For veterans transitioning to civilian life, purchasing a home is a big step towards living the American Dream. But a home is a big purchase that almost always requires getting a home loan. Thankfully for veterans, a VA loan or VA mortgage can help make that happen.

4 Types of VA Loans

- Native American Direct Loan (NADL) Program

- VA-Backed Purchase Loan

- Cash-Out Refinance Loan

- Interest Rate Reduction Refinance Loan (IRRRL)

The U.S. Department of Veterans Affairs (VA) offers many services and veterans benefits. One of the most helpful benefits is the VA loan. These mortgages are either offered directly by the VA or by third parties such as banks and other lending or financial institutions. These third-party lenders offer loans backed by the VA, making it easier for Veterans to qualify. Most veterans these days will not get a direct VA loan, but rather a VA-backed loan from a third-party mortgage lender.

VA Direct Loan vs VA-Backed Loan

A VA direct loan is issued and serviced directly by the VA. VA loans do not require down payments, but in some cases may have higher fees than loans provided by a bank. And yet, the upfront costs are still low since these fees can be rolled into the outstanding balance.

VA loans can be used to buy a home or multiple homes, refinance, or even remodel an existing property. Note, however, that recent changes to the eligibility requirements have limited VA direct loans to service members or veterans with specific disabilities.

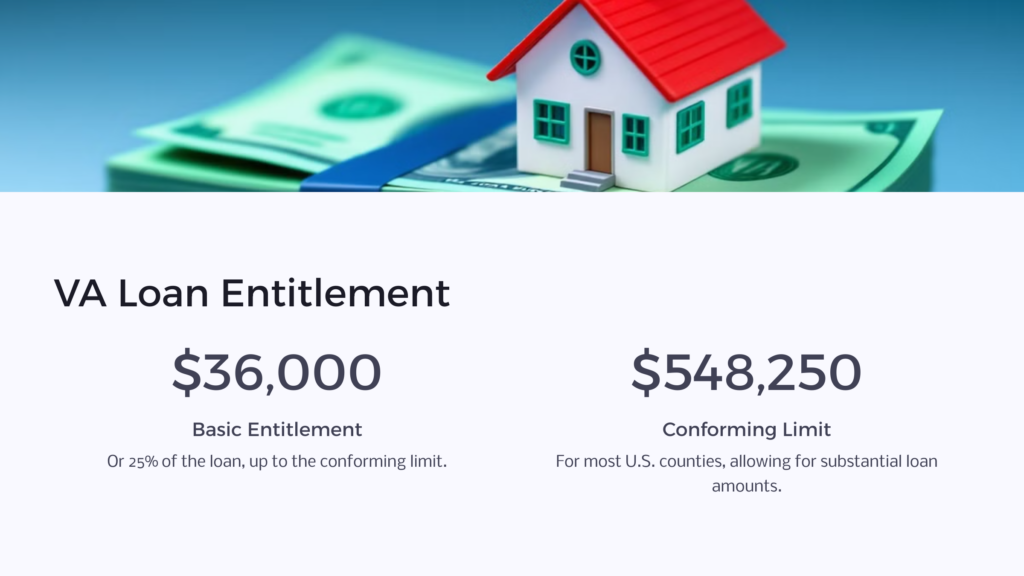

A VA-backed loan or VA guaranteed loan is a loan provided and serviced by a financial institution outside the VA. The VA guarantees or backs a portion of the loan referred to as VA entitlement, which makes the lender more comfortable about extending a loan to borrowers who might not normally qualify.

In most cases, VA loan entitlement is usually around $36,000 or 25% of the loan, up to the conforming limit, which is a substantial $548,250 for most counties in the United States. Like the VA direct loan, around 90% of VA backed loans do not require a down payment. In some cases, the lender might have additional requirements for the borrower to meet – something the borrower will have to find out from the lender.

This type of mortgage loan is similar to those available to nonmilitary homebuyers searching for a new primary residence: the FHA loan. Various types of FHA loans are backed by the U.S. Federal Housing Administration, which protects the mortgage lender by insuring them against the total loss of a borrower in default.

