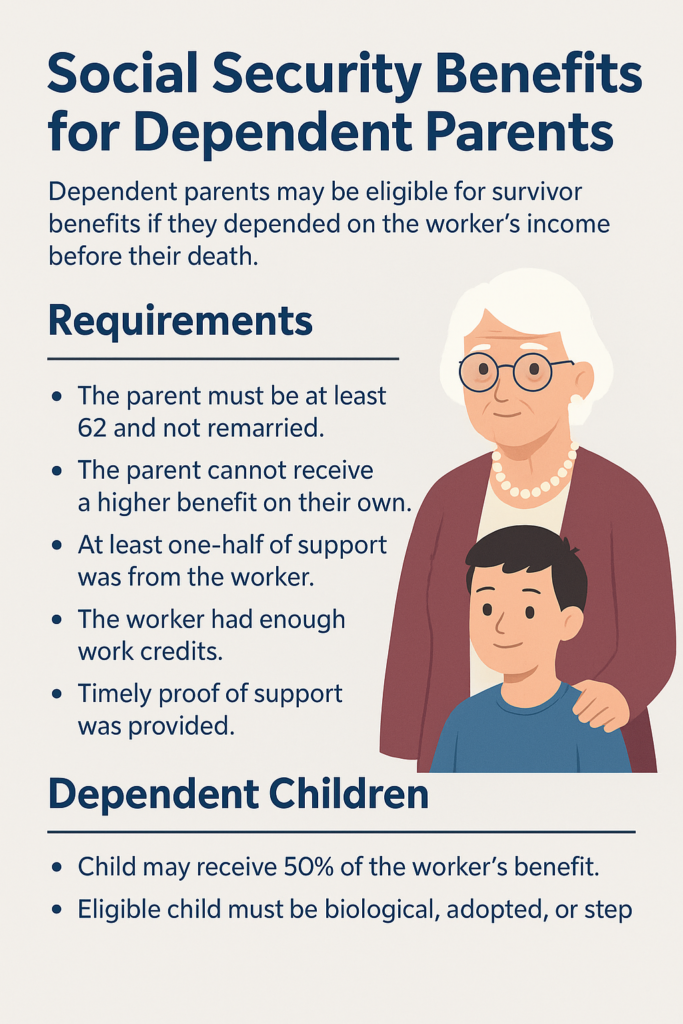

When a worker dies, Social Security benefits help stabilize the family’s financial future. Survivor benefits provide financial support to eligible individuals who depended on the worker’s income before the worker’s children and spouses. Dependent parents may also be eligible for a survivor’s benefit.

Social Security benefits for dependent parents include the following conditions:

- The parent must be at least 62 years old and not have remarried since the worker’s death.

- The parent cannot be entitled to their own, higher Social Security benefit.

- The parent must have received one -half of their financial support from the worker at the time of their death.

- The deceased worker had enough work credits.

- Dependent parents may be eligible for survivor benefits if they depend on the worker’s income before their death.

- The parent has provided timely documents that prove the deceased worker was providing at least one-half of their support.

- A child may receive Social Security benefit equal to 50% of their parent’s full retirement benefit or disability benefit.

- Eligible dependent children must be related to the worker in specific ways, such as biological child, adopted child, stepchild, grandchild or step grandchild.

- The parent must show proof of dependence within two years of the child’s death.

How much can a parent get?

- One parent may receive 82 ½% of the deceased worker’s full retirement or disability benefit.

- If there are two parents who will receive benefits, each may receive 75%.

What does a parent who receives benefits need to know?

- The parent’s benefit may stop if the parent marries.

- The parent’s benefit will stop if the parent becomes entitled to a retirement benefit amount higher than the parent’s benefit amount.

