Approaching retirement age as a veteran can be confusing, especially if you are collecting VA disability benefits. Veterans benefits are administered by the Department of Veterans Affairs and include a range of support programs such as disability compensation, healthcare, and long-term care services.

Many vets wonder what will happen to these benefits after they turn 65. Some fear that their benefits may stop altogether, while others wonder if payments will decrease or get replaced by Social Security. If you are approaching this milestone, you may be concerned, too. But is there anything to worry about? Do your VA disability benefits change after you reach retirement age, and how does veterans age affect the types of benefits and services available?

Here is everything you need to know to better understand how your benefits work after age 65.

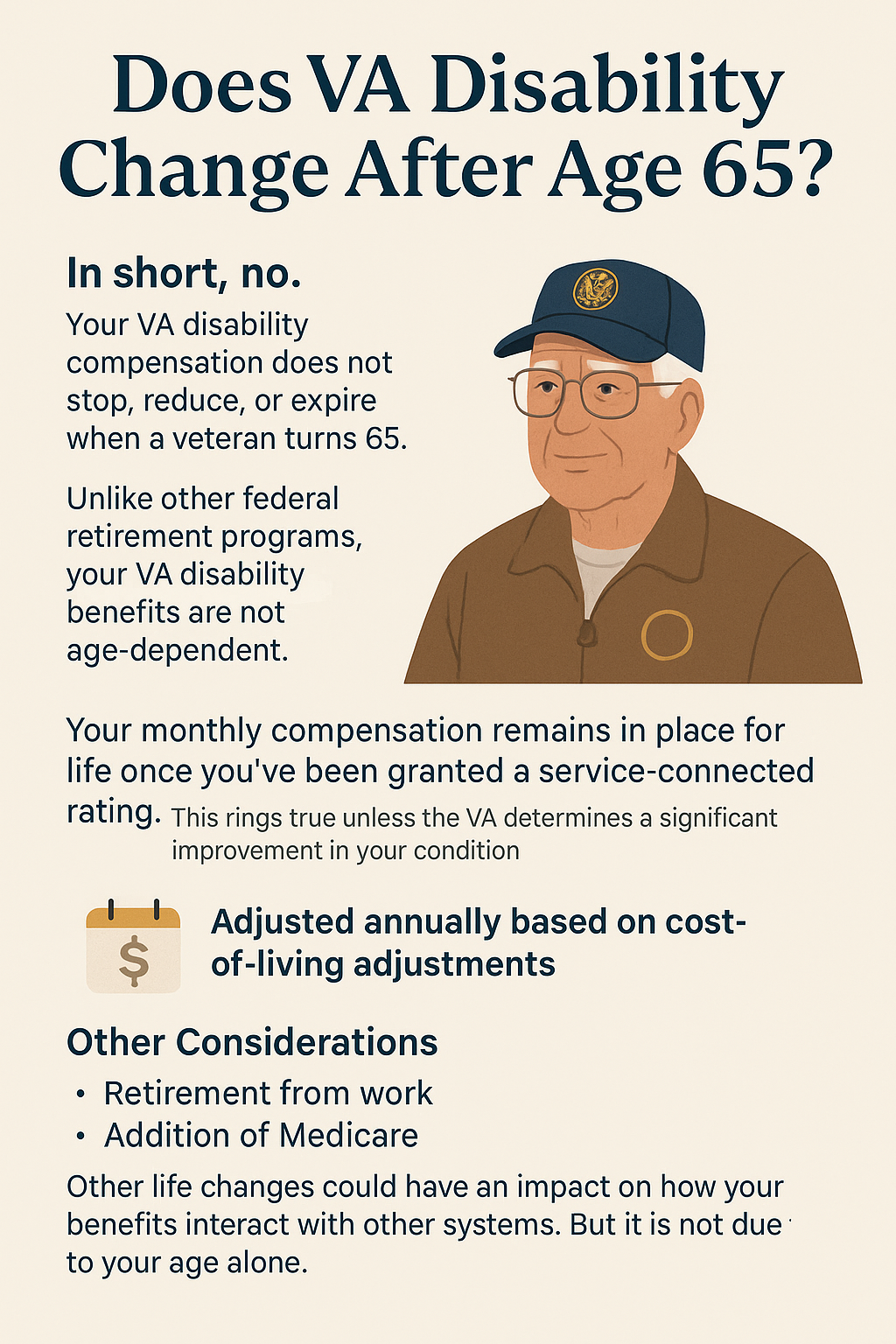

Does VA Disability Change After Age 65?

In short, no. Your VA disability compensation does not stop, reduce, or expire when a veteran turns 65. Unlike other federal retirement programs, your VA disability benefits are not age-dependent.

Your monthly compensation remains in place for life once you’ve been granted a service-connected rating. Disability compensation payments are adjusted annually based on cost of living adjustments, which can affect compensation rates over time. This rings true unless the VA determines a significant improvement in your condition.

However, it’s important to keep in mind that other life changes could have an impact on how your benefits interact with other systems. Retirement from work or the addition of Medicare could have some effect on your benefits, but it is not due to your age alone.

VA Disability Compensation vs. Retirement Benefits

First and foremost, it is important to distinguish between VA disability compensation and retirement benefits. When you reach the age of 65, it is easy to get confused about what might be impacted, and when it comes to your finances, you want to be incredibly clear on what’s right and wrong.

It’s important to understand that VA disability benefits and retirement benefits are completely separate. Your VA compensation is for injuries or illnesses connected to your military service. Retirement benefits, on the other hand, are based on age and work history. This includes benefits like Social Security or a military pension. Military retirement pay is a separate benefit from VA disability compensation, with its own eligibility criteria, calculation methods, and administration. They can be received at the same time and do not cancel each other out.

Many retired veterans may also be interested to know that if you receive a pension and also receive disability pay, you may be eligible for Concurrent Retirement and Disability Pay (CRDP). This is a program that allows for the full amount of both payments if you meet certain criteria. For individuals with a disability rating of 50% or higher, this is a likely outcome.

Veterans need to file a claim to be considered for this program.

When considering Social Security, keep in mind that full retirement age for Social Security benefits is typically between 66 and 67, depending on your birth year.