Homebuyers also can put down a smaller down payment, which means the eligibility requirements for this loan type make it more accessible. There are still requirements like having a favorable credit score and showing proof of sufficient income. In a similar vein, a USDA loan is a very low interest rate loan with no down payment at all, but only certain areas of the country are eligible for them.

Though a veteran is free to pursue finding a conventional loan from a private lender or even the aforementioned FHA loan or USDA loan, the VA home loan is usually a much better option. The VA loan program allows veterans to purchase a primary residence with no money down and a VA funding fee that is typically lower than the closing costs asked by a private lender or institutional lender.

For example, the VA funding fee usually ranges between 1.4% to 3.6% while loan origination fees for a conventional mortgage can run anywhere between 1% to 6%, sometimes as high as 8%.

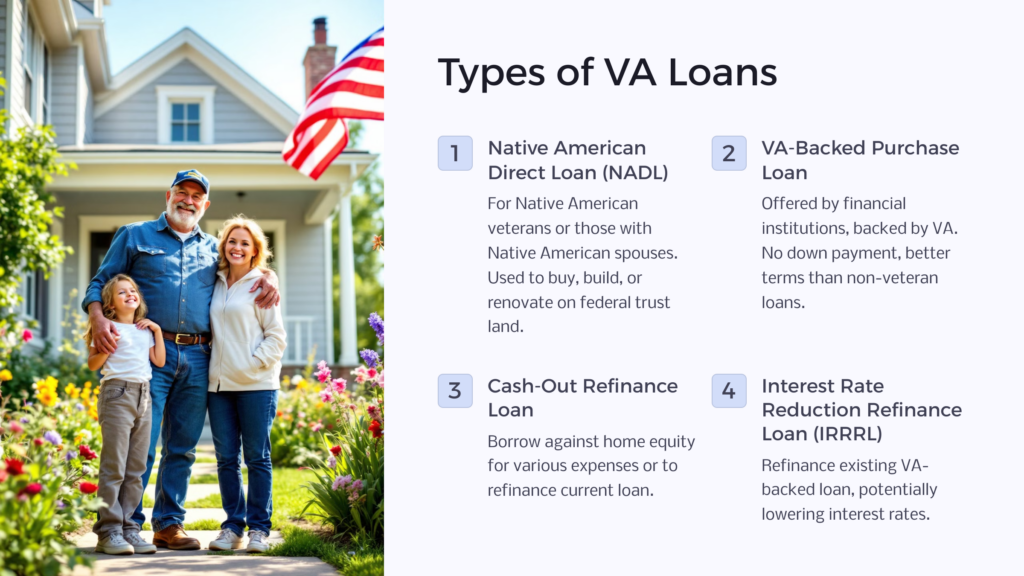

4 Types of VA Loans

There are several types of VA loans for veterans. Choosing the right loan depends on your specific situation, credit score, income, and the policies of a specific lender.

1. Native American Direct Loan (NADL) Program

If you are a Veteran and a Native American or a Veteran with a Native American spouse, you can get a Native American Direct Loan (NADL). This type of VA home loan allows the borrower to buy, build, renovate, or expand a home on federal trust land – which is a Native American reservation, in most cases.

Native Americans can also qualify for an NADL to refinance a property. There are additional requirements to qualify for the NADL. Your tribe must have Memorandum of Understanding with the VA detailing how the loan program can be used on tribal lands. You must have a valid Certificate of Eligibility (COE). You must prove that you will be financially solvent enough to cover your monthly payments and other associated housing costs. Finally, you must be the intended occupant of the home.

