The VA Clothing Allowance provides financial assistance to veterans whose clothing is damaged due to their service-connected disabilities. The clothing allowance payment is a yearly tax-free stipend provided by Veterans Affairs to help offset clothing costs for eligible veterans. This typically includes veterans who use prosthetic or orthopedic devices, such as artificial limbs or braces, or those who use specific skin medications that cause undue wear, staining, or tearing of their garments.

To qualify, a person must have a service-connected disability and use a prescribed device or medication that demonstrably damages clothing. The allowance helps offset the costs of replacing or repairing these items. Applications, often involving VA Form 10-8678, are generally processed annually, with specific deadlines.

Veterans can submit their clothing allowance application in person at their local VA medical center, by mail, or online through My HealtheVet. The appropriate VA department, such as the prosthetics or sensory aids service department, will review the application and determine eligibility for the benefit. Veterans can check the status of their application after submission.

Why This Update

The clothing allowance from the VA can change each year, as do most benefits. In 2026, the standard annual payment for the VA Clothing Allowance is $1,053.19.

What is the VA Clothing Allowance?

The VA Clothing Allowance provides financial assistance to veterans whose clothing is damaged by prosthetic or orthopedic devices (such as artificial limbs, braces, or wheelchairs), or specific skin medications prescribed for service-connected conditions.

Not all veterans are eligible for this benefit; eligibility is determined by specific criteria related to service-connected disabilities.

This benefit is paid annually and can help offset the costs of buying new clothing due to wear and tear from prosthetics or medications. Veterans can also use the clothing allowance to assist with the cost of alterations, repairs, laundry, and dry-cleaning services.

Eligibility Requirements for the VA Clothing Allowance

Veterans must have a service-connected disability that requires the use of a qualifying device or medication to be eligible for the VA Clothing Allowance.

A detailed, specific list of all qualifying prosthetic/orthopedic devices and skin medications for the VA Clothing Allowance is not available; the VA will determine eligibility based on the information provided, which may include a Compensation and Pension (C&P) exam to verify your claim.

Eligibility is determined by whether the prescribed device or medication for a service-connected condition causes undue wear, tear, staining, or damage to outer clothing, as described in 38 CFR 17.147.

All devices and medications must be medically prescribed by a physician for a service-connected disability. This requirement helps ensure that the benefit goes to veterans whose clothing damage stems directly from their service-connected care needs. Your doctor or prosthetist will certify that your device or medication causes wear and tear or irreparable damage to your clothes as part of the application process.

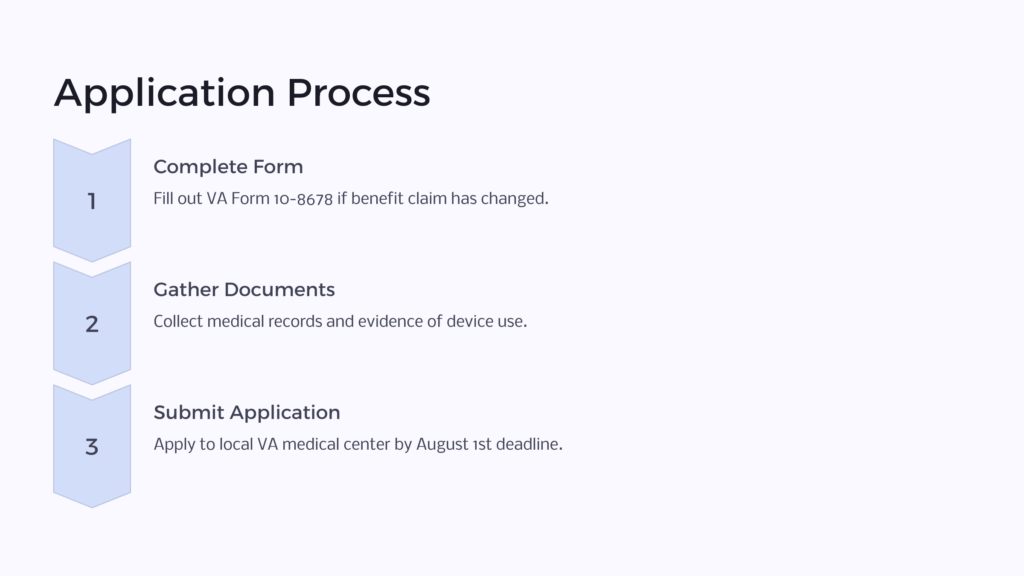

The Application Process for the VA Clothing Allowance

To apply for the VA clothing allowance, veterans must complete and file VA Form 10-8678, Application for Annual Clothing Allowance. Veterans can access the application online through My HealtheVet, in person at their local VA medical center, or by mail.

