Pension poaching is an unfortunate trend where scammers target older military service veterans for their VA pension benefits. Scammers and dishonest financial planners use financial exploitation to try and earn the trust of veterans claiming they can help them gain more benefits than they already have. Because of this, it’s essential veterans know what to look out for and how to keep their finances safe.

5 Tips To Avoid Pension Poaching

- Use a VA-Accredited Agent

- Take your time

- Read all paperwork carefully

- Never trust a guarantee

- You don’t have to pay to apply

When a veteran is targeted in this way, they’re led to believe they can earn more benefits or save more money by applying for new programs. They may also believe that by adjusting their finances in such a way that makes them seem needier they’ll qualify for more money.

This is intended to make the scammers money either through the fees they collect from you or with the money they siphon off from your benefits package. Ultimately, this can hurt you more than just this lost money upfront as it can also prevent you from qualifying for much-needed benefits in the future.

What Is Pension Poaching?

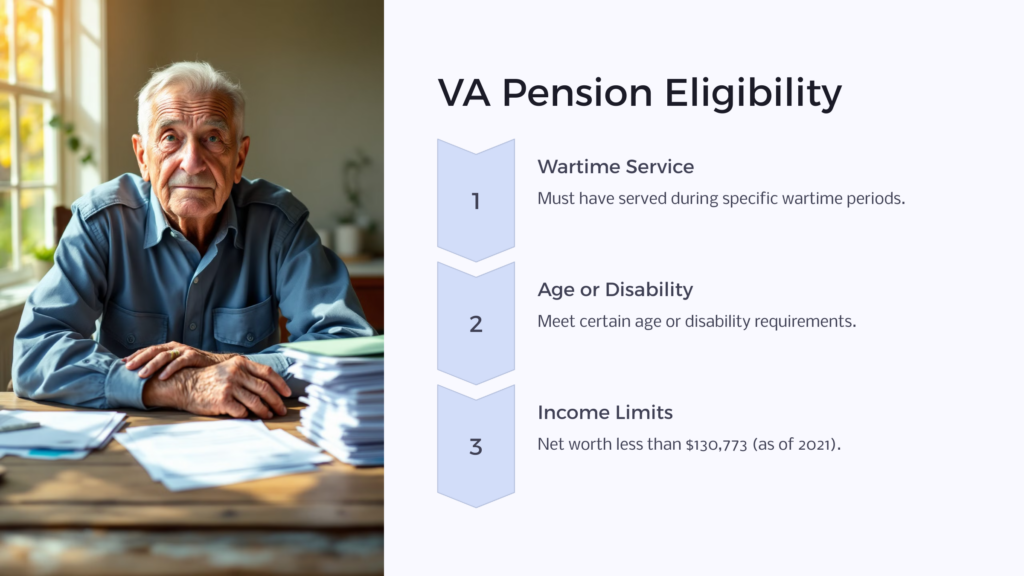

Veterans who have served during wartime and meet certain age or disability requirements, as well as income limits, may qualify for a VA pension benefit. They are sometimes referred to as “wartime pensions.” To be considered a “wartime” vet you must have served in World War II, the Korean Conflict, the Vietnam War, or the Gulf War.

These pensions are intended to help veterans with monthly support payments who might otherwise not be able to meet their needs. A survivor’s pension may also be available to some surviving spouses and children of qualifying vets.

In 2021, a veteran must have a net worth (income and assets together) of less than $130,773 to qualify for a pension. Assets such as your primary residence, car, or basic home items like furniture or appliances are not counted toward this total.

Your marital status, number of dependents, and any disabilities you may have (which would qualify you for other aid programs like Housebound benefits and VA Aid and Attendance), will determine your Maximum Annual Pension Rate (MAPR). MAPRs can range from as little as $13,931 for a basic pensioner with no dependents or disabilities, up to $36,861 for a pensioner who’s married to another veteran when both spouses qualify for disability compensation.

Warning Signs of Pension Poaching

If you are a veteran, you need to be aware of the potential threat of pension poaching even if you are not currently receiving a pension. It’s important to be able to recognize fraud so you can protect yourself if necessary.

