Unemployment benefits are a critical pillar of support for individuals who have lost their jobs and are struggling to make ends meet. In the state of Nebraska, unemployment benefits are administered by the Nebraska Department of Labor, which provides financial assistance to eligible workers who have lost their jobs through no fault of their own.

In this article, we will examine the unemployment benefits available in Nebraska, including the eligibility requirements, the amount of financial assistance available, and the application process.

Through a comprehensive analysis of the unemployment benefits system in Nebraska, this article aims to provide a clear understanding of the support available to workers who have lost their jobs and the role of the government in providing this support. By shedding light on the unemployment benefits system in Nebraska, this article may serve as a valuable resource for individuals in need of financial assistance, policymakers, and the broader community.

Who is Eligible for Unemployment Benefits in Nebraska?

In the state of Nebraska, eligibility for unemployment benefits is determined by the Nebraska Department of Labor.

Individuals must meet several requirements to be eligible for unemployment benefits in Nebraska. These requirements are:

Employment History

To qualify for Nebraska unemployment insurance, you must have worked for a certain period and earned a certain minimum wage. This period and minimum amount of wages are determined by the Nebraska Department of Labor.

Reason for Unemployment

The reason for unemployment must be through no fault of your own, such as a layoff, termination due to economic conditions, or a reduction in force.

Availability and Willingness to Work

You must be able and available to work and actively continue with work search activities. This also means you must be willing to accept a job if one is offered to you.

Additional Eligibility Requirements

You must also meet additional eligibility requirements related to your employment history, such as not being disqualified from receiving benefits due to misconduct or voluntarily leaving your job without good cause.

It is important to note that not every employee who has lost their job is eligible for unemployment benefits. For example, individuals who are self-employed or work on a contract basis may not be eligible for traditional Nebraska unemployment insurance benefits.

However, they may be eligible for other forms of financial assistance, such as the Pandemic Unemployment Assistance (PUA) program, which provides financial assistance to individuals who are unemployed due to the COVID-19 pandemic.

In addition to the above eligibility requirements, there are also ongoing eligibility requirements that must be met in order to continue receiving unemployment insurance benefits. These requirements include:

Filing Weekly Claims

To receive unemployment benefits in Nebraska, you must file a weekly claim certifying that you are able and available to work and actively seeking employment.

Reporting Earnings

If you do any work while receiving unemployment benefits, you must report your earnings for each week you work.

Accepting Suitable Work

You must accept any suitable work offered to you while receiving unemployment benefits.

How to Apply for Unemployment Benefits in Nebraska

Applying for these benefits can seem daunting, but the process is relatively straightforward.

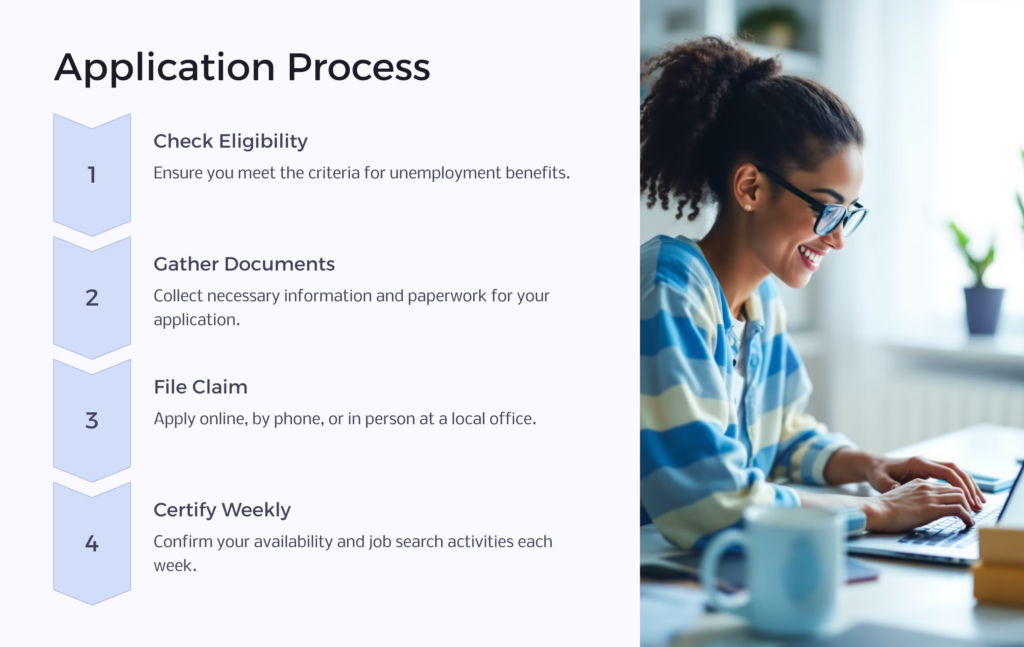

Step 1: Check Your Eligibility

Before applying for unemployment benefits in Nebraska, you must ensure that you meet the eligibility criteria. To be eligible, you must have worked in Nebraska and earned a minimum amount of wages during the past 12-18 months. You must also have lost your job through no fault of your own, be able and available to work, and actively seek new employment.

Step 2: Gather the Required Information and Documents

To apply for unemployment benefits, you will need to provide certain information and documentation, including:

Social Security number

Contact information

Employment history for the past 18 months, including employer names, addresses, and dates of employment

Reason for job separation

Bank account information for direct deposit (optional)

Alien Registration number (if you are not a U.S. citizen)

If you were separated from your job due to COVID-19, you will need to provide additional documentation related to your job loss, such as a notice of layoff or reduced hours.

Step 3: File Your Claim

To file your claim for unemployment benefits in Nebraska, you can apply online through the Nebraska Department of Labor website, by phone, or in person at a local Nebraska Department of Labor office. The online application process is the quickest and easiest way to file your claim.

When completing the application, be sure to provide accurate and complete information. Any errors or omissions may delay the processing of your claim.

Step 4: Certify Weekly

After you file your claim, you will need to certify each week that you are able and available to work and actively seeking new employment. You can do this online or by phone. Failing to certify weekly may result in a delay or denial of benefits.

Step 5: Wait for the Determination

After you file your claim, the Nebraska Department of Labor will review your application and determine whether you are eligible for unemployment benefits. If you are eligible, you will receive a determination notice outlining the amount of benefits you will receive and the length of time you can receive benefits.

What is the Maximum Benefit Amount for Unemployment in Nebraska?

The maximum weekly benefit amount for unemployment in Nebraska is $440. The benefits you receive depend on your earnings during your base period, which is the first four of the last five completed calendar quarters before the start of your claim. The Nebraska Department of Labor calculates your weekly benefit amount based on your highest quarter earnings during the base period.

In addition to the weekly benefit amount, individuals receiving unemployment benefits in Nebraska may also be eligible for an additional $300 per week under the Federal Pandemic Unemployment Compensation (FPUC) program. The FPUC program provides an additional $300 per week to eligible individuals who are receiving unemployment benefits from any program, including regular unemployment insurance, Pandemic Unemployment Assistance (PUA), or Pandemic Emergency Unemployment Compensation (PEUC).

It is important to note that the maximum benefit amount and duration of benefits can change based on state and federal legislation. Additionally, other factors may affect the amount of benefits you are eligible to receive, such as part-time work or other sources of income.

Benefits.com is here to answer your questions and make clear your options when it comes to receiving the help you deserve. Check out our other articles about unemployment benefits in other states such as Kansas and New Jersey, and be sure to sign up for a free benefits report to join our community.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.