income for most seniors, without a total tax cut in all cases.

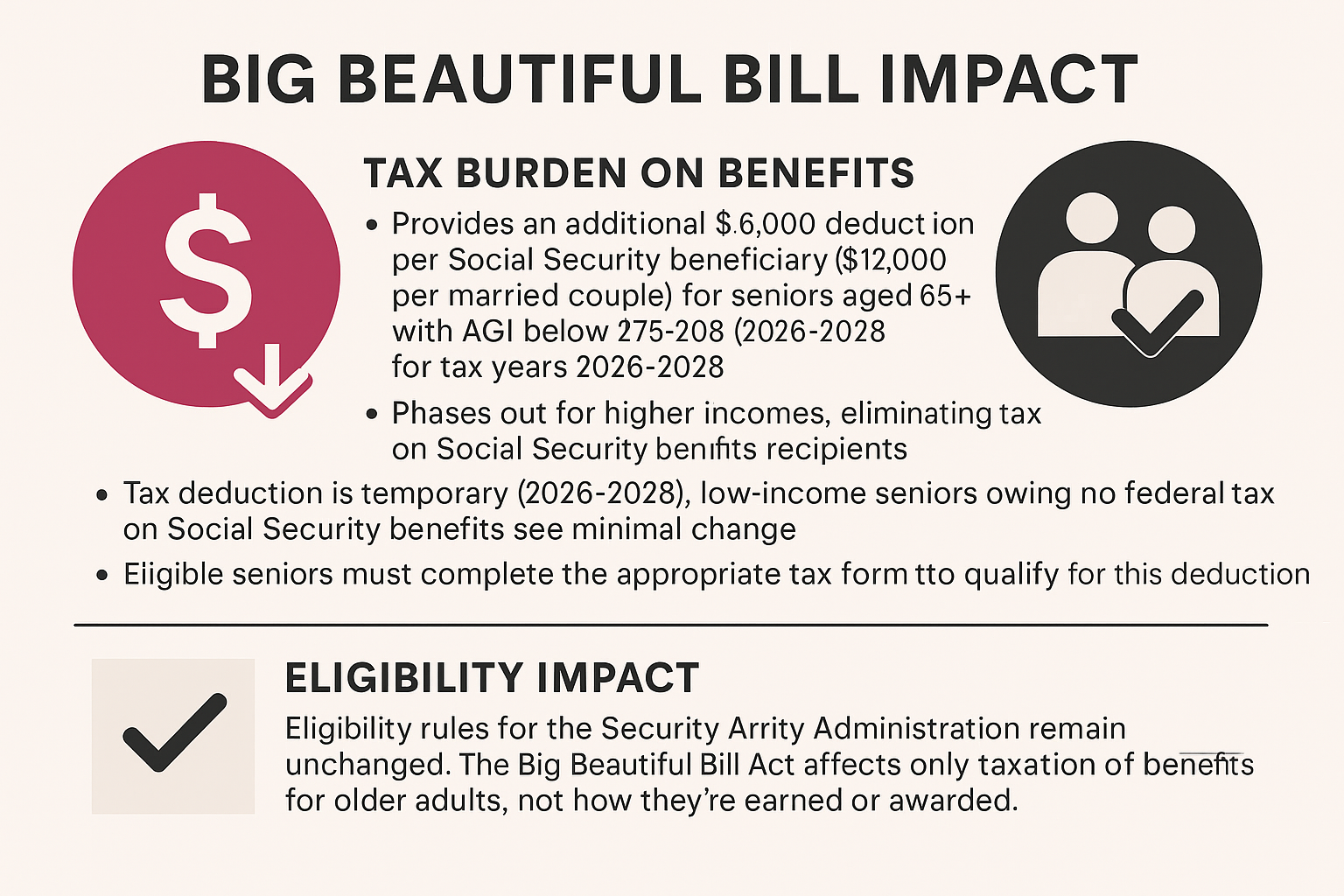

Big Beautiful Bill Impact

Tax Burden on Benefits

- Provides an additional $6,000 deduction per Social Security beneficiary ($12,000 per married couple) for seniors aged 65+ with AGI below $75,000 ($150,000 jointly) for tax years 2026–2028.

