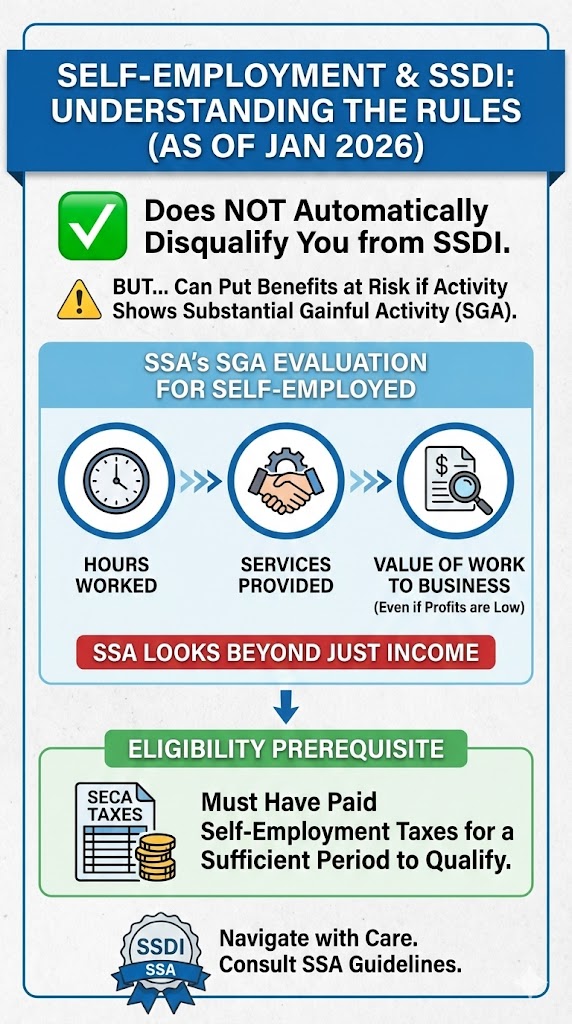

As of January 2026, self-employment does not automatically disqualify you from SSDI. Self-employed persons can qualify for Social Security Disability Insurance (SSDI) if they meet certain requirements. But it can put your benefits at risk if the Social Security Administration (SSA) determines that your work activity shows you can perform Substantial Gainful Activity (SGA).

For self-employed individuals on SSDI, the SSA looks beyond just income and closely examines hours worked, services provided, and the value of your work to the business, even if profits are low.

To qualify for SSDI benefits, a self-employed person must have paid self-employment taxes (SECA taxes) for a sufficient period.

Author’s Opinion

As someone who works closely with SSDI claimants, I see how self-employment is often pursued out of necessity, flexibility, or sheer survival, not because someone is suddenly “better.” The system allows work—but it doesn’t always explain the risks clearly. The goal here is clarity, not fear. Personally, after working in this field for almost 20 years, I often see claimants lose everything that they have worked for in life and it is so heartbreaking and what motivates me to do my best to help my client’s as much as possibly can through education and providing resources to them.

Can You Be Self-Employed While Receiving SSDI?

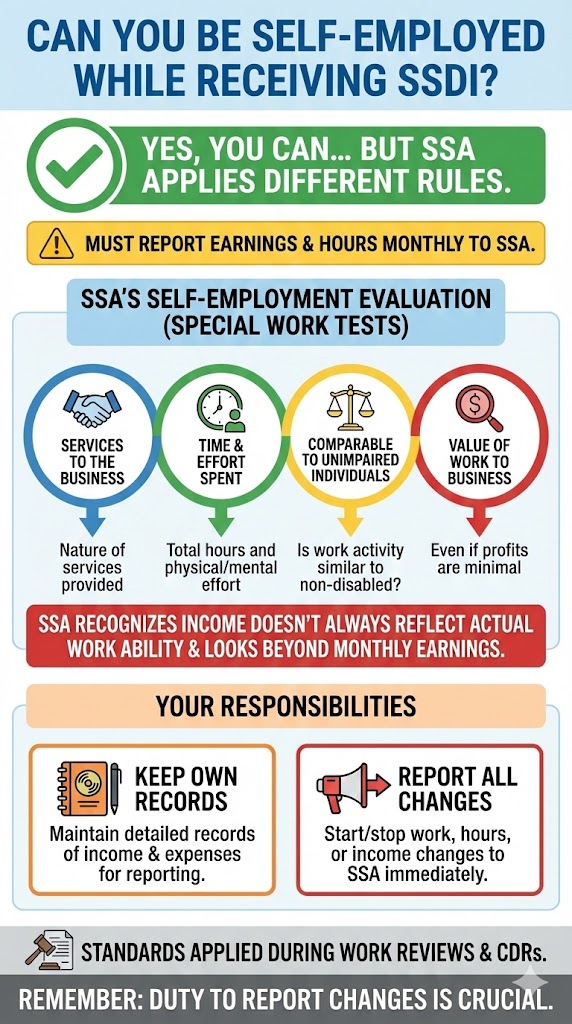

Yes, you can be self-employed on SSDI, but SSA applies different rules than it does for wage employment. Under Social Security Disability rules, self-employed individuals must report their earnings and hours of work to the SSA every month.

