The Cost-of-Living Adjustment, or COLA, is a vital part of Social Security and other federal benefits programs. It’s designed to help retirees and other beneficiaries keep up with rising prices. Each year, the Social Security Administration (SSA) looks at how much things cost and decides if benefits need to go up.

COLA matters because it helps people on fixed incomes maintain their buying power. Without it, inflation could eat away at the value of benefits over time. This is especially important for older Americans who rely on Social Security as a major part of their income.

For many retirees, the annual COLA announcement is a big deal. It tells them how much more money they’ll have to work within the coming year. This can affect budgets, spending plans, and overall financial security for millions of Americans.

The Projected 2025 COLA Increase Explained

For 2025, experts are predicting a smaller COLA increase compared to recent years. The Senior Citizens League, a nonpartisan senior advocacy group, forecasts a 2.5% COLA for 2025. This means that Social Security checks would go up by about 2.5% starting in January 2025.

While this increase might seem small, it’s important to remember that it’s based on changes in the cost of living. A lower COLA often means that inflation is not rising as quickly as in previous years. For example, the COLA for 2024 was 3.2%, which was already lower than the 8.7% increase in 2023.

If the 2.5% prediction holds true, it would be the smallest increase since 2021. This reflects a general trend of slowing inflation. However, it’s crucial to note that the final COLA won’t be announced until October 2024, so this number could change based on economic conditions.

How the COLA is Calculated

The Social Security Administration uses a specific method to figure out the COLA each year. They look at the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index tracks the prices of common goods and services that people buy.

Here’s how it works:

- The SSA compares the average CPI-W for July, August, and September to the same period from the previous year.

- If there’s an increase, Social Security benefits go up by that percentage the following January.

- If there’s no increase, benefits stay the same.

It’s important to understand that this method has some critics. Some say it doesn’t accurately reflect the spending patterns of older Americans, who tend to spend more on healthcare and housing. There have been discussions about using a different index, like the Consumer Price Index for the Elderly (CPI-E), but for now, the CPI-W remains the standard.

The Social Security Administration provides detailed information on COLA provisions for those who want to dive deeper into the calculation methods and potential changes.

Impact of the 2025 COLA on Social Security Benefits

The projected 2.5% COLA for 2025 will have a noticeable impact on Social Security benefits, though it may not be as dramatic as in some previous years. For the average retired worker, this could mean an increase of about $40 to $50 per month in their Social Security check.

Here’s a simple breakdown of what this might look like:

- If you receive $1,000 per month in benefits, your new monthly amount would be about $1,025.

- For those getting $2,000 per month, the new amount would be around $2,050.

While these increases may seem modest, they can make a difference in helping seniors cover rising costs. It’s important to remember that Social Security was never meant to be the sole source of retirement income. It’s designed to replace about 40% of pre-retirement earnings for average wage earners.

The impact of the COLA can vary depending on individual circumstances. For example, those with higher benefit amounts will see larger dollar increases, even though the percentage is the same for everyone. Additionally, for some beneficiaries, an increase in Social Security might affect other benefits they receive, such as Supplemental Security Income (SSI) or Medicaid.

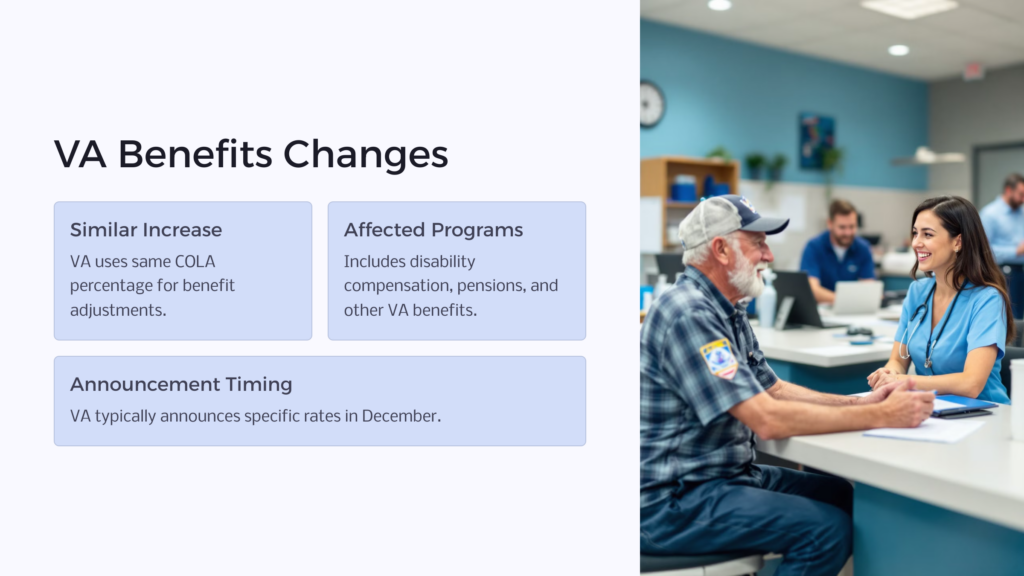

Changes to VA Benefits Following the 2025 COLA

The Cost-of-Living Adjustment doesn’t just affect Social Security. It also impacts benefits for veterans and their families. The U.S. Department of Veterans Affairs (VA) uses the same COLA percentage to adjust its benefit payments.

With the projected 2.5% increase for 2025, VA beneficiaries can expect to see their payments go up by a similar amount. This includes:

- Disability compensation

- Dependency and Indemnity Compensation (DIC)

- Pensions

- Other benefit programs

For example, a veteran receiving $1,500 in monthly disability compensation might see their benefit increase to about $1,537.50. While this may not seem like a large jump, it can help offset rising costs for healthcare, housing, and other necessities.

