When the Social Security Administration approves your application to receive Social Security Disability Benefit payments, you will receive a Social Security Benefits Award Letter, which usually arrives between 1-3 months after the decision. This benefit verification letter will provide some basic information about the terms of your SSDI or SSI payments.

Social Security Award Letter Information

- Benefit amounts

- Monthly payment dates

- Back pay amounts

- Back pay dates

- Amounts owed to representatives

- Taxability of your benefits

Social Security Disability Insurance (SSDI) is sometimes confused with Supplemental Security Insurance (SSI). SSI provides cash assistance for basic needs like clothing, food, and shelter for individuals with little to no income. Usually, these individuals are impaired, disabled, or have reached full retirement age. Most Americans over the age of 65 do collect some form of Social Security, though some will choose to defer it to a later date in order to increase the size of their monthly benefit payment.

SSDI is a different program to help cover the cost of living for individuals who have a disabling medical condition that will eventually result in death or that will keep them out of work for at least one year…though it is also meant to cover basic expenses and medical expenses.

While SSI is funded by taxpayers collectively and individuals can collect it regardless of work history, SSDI operates along the lines of a complex credit system that factors in years of previous work experience. Whether you’re applying for SSI or SSDI, if your application is approved, you’ll get a letter in the mail from the Department of Social Security, otherwise known as the Social Security Administration (SSA).

What is a Social Security Award Letter?

If your eligibility to receive social security income has been confirmed, you will generally receive your benefit verification letter one to three months after a decision is made by the social security office. But according to the SSA itself, a decision takes 3-5 months. That said, you may not get a letter in the mail for as long as eight months after you’ve applied. Even if you get one sooner than that, the quickest you should expect your Social Security Award Letter is around four months.

The good news is that you can cut that time in half by starting your application online, at least according to the SSA. Starting your application online will allow you to fill out both the benefits application and the disability worksheet (if you are applying for SSDI). You will still have an in-person or phone appointment which will generally last around one hour. If the SSA requests any documents to verify your identity or condition, you should be sure to bring those to the appointment, or your local social security office if you have a phone appointment, to avoid the risk of slowing down the process.

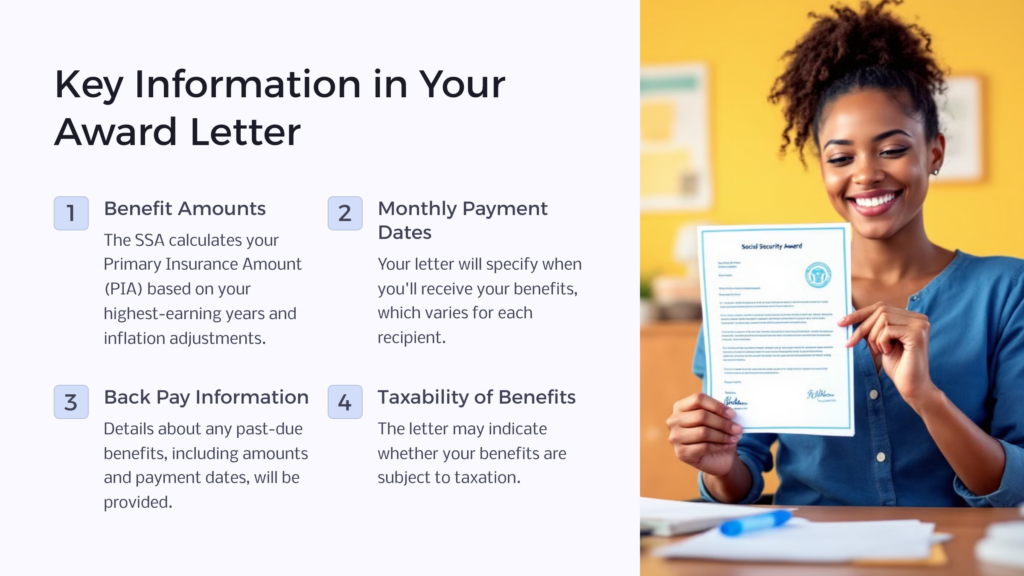

6 Things Included in a Social Security Award Letter

1. Benefit Amounts

Benefit amounts will be listed in your Social Security Award Letter. To determine this amount, the SSA will take into consideration your highest earning years in a 35-year time span, and divide those average annual earnings by 12 months to find the Average Indexed Monthly Earnings. The SSA will take 90% of your AIME under $960, 32% of everything earned over $960 and under $5,785, and 15% of anything beyond that. This gives the SSA a picture of your earning potential and allows them to calculate the Primary Insurance Amount (PIA) that will be paid to you each month. Note that the SSA does adjust your AIME for inflation.

