As you plan for retirement, it’s important to make sure that you’re making provisions to cover all your healthcare costs. While you’ll be eligible for Original Medicare starting at age 65, you might be interested in bundling those services into one health plan or expanding the range of services covered. That’s where Medicare Advantage plans may offer a suitable strategy to make sure you have access to all the health care you need throughout your years of retirement.

6 Types of Medicare Advantage Plans

- Health Maintenance Organization (HMO) Plans

- Preferred Provider Organization (PPO) Plans

- Private Fee-for-Service (PFFS) Plans

- Special Needs Plans (SNPs)

- HMO Point of Service (HMO-POS)

- Medicare Medical Savings Account (MSA)

There’s a lot to think about when planning for your retirement – from when to start receiving your Social Security retirement benefits to how you’ll handle health insurance. The decisions can pile up quickly. Medicare Advantage plans can help you decide how to structure your retirement health insurance coverage. They are available in several different varieties – and often, the plans available to you are determined by what providers offer which types of plans in your respective area. It’s a lot of information, but we’ll walk you through each type of plan to help you get a feel for the differences among your Medicare options.

What is a Medicare Advantage Plan?

A Medicare Advantage plan is simply a Medicare health plan offered by a private insurance company to contract with Medicare to offer all Medicare Part A and Medicare Part B benefits. You might also hear these plans referred to as “Medicare Part C” or “MA” plans. All private providers who participate must be Medicare-approved, and they must follow all rules Medicare sets forth.

Participating in a Medicare Advantage plan is just another way to access your Medicare benefits. You’ll still have access to all your Medicare benefits, but you’ll be getting them through the Medicare Advantage plan, rather than through Original Medicare. You still retain all the same Medicare coverage associated with Original Medicare – they’re just administered through a private provider.

After you enroll in a Medicare Advantage plan, Medicare will pay that provider a fixed amount every month toward your coverage. In return, providers must follow all of Medicare’s rules about how those benefits are administered.

6 Types of Medicare Advantage Plans

Medicare Advantage plans come in several different shapes and sizes – below is a list of the most common plans.

1. Health Maintenance Organization (HMO) Plans

An HMO plan will typically cover medical costs associated with visits to hospitals, physicians, and specialists if they are considered part of the provider’s approved network. The one exception to this is during urgent care or emergencies. To make sure your health care is a coordinated effort, most HMOs also typically require your primary care doctor to make a referral to any specialist you see, though there are some exceptions to this rule, especially when it comes to preventative care.

If you go with an HMO plan and decide that you’d prefer at some point to see a primary care doctor or specialist outside of your provider’s network, you can still do so. You just may have to cover the full cost of your care yourself. In most cases, HMO plans do cover prescription drugs, but the rules are different for every HMO plan, so make sure to ask questions and find out the specifics of any health plan you’re considering. If the HMO plan you choose does not include prescription coverage, you can also get a separate Medicare Part D prescription drug plan.

