Supplemental Security Income (SSI) is a federal program administered by the Social Security Administration (SSA) that provides monthly payments to individuals who are aged, blind, or disabled and have limited income and resources. Unlike Social Security Disability Insurance (SSDI), SSI is based on financial need—not work history.

If you’re wondering how to apply for SSI, you’re not alone. The process can feel confusing, but understanding the steps, eligibility rules, and what to expect can make the journey much smoother. This guide will walk you through how to apply for SSI benefits successfully.

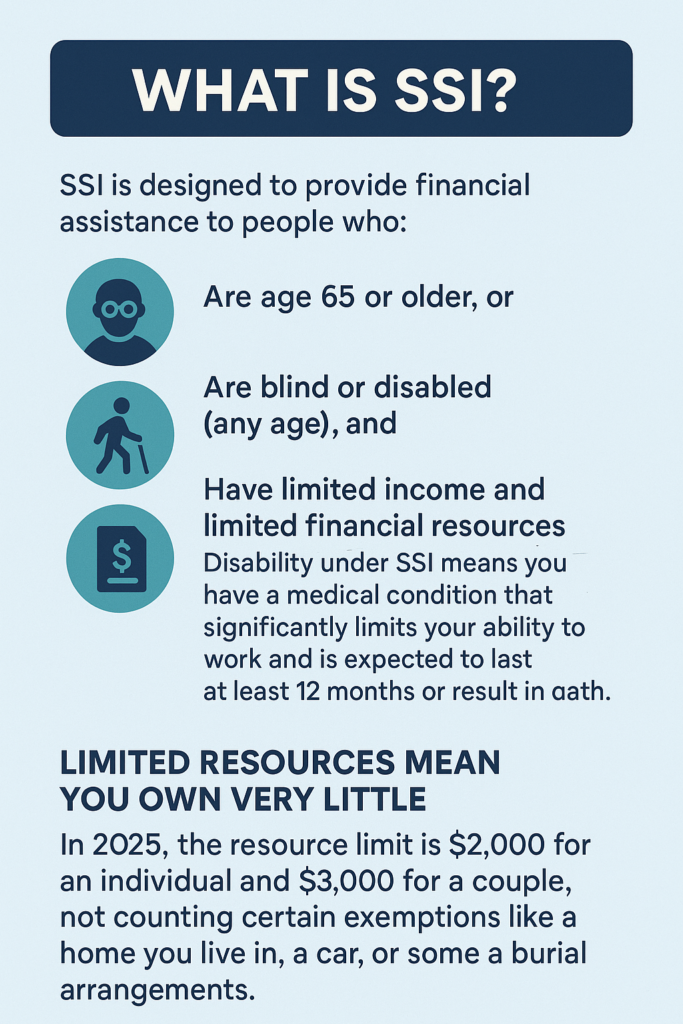

What Is SSI?

SSI is designed to provide financial assistance to people who:

– Are age 65 or older, or

– Are blind or disabled (any age), and

– Have limited income and limited financial resources

Disability under SSI means you have a medical condition that significantly limits your ability to work and is expected to last at least 12 months or result in death.

Limited resources mean you own very little. In 2025, the resource limit is $2,000 for an individual and $3,000 for a couple, not counting certain exemptions like a home you live in, a car, or some burial arrangements.

Understand If You’re Eligible

Before applying, confirm that you may qualify. The SSA will look at two main things:

1. Financial Need

You must have limited income and resources. This includes:

– Money you earn from work

– Money from other sources (like gifts, unemployment benefits, or support from family)

– Things you own (like bank accounts, land, vehicles, etc.)

Some income and resources are excluded, so it’s worth checking with SSA or a local disability advocate.

2. Disability

If you’re under 65, you must prove you’re disabled under the SSA’s rules. This usually involves:

– Medical records

– Doctor statements

– Limitations in your daily activities and work

If you’re over 65, you don’t have to prove disability—but you still need to meet the financial requirements.