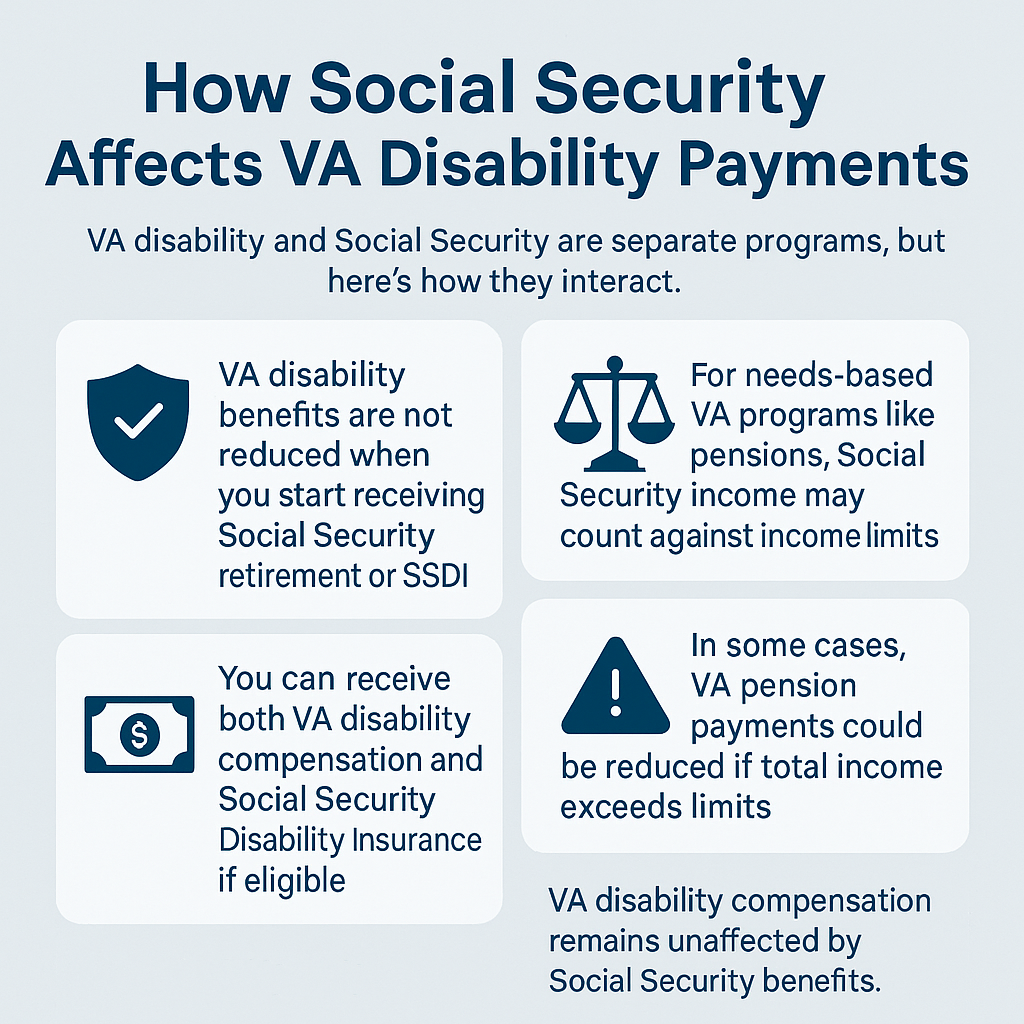

How Social Security Affects VA Disability Payments

A common question is whether Social Security retirement or disability benefits affect VA compensation. Most of the time, the answer is no. There is no impact on your VA disability benefits when you begin to collect Social Security.

Social Security benefits and VA disability are separate programs, and veterans benefits are not reduced when you start receiving Social Security. If you meet the eligibility requirements for both VA disability and Social Security Disability Insurance (SSDI), you can receive both.

That said, it is important to note that the opposite can be true when you are applying for needs-based VA programs like pensions. When you are applying for these programs, your Social Security income may count against the income limits, and in some cases, payments could be reduced if your income exceeds certain limits.

VA Disability and Medicare at Age 65

When you turn 65, you become eligible for Medicare, which is a federal health insurance program unrelated to the VA. Many veterans wonder if they should enroll in Medicare if they already receive healthcare through the VA. VA health care benefits are provided by the Department of Veterans Affairs and offer a range of health care services for eligible veterans, including geriatric care, home health services, and nursing home care. The answer depends on your personal needs, but enrolling in both can offer the best of both worlds.

VA health care is excellent for service-connected conditions and specialty care, but it may not cover emergency care at non-VA facilities. That’s where Medicare can serve as a backup.

Enrolling in Medicare when you become eligible is generally recommended, especially if you may lose access to VA care in the future or need broader medical coverage. Medicare and VA benefits work alongside each other, and having both options can help ensure you’re protected.

Special Benefits for Elderly Veterans

Veterans over the age of 65 may qualify for additional programs or enhanced VA disability benefits. Monthly payments may increase for veterans who require assistance with daily activities. This can include individuals with housebound status or Aid and Attendance benefits.

Eligible veterans with a permanent disability, especially those who are substantially confined to their homes or require assistance with performing daily functions, may qualify for an increased monthly pension amount through programs like Aid and Attendance or Housebound benefits.

These enhanced VA pension benefits are available to wartime veterans and are designed to provide financial support for those needing extended care services, including nursing home care. To qualify for these benefits and services, veterans must meet specific eligibility criteria, such as having a service connected disability or service connected condition, and may need to provide evidence of their health status and care needs.