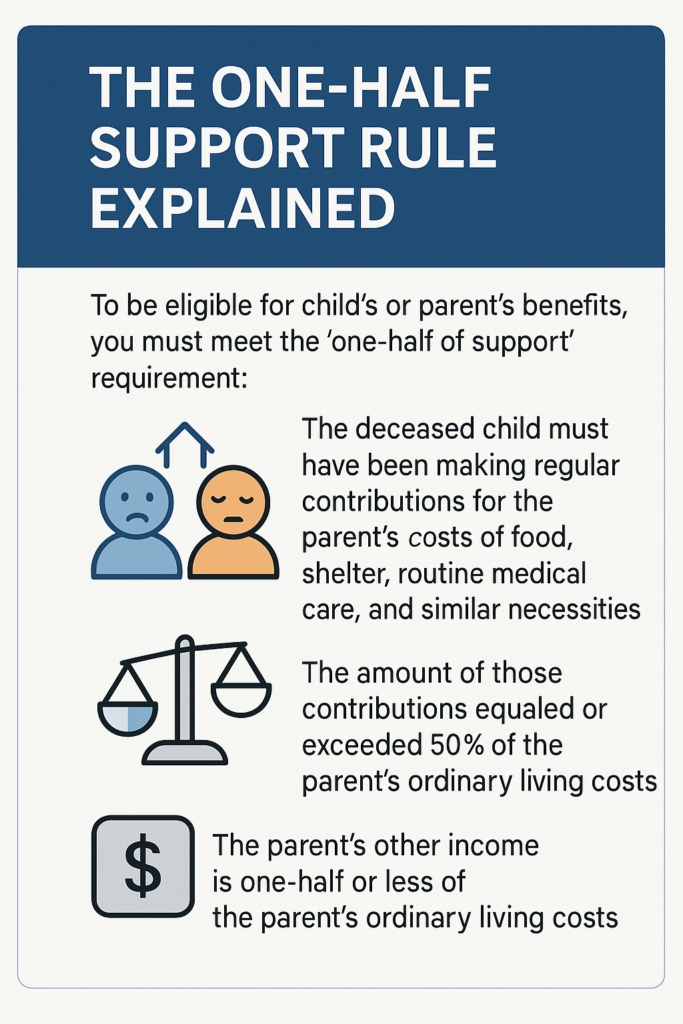

The One Half-Support Rule Explained

To be eligible for child’s or parent’s benefits, and in certain Government pension offset cases, you must be dependent upon the insured person at a particular time or be assumed dependent upon him or her.

To meet the “one-half of support” requirement:

- The deceased child must have been making regular contributions for the parent’s costs of food, shelter, routine medical care, and similar necessities, and

- The amount of those contributions equaled or exceeded 50% of the parent’s ordinary living costs

- The parent’s other income (from sources other than the deceased child) that is available for support purposes is one-half or less of the parent’s ordinary living costs.

Social Security Family Maximum Benefits

On paper, the Social Security system has a generous payment to beneficiaries of someone who retires, dies, or becomes disabled. But what catches many people by surprise is that there’s a limit to these payments. The parent’s benefit may stop if the parent marries, and these benefits would stop if the parent became entitled to a retirement benefit amount higher than the parent’s benefit amount.

What You Must Report While on Survivor Benefits

You need to report changes in your name, phone number, mailing address and direct deposit account.

You need to report changes to your personal situation such as marital status, citizenship and immigration status, incarceration, school attendance, custody change of a child who gets benefits.

Employment status and self-employment must be reported and any wages over $23,400 in 2025. (pre-tax)