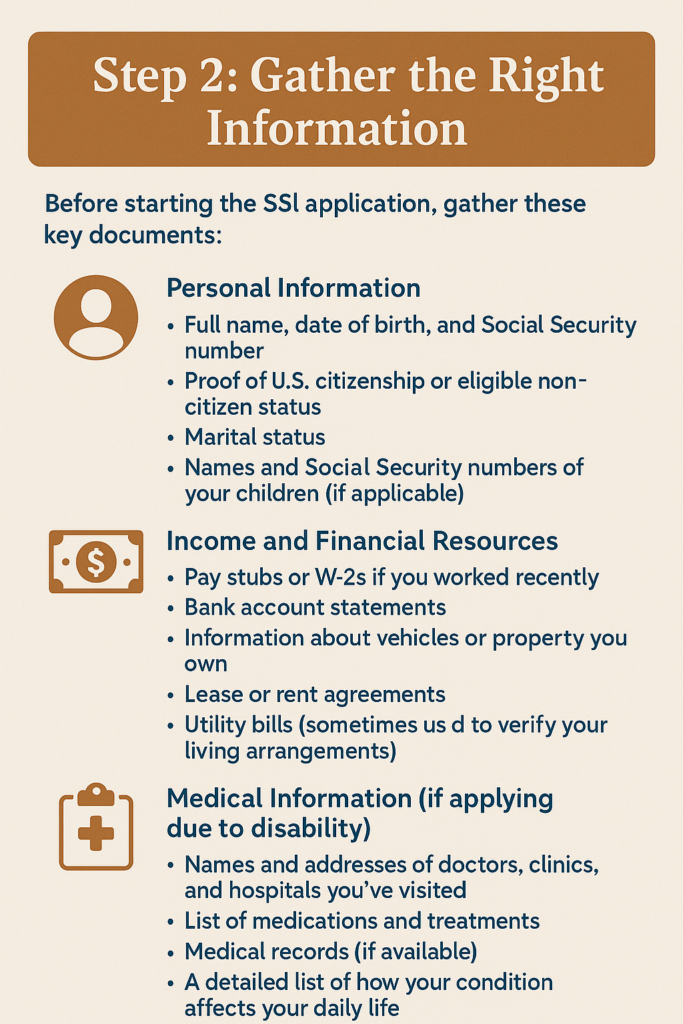

Gather the Right Information

Before starting the SSI application, gather these key documents:

Personal Information:

– Full name, date of birth, and Social Security number

– Proof of U.S. citizenship or eligible non-citizen status

– Marital status

– Names and Social Security numbers of your children (if applicable)

Income and Financial Resources:

– Pay stubs or W-2s if you worked recently

– Bank account statements

– Information about vehicles or property you own

– Lease or rent agreements

– Utility bills (sometimes used to verify your living arrangements)

Medical Information (if applying due to disability):

– Names and addresses of doctors, clinics, and hospitals you’ve visited

– List of medications and treatments

– Medical records (if available)

– A detailed list of how your condition affects your daily life

Choose How You Want to Apply

As of 2025, you can apply for SSI in one of the following ways:

1. Apply Online (for Adults Only)

You can start an SSI application online if you’re:

– Between 18–65

– Have never been married

– U.S. citizen

– Not applying for SSDI at the same time

Start at: https://www.ssa.gov/ssi

2. Apply by Phone

You can call the SSA at 1-800-772-1213 to start your application or to schedule a phone appointment. This is often the fastest option if you have questions or special circumstances.

3. Apply In Person

You can visit your local Social Security office. It’s a good idea to call first and make an appointment. Due to staffing shortages, wait times can be long, so prepare for delays.

Complete the Application

Whether you apply online, by phone, or in person, you’ll need to:

– Fill out the application forms

– Provide detailed information about your income, resources, and living situation

– Explain your medical conditions if you’re applying as disabled

– Sign medical release forms so the SSA can collect your records

Tip: Be as detailed and honest as possible. Vague answers or missing information can slow down the process or result in a denial.

Cooperate with SSA During the Review

After you apply, SSA may contact you for more details. This could include:

– Requests for more medical records

– Appointments for interviews or follow-ups

– Sending you to a doctor for a consultative examination (free exam paid for by SSA)

Respond promptly to letters and calls. If you move or change your phone number, notify the SSA right away to avoid missed communication.

Wait for a Decision

The decision process usually takes 3 to 6 months, depending on how long it takes to gather your medical records and verify your information.

Possible outcomes:

– Approved – You’ll receive a notice with the amount you’ll receive and your payment start date.

– Denied – The letter will explain why and how to appeal the decision.

If approved, SSI payments are made monthly, typically by direct deposit. In some cases, you may receive back pay for the months you were eligible while waiting.

If Denied, Consider an Appeal

If your SSI claim is denied, don’t give up—you have the right to appeal.

Appeal Levels:

1. Reconsideration – A new reviewer looks at your case

2. Hearing by an Administrative Law Judge

3. Appeals Council Review

4. Federal Court Review

Most successful cases are approved at the hearing level, especially when the claimant has a qualified disability attorney helping them.

You must file your appeal within 60 days of the denial letter. Missing that deadline may mean starting over.

Other Tips and Resources

– Apply as soon as possible. SSI payments can only go back to the date of your application, not to when you became disabled.

– Ask for help. You can contact a disability attorney, legal aid office, or nonprofit agency to help with your application.

– Check out SSA’s website. Visit https://www.ssa.gov for the most accurate and up-to-date information.

– Consider food, housing, or Medicaid help. Approval for SSI usually qualifies you for other benefits like Medicaid or SNAP (food stamps).

Benefits.com Is Here To Help

Applying for SSI can feel overwhelming—but millions of Americans have successfully gone through the process and now receive the help they need. By understanding the rules, staying organized, and getting help when needed, you can put yourself in the best position to be approved.

Remember: SSI is there to help those in genuine need. If you believe you qualify, don’t delay—start the application process today.

At Benefits.com, we are here to help you navigate the process and receive the benefits you deserve. Begin today by taking our free eligibility quiz.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.