SSI stands for Supplemental Security Income, a monetary amount people receive each month if they have a disability, income and/or resources below a certain financial threshold, or are over 65 and meet certain financial qualifications. It’s important to understand that SSI and social security benefits are different. Social security benefits are based on someone’s work before retirement, and SSI eligibility is based on disability or low income, regardless of age and retirement status.

SSI Basics

If you feel you need monetary help from the government to get by, be prepared to provide information about your living arrangements, income, resources/assets, third-party help, and other benefit amounts you may receive. The Social Security Administration (SSA) overlooks this and will use these factors to determine financial eligibility.

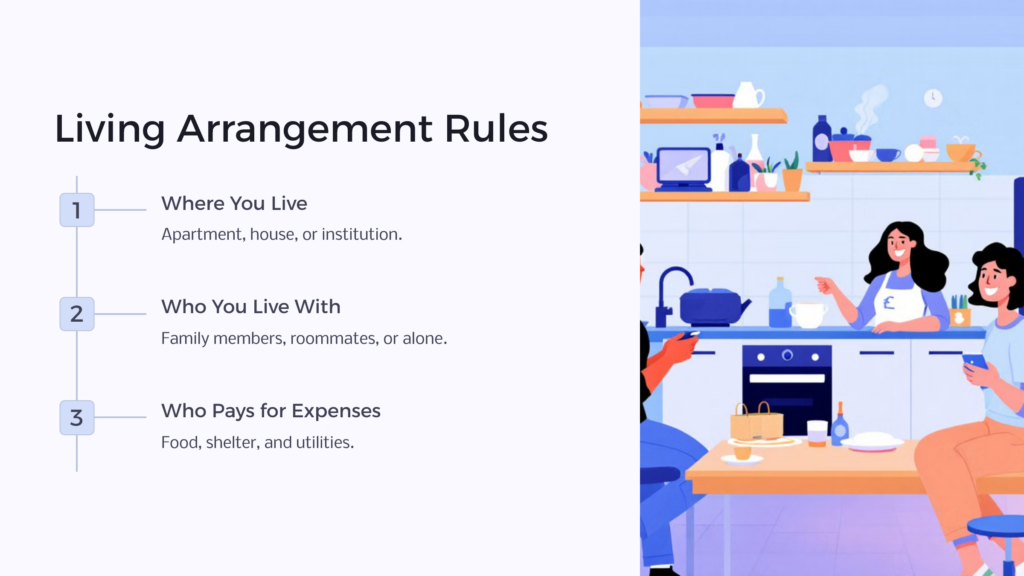

How Does My Living Arrangement Affect My SSI Amount?

Your “living arrangement” includes six considerations: where you live, who you live with, whether you live in an institution (such as a nursing care facility), and who pays for your food, shelter, and utilities. The amount of your SSI will depend on SSI recipients following these living arrangement rules and factors. Monthly SSI cash payments are for food and shelter, so if you receive assistance from another party, the amount you qualify for as an SSI beneficiary may be reduced.

In-Kind Support and Maintenance

Receiving food and/or housing help from a third party is called In-Kind Support. In-Kind Support reduces the monthly monetary amount you receive as if you were receiving cash. If your food and shelter expenses are paid for by a third party, your total monthly SSI benefits would be reduced by one-third of the maximum monthly payout. For cases where help is being provided for food or shelter, or partially covering both, the maximum amount your SSI payment could be reduced is capped at 30% plus $20. Avoiding reductions based on living arrangements can be a little complicated, so we’ll discuss it more below.

Reporting Living Arrangements

To qualify for SSI, you’ll need to report your living arrangements to the Social Security Administration. Get a written rental agreement or rent receipt, and information about your household operating expenses including rent amount/mortgage, utilities, and food. If you receive a loan agreement requiring you to pay the lender back, you may be eligible for retroactive payments without reducing your benefits.

Examples of Different Living Situations

Living Alone in An Apartment

If you live alone in an apartment, your only income is SSI, and someone else pays your rent, then that rent amount is considered in-kind support. However, the entire rent payment will not be deducted from your benefits. Usually, only ? of the federal benefit rate will be removed from your benefits.

Living Alone in a House You Own

If you live alone in a house you own with only SSI for income, and a family member pays your $100 utility bills, that $100 is considered in-kind support. A $20 general exclusion will be subtracted from the utility bill, and the rest will then be deducted from your benefits.

If You Live in Another Person’s House and Share Expenses

If you live in a household with four other people and the monthly expenses are $1600, then your share of the expenses would be $400. If you pay the $400 monthly, then nothing will be deducted from your benefits. However, if you don’t pay all the $400 every month, your benefits will be reduced by up to ? of the maximum benefit amount.

If You Live in a House Rent Free

Let’s say you live rent-free in a relative’s home but pay for utilities and food. The Social Security Administration would determine the rent amount as if your residence was currently on the open market. The rent-free house is considered in-kind support, so up to ? of the maximum SSI monthly benefit would be deducted from your payout.

Basically, if you pay for your share of the living expenses, you will receive your full benefits. If you don’t, then your benefits will be reduced by up to one-third. If you only pay part of your living expenses, your benefits can still be reduced by up to one-third, depending on the expenses you don’t cover yourself.

How Social Security Monitors Living Expenses

When you apply for SSI, the Social Security Administration will investigate your living expenses and determine if you receive any in-kind support. They will also complete periodic reviews to make sure no changes have occurred. If your living situation does change, you must report it within 10 days, and it will be factored into your benefits for the following month.

How Does Living With A Spouse Affect SSI? What About Kids?

Being married can greatly impact your benefit amount, and it’s usually for the worst. If you and your spouse are both eligible for benefits, then there is a couple cap, which is only 1.5 times the amount an individual can receive. If you are applying for benefits and your spouse is not, then your spouse’s income can be considered when determining the amount you receive.

(However, neither marital status nor spouse income will affect Social Security Disability Insurance Income).

Living with family can affect your SSI and living with children is no exception. If you move in with your kids, any help they give toward rent and food is still considered in-kind support and will reduce your monthly SSI amount. However, if you pay your fair share of food and shelter costs while living with them, then nothing, at least on that front, will be counted against you.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.