The Short Answer (Because Everyone Asks This First)

The 2.8 percent cost-of-living adjustment (COLA) will begin with benefits payable to nearly 71 million Social Security beneficiaries in January 2026. If you receive Social Security Disability benefits, your payment amount automatically increases starting with your January 2026 payment. You don’t need to apply, call, or fill out any paperwork — the increase is applied for you.

Most Social Security beneficiaries actually see the increase later in January, depending on their regular payment date.

Why This Matters Right Now

As of January 2026, many SSDI recipients are checking their bank accounts and asking the same question:

“Did my Social Security check go up yet?”

That’s completely normal. Cost-of-living adjustment (COLA) affects real monthly payments — rent, groceries, utilities, and medical expenses. Even a small change can matter when you’re living on a fixed income, so it’s important to know when the increase starts and what it should look like.

The average monthly SSDI benefit is estimated to increase to $1,630 in 2026, which is a $44 increase from $1,586 in 2025.

A Quick Personal Note

Every year, I hear from people who worry something went wrong because their January payment didn’t look quite right. Most of the time, nothing is wrong at all — it’s just a timing or deduction issue. Understanding how COLA works can save you a lot of unnecessary stress.

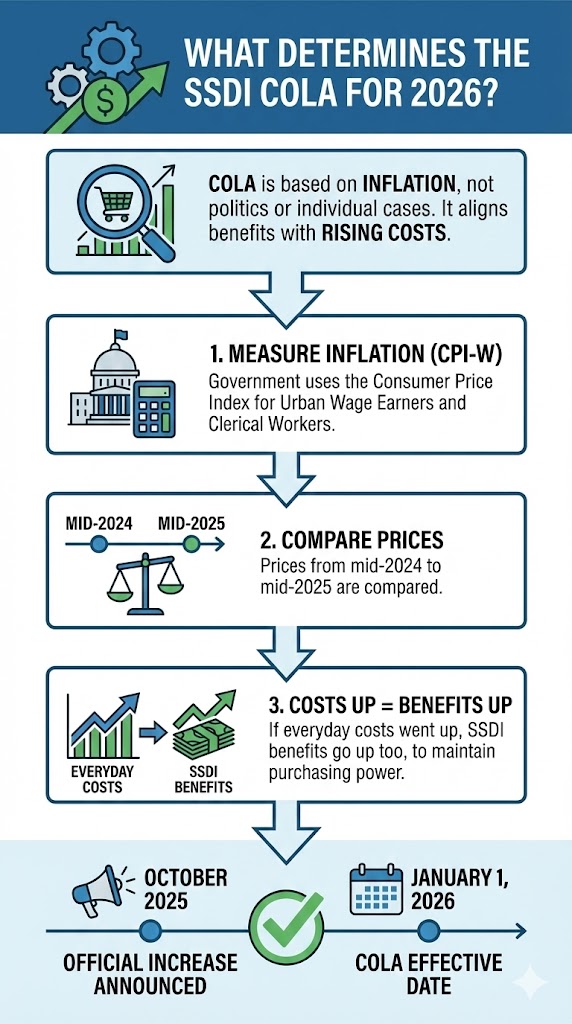

What Determines the Social Security Payment Increase for 2026?

The SSDI COLA for 2026 is based on inflation — not politics or individual cases. The COLA is designed to keep benefit payments aligned with inflation as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).This helps ensure Social Security benefits maintain their purchasing power over time.

Here’s the simple version:

- The government looks at inflation using the Consumer Price Index (CPI-W)

- Prices from mid-2024 to mid-2025 are compared

- If everyday costs went up, SSDI benefits go up too

The official increase percentage is announced in October, but the Social Security COLA effective date is always January 1 of the following year.

When the 2026 SSDI COLA Increase Actually Shows Up

Even though the increase starts January 1, most SSDI payments are sent later in the month.

Your SSDI payment dates for 2026 usually depend on your birthday:

- Born 1st–10th → paid the 2nd Wednesday

- Born 11th–20th → paid the 3rd Wednesday

- Born 21st–31st → paid the 4th Wednesday

So, if your birthday falls later in the month, your increased payment may not arrive until the third or fourth week of January.

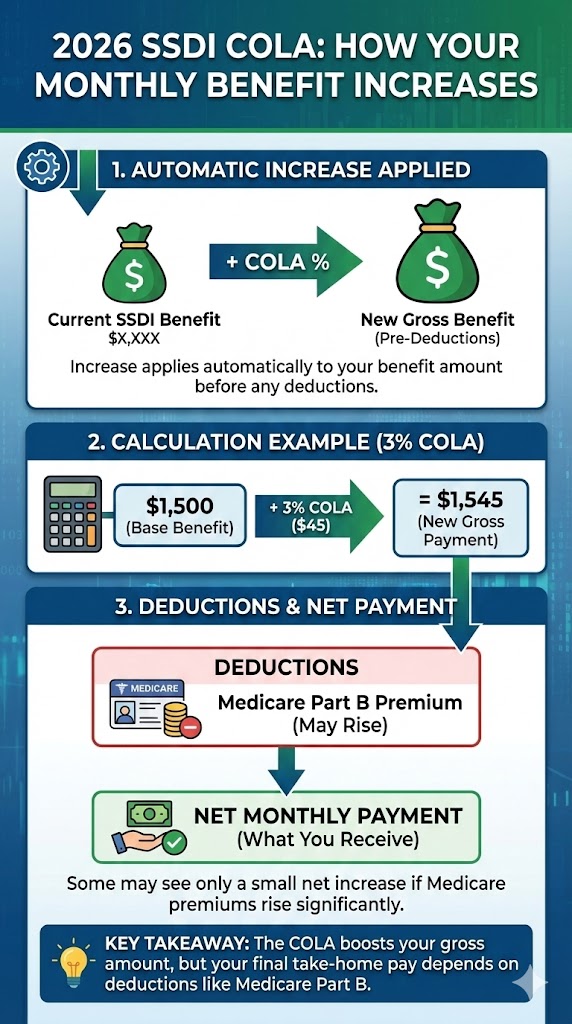

How the 2026 Increase Affects Your Monthly Disability Benefits

The SSDI monthly benefit increase applies to your regular Social Security benefit amount automatically.