- Phases out for higher incomes, eliminating tax on Social Security benefits for recipients who qualify.

- Tax deduction is temporary (2026–2028); low-income seniors owing no federal tax on Social Security benefits see minimal change.

- Eligible seniors must complete the appropriate tax form to qualify for this deduction.

Eligibility Impact

Eligibility rules for the Social Security Administration remain unchanged. The Big Beautiful Bill Act affects only taxation of benefits for older adults, not how they’re earned or awarded.

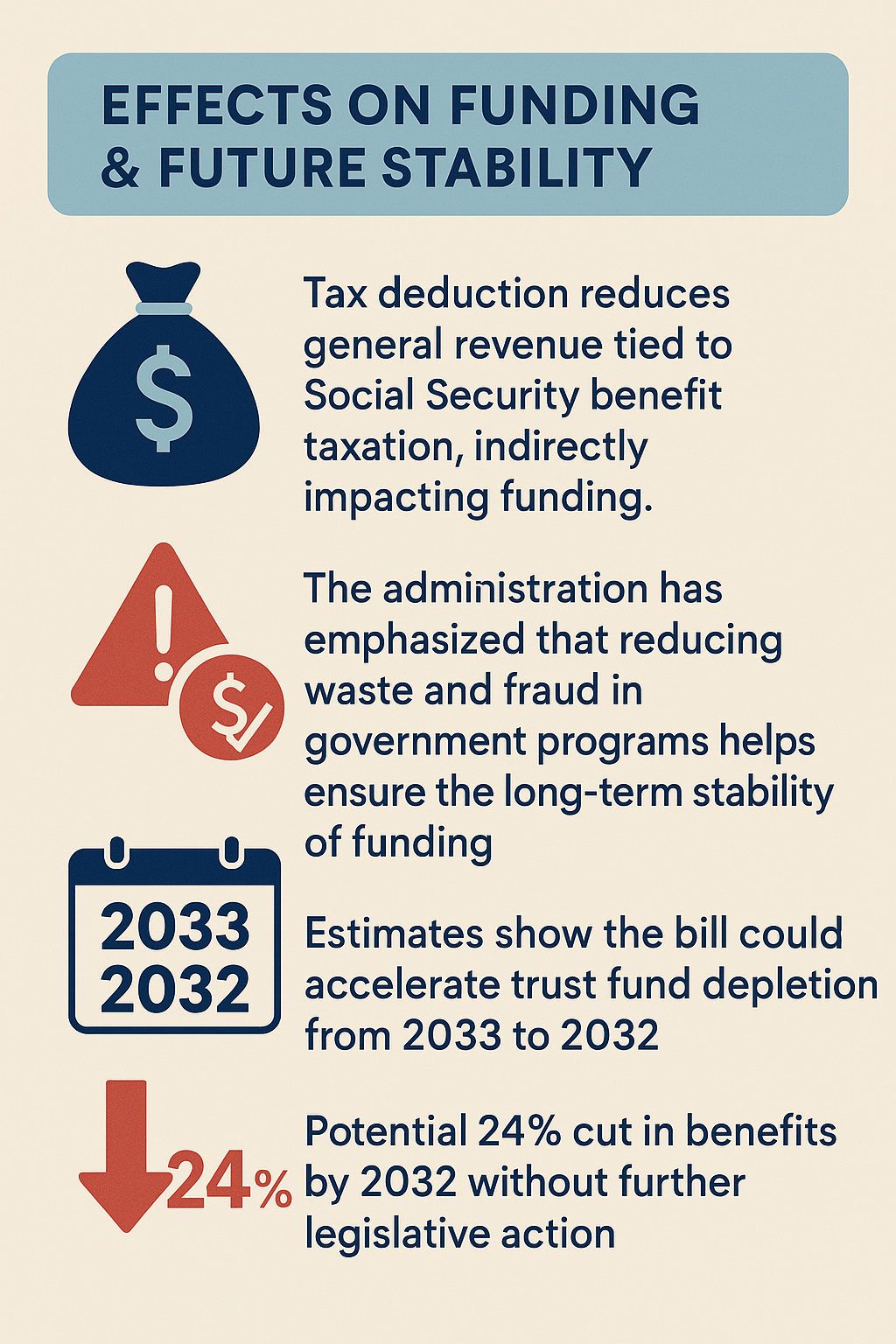

Effects on Funding & Future Stability

- Tax deduction reduces general revenue tied to Social Security benefit taxation, indirectly impacting funding.

- The administration has emphasized that reducing waste and fraud in government programs helps ensure the long-term stability of money.

- Estimates show the bill could accelerate trust fund depletion from 2033 to 2032.

- Potential 24% cut in benefits by 2032 without further legislative action.

Potential Longer-Term Implications

– Without reforms, most beneficiaries could face significant reductions by the early 2030s.

– Bipartisan proposals, such as the Cassidy–Kaine $1.5 trillion investment fund, are being discussed to stabilize funding.

Summary Table

| Area | Effect of the Big Beautiful Bill |

| Social Security eligibility | No change—rules and qualifications remain the same |

| Benefits amount (monthly) | Unchanged in law; future cuts likely if trust fund depletes |

| Taxation of benefits | Indirect relief via extra senior deduction (2026–28) |

| Percentage of seniors affected | ~90% now exempt from taxation on benefits |

| Impact on funding timeline | Accelerates insolvency to ~2032 |

| Future risk | Possible ~24% cuts if unaddressed |

The One Big Beautiful Bill ensures significant tax relief for most seniors by shielding nearly 90% from paying federal income tax on Social Security benefits via a temporary enhanced deduction. However, the historic tax relief reduces revenue and accelerates the depletion of the trust fund—raising the risk of drastic Social Security benefit reductions in just a few years unless further legislative action is taken.

Social Security Reform 2025

The OBBB coincides with broader Social Security Reform initiatives in 2025 aimed at shoring up long-term funding and modernizing benefit structures. These reforms include proposals to adjust payroll tax caps, implement investment funds for the trust, and provide targeted relief for low-income Social Security beneficiaries.