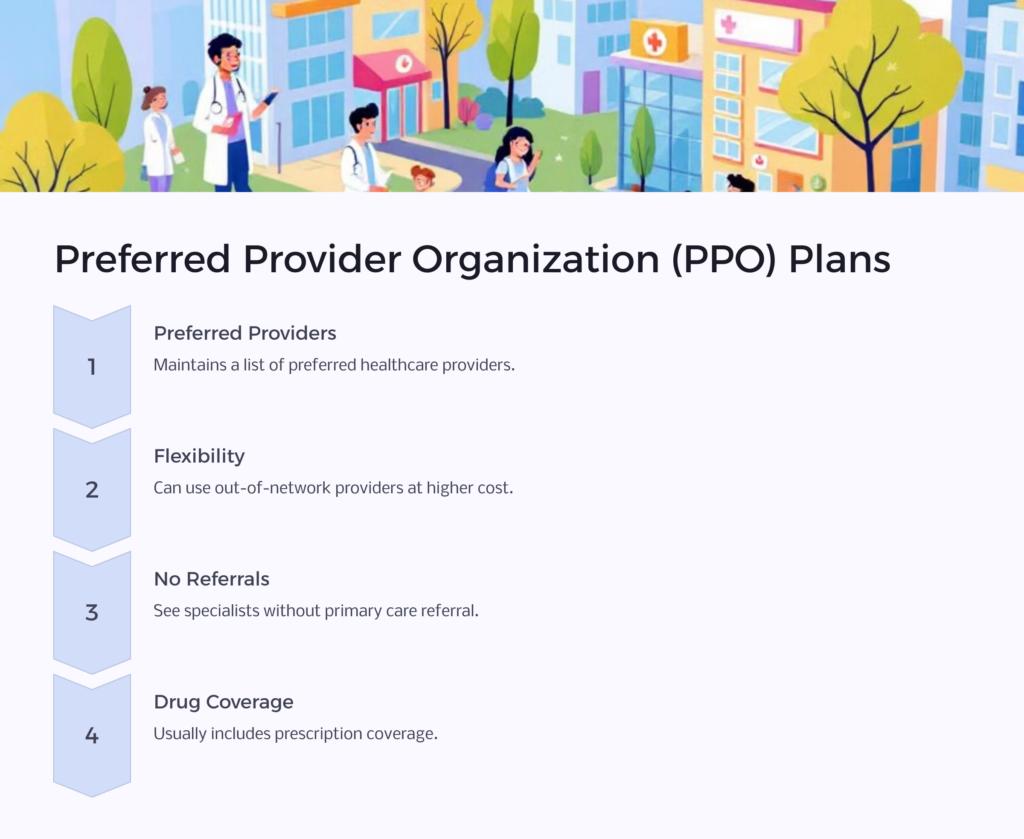

2. Preferred Provider Organization (PPO) Plans

A PPO Medicare Advantage plan maintains a list of physicians, hospitals, specialists, and other service providers it considers, “preferred.” Under this type of health plan, you save money by using a preferred healthcare provider. You can still get healthcare services from providers outside of the preferred umbrella, but they will be more expensive. If you choose to go with a PPO plan, you also can typically see any type of specialist without having to first get a referral or any other type of prior authorization from your primary care doctor, which is a key difference between a PPO and an HMO plan.

A PPO Medicare Advantage plan maintains a list of physicians, hospitals, specialists, and other service providers it considers, “preferred.” Under this type of health plan, you save money by using a preferred healthcare provider. You can still get healthcare services from providers outside of the preferred umbrella, but they will be more expensive. If you choose to go with a PPO plan, you also can typically see any type of specialist without having to first get a referral or any other type of prior authorization from your primary care doctor, which is a key difference between a PPO and an HMO plan.

Prescription drug coverage is usually included in a PPO plan, but make sure you’re familiar with the parameters of any PPO plan you’re considering. One key point to keep in mind: If you join a PPO that does not include prescription drug coverage, you are not eligible to then independently join a Medicare plan for prescription drug coverage – also known as a Medicare Part D plan.

3. Private Fee-for-Service (PFFS) Plans

Offered by private health insurance providers, Fee-for-Service plans require you to get healthcare services from Medicare-approved healthcare professionals and facilities who also accept the private provider’s terms and agree to treat you under those terms. Some PFFS plans also retain provider networks, so you can also see any physician within the network since they’ve already agreed to the provider’s terms. If you choose to see an out-of-network provider under this type of plan, you can still do so, but typically at a higher cost to you.

With this type of plan, it’s imperative that before you accept any type of medical service, you have the healthcare provider contact a plan administrator to make sure they are willing to accept the plan’s payment terms. If they do agree to treat you, they will not charge you for any services; they will simply bill the health plan for any covered services. You will only be asked to pay a copay – unless the plan allows the healthcare provider to balance bill. Balance billing occurs when a healthcare provider bills you for the difference between the amount your insurance coverage will pay and what the provider charges for a particular service.

This one’s a little tricky – if the physician or medical facility agrees to treat you, they must adhere to the rules of the insurance provider’s plan. The flip side is that the healthcare provider has the option to stop accepting the health plan at any time, which means they would then not agree to treat you. If this happens, they should only treat you during an emergency, and you’ll need to find a new healthcare provider that will agree to the terms of the PPFS plan you’ve joined.

Prescription drug coverage is offered as part of some PFFS plans, but you’ll need to check the specifics of any plan you’re considering to make sure. If your selected plan doesn’t offer prescription drug coverage, you can choose to join a separate Medicare Part D prescription drug plan to make sure any necessary prescriptions are covered.