These enhanced benefits are not based solely on age. Instead, they’re awarded to veterans who are permanently disabled, substantially confined to their homes, or need help with personal care tasks or performing daily functions. However, age often makes these needs more likely, which is why older veterans and their families are encouraged to apply if they meet the criteria.

Available services include:

- Geriatric care

- Home-based primary care

- Pension supplements

- Nursing home care

- Extended care services

- Financial support

These benefits contribute to financial security for elderly veterans and their families.

Common Misconceptions About VA Disability After 65

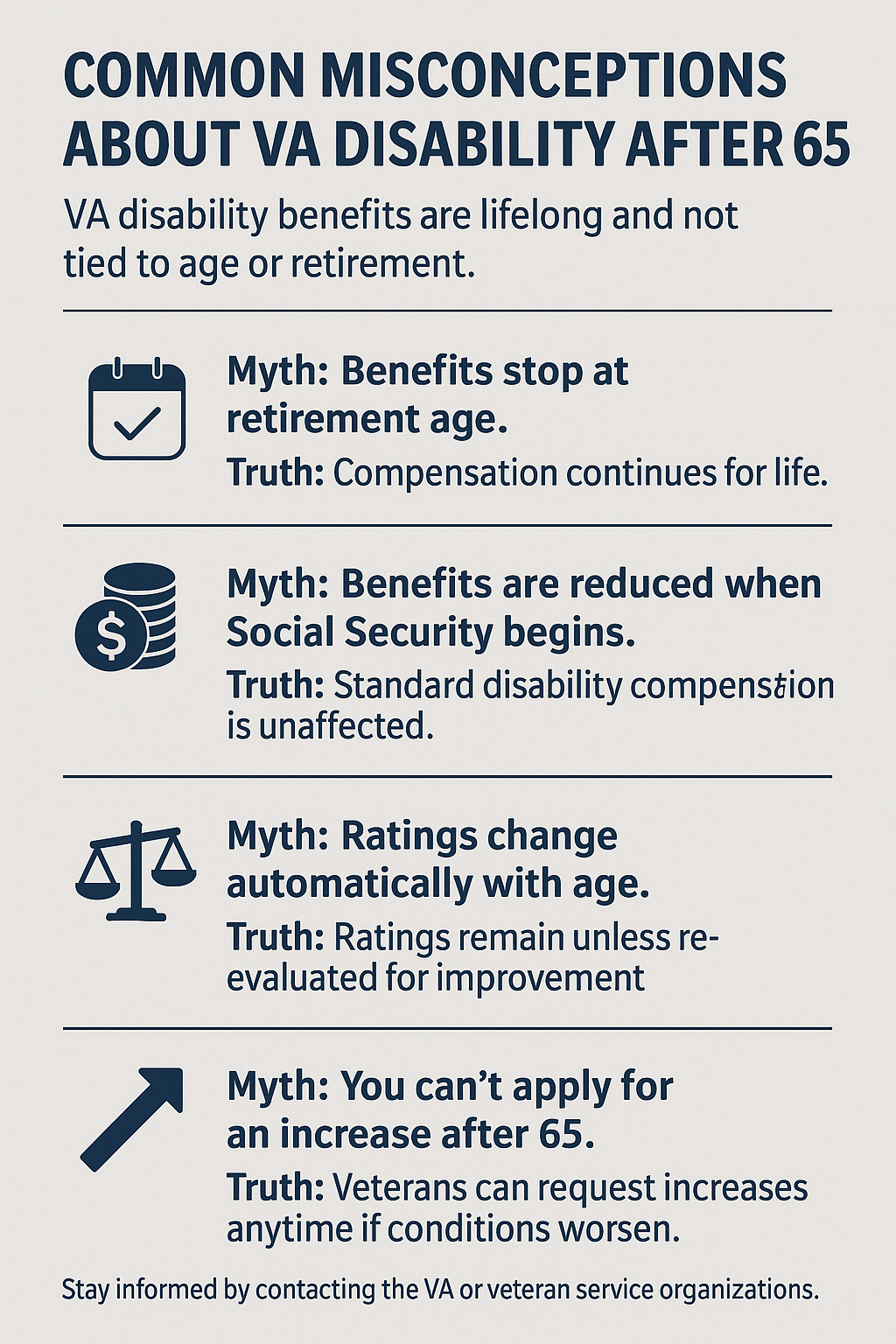

One of the most widespread myths is that VA disability stops at retirement age. It does not. VA compensation is not tied to employment status, age, or Social Security. It is a recognition of injury or illness sustained due to military service and is considered a lifelong benefit. The Department of Veterans Affairs (VA) is responsible for administering these benefits and ensuring they continue for eligible veterans.

Another misconception is that VA benefits are reduced when other retirement programs begin. While this can be true for needs-based benefits like the VA pension, it’s not the case for standard disability compensation. Similarly, VA disability ratings do not automatically change due to aging. Unless the VA re-evaluates your condition and finds medical improvement, your rating remains in place.

Lastly, some veterans mistakenly believe they are no longer eligible for an upgrade or increase after turning 65. This is also false. Veterans can apply for an increase in their rating at any age if their condition worsens or new secondary conditions develop. To stay informed about changes to Veterans Affairs VA benefits, veterans can contact their local VA office or veterans service organizations for up-to-date information and assistance.

How to Maximize Benefits as a Senior Veteran

If you are over 65 and receiving VA disability compensation, you want to ensure that you are receiving the maximum support available to you. Here are some things you can do to maximize your benefits:

- Make sure your disability rating reflects your current condition. If your health has declined or new symptoms have appeared, consider filing for a rating increase or secondary service connection.

- Look into additional programs that provide aid to elderly veterans. These may include VA home and community-based services, caregiver support, or supplemental pension benefits if you have limited income.

