In the United States, HUD’s Section 8 voucher program helps provide safe and affordable housing for many low-income, disabled, and elderly households. However, qualifying for a Section 8 housing voucher isn’t always easy. There are standard eligibility requirements for this federal program. Plus, since public housing authorities administer the Housing Choice Voucher program locally, an applicant must consider additional qualifications.

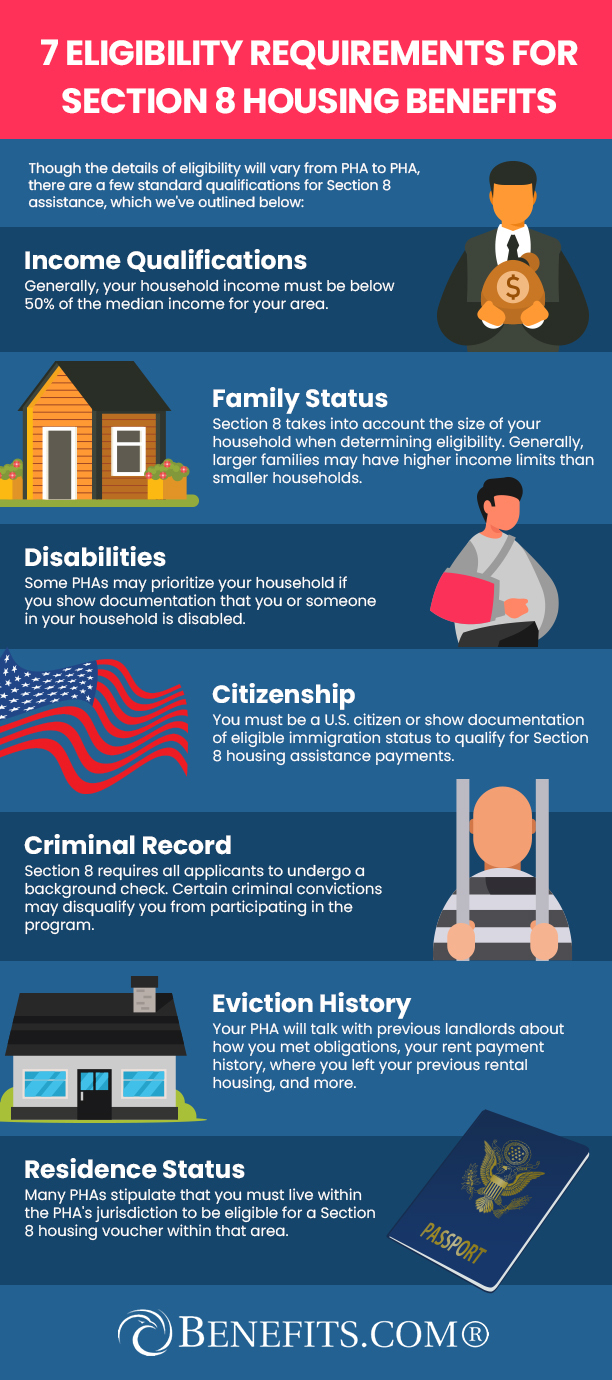

7 Eligibility Requirements for Section 8 Housing Benefits

Though the details of eligibility will vary from PHA to PHA, there are a few standard qualifications for Section 8 assistance, which we’ve outlined below:

- Income Qualifications

- Family Status

- Disabilities

- Citizenship

- Criminal Record

- Eviction History

- Residence Status

Housing vouchers help provide rental subsidies for many families in the United States who might struggle to afford clean and safe housing on their own. If you’re wondering whether Section 8 housing assistance is the right path for you, keep reading. We’ve outlined all the Section 8 eligibility requirements so that you can make an informed decision about whether to move forward with an application.

If you think Section 8 may be right for your family, it’s important to act early. More households qualify for Section 8 rental assistance than the HCV program can help. Some estimates indicate that merely 25% of Section 8 housing voucher applicants end up receiving assistance.

Let’s look in more detail at each standard eligibility requirement you must meet to qualify for Section 8 rental assistance.

1. Income Qualifications

Because one of the main functions of the Section 8 program is to ensure safe and clean housing for low income families, family income qualifications are one of the most important factors that determine whether your application for Section 8 housing choice voucher assistance will be approved. Generally, your household income must be below 50% of the median income for your area. However, specific household income limits may vary depending on family size, location, and other factors.

