The Unemployment Insurance program is a government initiative that pays unemployment insurance benefits to eligible workers who have lost their jobs. The state Department of Labor or Department of Employment Services is responsible for administering the unemployment benefits. The program is funded by state and federal payroll taxes paid by employers.

Unemployment insurance is funded primarily by employer payroll taxes; in a few states, employees may also contribute. Cyclical unemployment, caused by the natural ebb and flow of the business cycle, tends to increase during economic downturns, highlighting the importance of such programs.

There are a few main types of unemployment benefits:

- Regular Unemployment Insurance – These are UI benefits that provide temporary income to eligible workers. Weekly benefit rates are typically calculated as 1/26 of the high quarter wages in the base period.

- Extended Benefits – During times of high unemployment rates, the state and federal government may provide additional weeks of benefits beyond the regular 26 weeks.

Eligibility Requirements for Unemployment Benefits

To receive unemployment benefits you must meet the following requirements:

Involuntary job loss – You must have lost your job through no fault of your own. This means being laid off, downsized, position eliminated, or fired without cause. Those who voluntarily quit or were fired for cause may not be eligible.

Earned Wages – You must have enough wages earned during the base period, to qualify for benefits. Most states have an earnings threshold you must meet during a base period, which is usually the first four of the last five completed calendar quarters. Requirements range from $130 to $3,400+ over the base period.

Able and Available – You must be physically able to work and actively seeking full-time work. Being unable to work due to health/family reasons or limiting your work search makes you ineligible.

Citizen or Legal Authorization – You must be a U.S. citizen or legally authorized to work in the U.S. to receive unemployment benefits.

Weekly Eligibility – You must file a weekly claim and report you are still unemployed, able and available for work, and fulfilling the work search requirement. Failing to file or report makes you ineligible for benefits until requirements are met again.

Be sure to understand the specific eligibility details for your state. Requirements can vary so check your state’s unemployment website for specifics. Each person is legally responsible for providing accurate information and complying with the law to maintain eligibility. Meeting these requirements allows you to receive unemployment benefits.

Preparing to File for Unemployment Insurance Benefits

Before you file for unemployment, take time to gather information and understand your state’s rules to make the process as smooth as possible. Make sure you access the correct application form through your state’s official portal, as completing and submitting the right form is essential before your claim can be filed. You should also be prepared to report any non-wage compensation, such as food benefits, as these may impact your eligibility.

Gather Required Information

Having this information ready ahead of time will save major delays:

- Social Security Number

- Driver’s License/State ID

- Employment History (including employer names, addresses, dates employed, and reason for separation)

- Bank account & routing numbers

Know your State’s Rules

Each state sets basic rules for eligibility requirements and benefit amounts according to federal guidelines but the specifics can vary. Be sure to check your state’s unemployment website for details like:

- Base Period – The specific time frame of wages/work history examined to determine your monetary eligibility. Earnings from the base period are crucial for calculating future unemployment claims, as they cannot be reused once a claim is established.

- Benefit Amounts – Formulas used to calculate your weekly benefit payment if eligible. After you file, you will receive a monetary determination, which is a formal notice detailing your benefit amount, how it was calculated, and your eligibility. The calculation of unemployment benefits is based on the highest quarter of earnings during a specific base period.

- Work Search Requirement – The specific requirements you must meet each week to show you are actively looking for work. These include how many jobs to apply to, what verification materials to record and submit, exemptions, etc.

Understanding state guidelines upfront allows you to accurately report earnings and job search details – preventing denial of benefits or additional resources down the road.

Our blog provides state-specific information as well! You can check our unemployment page here to look your state up, but here are some big ones:

You can also use online tools to estimate your potential benefit amount before applying.