The SSA recognizes that self-employment income doesn’t always reflect actual work ability. Because of that, SSA evaluates self-employment under special work tests rather than relying solely on monthly earnings.

According to SSA policy, self-employment is evaluated based on:

- Your services to the business

- Time and effort spent

- Whether the work activity is comparable to unimpaired individuals

- The value of your work to the business, even if profits are minimal

Self-employed individuals must keep their own records of income and expenses for reporting to Social Security.

These standards are summarized in SSA guidance and applied during work reviews and CDRs.

Remember, you must report starting or stopping work, as well as any changes in hours or income, to the SSA.

How SSA Evaluates Self-Employment for SSDI Eligibility

When assessing working for yourself on disability, the SSA uses three tests to determine if your self-employment is considered substantial gainful activity (SGA). The SSA evaluates not only your income but also the actual work performed when applying these tests. This means that the focus is on the nature and extent of the work performed, not just how much you earn. Work activity may be considered substantial even if your income is low, depending on the type and amount of work performed.

1. Significant Services and Substantial Income Test

If you:

- Perform significant services in your business, and

- Earn income above SGA levels

SSA may find you engaging in SSDI substantial gainful activity self-employment. The SSA considers self-employment income to be substantial if it exceeds $1,690 per month in 2026.

2. Comparability Test

SSA asks whether your work:

- Is comparable to that of non-disabled individuals

- In terms of hours, skills, duties, and responsibilities

Even low income does not protect you if your work looks “normal” for that role.

3. Worth of Work Test

SSA evaluates whether:

- The value of your work to the business exceeds SGA

- Even if profits are low due to startup costs or poor margins

The SSA may assess work activity based on the value of services you provide, not just your income or hours worked.

This test frequently affects SSDI freelance work and small online businesses.

Income, Hours Worked, and Substantial Gainful Activity (SGA)

For SSDI self-employment income, SSA does not rely on gross receipts alone. SSA considers both gross income (total earnings before deductions) and net earnings (after allowable deductions) when evaluating self-employment income.

Key factors include:

- Countable income SSDI self-employment (after allowable deductions)

- Hours worked per week

- Decision-making authority

- Operational control of the business

To calculate Net Earnings from Self-Employment (NESE), Social Security allows deductions for business expenses and half of the self-employment tax paid.

Importantly:

- You can earn below SGA and still be found working at SGA

- You can earn above SGA during a trial work period SSDI self-employed without immediate benefit loss

Social Security requires self-employed individuals to report any changes in income by the 10th day of the month following the change.

This is where many people get tripped up—especially during CDRs.

Steps to Take Before Starting Self-Employment on SSDI

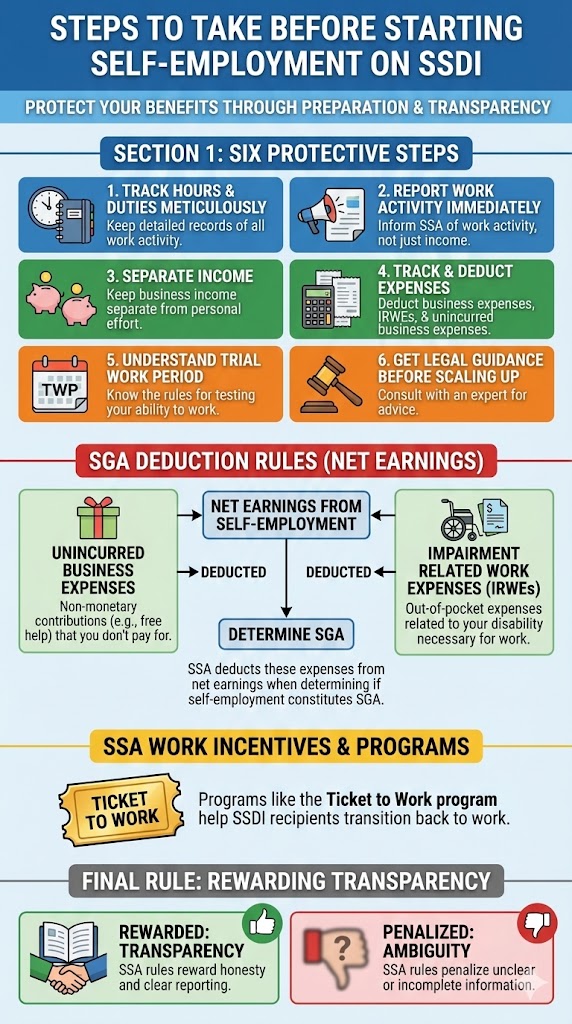

Before running a business on SSDI, consider these protective steps:

- Track hours and duties meticulously

- Separate business income from personal effort

- Track and deduct business expenses, impairment related work expenses (IRWEs), and unincurred business expenses from your income

- Report work activity immediately, not just income

- Understand Trial Work Period rules

- Get legal guidance before scaling up

The SSA deducts unincurred business expenses from net earnings when determining if self-employment constitutes SGA. Unincurred business expenses are non-monetary contributions that someone else makes to your self-employment effort that you don’t have to pay for. Impairment Related Work Expenses (IRWEs) are out-of-pocket expenses related to your disability that are necessary to help you work, and these can also be deducted.

