One of the most common ways for anyone to start a business with the capital they need is to get a business loan. For veterans, that often means securing a VA business loan. But did you know that veterans can also take advantage of a number of VA small business grants?

9 Small Business Grants for Veterans

- Warrior Rising

- StreetShares Foundation

- Small Business Innovation Research (SBIR) program

- State Business Grants for Veterans

- Hivers and Strivers

- Boots to Business

- NASE Grants

- Idea Cafe

- Small Business Technology Transfer (STTR) Grant

Veterans often enter into the world of business ownership. In fact, the SBA estimates that as many as 10% of all businesses are veteran-owned businesses. Veterans certainly acquired many of the skills needed to succeed in entrepreneurship from the military, including leadership, self-sufficiency, accountability, problem solving, and persistence, among others.

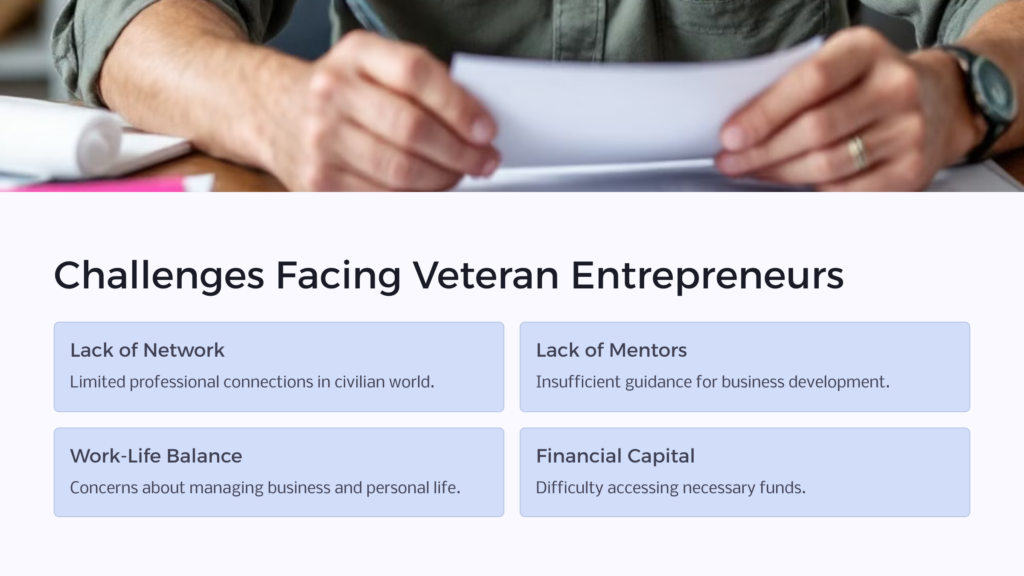

Even so, veteran business ownership has declined over the years. Around half of WWII vets became business owners, but in the post 9-11 era, less than 5% decided to open their own business. Among the most significant inhibiting factors that steer veterans away from business ownership are lack of available mentors, lack of a substantial network, work-life balance concerns, and financial capital.

Grants for veteran business owners might be able to assist in closing the financial gap. A grant is a monetary gift that often does not need to be paid back. There is usually no interest charged on the grant money, which gives grants a definite advantage over loans. These grants are issued by federal, state, and local governments, as well as nonprofit organizations.