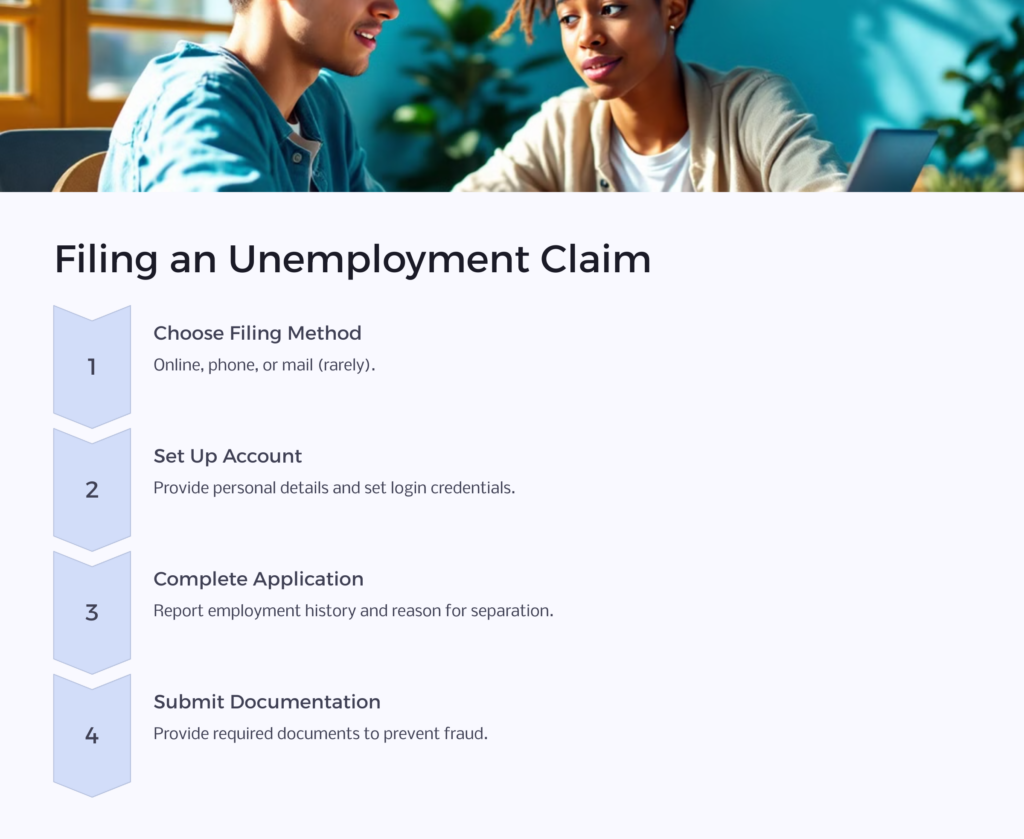

How to File an Unemployment Claim

You will need to file a claim with the unemployment program in the state where you worked. Here’s how to get started:

After you receive a written determination from the state’s labor agency and your claim is approved, the state will pay benefits according to its payment schedule. Typically, the first payment is issued within two to three weeks after your claim is processed.

Customer service and support services are available to assist claimants with the filing process.

Where to File

You can file an unemployment claim in one of three ways:

- Online – Most states now allow you to file claims and manage benefits online. Check if your state has an online filing system.

- Phone – Some states allow filing claims over the phone through an Interactive Voice Response system or with an agent.

- Mail – In limited cases, states may allow mailing an application. This is rare as most have moved to online or phone-based systems.

Check to see all the options your state provides and use the method easiest and most convenient for you.

Process of Filing

Follow these key steps to file an unemployment claim:

- Set up your account – You will need to provide personal details like your Social Security number so the state can verify your identity and work history. Set up login credentials that you will use throughout your claim process.

- Complete application – The application will request details on your past employment and income over the base period, your reason for job separation, and your ability and availability to work. Accurately report all details and additional information even if you’re unsure if they affect eligibility.

- Submit documentation – Some states require documentation up front to prevent UI fraud. Documents like payroll stubs, a letter of separation from employer, or identification would work. Some states allow submitting documents later in the process if requested. Your claim is not considered filed until all required documents and forms are submitted. The effective date of your initial claim is the Sunday of the week in which you apply.