- Coordinate your healthcare. Having both VA care and Medicare gives you flexibility and security. You can use VA services for specialized treatment while relying on Medicare for general care and prescriptions not covered by the VA.

- Stay informed. Laws and policies regarding veterans’ disability benefits change regularly, and new programs are sometimes introduced to support aging veterans. Your local VA office can be a valuable resource for updates.

- Checking in with a Veterans Service Organization (VSO) or accredited representative can help you stay updated and take advantage of every benefit you’ve earned. Consulting an accredited attorney can also help ensure your claim is properly filed and your rights are protected.

FAQs About VA Disability After Age 65

When it comes to what happens to your VA disability after age 65, there are a lot of things veterans aren’t certain of.

- Does VA disability stop at 65? No. VA disability payments continue for life, regardless of age. They are not tied to retirement or Social Security.

- Can I receive both VA disability and Social Security retirement benefits? Yes. These are separate programs and do not impact each other.

- Does Medicare replace VA healthcare at 65? No. Medicare and VA healthcare operate independently. Having both can improve your access to a wider range of services.

- Are there extra VA benefits for elderly veterans? Yes. Veterans over 65 may qualify for aid and attendance, housebound benefits, and other forms of support depending on health needs.

- Can I still file for a VA rating increase after retirement? Yes. Age does not restrict your ability to file for a rating increase or secondary service connection if your condition worsens. For convenience, you can apply online through the VA’s eBenefits portal.

Growing Older Doesn’t Mean Giving Up Your Benefits

Aging as a veteran brings unique challenges, but it also creates opportunities to reinforce the support systems you rely on. Your VA disability compensation is not a short-term benefit. It’s a lasting acknowledgment of your service. As you approach retirement or navigate life after it, understanding how the system works is key to protecting what you’ve earned.

If you’re wondering how VA disability connects with Medicare, Social Security, or long-term health planning, you don’t have to figure it out alone. At Benefits.com, we aim to point you in the right direction towards all the benefits available to you. Take our free eligibility quiz today to get started!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.