Section 8 housing is a government-run program to provide safe and affordable housing to low-income families, seniors, and persons with disabilities in Florida.

The program, also known as the Housing Choice Voucher program, is administered by the U.S. Department of Housing and Urban Development (HUD) and local Public Housing Agencies (PHAs) in Florida.

Section 8 vouchers provide rental assistance to eligible households, which can be used to help pay for a portion of their rent. In Florida, Section 8 is a critical resource for those struggling to afford housing due to financial hardship. This article will provide an overview of the Section 8 program in Florida, its eligibility requirements, and how to apply.

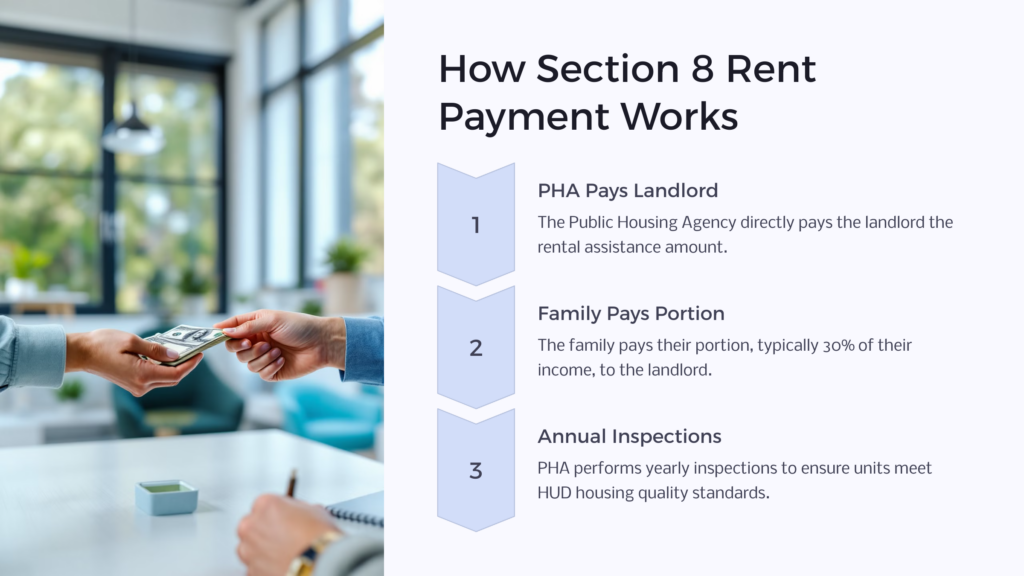

How Rent Payment Works

Under the Section 8 program, the PHA directly pays the landlord the rental assistance amount. The family is responsible for paying the landlord their portion of the rent. The amount the family pays is calculated based on their Income and is typically around 30% of their Income.

The PHA also performs annual inspections of the rental units to ensure that they meet HUD housing quality standards. These standards include requirements for basic amenities such as heating and cooling, running water, and safe electrical and plumbing systems.

If the rental unit fails the inspection, the landlord must make necessary repairs before the tenant can continue to live in the unit. The PHA may terminate the rental assistance payments if the landlord does not make the required repairs.

What is the Most Section 8 in Florida will pay?

The maximum amount of rental assistance Section 8 in Florida will pay is determined by a formula established by HUD. The formula considers the household’s Income, family size, and the area’s rental rates.

The amount of rental assistance provided to a household is calculated by subtracting 30% of the household’s adjusted Income from the Payment Standard for the area where the household is located. The PHA sets the Payment Standard based on the area’s Fair Market Rent (FMR).

HUD determines the FMR as the amount needed to rent a moderately-priced rental unit. The FMR varies depending on the area’s rental market and can be different for each county within Florida.

Once the maximum rental assistance is determined, the household is responsible for paying its portion of the rent directly to the landlord. The amount the household pays is calculated based on their Income and is typically around 30% of their Income.

The Payment Standard and Maximum Rent Limits

Each PHA sets its Payment Standard for each county within its jurisdiction in Florida. The Payment Standard is set based on the area’s FMR, representing the maximum rental assistance a household can receive. The Payment Standard determines the maximum rent that can be charged for a rental unit under the program.

Florida’s 2023 FMR varies from county to county, you can look up yours and the size of apartment you are looking for. The FMR for the Fort Lauderdale area is $1,478 for a 1 bedroom, and $3,146 for a 4 bedroom apartment. Jacksonville has FMR of $954 for a 1 bedroom, and $2,123 for a 4 bedroom. The FMR in Tallahassee is $902 for a 1 bedroom and $1,671 for a 4 bedroom.

In addition to the Payment Standard, the PHA establishes a Maximum Rent Limit for each rental unit. The Maximum Rent Limit is the highest amount that can be charged for a rental unit under the Section 8 program. The Maximum Rent Limit is determined based on the unit’s size, location, and amenities provided.

The Maximum Rent Limit ensures that the rental units provided under the Section 8 program are affordable and meet the program’s requirements for quality and safety.