Impact of New Legislation on Social Security

The bill’s temporary tax deductions reduce the number of Social Security recipients that pay taxes on their benefits, but the tax cut comes at the cost of reducing general revenues that support Social Security. This accelerates funding pressures and underscores the need for permanent funding reforms.

The Social Security Administration has publicly supported the new legislation, with officials stating that Social Security applauds passage of the bill for its positive impact on beneficiaries.

How Will It Affect Retirees?

For current retirees, the senior deductions provide immediate tax relief. The timing of when retirees claim Social Security benefits can affect how much they benefit from the new deduction. However, if the trust fund money depletes as projected in 2032, retirees could face across-the-board benefit cuts of approximately 24%, impacting monthly income and long-term retirement planning.

Changes to SSDI and SSI in 2025

While the Big Beautiful Bill focuses on taxation of retirement benefits, concurrent 2025 legislation updates SSDI and SSI programs. These include modest increases in the SSI resource limits and streamlined disability determinations for SSDI applicants with severe medical listings, aimed at reducing processing backlogs.

SS Funding and Reform

The bill highlights the urgent need for comprehensive Social Security funding reform. Lawmakers are considering payroll tax adjustments, means-testing high-income benefits, and creating investment vehicles similar to the Cassidy–Kaine proposal to ensure the program’s long-term solvency.

The OBBB represents both immediate relief and long-term risk for Social Security. While seniors benefit from reduced taxes on their benefits in the short term, the accelerated trust fund depletion highlights the urgency for comprehensive reform. The coming years will determine whether Congress enacts sustainable solutions to protect Social Security benefits for future generations, balancing tax policy, program funding, and the needs of retirees and disabled Americans.

At Benefits.com, we aim to point you in the right direction towards all the benefits available to you. Take our free eligibility quiz today to get started!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.