Here are four things to look out for if an organization or individual approaches you saying they can help you with your veterans’ benefits:

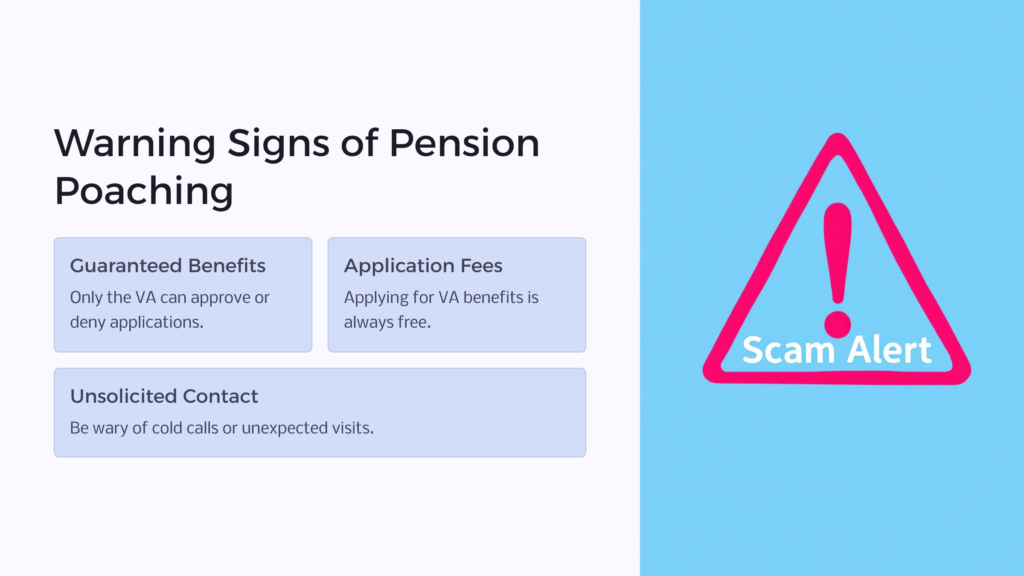

Guaranteeing More Benefits

Only the VA can approve or deny your application for compensation, and any advisor or organization who promises you that you’ll receive more money is probably trying to scam you. If you feel you’re eligible for a VA pension benefit, always apply directly with the VA. An advisor may be able to give you a good idea of the likelihood of receiving aid, but they can never guarantee it.

Asking for a Fee To Help You Apply

Applying for VA benefits and a VA pension is free, and it’s against the law for anyone to charge you for this service. Furthermore, the VA provides trained advisors who can help you with the application process, but you should ensure they are accredited as Veteran Service Officers (VSO) on the VA’s website.

It is always up to you whether you’d like to pay an advisor for help with your finances, but you always have the option of seeking help for free and applying at no cost directly through the VA.

Telling You To Reallocate Your Assets To Appear “Poor”

It’s technically legal to move around your personal funds from one account to another, or shift a portion of your assets into an irrevocable trust to artificially present your total wealth. Using trusts can be a useful way to manage your estate. However, there are a few reasons why you should avoid this practice when applying for government benefits.

Even if your scheme works temporarily to meet the criteria for a VA pension, the VA has a “lookback” period of three years in which they will scrutinize your finances. If they find that you have more money than you claim, it could mean a lost pension. Second, many veterans who receive a pension may also sign up for an additional service like Medicaid, which has a five-year lookback period. If the government finds that you’ve moved around your assets in bad faith, you could lose this benefit as well.

Being Contacted Out of the Blue

Beware of any individual or organization cold-calling you or showing up at your door claiming they can help. This can be an indication of a pension scam. When in doubt, get the name of the representative and double-check their credentials. Tell them you’ll contact them later if you want their services.

You can also file a complaint with your state Attorney General, county Veterans Affairs office, or the Federal Trade Commission.

Asking for Your Personal Information Over the Phone

No one from the VA or a VSO will ever ask for personal information like your credit card number or Social Security number over the phone. Remember, filing for VA benefits is free so there will never be a need to provide payment at any time. Make it a rule never to give personal information like this out over the phone, especially if you weren’t the one who placed the call in the first place.

5 Tips To Avoid Pension Poaching

Even the savviest among us can still fall victim to sophisticated scams such as identity theft, phishing, investment fraud, or pension poaching. The good news is there are proactive steps you can take to ensure you and your loved ones stay protected.

Follow these basic guidelines to avoid veteran pension poaching schemes and to ensure your benefits stay safe. The Department of Veterans Affairs is committed to helping service members both during their active duty time and afterward, and there are packages available to those who need help.