When you apply for Section 8 assistance, your local housing authority will consider both your household’s annual income and the size of your household to determine the appropriate amount you should be expected to pay for rent. A good rule of thumb is that typically the more people in your household, the higher the annual income you can bring home and still qualify for Section 8 housing assistance. That’s because the more mouths to feed, the more money you’ll need to make a reasonable accommodation. Your housing agency will want to see documented income from every member that earns money.

Households can be classified as low income, very low income, or extremely low income. Those deemed as low income families generally earn up to 80% of their area median income, while those classified as very low income can earn up to 50% of their area’s median income. Households with extremely low incomes may only earn up to 30% of an area’s median income.

These limits vary from state to state and from housing authority to housing authority, so make sure you talk with your local PHA about its specific income qualifications and your income limit. Each year, HUD adjusts these limits to account for inflation. PHAs prioritize their extremely low applicants, followed by the very low-income applicants on a waiting list and the low-income family applicants.

When considering your application, your PHA will want to see all forms of household adjusted income, including hourly wages, salaries, overtime pay, alimony, child support, commissions, welfare benefits, retirement fund withdrawals, pension benefits, Social Security benefits, lottery winnings, disability benefits, veterans benefits, interest earned from investments, rental property income, and more. From the very beginning, it’s best to report every possible source of your family’s income for the PHA’s full consideration.

Once your household is accepted for Section 8 rental assistance, the rent you pay your landlord generally aligns with around 30% of your household’s adjusted income. It’s also important to note that income verification is not a one-time process.

Each year, you will have to go through the income verification process to ensure your household still qualifies for financial assistance. You must also notify your local public housing program if you experience a substantial change in your household’s annual income.

How Income Limits Work

Section 8 income limits determine the eligibility of applicants for rental assistance programs such as the Housing Choice Voucher Program. These limits are usually based on the median income levels of a particular area or region, with adjustments made for household size. For instance, a family’s income may not exceed a certain percentage (often around 50%) of the median income for their area to qualify for assistance.

Calculating income limits for Section 8 is a complicated process that considers family size, local housing costs, and prevailing economic conditions. HUD updates these limits regularly to reflect changes in economic conditions and ensure that benefits go to those most need them.

For families living in areas with high housing costs, Section 8 income limits may be adjusted upward to account for the increased financial burden of finding suitable housing. Conversely, in areas where housing costs are relatively low, income limits may be lower, reflecting the lower cost of living.

These income limits serve as a critical tool in the fight against homelessness and housing insecurity, providing a safety net for vulnerable individuals and families who may otherwise struggle to afford stable housing. By ensuring that assistance is targeted towards those with the greatest need, Section 8 income limits help to promote economic stability and improve the quality of life for millions of Americans across the country.

In conclusion, Section 8 income limits play a vital role in determining eligibility for housing assistance programs and ensuring that limited resources are allocated effectively to those in need. By taking into account regional variations in living costs and household size, these limits help to ensure that assistance reaches those who need it most, providing a lifeline for low-income individuals and families striving for stable housing and economic security.

For more detailed information on your area’s Section 8 income limits, check your region and the current year on HUD.gov.

2. Family Status

To qualify for Section 8 assistance, your household must meet the definition HUD uses for “family,” which comprises any of the following characteristics:

- At least one household member over age 62

- At least one household member with a documented disability

- A household of multiple members, with or without children

- A household displaced from its current place of residence—by natural disaster, other physical damage, or government action

- A tenant remaining in a housing unit after all others have moved out, and the household previously received Section 8 assistance

- A single person living alone who meets none of the above criteria

Section 8 takes into account the size of your household when determining eligibility. Generally, larger families may have higher income limits than smaller households.

While HUD has laid out these general guidelines, it has also authorized local public housing authorities to add to these qualifications as appropriate. Make sure you check with your local PHA before you apply to make sure you have a full understanding of your area’s household eligibility criteria.

3. Disabilities

Some PHAs may prioritize your household if you show documentation that you or someone in your household is disabled. You will need to show appropriate medical evidence and documentation of the disability, and you may also present proof of any Social Security disability compensation received.

In addition to receiving priority status on the waiting list, a documented disability may qualify your household for a bigger housing unit or an extra bedroom, as the disability warrants.