SSA offers work incentives and work programs, such as the Ticket to Work program, to help SSDI recipients transition back to work.

SSA rules for self-employed SSDI claimants reward transparency—but penalize ambiguity.

Example Scenario #1: The Online Shop That Got Too Big

Maria receives SSDI for multiple sclerosis. Because she needs flexible work, she opens a small online shop selling digital planners. At first, it feels manageable. She works from home, sets her own hours, and earns about $600 per month, well below the SGA amount.

Over time, though, Maria spends 25–30 hours per week designing products, responding to customers, updating listings, and marketing on social media. Even though her profits stay low, the work becomes a regular part of her routine.

During a review, SSA looks past her income and focuses on how much she is actually doing.

Why SSA denied this:

- She provided significant services to the business

- Her work was comparable to non-disabled online sellers

- Her hours and responsibilities showed the ability to sustain regular work

SSA concluded that Maria’s work activity demonstrated substantial gainful activity, despite low earnings.

Example Scenario #2: Low Hours, High Responsibility

Charles receives SSDI for severe back problems. He starts a small consulting business that he runs from home. He only works 8–10 hours per week and earns around $900 per month. Because he keeps his hours low, he assumes he is safe.

What Charles doesn’t realize is that SSA also looks at how important his role is. Charles sets prices, negotiates contracts, and provides specialized expertise that no one else in the business can do. The business exists because of him.

When SSA reviews his case, they don’t focus on hours alone.

Why SSA denied this:

- His services were essential and highly skilled

- The business could not operate without his involvement

- The value of his work exceeded SGA, even if his pay did not

SSA applied the worth of work test and found that Charles was engaging in substantial gainful activity.

SSA determines that the value of Charles’ services to the business exceeds SGA levels, even though his actual take-home income does not. As a result, SSA finds that he is engaging in substantial gainful activity under the worth of work test, placing his SSDI benefits at risk.

Example Scenario #3: Gig Work That Didn’t Feel Like “Real Work”

Tanya receives SSDI for anxiety and panic disorder. To cover rising costs, she signs up for Uber and DoorDash, telling herself she’ll only work “a little here and there.” She drives when she feels up to it and stops when symptoms flare.

Some months, Tanya earns only $500–$700. Other months, she drives more and earns close to SGA. Over time, SSA sees a pattern of ongoing, repeatable work activity rather than occasional attempts.

When Tanya’s case is reviewed, SSA looks at her overall work pattern—not just her worst months.

Why SSA denied this:

- She performed ongoing services for pay

- Her work showed the ability to meet competitive work demands

- Her gig activity was not sporadic or brief enough to be considered unsuccessful work attempts

SSA determined that her gig work demonstrated the ability to perform substantial gainful activity, placing her SSDI benefits at risk

Frequently Asked Questions (FAQ)

Will self-employment disqualify me for SSDI?

Not automatically—but it can if SSA finds your work activity equals SGA.

Can I do freelance work while on SSDI?

Yes, but SSDI freelance work is closely reviewed under SSA’s worth-of-work and comparability tests.

Does SSA look at profit or effort?

Both. Effort often matters more than profit.

What income counts for SSDI self-employment?

SSA evaluates countable income, after allowable deductions, plus the value of your services.

Can I start a business during a Trial Work Period?

Yes. Trial work period SSDI self-employed rules allow experimentation, but documentation is critical.

Self-Employment on SSDI: Risk Levels at a Glance

This guide explains how the Social Security Administration (SSA) evaluates self-employment and gig work for SSDI recipients. Staying under the income limit alone does not guarantee safety.

| ■ GREEN FLAG – Lower Risk (with proper documentation) • Very limited, irregular hours • Work stops when symptoms flare • Simple, low-skill, easily paused tasks • Income well below SGA and matches effort • You are not essential to business operations • Detailed tracking of hours and duties |

| ■ YELLOW FLAG – Caution Zone • Part-time but consistent weekly work • Skilled or professional services • Some control over scheduling or pricing • Income below SGA but hours increasing • Regular gig work most weeks • Incomplete or vague documentation |

| ■ RED FLAG – High Risk of SGA Finding • Regular, predictable work schedule • Work continues despite symptoms • You are the owner, manager, or decision-maker • Business depends on your personal services • Frequent gig work over multiple months • Little or no tracking of work activity |

Important: SSA evaluates patterns, consistency, and functional ability—not just income. If your work shifts from green to yellow or red, your SSDI benefits may be at risk.

If you have any questions about your eligibility for benefits, come take our free eligibility quiz at Benefits.com! We are happy to help you figure out your best benefits situation!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.