Making ends meet has proven a challenge for many in the last few years. Whether it’s rising living costs, limited employment opportunities, or sudden and unplanned expenses, families and individuals alike have faced major struggles in spite of their best efforts.

Sure, the average young adult can always “work harder.” But what about people facing different circumstances? What if your biggest hurdles are tied to physical limitations, illness, or age? When a regular, steady job is out of the question, how are you supposed to foot the bill for, well, living?

Welfare programs are meant to address concerns like these, at least in concept. For those who qualify, a little bit of legwork can lead to much needed assistance and relief. Even if navigating some of the red tape can be somewhat confusing.

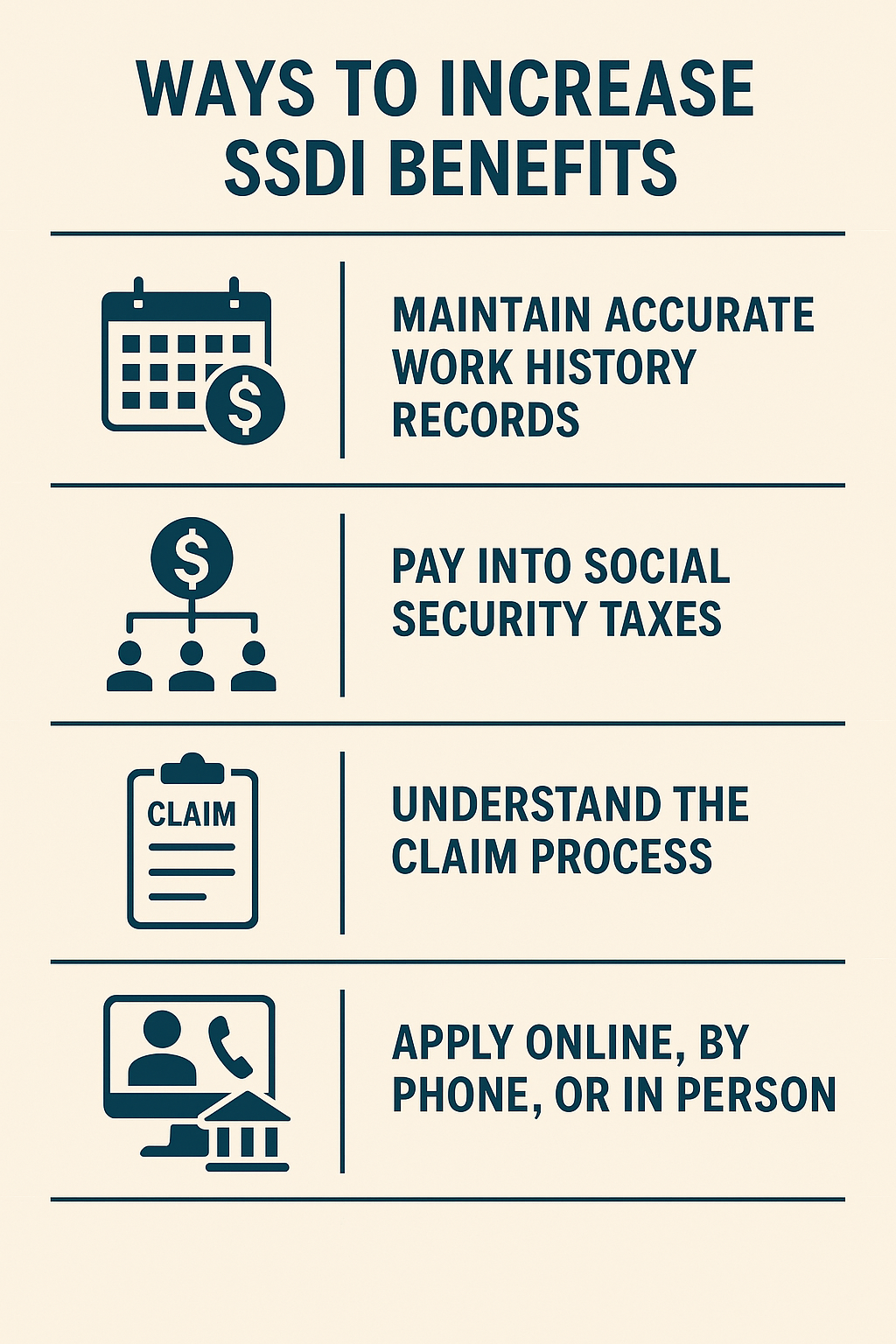

There are several ways to get more money from SSDI, and understanding the claim process is crucial to maximizing your benefits. Your SSDI benefits are calculated based on your average lifetime earnings, making it essential to maintain accurate records of your work history.

SSDI is available to individuals who have paid Social Security taxes, and your earnings and workforce history play a key role in determining both your eligibility and the amount of benefits you may receive. You can apply for SSDI online, by phone, or in person, making the process accessible to a wide range of applicants.

Key Disability and Welfare Programs

A significant portion of the welfare programs available to the public in the United States are handled through the Social Security Administration (SSA). You’re likely already familiar with the SSA because of its foundational program, namely the retirement benefit offered to elderly citizens. But the SSA does more than simply issue Social Security retirement checks.

The SSA also administers programs handling benefits for elderly and disabled individuals who are unable to work to provide for themselves. These include Social Security Disability Insurance (SSDI), and Supplemental Security Income (SSI). Both SSDI and SSI are designed for people with disabilities, and in many cases, family members such as spouses and dependent children may also be eligible for additional benefits based on the primary applicant’s record. Your spouse or former spouse and your children may be eligible for benefits when you start getting SSDI.