2. Monthly Payment Dates

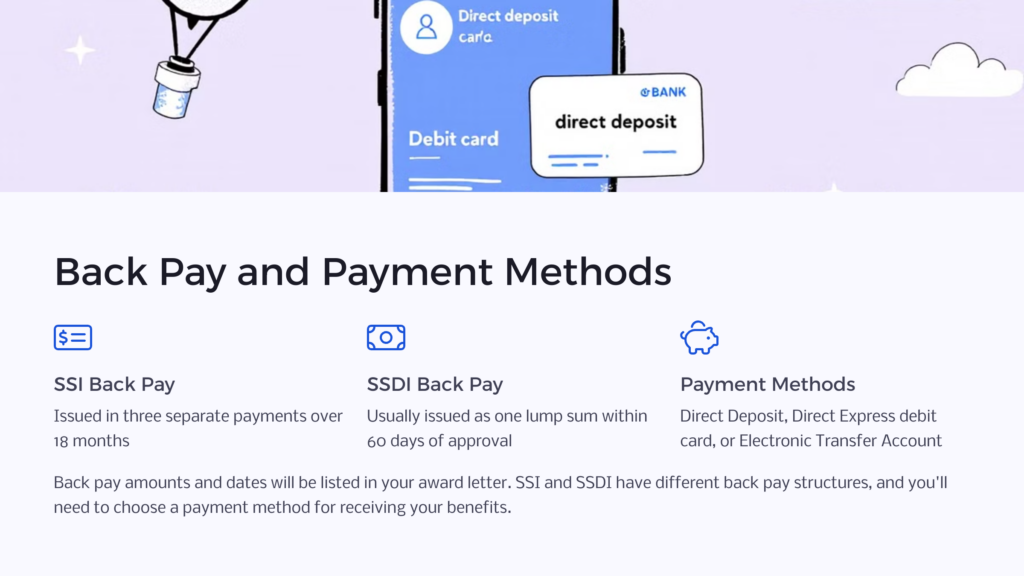

Monthly payment dates will be listed on the letter that let you know when your benefits will be issued. At the time of your application, you would have been asked about your preferred method of receiving your benefits, which included options for Direct Deposit into a bank account, a Direct Express debit card issued by the SSA, or having them sent into an Electronic Transfer Account. Payment dates will be different for every person, so it’s a good idea to make note of when your payment date is so you can plan out paying your monthly bills, rent, or mortgage. Keep in mind that if you are applying for SSDI, it will take payments a mandatory five months to start being issued.

Monthly payment dates will be listed on the letter that let you know when your benefits will be issued. At the time of your application, you would have been asked about your preferred method of receiving your benefits, which included options for Direct Deposit into a bank account, a Direct Express debit card issued by the SSA, or having them sent into an Electronic Transfer Account. Payment dates will be different for every person, so it’s a good idea to make note of when your payment date is so you can plan out paying your monthly bills, rent, or mortgage. Keep in mind that if you are applying for SSDI, it will take payments a mandatory five months to start being issued.

3. Back Pay Amounts

Back benefits owed to an SSI recipient or SSDI benefits recipient pay will be listed on their Social Security Award Letter as well. These past-due benefits will depend on how long your application took to process and the PIA calculated by the SSA, which again varies from person to person. While SSI recipients will generally not get their back payment in one lump sum, SSDI recipients will. You are required to have a bank account to receive these payments because the SSA only issues them through direct deposit.

4. Back Pay Dates

Back pay dates may be listed on your Social Security Award Letter if you applied for SSI because SSI back payments are issued as three separate payments separated by six-month increments. By contrast, SSDI back pay is usually issued as one lump sum within 60 days of approval. SSI back payment installations are split up because the first two cannot be larger than three times your monthly benefit amount, though there are no such limitations on the third back payment installment.

5. Amounts Owed to Representatives

Amounts owed to any representative payee will also be listed. You do not have to elect a representative to receive your benefits payments and manage them, but if you indicated that you would like that on your application, this individual carries the fiduciary responsibility for managing your benefit payments.