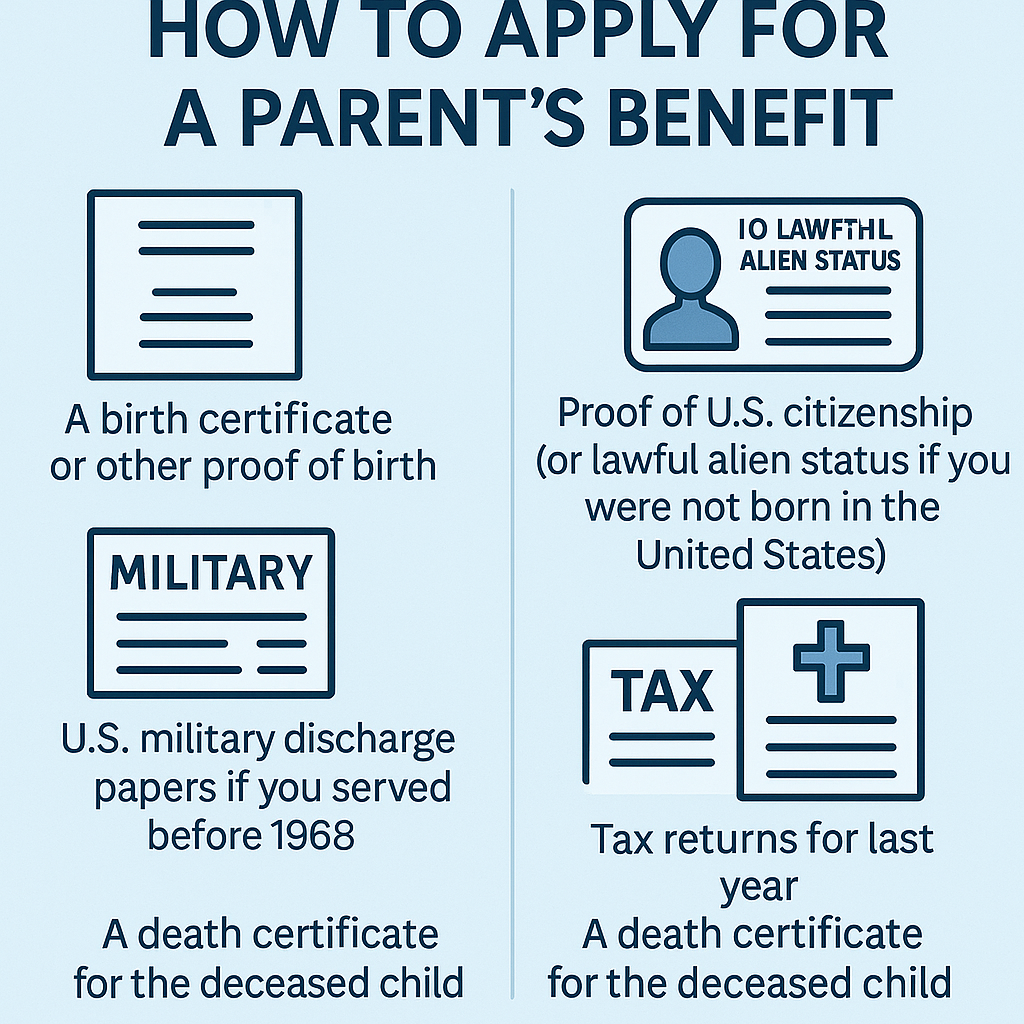

How to Apply for a Parent’s Benefit

You will need to provide certain documents such as:

- A birth certificate or other proof of birth

- Proof of U.S. citizenship (or lawful alien status if you were not born in the United States)

- U.S. military discharge papers if you served before 1968

- Tax returns for last year

- A death certificate for the deceased child.

You should also be prepared to answer questions on things such as:

- Your name and Social Security number

- Your deceased child’s name, gender, date of birth and Social Security Number;

- Your date of birth and place of birth

- Your deceased child’s date and place of death

- Whether a public or religious record was made of your birth before age 5

- Whether you were dependent on the worker for 1/2 of your support at the time of the worker’s death or at the time the worker became disabled. (They WILL require proof of this so be ready to provide bank records or anything else that would prove you received at least one-half support from the deceased child.)

- Whether you have ever filed for Social Security benefits, Medicare or Supplemental Security Income on your behalf

- Whether the deceased child ever filed for Social Security benefits, Medicare or Supplemental Security Income

- Depending on when the child died, they may ask you whether he/she was unable to work because of a disabling condition. (If so, they will ask you for the date he/she became unable to work.)

- Whether you or the child were ever in the active military before 1968 or ever worked for the railroad industry. (If so, they will ask you for the dates of service and whether you or the child ever received or expect to receive a pension from a military or Federal civilian agency.)

- Whether your spouse ever worked for the railroad industry;

- Whether you have earned Social Security credits under another country’s Social Security system;

- Whether you have married since the child’s death;

- The amount of the child’s earnings in the year of death and the preceding year;

- Whether the child had earnings in each year since 1978;

- The amount of your earnings for this year, last year, and next year.

At Benefits.com, we are here to help you navigate the process and receive the benefits you deserve. Begin today by taking our free eligibility quiz.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.