Beyond the benefits offered through the SSA, former service members may qualify for benefits through the Department of Veteran Affairs (also known as the VA). VA benefits are similar in many ways to SSA benefits, with similar eligibility requirements, but are only available to former members of the armed forces (and in some cases their immediate family).

Let’s briefly break down how these three main benefits programs compare and contrast.

| SSDI | SSI | VA | |

|---|---|---|---|

| Available to: | Disabled individuals; blind individuals | Disabled individuals, blind individuals, elderly individuals | Disabled former service members |

| Unique Qualification | Recipient must be “insured” (i.e. they’ve contributed via Social Security taxes on past income) | Recipient must have limited income/resources | Disability must be service-connected |

| Provided Health Coverage | Medicare | Medicaid | VA services |

| Benefit Amount Calculations | Based on past income; higher amounts on average, and much higher maximums | Depends on need, with lower maximum amount; may be supplemented by state programs | Based on disability rating |

Can I Receive More Than One Benefit Type Simultaneously?

The short answer is yes, it’s possible. The longer answer is a little complicated; technically, you can apply for everything you qualify for, but there are some restrictions on what you might get if you receive more than one benefit type, and situations where you’re better off applying for one over another. Filing for spousal benefits can help you get more money from SSDI or retirement programs, as it allows a spouse to claim additional benefits based on their partner’s work record. The number of work credits required for SSDI eligibility depends on your age at the onset of the disability.

There are situations where you might qualify for retirement, VA disability, SSDI, and SSI all at once. Those cases tend to be uncommon, however.

Most notably, SSDI and SSI are not mutually exclusive, but their requirements do often preclude many who qualify for the other one. SSDI is based on past income (similar to SSA retirement benefits), and the limit is much higher (over $4,018 in some cases, as of 2025). SSI is intended for those with very limited income and resources, with strict means testing requirements, and hard limits on what you can have in your bank account at a given time. The monthly payment you receive may be affected by which benefits you file for, and payment schedules can vary depending on the program, so it’s important to understand when and how your payment will be disbursed.

Case in point: if your benefit from SSDI exceeds the maximum benefit allowed through SSI, you won’t receive SSI benefits.