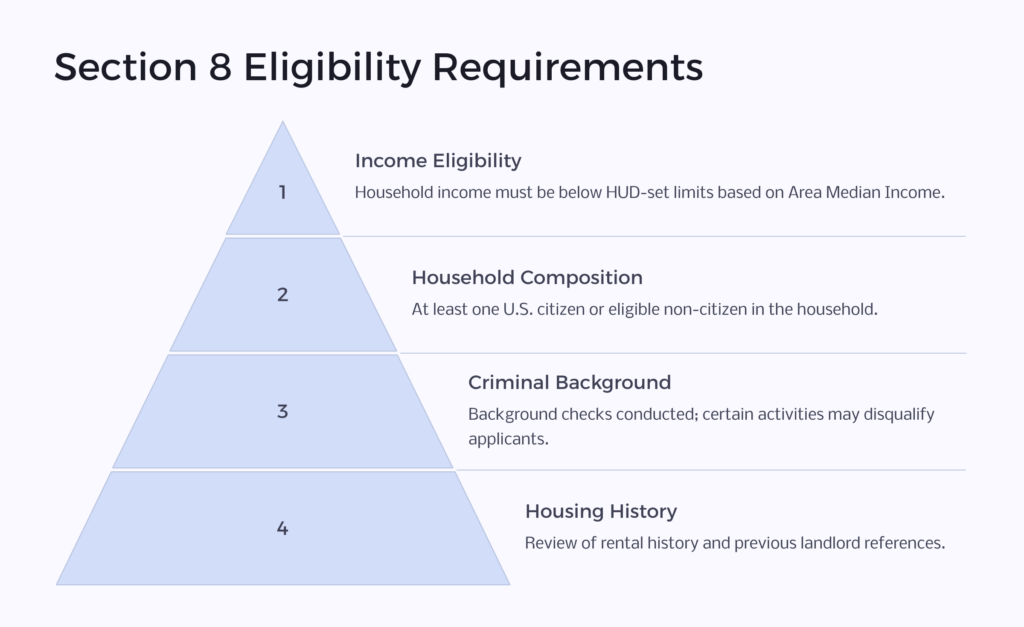

What Do You Need to Qualify for Section 8?

Certain Section 8 Florida eligibility requirements must be met to qualify for Section 8 housing assistance in Florida.

Income Eligibility

The first requirement for Section 8 eligibility is Income. To qualify for this new housing bill assistance, a household’s Income must be below a certain level.

The income limits are set by HUD and are based on the Area Median Income (AMI) for the area where the household is located. The AMI is the midpoint of the income distribution in a given area and is adjusted annually to account for inflation.

As of 2023, Florida’s mean family income is $85,500. The low income limit (80% of median) is $46,450 for 1 person, and $66,350 for a family of 4. The very low income limit (50% of median) is $29,000 for 1 person and $41,450 for a family of 4. The extremely low income limit (30% of median) is $17,400 for 1 person and $24,850 for a family of 4. To see the low income, very low income, and extremely low income limits in Florida for 1-8 person households, you can see Florida 2023 income limits here.

To determine income eligibility for Section 8, the household’s Income is compared to the income limits for their area and family size. The Income of all household members, including children, is included in the calculation.

Household Composition

Another eligibility requirement for Section 8 is household composition. The program is designed to assist families, seniors, and persons with disabilities living in poverty or at risk of homelessness.

To be eligible for Section 8, the household must have at least one member who is a U.S. citizen or a non-citizen with eligible immigration status. The household must also meet the PHA’s definition of a family, including single individuals, couples without children, and families with children.

Criminal Background

In addition to Income and household composition, Section 8 eligibility includes a review of the household’s criminal background. While a criminal record does not automatically disqualify a household from receiving Section 8, certain criminal activities can make a household ineligible.

The PHA will conduct a background check on all adult household members and review their criminal history. In addition, the PHA will consider the nature and severity of the crime, the length of time since the conviction or release from prison, and the individual’s behavior since the offense.

Drug-related and violent criminal activity can make a household ineligible for Section 8. However, the PHA can approve an applicant with a criminal history if they can demonstrate that they have rehabilitated and are not a threat to other residents.

Housing History

The PHA will also review the household’s housing history as part of the Section 8 eligibility process. For example, the PHA will check with previous landlords and review the household’s rental and payment history.

If the household has a history of eviction or unpaid rent, they may be ineligible for Section 8. The PHA will also check for any lease violations, such as damage to the property or disruptive behavior.

What Factors Disqualify you From Section 8 Housing?

In addition to the eligibility requirements discussed above, certain factors can disqualify a household from receiving Section 8 housing assistance. These factors include:

- Owning a home or having significant assets

- Being enrolled in college or university full-time

- Having a household member who owes money to a PHA or another housing authority

- Having a household member convicted of producing methamphetamine in federally subsidized housing.