2. VA-Backed Purchase Loan

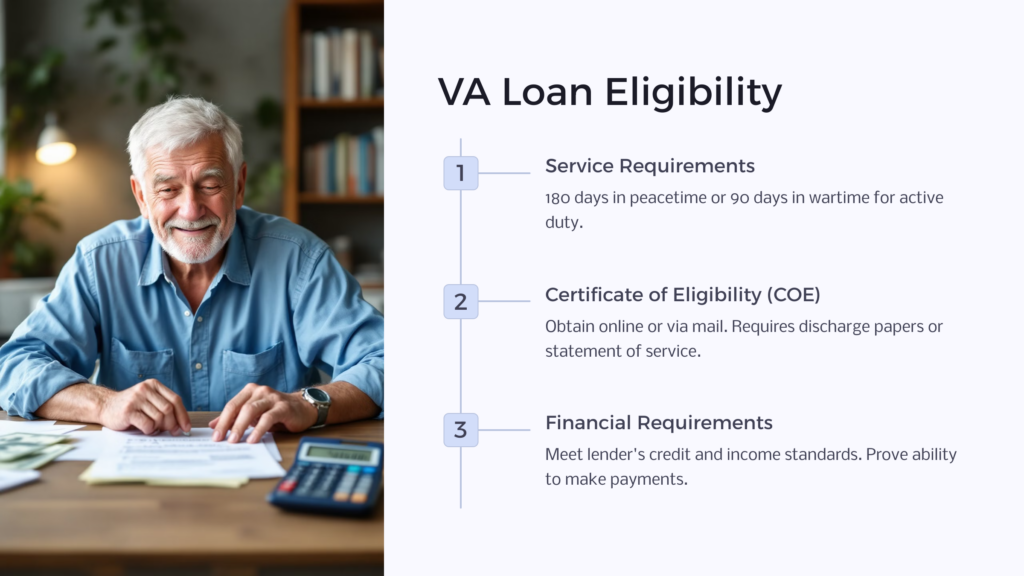

A VA purchase loan is a VA backed loan offered by a financial institution. If you have a valid COE, meet the lender’s credit and income requirements, and will live in the home, you can obtain this type of loan.

A VA-backed purchase loan typically has no down payment, fewer closing costs, better terms and interest rates than those offered to non-veteran consumers, and no penalty for paying it off early. A purchase loan allows the borrower to take up to the Freddie Mac and Fannie Mae limits – and go beyond those limits if they elect to make a down payment.

Even though the loan can be taken out with no down payment, borrowers on a VA-backed purchase loan do not need to get private mortgage insurance (PMI), which reduces the amount of the monthly payment. Such loans can be used to buy, build, or renovate a home, even one with up to four units.

3. Cash-Out Refinance Loan

A cash-out refinance loan allows you to borrow money against the equity of your home. You can use that money to either refinance your current loan or for expenses such as renovations, college tuition, or whatever else you need it for.

If you have a valid COE and meet the lender’s requirements for credit and income, the cash-out refi (as it’s called for short) can be a great way to pay off and consolidate other debts, or even refinance your current home loan to reduce the interest rate and monthly payment.

You can use the VA refinance to pay off your current conventional loan, or a previous VA loan. This type of loan is similar to a home equity line of credit (HELOC) which banks offer to consumers, allowing them to take out what is essentially a personal loan, offering their equity in the home as collateral.

4. Interest Rate Reduction Refinance Loan (IRRRL)

An IRRRL allows you to refinance an extant VA-backed loan if you can show that you are residing in the home to be refinanced or that you used to live there.

For homeowners whose initial mortgage had a variable rate – that is, one that fluctuates based on the prime rate – switching to an IRRRL with a fixed rate can be a great way to save money and stabilize long-term expenses.

If you already have a second mortgage on the property, the lender will need to agree that the IRRRL will become your first mortgage. The IRRRL is also called a VA streamline refinance, which (as the title suggests) is easier to apply for because there is less paperwork.

There are several specific eligibility requirements for the VA IRRRL, most of which have to do with good behavior on the part of the potential borrower – for example, never being 30 days past due on any payment in the past 12 months. The VA IRRRL is also specifically for refinancing a primary residence, so it cannot be used as a cash-out refi to defray large expenses like college tuition.

