Many Veterans transitioning to civilian life choose to go the traditional route of seeking “nine to five” employment. Some veterans decide to start a business instead. But like most new business owners, that means getting funding with the right small business loan.

6 Small Business Loans for Veterans

- SBA 7(a) loan

- SBA 504 loan

- SBA Microloan

- SBA Veterans Advantage Guaranteed Loan

- Military Reservist Economic Injury Disaster Loan Program (MREIDL)

- Hives and Strivers Program

Did you know that Veterans are 45% more likely to start their own business than non-Veterans? That’s according to Operation Entrepreneurship, a recent study that set out to gauge the motivations inspiring and challenges facing Veterans who start their own business. Veterans typically have the training needed to run a business, such as discipline, troubleshooting skills, and the ability to follow through when the going gets rough.

Some of the more common obstacles for veterans include lack of mentorship, work-life balance (or lack thereof), and lack of capital. Regarding the issue of financing, a military Veteran who is interested in becoming a small business owner can explore a Veteran small business loan.

For entrepreneurial Veterans, there are small business loans and small business resources that can help set them up for success. A Veteran small business loan is not necessarily a VA business loan, since the VA partners with the SBA to deliver Veteran business loan options through third-party lenders. Even so, you may hear them referred to as VA small business loans.

1. SBA 7(a) Loans

SBA 7(a) loans are not exclusive to Veterans, and are, in fact, the most common type of small business loan. To qualify for an SBA 7(a) loan, the borrower needs to demonstrate that they need a business loan for a sound business purpose to operate a for-profit business in the United States. The borrower must have first attempted to leverage other financial resources such as personal assets to start their business.

If a business is at least 51% owned by a Veteran or borrower who has received an honorable discharge, is an active duty reservist or National Guard Member, or meets other select criteria (such as being the widower or spouse of a Veteran), an SBA loan can be extended under the Veterans Advantage Program.

In some situations, a Veteran can get an SBA express loan as part of the Patriot Express Loan Program. These loan options are among the easiest ways to obtain an SBA 7(a) loan, but the funding limits will generally be lower with a maximum of up to $1 million.

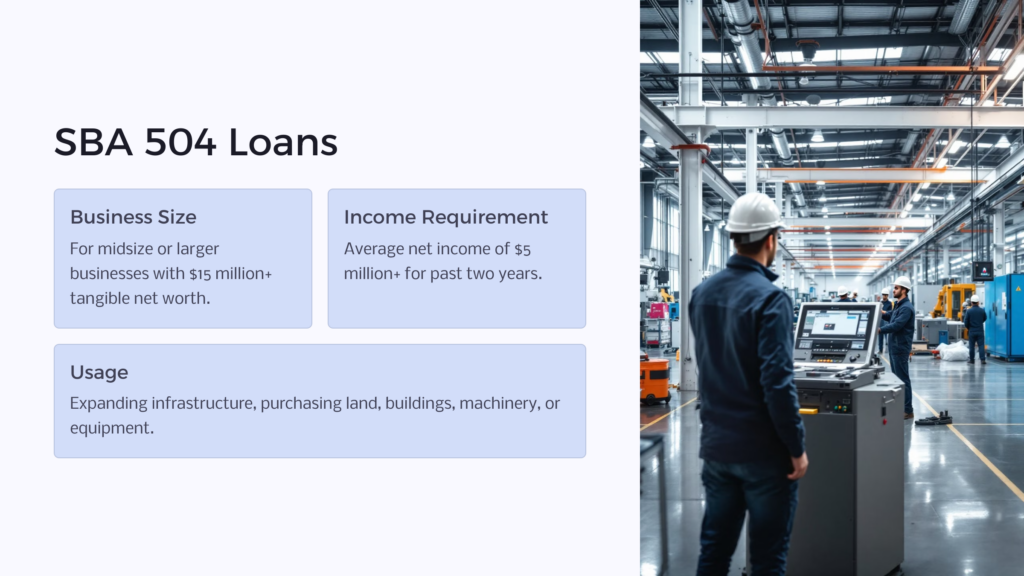

2. SBA 504 loans

An SBA 504 loan is for a midsize or larger business with a tangible net worth of at least $15 million. The business must show an average net income of $5 million or more for the past two years prior to seeking your SBA loan. The company must also be operating in the United States.

SBA 504 loans are not meant to be used to start a business or even to finance inventory. It can’t be used to restructure debts or for real estate investing (instead, veterans can get a VA loan for their primary residence). An SBA 504 loan can be used for expanding and updating the business infrastructure, purchasing land, buildings, machinery, or equipment. It can also be used to improve the appearance of a business with landscaping, modernize its equipment, pave its roads and parking lots, or whatever else must be done for its existing facilities.

3. SBA Microloans

If your small business does not need much startup capital, or it’s one of the non-profit childcare facilities that qualify, an SBA Microloan can provide you with up to $50,000 of funding. A microloan is fairly flexible in terms of how it can be used, from inventory to startup costs to fixtures, furniture, and business supplies. Most microloans are available through non-profit entities that focus on community-based development.