4. Citizenship

You must be a U.S. citizen or show documentation of eligible immigration status to qualify for a Section 8 housing assistance payment. In many cases, you’ll need to show a U.S. passport and a Social Security card or Green Card when you submit your application. You may also be asked to sign a declaration that everyone in your household is an American citizen. Non-citizens must meet specific criteria outlined by the U.S. Department of Housing and Urban Development (HUD).

You will also need to submit a copy of a birth certificate for any children within your household. Suppose every household member cannot show proof of citizenship or eligible immigration status. In that case, you still can receive assistance as a “mixed family,” but your assistance amount will not be as high as for those households with members who are all citizens or can show approved immigration status.

5. Criminal Record

One of the main goals of Section 8 housing assistance is to ensure that those with low incomes can find safe places to live. The HCV program is unlikely to accept anyone with a criminal record, especially if a household member has engaged in criminal activity within the last five years. HUD prohibits participation in the Section 8 housing program to any registered sex offender and to anyone convicted of making methamphetamines in public housing.

Section 8 requires all applicants to undergo a background check. This includes verifying your rental history, criminal record, and other relevant information. Certain criminal convictions may disqualify you from participating in the program.

According to federal guidelines, PHAs should deny the application of anyone who is currently an illegal drug user or abusing a substance in such a way that might be dangerous to the immediate household or others living nearby.

6. Eviction History

The Section 8 housing choice voucher program wants to ensure that you’ll agree to abide by the strict tenant rules and regulations. Your PHA will talk with previous landlords about how you met obligations, your rent payment history, where you left your previous rental housing, and more. Suppose your PHA discovers that you or anyone in your household has been evicted from a rental property within the last three years, especially for a drug-related crime. In that case, it will not accept you into the Section 8 rental assistance program. The housing choice voucher program also will not accept your application if you or anyone in your household has been convicted of producing methamphetamines within public housing during any previous residency.

7. Residence Status

Many PHAs stipulate that you must live within the PHA’s jurisdiction to be eligible for a Section 8 housing voucher within that area. If this is the case for your PHA, you may be required to submit documentation that validates your current residency. This could be a utility bill or some other type of official mail sent to your current address.

Can College Students Qualify for Section 8?

College students aren’t generally considered applicants for Section 8 housing assistance payment unless any of the following exceptions are true:

- You are a full-time student age 24 or older

- You are a full-time college student who is married

- You are a full-time professional graduate student

- You are a full-time college student who was an orphan or ward of the court until the age of 18

- You are a full-time college student who is an emancipated minor

- You are a full-time college student who is a U.S. veteran or currently on active duty

- You are a full-time college student with a dependent child or other dependents

- You are a full-time college student with a disability and were receiving housing assistance payments as of Nov. 30, 2005

- You are part of a household that is otherwise section 8 qualifying.

If your local PHA determines that you meet the criteria for an independent student, then parental income eligibility will not affect your application. Any grants, scholarships, or other income you earn while in school will be considered when determining your income eligibility.

What If My Income Goes Up?

If your annual income changes, it’s important to let your housing authority know as soon as possible. Since the goal of the Section 8 housing choice voucher program is largely based on your income, your calculated rent amount may need to be adjusted based on your new income level. You’ll still pay roughly 30%, but because your income will be higher, your rental amount will increase as well.

The same is true if your annual income goes down. Your PHA can adjust your rental amount so that you’re still paying 30% of your income, but your rental amount will decrease.

You should note that if your annual income increases to 30% of your income will allow you to pay the full market value of your rent without assistance, you will be asked to exit the Section 8 housing choice program.

Section 8 Eligibility

Finding safe and affordable housing is the biggest concern for many low-income families. That’s where HUD’s Section 8 rental assistance proves tremendously valuable to the family receiving a Section 8 voucher and to society at large. This type of rental assistance helps families find safe, clean appropriate housing.

Due to the high demand for affordable housing, some areas may have waiting lists. Priority is often given to families with children, elderly individuals, or individuals with disabilities.

To determine your eligibility for Section 8, it’s best to contact your local Public Housing Agency (PHA) or the HUD office in your area. They will provide detailed information about income limits, application processes, and waiting times specific to your location.

Remember, meeting the basic eligibility requirements doesn’t guarantee immediate assistance; you may have to wait for approval. But Section 8 can be a valuable resource for those needing affordable housing. Take the first step by contacting your local PHA to learn more about the program and begin the application process.

If you think the Section 8 housing choice voucher program could help you and your household, reach out to your local PHA to find out more about specific eligibility criteria in your area.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.