Where this gets really complicated is how a given living situation can involve multiple individuals, each qualifying for programs separately. Here’s a hypothetical example.

Let’s say you have a retired older couple. Partner A served in the military, but hasn’t worked since, due to a connected disability. Partner B was a civilian, who worked at a private corporation earning a decent salary for their entire adulthood. Then, if that couple cares for their grandchild as primary caregivers, and that grandchild has a qualifying disability, you may have a situation where:

- Partner A qualifies for VA disability due to service-connected conditions

- Partner B qualifies for SSDI due to age, and past work history

- Both partners qualify for SSA retirement benefits, and may be eligible for spousal benefits to increase their monthly payment

- The grandchild qualifies for SSI, making the caregivers the recipients

Again, the most likely benefits to be mutually exclusive even in such a circumstance would be the SSDI (which depends on having sufficient income in the past), and SSI (which depends on having insufficient income at the moment).

Can I Work While Receiving Disability Benefits?

Another question with an easy short answer, but a more complicated full explanation is how employment factors in.

As a general rule, state-sponsored disability programs are intended as a replacement for income. The idea here is that the disability is what prevents gainful employment and self-sufficiency, so the whole point of receiving benefits is to ameliorate that financial strain. So, broadly speaking, if you can work, you’re less likely to qualify for disability.

It’s not necessarily cut and dry, though: for nearly every program, there are both caveats and exceptions. One exception that’s nearly universal is for those who are legally blind: this condition tends to qualify you for benefits by default, even if you’re not retirement age, and even if you can still work a job with the appropriate accommodations. A longer work history and higher earnings can raise your SSDI benefit amount and positively affect your future benefits by increasing the baseline used for benefit calculations. If you become disabled at a younger age, you may have fewer high-earning years, resulting in a lower AIME.

Beyond that, there are typically stipulations in these benefit programs intended to help individuals ease their way back into financial independence, if possible. In situations where these are applicable, be aware that returning to work may lead to an adjustment in your benefit amount and can affect your eligibility for certain programs. There may be a limit to how much you can earn in a month, an associated decrease in benefit amounts based on how much you earn, or possibly both.