It’s worth noting that the VA typically announces its specific benefit rates for the coming year in December after the Social Security Administration has officially announced the COLA. Veterans and their families should keep an eye out for this announcement to understand exactly how their benefits will change.

Factors Influencing the 2025 COLA Prediction

Several factors play into the prediction of a 2.5% COLA for 2025. Understanding these can help beneficiaries better prepare for future adjustments:

- Inflation trends: The main driver of the COLA is inflation. Recent data shows inflation has been cooling, which is why experts expect a smaller increase compared to previous years.

- Economic recovery: As the economy continues to recover from the impacts of the COVID-19 pandemic, price increases for many goods and services have slowed down.

- Energy prices: The cost of gasoline and other energy sources can have a big impact on overall inflation. These prices have been relatively stable recently, contributing to lower inflation expectations.

- Healthcare costs: While healthcare costs continue to rise, the rate of increase has slowed somewhat, which affects the overall inflation rate.

It’s important to remember that these are predictions based on current trends. The actual COLA for 2025 could be different depending on how these factors change over the coming months.

Comparing 2025 COLA to Previous Years

To put the projected 2.5% COLA for 2025 into perspective, it’s helpful to look at the adjustments from recent years:

- 2021: 1.3%

- 2022: 5.9%

- 2023: 8.7%

- 2024: 3.2%

The 2025 projection is lower than the past three years but higher than 2021. This reflects the overall trend of inflation rising sharply after the pandemic and then gradually coming back down.

The unusually high COLA in 2023 (8.7%) was the largest increase in 40 years. It came in response to rapid inflation caused by various factors, including supply chain issues and increased consumer demand as the economy recovered from the pandemic.

While a 2.5% increase might seem small in comparison, it’s actually closer to the historical average. Over the past 20 years, the average COLA has been around 2.6%. This suggests that the 2025 projection, if accurate, would represent a return to more typical adjustment levels.

Understanding Inflation’s Role in COLA Adjustments

Inflation plays a crucial role in determining the Cost-of-Living Adjustment. Simply put, inflation is the rate at which the prices of goods and services increase over time. When inflation goes up, the purchasing power of money goes down. This is why COLAs are necessary – to help benefits keep pace with rising prices.

The Consumer Price Index (CPI) is the main tool used to measure inflation. For Social Security’s COLA, the specific measure used is the CPI-W, which tracks urban wage earners and clerical workers. This index looks at the costs of a “basket” of common goods and services, including:

- Food and beverages

- Housing

- Transportation

- Medical care

- Recreation

- Education

When the prices of these items go up, it results in a higher COLA. Conversely, when prices stay stable or decrease, the COLA is smaller or sometimes even zero.

It’s important to note that while the COLA aims to match inflation, it’s not always a perfect match. Sometimes, the increase in benefits may not fully cover the rise in costs that seniors actually experience, especially when it comes to healthcare expenses.

What Retirees Should Know About the 2025 COLA

For retirees and soon-to-be retirees, understanding the implications of the 2025 COLA is crucial for financial planning. Here are key points to keep in mind:

- Benefit increases are permanent: Once your benefit increases due to a COLA, it doesn’t go back down, even if inflation decreases in the future.

- COLAs affect more than monthly checks: The increase also applies to the maximum amount of earnings subject to Social Security tax, as well as the retirement earnings test exempt amount.

- Medicare premiums may offset gains: For many seniors, Medicare Part B premiums are deducted from their Social Security benefits. If these premiums increase, it could reduce the net gain from the COLA.

- Taxes may change: A higher benefit amount could push some beneficiaries into a higher tax bracket, potentially increasing the portion of benefits subject to income tax.

- Other benefits may be affected: An increase in Social Security benefits could impact eligibility for other income-based benefits programs.

Retirees should review their overall financial situation each year when the new COLA is announced. This can help ensure that their retirement strategy remains on track despite changes in benefit amounts and living costs.

How to Prepare for Changes in Social Security Benefits

With the 2025 COLA projected to be smaller than in recent years, it’s wise for beneficiaries to prepare for potential changes in their Social Security income. Here are some steps you can take:

- Review your budget: Look at your current expenses and see where you might need to make adjustments if your benefits don’t increase as much as you’d hoped.

- Consider additional income sources: If possible, explore ways to supplement your Social Security income, such as part-time work or passive income streams.

- Stay informed: Keep up with announcements from the Social Security Administration about benefit changes and program updates.

- Check for benefit programs: Look into state and local benefit programs that might help offset living expenses, especially if you’re on a tight budget.

- Consult a financial advisor: If you’re unsure how to adjust your financial plan, consider speaking with a professional who can offer personalized advice.

Remember, Social Security is just one part of a comprehensive retirement plan. By staying proactive and flexible, you can better navigate changes in your benefits and maintain your financial stability.

Additional Resources for Social Security Recipients

For those seeking more information about Social Security benefits and the upcoming COLA, here are some valuable resources:

- Social Security Administration website: www.ssa.gov – The official source for all things related to Social Security.

- My Social Security account: Create an online account to view your benefits estimate, check your earnings record, and more.

- AARP Social Security Resource Center: Offers articles, calculators, and expert advice on maximizing your benefits.

- National Committee to Preserve Social Security and Medicare: Provides updates on legislation affecting Social Security and Medicare.

- Local Social Security offices: For in-person assistance with specific questions or issues.

- Benefitscheckup.org: A free service that helps seniors find benefit programs they may qualify for.

These resources can help you stay informed about changes to Social Security, understand your benefits better, and make more informed decisions about your retirement finances. By staying educated and proactive, Social Security recipients can better navigate the changes brought by annual COLAs and ensure they’re making the most of their benefits.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.