4. SBA Veterans Advantage Guaranteed Loan

SBA Veterans Advantage guaranteed loans can be up to $150,000 with no guarantee fee, or up to $500,000 with a guarantee fee half that of non-Veteran owned business loans. A veteran can use this loan to borrow up to $5 million with a fee that depends on the loan amount and its maturity period, but it still has more favorable loan terms than a loan extended to a non-Veteran business owner.

SBA Express Loans carry no fee in this program. The guarantee fee is meant to cover the cost shouldered by the government if a borrower defaults on their SBA loan. For example, loans under $500K with a maturity period greater than 12 months will have a guarantee fee of 1.5%, while loans under $500K with a maturity period under 12 months will have a guarantee fee of just 0.125%.

As for loans over $500K and under $5 million, anything with a maturity fee under 12 months will have a 0.25% guarantee fee, while those over 12 months will be 3% for amounts borrowed up to $700K, and 3.5% for anything above that.

5. Military Reservist Economic Injury Disaster Loan Program (MREIDL)

An EIDL is a loan extended to business owners in need of financial assistance to carry their business through difficult times. This type of loan can be used to cover lost profits, so the recipient can keep their business going and cover their payroll, and to restructure or refinance debt. Many EIDL loans were extended in the aftermath of the Covid-19 Pandemic. The MEREIDL program is just for Veterans and can provide loans up to $2 million. Anything above $50,000 will require collateral.

The $2 million limit can be waived by the SBA if they assess that your small business is a major source of employment and economic activity. After all, SBA loans are meant to stimulate the economy by keeping businesses open. If the SBA determines that a business can fund its own recovery, it will not extend an MREIDL loan.

6. Hives and Strivers

Hivers and Strivers is not a loan offered through the SBA, but rather it is an example of Angel investing or Venture Capital Funding. These are private sources of funding from angel investors, accredited investors, or others who are interested in investing in small to midsize businesses.

Hivers and Strivers is just one example of this private funding. The program has helped a diverse range of businesses, from Black Rifle Coffee Company (food services) to Independence Hydrogen (green energy). Venture capital funding can be, in some ways, easier to get than SBA loans, and the terms and amounts can have greater flexibility.

What Is the Veteran Entrepreneur Portal (VEP)?

The Veteran Entrepreneur Portal (VEP) helps connect Veterans to sources of funding. But more than that, it also connects Veterans to educational resources about business ownership and some mentorship around marketing and business development. There is also an opportunity to score government contracts, which can be an excellent way for a Veteran owned business to lock in a steady stream of revenue.

In some situations, Veteran-owned businesses will have preferential treatment in the selection process. The small business market share of all small businesses engaged in government contracts is around 23%.

More Ways for Veterans to Fund a Small Business

There are several ways to fund your Veteran-owned small business outside of the VA and SBA. Private funding programs like Hivers and Strivers can provide a source of venture capital.

One way to discover sources of venture capital is to create LinkedIn profiles for yourself and your business, and state in your About section that you are a veteran with a veteran-owned business. Private lenders will be able to find you with a quick search, but make sure you or someone you trust can help analyze the overtures of a private lender or venture capital firm.

There is also the possibility to use crowdfunding on a site like Kickstarter or GoFundMe. Small businesses of all types and orientations have used crowdfunding to successfully pull together much-needed capital. Then there is also the possibility of looking into VA small business grants. Grants may be better than loans for some borrowers, especially when the grant is a gift that does not need to be returned (however, not all grants are like this).

Some Veterans choose to use their own available capital to fund their startup or revitalize their existing business. There are certainly pros and cons to doing this, one obvious pro being that there will be no loan and interest to pay back, and one obvious con being the risk of losing their savings. There are a number of choices for pursuing entrepreneurship, and a Veteran is not just limited to the SBA.

Small Business Loans for Veterans

While entrepreneurship among Vets is very high, it has declined slightly over the years. Around half of WWII vets became self-employed, but that number dropped to 40% of Korean War Vets. In the post 9-11 era, just under 5% of Veterans are opening their own business.

This trend is not unique to veterans – small business ownership has been on a general decline since the 1970s. Experts blame the proliferation of corporate-owned chain stores, the rising cost of education and its resultant student debt, and the fact that many corporations now pursue entrepreneurial ventures leveraging their working capital.

But small businesses have long been the lifeblood of our economy, and despite downward trends, small businesses account for 44% of economic activity and 43.5% of the national GDP.

This is why the Small Business Administration was established in the 1950s: to facilitate the growth of small businesses through funding solutions, entrepreneurship training, and access to government contracts.

SBA loans are provided by third-party lenders like banks and credit unions but backed by the government up to 90% of the loan amount. This makes banks more willing to take on the credit risk of small business financing since many small business owners close their doors. But of course, many succeed. If you are a veteran who would like to enter the world of business and need the capital to get started, there are plenty of VA small business loan options that can help you get started.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.