Becoming a Vetrepreneur

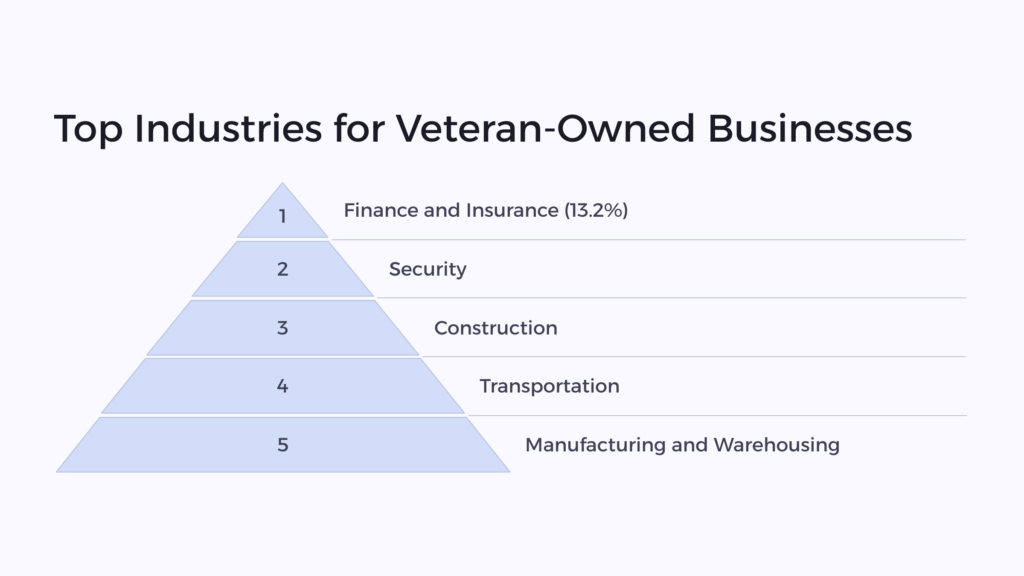

You will sometimes see veteran business owners referred to as “vetrepreneurs.” As you can imagine, this is a combination of the words veteran and entrepreneur. While many veteran business owners go into different types of business, the most common types are finance and insurance with a 13.2% share of veteran-owned businesses.

Other commonly chosen verticals include security, construction, transportation, manufacturing, and warehousing. Some vetrepreneurs will engage in technological development, while others will develop consumer facing retail ventures like a gym or hair salon. It all depends on the veteran and their interests and experience. But no matter what type of business they are contemplating or operating already, there is probably a grant to help them out, just as there are many other benefits for veterans to assist in the transition to civilian life.

9 Small Business Grants for Veterans

Grants are usually geared towards specific individuals or groups that meet particular qualifying criteria. In this case, VA grants are issued to veterans who have started or are already running their own business.

1. Warrior Rising

Warrior Rising is a nonprofit organization that was founded in 2015 to help entrepreneurs start or accelerate a veteran-owned business. The process begins by filling out an application for mentorship, which is followed by an intake phone call. Warrior Rising does not just help with financing, but also provides ongoing mentorship. If you look at the business on their website, you will see organizations in every vertical from craft brewing to patient management software.

Warrior Rising business grant opportunities cannot be used for passive investments like flipping homes or buying and selling securities. In addition to meeting the eligibility criteria, applicants must provide a thorough, clear, and thoughtful business plan. In some cases, Warrior Rising may choose to help a business owner improve their business plan as part of the mentorship component of the program.

As stated on their site their goal is not just to hand out grant opportunities, but to empower veterans to take matters into their own hands and become successful business owners, whether they are going to operate a sole proprietorship or a future Fortune500 company.

2. StreetShares Foundation

The StreetShares Foundation is a veteran-run 501(c)3 nonprofit that distributes grants of up to $15,000 to veteran entrepreneurs. Founded on Veterans Day in 2016, the foundation has helped over 5,000 veteran small businesses owners get started or boost their existing business, along with developing a community of over 85,000 members and supporters.

The application process for their small business grant “The Veteran Small Business Award” assesses the potential social impact of the business on the veteran community, the veteran’s personal story, and how the funds will be used. Aside from the grants, the StreetShares Foundation also administers a P2P lending platform where angel investors can connect with potential veteran entrepreneurs.

Additionally, the StreetShares Foundation has other programs for community development around the areas of mental health, healthcare, employment, housing, and the overall transition to civilian life.

3. Small Business Innovation Research (SBIR) Program

The SBIR is not uniquely specific to veteran entrepreneurs, but it can be a helpful grant opportunity to secure funding if their startup requires research and development or is in the tech sector.

SBIR grants are split into two categories: Phase I and Phase II. Phase I grants are for businesses in the initial stages of figuring out whether or not they’ll be commercially viable and can run up to $150,000 of non-dilutive funding. Phase II grants are based on how your business performed in Phase I and can run up to $1 million.

If a veteran small business is focused on something like robotics, software development, or any other area that requires some trial and error to create a finished and marketable tech product, the SBIR should be a go-to grant program. The SBIR is not limited to veterans and is administered by the SBA.