Your representative will be required to fill out an annual report to track expenses and help the SSA make sure that benefit payments are being used for the care of the intended recipient. If you worked with a lawyer to file your application, the attorney will usually receive 25% of your back pay, but no more than $6,000.

6. Taxability of Your Benefits

The taxability of your benefits may also be listed. SSI benefit payments are never taxable. They were, after all, funded by social security taxes. SSDI benefits, by contrast, may be taxable, but in most cases, they will not be subject to that taxation. If your benefits are under $25,000 for an individual and $32,000 for a married couple filing jointly, your income is not taxable. If you are receiving more than that, roughly 50% of it will be taxable. Take note that lump sum back payments could drive up your income and make it subject to taxation.

7. How to Get a Copy of Your Social Security Award Letter

The social security award letter will be delivered to the applicant, so you will not need to go out of your way to specifically request a copy. However, it is a good idea to call and check on the status of your application. In checking, remember that the phone representative will most likely not be able to tell you any details about the decision, but they may be able to confirm for you that it has been mailed out.

Remember that it will take some time (again, as long as up to four months) for your SSA benefits letter to be received. Keep in mind that this letter can only go to the address associated with your social security number, so you cannot appoint someone else to receive it. Should you require additional copies of your letter, you can request them online from the SSA via the “my Social Security” account portal.

This letter will alternatively be called a budget letter, benefits letter, proof of income letter, or proof of award letter. If you have specifically applied for a disability payment, you might refer to it as a disability award letter. Keep in mind that this benefit verification letter is not the same thing as the social security statement that reflects the estimated benefit your social security account will provide you upon retirement. Keep your letter in a safe but accessible place—perhaps in the same place you keep proof of your Medicare benefits and your social security card.

What If I Disagree with My Award Letter?

If you disagree with any part of your letter, you need to act quickly and file an appeal. These disagreements might be more common among those who have filed a disability claim, but even those waiting to get a social security retirement benefit can find something to contest, especially if they were expecting a higher benefit amount.

You have 60 days to file this appeal online by filing a claim in writing or filling out Form SSA 561 (Request for Reconsideration) or a Form SSA-789 (Request for Reconsideration Disability Cessation). Those 60 days begin five days after the date of your letter. If you are receiving SSI, you should file these forms or write this letter within 10 days, so you can continue to receive any benefits that will be awarded to you as your appeal is pending.

The SSA will send you a written re-determination. Should you disagree with that, you can request a face-to-face hearing in front of an administrative law judge (ALJ) by writing to the SSA directly or by completing a Form HA–501 (a Request for Hearing by Administrative Law Judge). Once again, you have 60 days to file such a request by sending it in writing, filling out the forms, or filing it online. You do not have to appear before an ALJ, but you can elect to have them review the case in your absence.

If you choose to have your case reviewed in person, you must appear before the judge for that meeting or cancel it five days in advance. On occasion, a judge will allow for teleconferencing or a phone call, but generally, the SSA will determine the means of meeting. The SSA may cover your travel expenses if you should need to travel more than 75 miles, so if that applies to your situation, be sure to look into it. The ALJ may ask you to complete medical examinations or tests to determine the validity of your claim, along with summoning witnesses and requesting written evidence such as medical records.

If you applied for SSDI, you may disagree with the date that the SSA believes you became disabled, also called the Established Onset Date or EOD. The default of this date is when you applied for benefits, which is one reason you do not want to wait around and see if an extant condition gets better before applying for SSDI. An attorney can help you challenge this date and obtain retroactive payments.

Retroactive payments are different from back payments, as back payments are those payments calculated from the time of your application, whereas retroactive payments are calculated back to the time of the onset of your disability. But keep in mind that the SSA will only issue retroactive payments from 12 months prior to your application for Social Security Disability.

The Supplemental Security Income and Social Security Disability Application can be daunting, and the wait time for your letters may seem particularly long. You can speed up the process by applying as soon as you can and providing all the necessary documentation to the SSA before they need to ask you for it twice.

Make sure you show up to all your appointments, and if you feel the need to appeal the decision about your benefits, do so as quickly as possible. Once you receive your social security award letter, keep it in a safe place and do not throw it out, in case you need to reference it for any disputes about your disability payment or retirement benefits.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.