- Get determination – After submitting your application, you will receive a written determination from your state’s labor agency on your eligibility for benefits. This may take 2-4 weeks. If approved, it provides details on your weekly benefit amount and duration. Claim information is kept confidential and is only shared with authorized agencies as required by law. You will receive a Notice of Monetary Determination in the mail after filing your first claim.

What to Do After Filing a Claim

After filing, there are still ongoing requirements and processes before you start receiving benefits. It generally takes a few weeks after filing your claim before you receive benefits, as your eligibility and claim details are reviewed. It takes about three weeks to process your unemployment insurance benefit application and make the first payment.

When it comes to ongoing requirements, you must continue to certify for benefits as instructed. If you find a new job, you must report it immediately to avoid receiving benefits you are not entitled to.

For benefit payments, the amount of money you receive is based on your previous earnings and state guidelines. This determines how much you can receive in unemployment benefits.

The Waiting Period

Most states have an unpaid waiting period of 1-2 weeks after filing before benefit payments begin. This helps reserve funds for those who lose jobs for longer periods. Keep filing your weekly claim and continue your job search during this time; otherwise, the waiting period resets.

If you file a claim after losing your job, you must wait until the next Monday to file if you work more than 30 hours or earn above the maximum benefit rate during that week.

Maintaining Eligibility

To maintain benefits, states require you to file weekly or biweekly claims reporting:

- You are still unemployed

- Actively seeking work based on their guidelines

- Earned income from temporary work

Failing to file or report accurately could make you ineligible until requirements are met.

Understanding Benefit Payments

If approved, benefits are paid weekly or biweekly either via paper checks, mailed debit cards, or direct deposit (depending on state). Payments may show as pending for 5-10 days before funds clear.

If issues arise with the payment method or any missing payments, contact the unemployment office immediately. Unemployment benefits are considered taxable income, and recipients receive a Form 1099-G for tax purposes.

Keep track of benefits paid to understand when regular benefits may run out. Refer to your state’s policies around extensions in periods of high unemployment.

Potential Challenges and Troubleshooting

While unemployment insurance can provide vital financial help when you lose a job, it does not come without complexities. Unemployment benefits are governed by federal and state laws and the rules set by the department, which claimants must follow to remain eligible. Stay ahead of potential issues that could delay or deny benefits.

If you encounter problems, employment services are available to help resolve issues and support job seekers.

Denial of Benefits

You may receive a denial of benefits for reasons like:

- Voluntarily quitting your last job instead of being laid off

- Getting fired for a reason

- Insufficient earnings during the base period

- Failure to conduct an adequate work search after starting your claim

- Misconduct or voluntary resignation, which are common reasons for denial.

If denied, immediately review the reason and consider reapplying after 6 weeks if the reason no longer applies. For example, if denied for voluntarily quitting, reapply once employed and laid off from another job.

You can also file an unemployment denial appeal. This will lead to a hearing where you can provide evidence supporting your eligibility. Having a thoroughly documented case increases the chances of winning an appeal.

Other Common Issues

- Identity verification problems due to SSN or name changes

- Changes in ability to work preventing you from collecting

- Errors in reporting earnings from temporary work

- Problems receiving checks or debit cards

- Not recertifying benefits on schedule

Proactively communicating changes that affect benefits and keeping detailed payment records helps resolve issues faster.

Preparing to Apply

While losing a job brings uncertainty, unemployment benefits offer short-term financial help for those eligible. Keys to a smooth application process include:

- Gather personal records and understand state rules upfront

- File complete and accurate weekly benefit claims throughout

- Keep payment records and report issues immediately

With preparation and diligence, unemployment benefits can provide support exactly when people need it most. Hopefully, this guide better prepares you to successfully apply for and manage this temporary relief program.

If you have lost your job or had hours cut involuntarily, now is the time to apply for unemployment benefits in your state. Even if you are unsure about eligibility, submit an application right away as you have nothing to lose. Ensure you understand your rights and responsibilities to maintain eligibility each week. With unemployment still high, don’t leave this financial assistance on the table.

At Benefits.com, we aim to point you in the right direction towards all the benefits available to you. Take our free eligibility quiz today to get started!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.