4. Special Needs Plans (SNPs)

A Special Needs plan is designed to help meet the medical needs of those with specific medical conditions or those with limited incomes. An SNP typically will tailor its services and offerings – be they drug formularies, provider networks, or benefits – to meet the needs of a specific group of patients that a plan exists to serve. SNPs keep their membership limited – you’re only eligible to enroll in an SNP if you meet the qualification criteria, and if at any point you stop meeting those criteria, you’ll no longer be eligible for that plan.

SNPs will cover all standard services as all other Medicare Advantage plans but may add specialty services unique to a particular group. For example, if a long-term illness or chronic condition requires frequent hospitalization, an SNP for that patient group might cover more hospital stays than a typical plan. Below is a general list of chronic conditions that may make you eligible for an SNP if one is offered in your area:

- Diabetes mellitus

- Cancer (excluding pre-cancer conditions)

- Chronic lung disorders

- Autoimmune disorders

- Chronic heart failure

- Cardiovascular disorders

- Neurological disorders

- Severe hematologic disorders

- End-Stage Renal Disease (ESRD) requiring dialysis (any mode of dialysis)

- Chronic alcohol and other dependence

- Dementia

- Chronic and disabling mental health conditions

- Stroke

- HIV/AIDS

- End-stage liver disease

These plans are known as Chronic Condition SNPs or C-SNPs. You might be eligible to enroll in an SNP if you live in a skilled nursing facility or other assisted care facility or you require nursing care in your home. This kind of plan is called an Institutional SNP or I-SNP. You may be eligible for SNP enrollment if you currently receive benefits from both Medicare and Medicaid simultaneously – this is known as a Dual Eligible SNP or D-SNP.

With an SNP, you typically will need to receive all healthcare services from physicians, facilities, and other providers of medical services who are part of the plan’s network. As with most plans, exceptions to this include emergency or urgent care, along with out-of-area dialysis in some cases. And many SNPs require patients to work with either a central primary care doctor or a care coordinator to help ensure that they get the right level of coordinated care.

In some cases, a care coordinator may even help patients manage the day-to-day aspects of living with a chronic condition. For example, a care coordinator might help a patient with diabetes make sure to check blood sugar regularly and learn to cook low-sugar meals. All SNPs include prescription drug coverage.

5. HMO Point of Service (HMO-POS)

HMO-POS plans have much in common with traditional HMO plans, with the exception that you may be able to see an out-of-provider physician or specialist by simply paying a higher co-payment. Under this type of plan, the care you receive in-network and the care you receive out-of-network also will have two separate deductibles.

6. Medicare Medical Savings Account (MSA)

MSA plans combine a high-deductible health insurance plan with a medical savings account that can be used to cover healthcare expenses. Because the health insurance plan is a high-deductible version, it will only begin to cover healthcare expenses once you’ve spent a predetermined amount out of pocket. The amount of the deductible will vary according to the specific plan you’re enrolled in, but it’s typically much higher than what you would expect from the other types of Medicare Advantage plans. That’s where the medical savings account comes in – the MSA regularly deposits money into a special savings account, which you can access to pay for medical expenses.

Once you reach your deductible, the plan then begins to cover your expenses. You just need to manage the funds in your MSA carefully. If you use all the money in your MSA and still have healthcare expenses, you will need to pay for those out of pocket. But if you have money left over in your MSA at the end of the year, it will remain in your account to be used for future healthcare expenses.

In addition to typical Medicare Part A and B services provided by all Medicare Advantage plans, some MSAs may also cover things like dental, vision, and long-term care, like hospice care. With an MSA, you choose the healthcare providers that you’d like to work with. If you enroll in an MSA, you must also enroll in a Medicare Part D prescription drug plan to get prescription drug benefits.

Medicare Advantage Plans

Healthcare expenses are often some of the most significant budget items for those living out their retirement years – so it’s important to take time to research all your health insurance. While Medicare kicks in once you reach age 65, you do have some flexibility when it comes to how your traditional Medicare benefits will be administered, including enrolling in a Medicare Advantage plan. Armed with the information presented here, you can be confident in making an informed decision that supports your health care well into the future.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.