4. Hivers and Strivers

Hivers and Strivers is a group of angel investors who typically invest anywhere from $250,000 to $1,000,000 in startups owned by U.S. Military Academy graduates. They also provide networking connections, guidance, and mentorship for each eligible business that they fund. It’s important to realize that Hivers and Strivers does not specifically provide grant funding, but rather extends working capital to military veterans through angel investors.

Angel investors do expect to see a return on the investment they make to veteran entrepreneurship. In that regard, their help is more comparable to a small business loan. However, a small business owner may find that the private funding of angel investors is easier to obtain than veteran business grants or even an SBA loan, and that the relationship with their investors is much easier than working with the Department of Veterans Affairs.

There is more flexibility when working with private investors, both in terms of eligibility and in the funding terms worked out by the investor and the veteran business owner. Moreover, Hivers and Strivers is itself made up of veterans, so their financial interest in veteran-owned small businesses is augmented by a sense of purpose around their mission for military community development.

5. Boots to Business

Boots to Business is an immersive two-day educational experience that is meant to help veterans learn about the ins and outs of business ownership. It’s essentially an entrepreneurship training program, not a venue for grants. However, it can be a good place to learn about where to get government grants or how to secure other types of financial assistance like SBA loans for veterans (especially since the program is run by the SBA).

6. NASE Grants

The National Association for the Self Employed has grants that are specifically for veterans running up to to $4,000. You do need to be a member of NASE in order to apply for these grants, along with furnishing a business plan for a startup or business growth.

7. Idea Cafe

Idea Cafe is an online forum for entrepreneurs, but they also provide grants to business owners. If nothing else, it’s a great place to locate available grant funding opportunities. Idea Cafe is also a great place for business owners to network and get support, both in terms of tangible business solutions like funding and in terms of intangible needs like troubleshooting issues.

8. Small Business Technology Transfer (STTR) Grant

The STTR is similar to the aforementioned SBIR in that it’s geared toward tech companies, but it’s specifically geared toward companies that contract with the Federal Government to do research. So if your tech solution involves working with entities like the Department of Defense, NASA, or the Department of Health, your business can get up to $850,000 in funding.

9. State Business Grants for Veterans

Contact your local chamber of commerce to see if they have any ideas about state or even local grants for veteran entrepreneurs. These grants, their terms, and their application process will vary from state to state and city to city (for local grants) so it’s best to just start at the local level in terms of gathering information, or with the state’s department of commerce.

Here are some examples of state small business grants for veterans:

California Veterans Benefits

If you live in the Golden State, there are California veterans benefits such as small business grants, some of which are geared towards veterans. There are also grants associated with Covid-19 relief if your veteran-owned business has been negatively impacted by the lockdowns and quarantines.

Florida Veterans Benefits

In the Sunshine State, there are Florida veterans benefits like grants for veteran business owners, noteworthy among them opportunities with the Florida High Tech Corridor Grant, which partners with the University of Central Florida and the University of South Florida.

New York Veterans Benefits

There are also veterans grants in New York State, among many other New York veterans benefits. Some of these available grants are actually geared towards other demographics such as women-owned businesses, but if you’re a veteran and fall into one of those other demographics, you can take advantage of that as well.

Ohio Veterans Benefits

If you reside in the Buckeye State, don’t miss checking out the plethora of Ohio veterans benefits, such as some of the small business grants that are specifically geared towards veteran business owners. Some of these grants also target women-owned businesses.

Pennsylvania Veterans Benefits

If you live in the Keystone State and you’re a veteran in search of startup funding, or funding to expand your extant business, then you should check out some of the business grants for veterans among Pennsylvania veterans benefits.

Texas Veterans Benefits

If you’re one of the many veterans living in the Lone Star State (including 1.2 million combat veterans) then you should check out the extensive list of business grants for Texas veterans, which are among the many other Texas veterans benefits available to discharged residents.

VA Small Business Grants

Grants are offered by federal, state, and local governments, along with for-profit and nonprofit organizations. Grants are usually geared toward specific types of people or businesses, and many grants are awarded to veteran-owned businesses.

While other options for funding certainly exist, such as leveraging one’s capital or securing one of the many VA business loans, veteran grants can often be an excellent, interest-free source of funding.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.