The purpose of Supplemental Security Income (SSI) payments is to help disabled people, or their families, who have limited financial resources. Children with certain disabilities can be eligible for Social Security disability benefits beginning from birth. In the case of parents with autistic children, this monthly benefit and SSI payment can help provide needed therapies and care to maximize the abilities and strengths of their autistic child.

Can You Get Disability Benefits for Autism?

Yes, children and adults can receive disability benefits for autism because it’s considered a neurological developmental disability. The Social Security Administration (SSA) in the United States provides two main programs that offer benefits for individuals with disabilities:

1. Supplemental Security Income (SSI): SSI is a needs-based program that provides financial assistance to disabled individuals with limited income and resources. Children and adults with autism may be eligible for SSI benefits if their condition meets the SSA’s definition of disability and their income and resources fall within the program’s limits.

2. Social Security Disability Insurance (SSDI): SSDI is a program that provides benefits to disabled individuals who have paid into the Social Security system through employment. To qualify for SSDI benefits, individuals with autism must meet the SSA’s definition of disability, have earned enough work credits, and have a work history.

When applying for disability benefits for autism, it’s crucial to provide comprehensive medical documentation demonstrating the condition’s severity and impact. This typically includes medical records, evaluations, assessments, and reports from healthcare professionals, such as doctors, psychologists, and psychiatrists, who have diagnosed and treated the individual with autism.

Benefits for Children with Autism

Applying for SSI is a two-step process of showing financial need and using medical evidence to demonstrate the level of disability.

Financial Need

The Social Security Administration provides Supplemental Security Income (SSI) payments to disabled people with limited financial resources. It is a needs-based program, meaning your family income and assets must fall below a certain level.

To meet the SSI’s financial criteria, they first look at your total assets, or what they call resources. These are items you could sell if needed to provide food and shelter. However, there are many essential assets they don’t count, such as your personal car. To qualify a child, the child’s countable assets must be $2000 or less, and the parents’ countable assets must be less than $2,000 if a single parent, or $3000 if it’s a two-parent household. There are additional rules that apply if a parent’s resources are over the limit, in which case the extra will be attributed to the child’s $2,000 limit. Some typical countable resources are cash on hand and money in checking accounts and savings accounts.

Regarding income, the SSA measures your countable income against the maximum benefit level; if the child’s countable income including income deemed from his or her parents living in the same household less than the benefit level, you will get the difference between the maximum benefit and the countable income. In 2020, the highest federal SSI monthly payment was $783 for an individual child. Some states supplement that amount.

For a child, a portion of the parent’s income is “deemed” to count as the child’s income. As with resources, there are types of income that are not counted, such as food stamps, and income received from foster care support. If your autistic child receives child support payments, the SSA will count two-thirds of that amount in your total income, and exclude one-third of it. If there are additional children in the house, there may be a reduction in the income otherwise countable.

In general, the Social Security Administration states that when single parents live with another adult who is not the child’s other parent, the income from that person is not counted. For the income of another adult to count, the two people have to be legally married or hold themselves out as a married couple to the public. Otherwise, if you have roommates who are adults that you are not married to, their income will not be counted. Their relationship to you doesn’t matter, so they could be romantic interests, adult relatives, friends, or just housemates – as long as you’re not married or holding out and the other adult is not the disabled child’s parent, SSA won’t attribute their income to your child with autism. However, if that person is providing the child with shelter or food from them, your child’s benefit may be reduced by free or subsidized shelter or food received from that other adult.

The financial requirements can be very confusing. SSA encourages individuals to call their offices to help get answers to their questions (see numbers below) and to file an application whenever there is a possibility of financial eligibility.

Disability Determination for Children Under 18

Children with certain disabilities can be eligible for Social Security disability benefits beginning from birth. Because autism is a Spectrum Disorder, whether children qualify for assistance will depend on the severity of their symptoms. To qualify for a disability rating, the SSA uses different criteria for children than for adults.

Children with severe autism limitations will generally qualify. The SSA considers a child under 18 to be “disabled” if they have a permanent physical or mental condition that very seriously limits their activities.

The Social Security Administration clarifies that conditions must be established with medical evidence. This means the doctor’s documentation of symptoms, along with lab results. A parent’s own listing of symptoms is not enough alone to show the disability, but a parent can help provide full details of the level of daily care and assistance that the child needs. It’s also helpful to include written statements from any professionals who work with your child and can attest to their challenges. These can include health care providers, teachers, or caretakers.

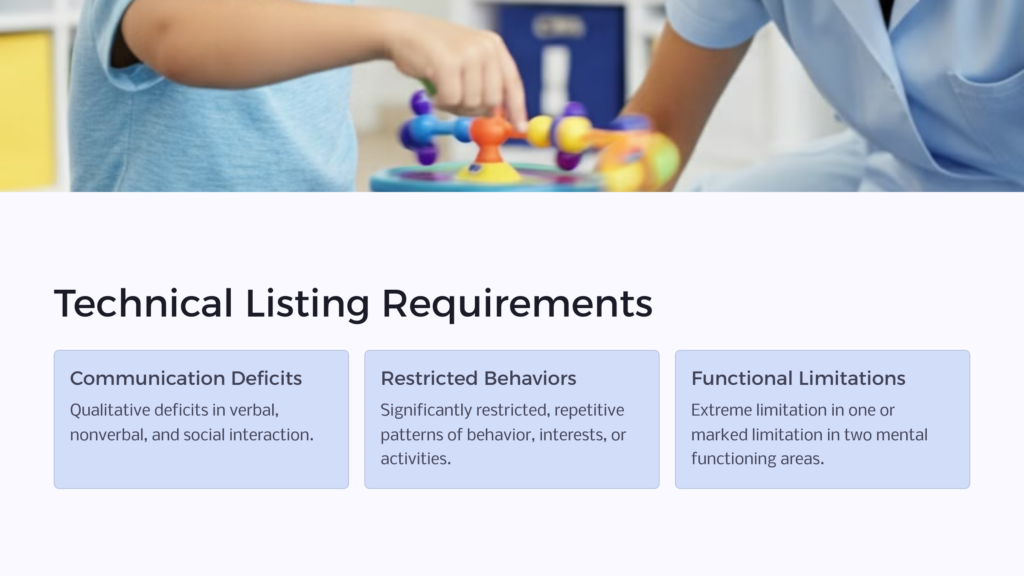

Technical Listing Requirements for Autism Spectrum Disorder

112.10 Autism Spectrum Disorder, for children age 3 to attainment of age 18, satisfied by A and B:

Medical documentation of both of the following:

- Qualitative deficits in verbal communication, nonverbal communication, and social interaction; and

- Significantly restricted, repetitive patterns of behavior, interests, or activities.

AND

Extreme limitation of one, or marked limitation of two, of the following areas of mental functioning;

- Understand, remember, or apply information.

- Interact with others.

- Concentrate, persist, or maintain pace.

- Adapt or manage oneself.

Your child’s condition will be compared to the guidelines, so you and your doctor can review them and collect the necessary evidence to show your child’s challenges. While each case is decided individually, if a child’s autism symptoms keep the child from doing average activities for his/her age, it is likely they will meet the disability definition.

State agencies make the initial disability determination, which can take up to five months. If the agency needs more information, they will contact you to schedule an examination and/or tests, which will be paid for. If your child is found to be disabled, a monthly benefit will then be calculated. If a disability rating is denied, you can appeal.

To start the application process, you can call Social Security directly at 1-800-772-1213 (TTY 1-800-325-0778), or visit your local Social Security Office. We at Benefits.com want you to succeed. Contact us for extra support today!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.