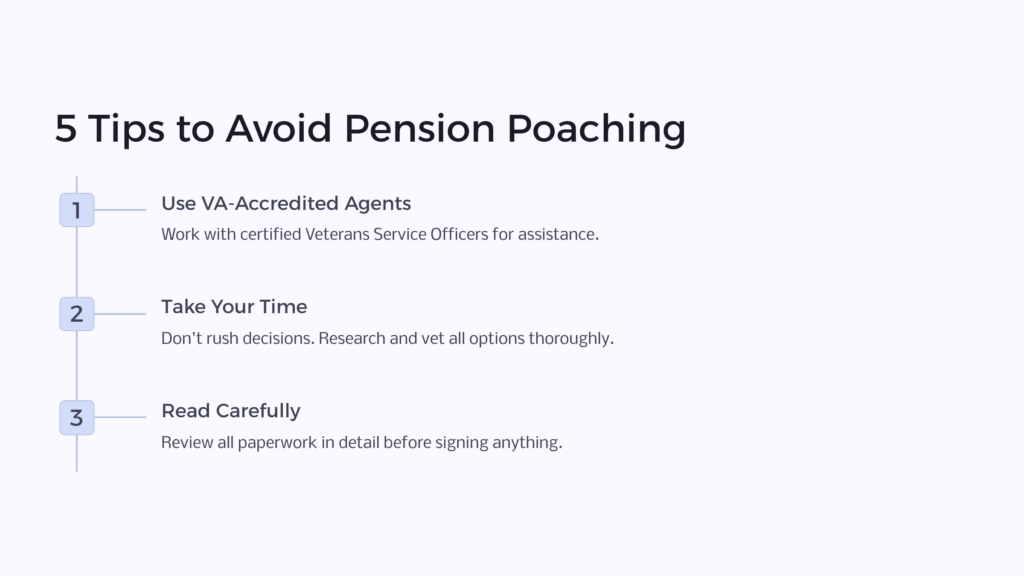

1. Use a VA-Accredited Agent

If you’d like help applying for a VA pension or additional benefits such as Aid and Attendance or Housebound, use an accredited Veterans Service Officer or VA-accredited attorney. Remember, you can always get free help if you need it. Even if you have a trusted financial advisor, you still may wish to work with someone with specific veterans benefit training.

2. Take Your Time

If an agent or advisor ever makes you feel rushed or that you don’t have enough time to adequately weigh your options, that’s a red flag. Any legitimate agent will take the time to explain things to you fully, provide time for you to do your own research and vetting, and won’t pressure you to move forward with any financial decisions you’re uncomfortable with. These predatory methods are used on all service members and veterans, but especially on older adults.

3. Read All Paperwork Carefully

This goes hand in hand with the previous tip to take your time. Your VA benefits, once in place, will serve you for the rest of your life and can provide life-changing aid to many veterans who couldn’t otherwise afford to get themselves the services they need.

Whatever you are asked to sign, make sure to read all the paperwork thoroughly and ask about anything that feels unclear. It can be especially helpful to have a trusted friend or family member read it to help detect a financial scam.

4. Never Trust a Guarantee

A common strategy with military pension poaching is convincing former service members that they have thousands in unclaimed veteran benefits. Remember, only the VA can approve or deny your pension claim. Never trust an organization or advisor who says they can “guarantee” you benefits. They may be able to tell you that you have a good chance of qualifying, but their job is only to help you prepare and submit your application, not to tell you whether or not you qualify.

5. You Don’t Have To Pay To Apply

Yes, you can always choose to hire a financial advisor on your own to help with your personal finances. Depending upon their certifications, they may also be able to help you with navigating your options for VA benefits, but this is not necessary. The VA understands that many veterans (especially those who are most in need of additional benefits like the pension program of Aid and Attendance) don’t have a lot of spare income to hire advisors.

The VA offers this completely free service from trained professionals who can help you understand what the programs are asking for and can help you complete your application and answer any questions that come up along the way.

How To Avoid Pension Poaching

If you’re a wartime veteran who’s struggling to make ends meet, there are programs available to those who qualify. The VA pension program as well as Housebound and Aid and Attendance are designed for veterans, especially senior or disabled veterans, who need extra help meeting their immediate needs for home or medical assistance.

Sadly, the practice of pension poaching is leaving many veterans worse off than they were before and can prohibit them from receiving more aid in the future.

If you or a loved one thinks you may qualify for one, especially wartime veterans, reach out to the Department of Veterans Affairs or your local DMVA (Department of Military and Veterans Affairs) bureau today and get connected with a VA representative. Avoid unknown organizations who promise big pension payments or are asking for any of your money, as they are likely part of a pension poaching scam.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.