After completing the form, it should be submitted to the Prosthetic and Sensory Aids Service (PSAS) department at the VA medical center, as this department is responsible for processing clothing allowance applications. Supporting documentation, such as medical records and prescription information, must be provided to establish eligibility.

A healthcare provider will need to verify that the device or medication causes clothing damage as part of the certification process. Once approved, you only need to apply once—the VA will automatically pay you each year after your initial application, as long as you remain eligible. This automatic renewal process simplifies ongoing benefit receipt for veterans whose qualifying conditions remain stable.

Important Timelines and Deadlines

The application period for the annual allowance runs from August 1 of the current year to July 31 of the next year. Veterans must submit their application by August 1 to be entitled to the annual clothing allowance payment for that year. The clothing allowance is paid as a lump sum annually, typically between September 1 and October 31, to those who applied before the August 1 deadline. Veterans are encouraged to apply as early as possible within this window to help ensure timely processing and payment.

If a veteran’s qualifying condition or device hasn’t changed, they may not need to reapply annually for continued benefits, as eligibility is automatically assessed for those already in the system.

Failure to submit applications or necessary updates within the specified timeframe can result in delays or denial of benefits for that year. If your qualifying service-connected condition, prosthetic or orthopedic device, or prescribed skin medication changes, notify the VA and submit a new VA Form 10-8678 to update your claim.

Example Scenario

James, a veteran, uses a prescribed prosthetic leg due to a service-connected injury. The constant friction and pressure from the device cause rapid wear and tear on his pants, requiring frequent replacements. Without the VA clothing allowance benefits, James would face significant cost to maintain a suitable wardrobe.

Frequently Asked Questions

Can veterans who use multiple qualifying devices or medications receive more than one clothing allowance?

Yes, if a veteran uses multiple prosthetic or orthopedic devices, or prescribed skin medications, and each independently meets the eligibility criteria, they may be eligible for multiple clothing allowances.

Is the VA Clothing Allowance considered taxable income?

No, the VA Clothing Allowance is not considered taxable income by the IRS. Veterans do not need to report it on their tax returns.

Is the VA Clothing Allowance automatically granted to all veterans with service-connected disabilities?

No, the allowance is not automatic. Veterans must meet specific criteria related to the use of a prosthetic, orthopedic device, or prescribed skin medication for a service-connected condition that causes clothing damage. An application or annual qualification is required.

Is the VA Clothing Allowance only available to veterans with severe disabilities?

The allowance is not restricted to veterans who have the most severe disabilities. Any veteran with a service-connected condition requiring devices or medications that damage clothing, meeting the specific eligibility criteria, may qualify, regardless of their overall disability rating.

What types of clothing are covered by the VA Clothing Allowance?

The VA Clothing Allowance covers outer garments such as shirts, blouses, pants, skirts, and similar garments that are subject to wear and tear or staining from prosthetic or orthopedic devices or prescribed skin medications. However, hats, scarves, shoes, socks, underwear, and similar garments are explicitly excluded from the clothing allowance.

What is VA Form 10-8678 used for?

VA Form 10-8678, “Application for Annual Clothing Allowance,” is the official form used to apply for this benefit. It is typically required for initial claims or if there are changes to a veteran’s qualifying condition or devices.

How long does it take to receive the allowance after applying?

While processing times can vary, the VA typically processes applications and disburses payments by the end of the calendar year, with applications often due by August 1st. The benefit is paid as a lump sum once per year. Submitting early is recommended to avoid delays.

What should a veteran do if their qualifying medical condition or device changes?

If there is a change in the veteran’s qualifying service-connected condition, prosthetic/orthopedic device, or prescribed skin medication, they should notify the VA and likely submit a new VA Form 10-8678 to update their claim and ensure continued eligibility.

How can veterans check the status of their VA Clothing Allowance claim or file an appeal?

Veterans can check the status of their clothing allowance claim online through the VA’s official website, by contacting their local VA office, or by calling the VA directly. If a claim is denied or if the veteran disagrees with a decision, they have the right to file appeals to have their case reviewed.

At Benefits.com, we want to make sure you are getting your benefits. Contact us today by taking our free eligibility quiz!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.