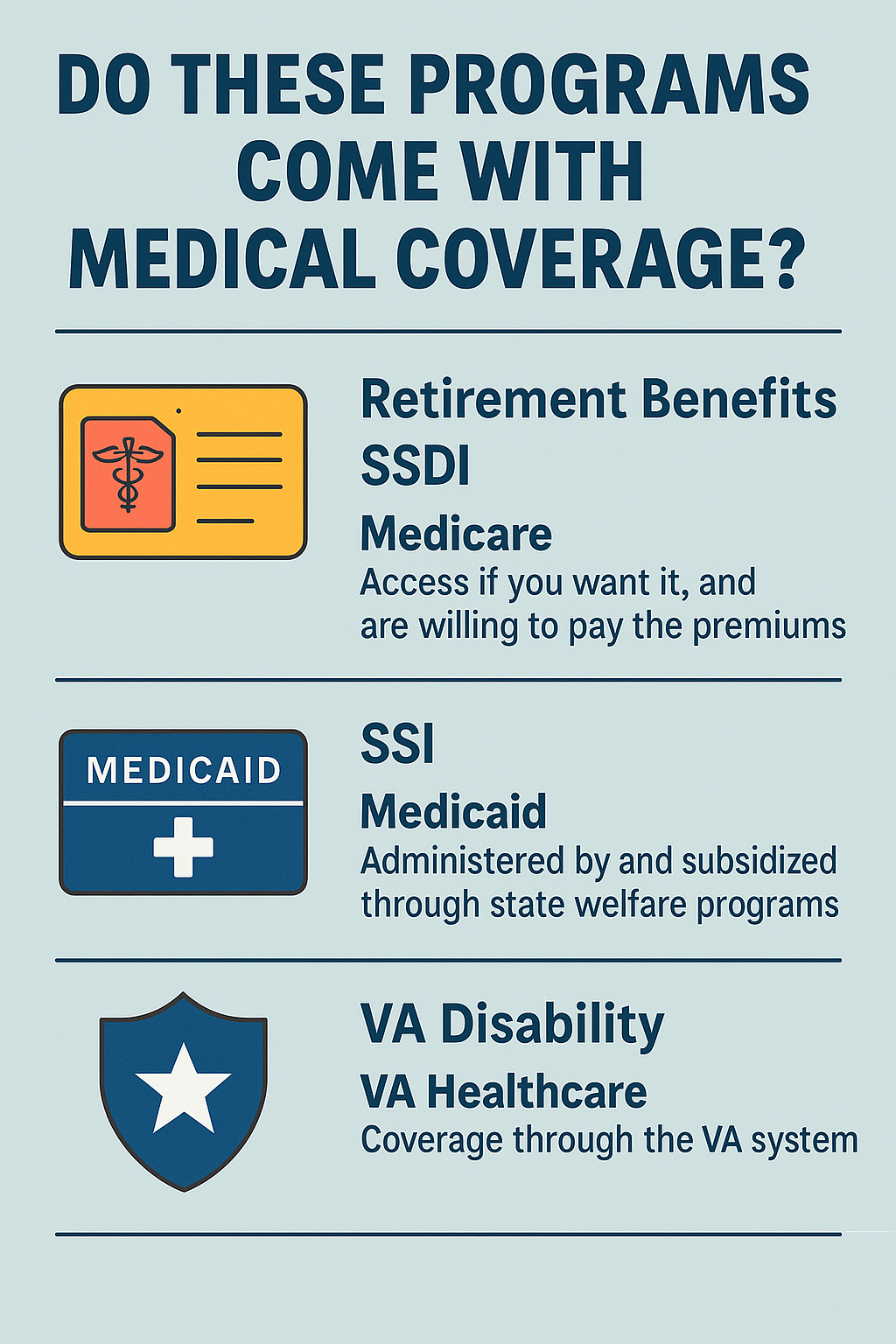

Do These Programs Come with Medical Coverage?

This one is a little more straightforward. Each of these programs comes with access to some kind of healthcare benefit. What coverage you have access to will depend on the program.

Retirement benefits and SSDI give you access to Medicare, which means you’ll have coverage if you want it, and are willing to pay the premiums.

SSI provides Medicaid, administered by and subsidized through the recipient’s state welfare programs. This tends to be more comprehensive coverage with lower cost to the recipient, since the program is aimed at those facing financial difficulties.

VA disability, and veteran status generally, usually comes with coverage through the VA system of clinics and providers.

What Do I Do If I’m Still Struggling?

If you find that even with programs like these, you’re still facing difficulties managing your expenses, you’re not alone. And you’re not alone if you feel embarrassed and self-conscious about needing help. It’s not a sign of weakness or personal failing, though. It’s a sign of being human.

Assistance programs can supplement your SSDI benefits, and having a plan in place is important for maintaining financial stability. Each year, benefits may be adjusted based on inflation to account for the rising cost of living, helping beneficiaries maintain their purchasing power.

No one should have to go without food, housing, or the medical care they need to live a safe and healthy life, whatever their current situation. If those are regular worries you deal with, don’t be afraid to cast a wider net when looking for assistance.

There are other programs, non-profits, and community outreach initiatives that may help you close the gap. Talking to a financial advisor or professional can help clarify the application process and ensure you maximize your social security benefits. Consulting with a disability attorney can help ensure thorough documentation during the SSDI application process, which can be critical for approval and receiving the correct benefit amount.

At Benefits.com, we are here to help you navigate the process and receive the benefits you deserve. We are committed to helping every person with disabilities and their family members get the most out of their SSDI benefits, including any additional benefits they may be eligible for.

Begin today by taking our free eligibility quiz!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.