Defining “Low Income” in Florida

The Florida unemployment benefits program uses the federal poverty guidelines to determine eligibility for some low-income programs. The poverty guidelines are issued annually by the U.S. Department of Health and Human Services (HHS) and vary depending on household size and Income.

- Low Income (80% of median Income)

- Very Low Income (50% of the median Income)

- Extremely Low Income (60% of the very low-income level and 30% of the median Income)

A family’s household income usually falls into the very low or extremely low categories to qualify for Section 8 assistance.

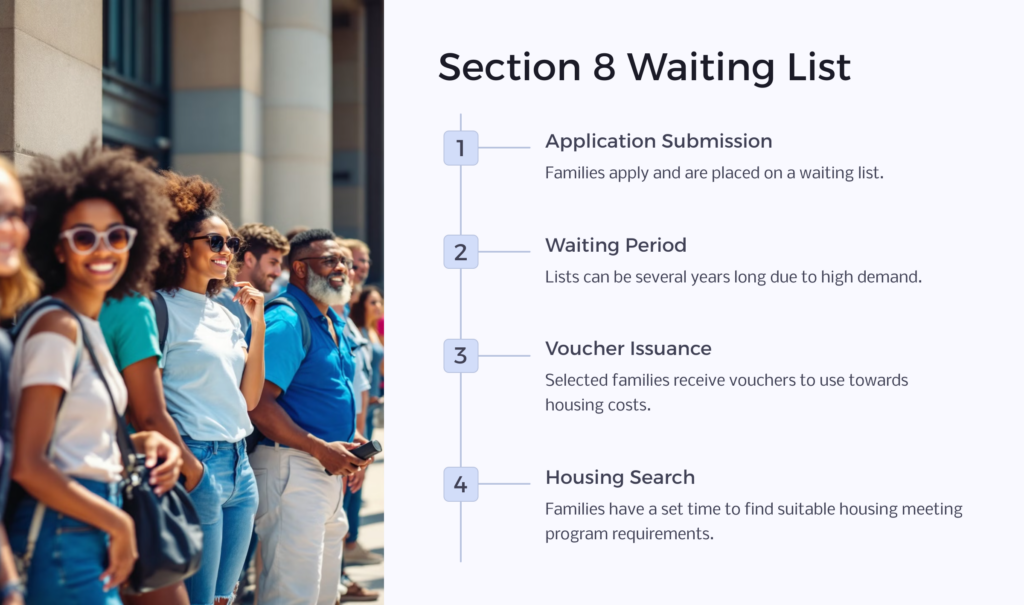

Is There a Waitlist for Section 8 Housing?

There is often a Section 8 waiting list in Florida. This is because the demand for affordable housing is typically much greater than the supply, and as a result, many housing authorities have waiting lists for Section 8 vouchers.

The length of the waiting list can vary depending on factors such as the area’s population, the availability of affordable housing, and the funding available for the program. It is not uncommon for waiting lists to be several years long; in some areas, the waiting list may be closed due to a high volume of applicants.

When a family applies for Section 8 housing assistance, they will typically be placed on a waiting list and notified of their status. Families may be required to update their information periodically to remain on the waiting list. In addition, some housing authorities may use a lottery system to select families from the waiting list.

Once a family’s name comes up on the waiting list, they will be given a voucher to use towards their housing costs, and they will have a specific period of time to find a unit that meets the program’s requirements. However, it’s important to note that even after a family receives a voucher, they may still face difficulties finding affordable housing that meets the program’s requirements.

What if My Claim is Rejected?

If your claim for Section 8 assistance is rejected, you have the right to appeal the decision. However, the appeals process varies, so contacting the appropriate agency or organization for guidance is essential.

To appeal a Section 8 decision, you must submit a written request or form within a specified time frame, typically 14 to 30 days from the decision date. In addition, you may be required to attend an informal hearing or meeting to present your case, and you may have the option to bring an advocate or representative to the hearing.

Providing additional documentation or evidence supporting your claims is crucial during the appeals process, such as Income or household changes, medical bills, or other extenuating circumstances. It’s also essential to remain patient and persistent, as the appeals process can take several weeks or months to complete.

If your appeal is denied, you may need to explore other housing assistance options, such as low-income housing programs, rental assistance programs, subsidized housing, or applying for disability in Florida. It’s essential to stay informed and seek out resources and support from local agencies or organizations to help you navigate the process.

Free Consultation and Advice

Navigating the application process and understanding eligibility requirements can be daunting. That’s where we come in. At Benefits.com, we are dedicated to providing accurate and up-to-date information about Section 8 in Florida, and we’re here to help you every step of the way.

Whether you’re just starting your housing search or in the middle of the application process, we can answer your questions and provide guidance. We understand the importance of finding a stable and affordable living place and are committed to helping you achieve that goal.

Don’t let the complexities of Section 8 discourage you. Our team is ready to assist you and provide the information you need to make informed decisions about your housing options. Contact us to receive the assistance you deserve.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.