A few important things to know:

- The increase applies before deductions

- Medicare Part B premiums may still come out

- Some people see only a small net increase if premiums rise

Example:

If your SSDI benefit was $1,500 per month and the COLA was 3%, your new payment would be about $1,545 — before any deductions.

What If Your SSDI Payment Didn’t Increase?

If your SSDI benefits 2026 update doesn’t look right, don’t panic. Try this first:

- Look for your COLA notice (available in December or online)

- Check whether Medicare premiums changed

- Confirm you received your January payment — not December’s

- If it still looks wrong in February, contact the Social Security Administration (SSA)

In most cases, delays or deductions explain the issue.

A Real-Life Example

Let’s say John receives SSDI and is paid on the fourth Wednesday each month. His December 2025 payment didn’t include any increase. In late January 2026, his new payment arrives — and that’s when he sees the higher amount. Nothing was wrong; his payment date just fell later in the month.

Common Questions We Hear All the Time

When will the 2026 SSDI pay increase begin?

January 2026.

Do I need to apply for the SSDI COLA 2026?

No. It’s automatic.

Will everyone get the same increase?

Everyone gets the same percentage, but dollar amounts differ.

Why didn’t my increase seem very big?

Medicare premiums or other deductions may offset part of it.

Does this affect back pay?

No. COLA applies only to ongoing monthly benefits.

Where can I see my new amount?

In your Social Security COLA notice or online account.

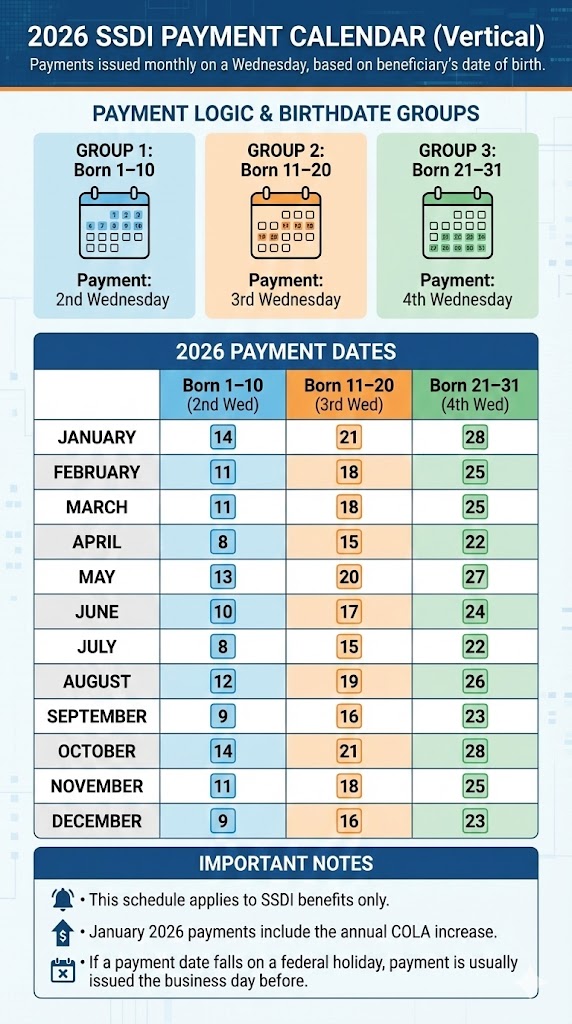

2026 SSDI Payment Calendar

This handout shows the Social Security Disability Insurance (SSDI) payment schedule for calendar year 2026. Payments are issued once per month based on the beneficiary’s date of birth and are paid on a Wednesday.

2nd Wednesday (Born 1–10)

3rd Wednesday (Born 11–20)

4th Wednesday (Born 21–31)

January

January 14, January 21, January 28

February

February 11, February 18, February 25

March

March 11, March 18, March 25

April

April 8, April 15, April 22

May

May 13, May 20, May 27

June

June 10, June 17, June 24

July

July 8, July 15, July 22

August

August 12, August 19, August 26

September

September 9, September 16, September 23

October

October 14, October 21, October 28

November

November 11, November 18, November 25

December

December 9, December 16, December 23

Important Notes:

• This schedule applies to SSDI benefits only.

• January 2026 payments include the annual COLA increase.

• If a payment date falls on a federal holiday, payment is usually issued the business day before.

The 2026 SSDI pay increase is applied automatically beginning in January under federal COLA requirements, and most Social Security beneficiaries do not need to take any action. Because SSDI payments are issued on different dates throughout the month and may include routine deductions, the increase may not be immediately obvious for every recipient.

Understanding your payment schedule and reviewing your benefit notice can help you confirm that the adjustment has been applied correctly and recognize when follow-up with the Social Security Administration (SSA) may be appropriate.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.