How To Choose a VA Loan

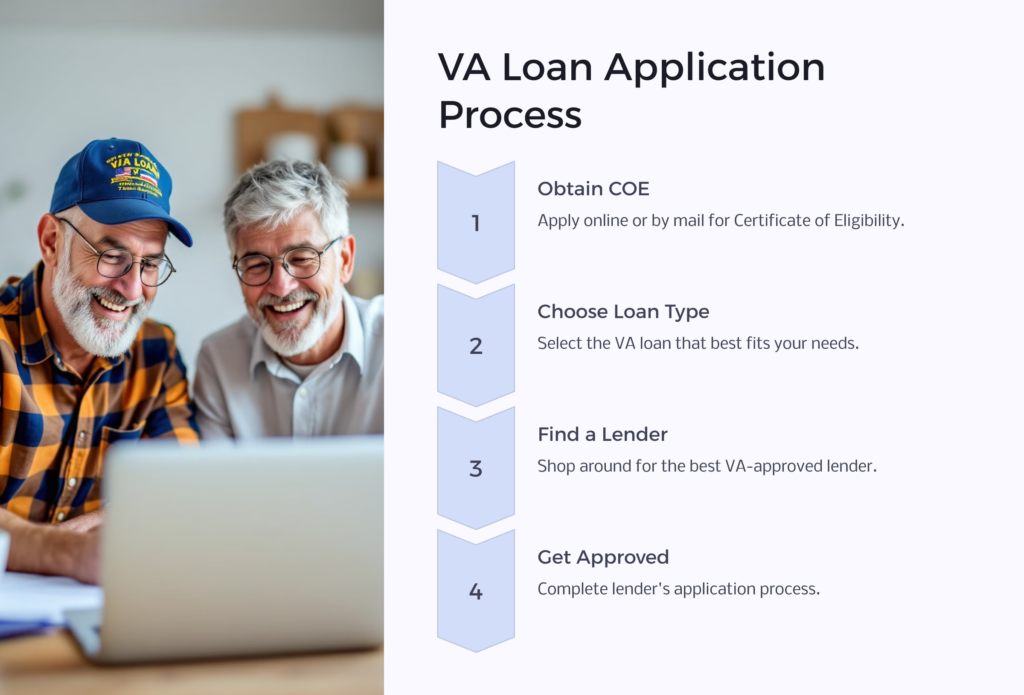

The first step towards selecting a VA loan is obtaining a Certificate of Eligibility (COE). You can apply for the COE online or via mail. The information you need as part of your application will depend on whether you are a veteran, an active service member, National Guard member, Reserve member, or surviving spouse of a veteran.

If you are a veteran, you will need to provide a copy of your discharge papers. If you are on active duty, you will need a signed statement of service signed by your commander, personnel officer, or adjutant.

Active duty service members can qualify for a VA loan if they have served in the military for at least 180 days in peacetime or 90 days in wartime. In some cases, you may also need to provide the VA lender with a Leave and Earnings Statement – in other words, your paycheck, which the lender will use to determine your financial profile.

Once you have your COE and have selected the type of VA loan you want and found a lender, you will need an appraiser to conduct a VA appraisal. The appraisal will determine the market value of the home, but it will not serve as a building inspection. It’s important to remember this distinction if you are buying a home – you will also want to have it inspected to make sure there are no major issues with the property.

If you meet VA loan eligibility, the next step is to get approved by the VA lender. Once you are approved by the lender and have worked out the contract with the seller (if you are buying a home), then it’s time for settlement. The lender will usually help you find a title and escrow company that can facilitate this part of the process.

If you are using the VA loan to cash out or renovate your property, the lender will provide you with the money upon approval. If you have any questions about the VA loan process, you can always contact your regional VA loan center by calling 877-827-3702 from 8:00 AM to 6:00 PM EST, Monday through Friday.

Understanding the Different Types of VA Loans

There are different types of VA loans, and each one is suited towards a certain type of borrower. Depending on your goals – buying, building, renovating, refinancing, etc. – and your financial situation, you can apply for the type of VA loan that best meets your needs.

Remember that in some instances, a conventional loan might offer more favorable terms, so you should shop around and compare available loan options. If you have questions, don’t be afraid to reach out to the Department of Veterans Affairs or a VSO who is trained to administer veterans benefits.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.