Millions of Americans rely on Social Security benefits to make ends meet. Retired employees are the biggest beneficiaries, but disabled people, spouses, and children might also receive these payments from the government.

Although Social Security payments are often calculated using an employee’s earning record, monthly benefits can quickly lose purchasing power if not adjusted. Legislation was passed in 1973 and implemented the annual cost-of-living adjustment (COLA), which started in 1975 to prevent that.

COLAs vary significantly annually, with some feeling that they don’t adequately mirror increases in senior expenses. The Social Security COLA for 2025 is 2.5%.

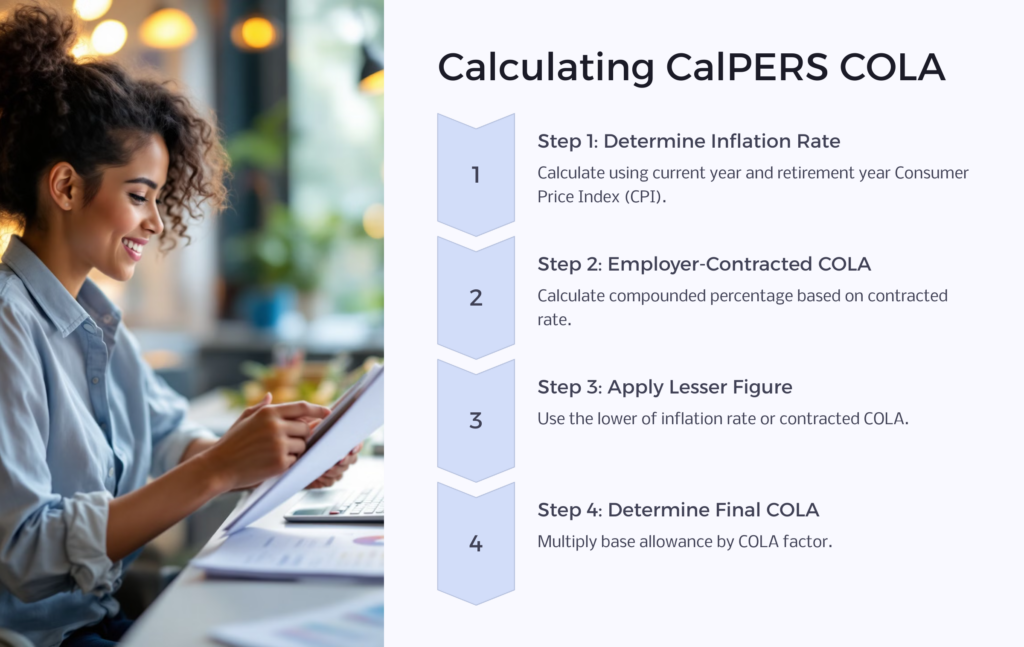

Calculating the CalPERS COLA

CalPERS uses this methodology to calculate COLA:

Step 1

Determine the current year inflation rate based on your retirement year.

Use this equation to determine the inflation rate: (CPI for current year – CPI for retirement year) / CPI for retirement year.

Let’s use the year 2022 as an example. To calculate this inflation rate, we use:

(Consumer price index for the current year -retirement year CPI )/ retirement year CPI

The current year CPI for 2022 is 876.664, and if someone retired in 1997, the retirement year CPI is 480.8

(876.664 – 480.8) / 480.8 = 8.2%

Step 2

Determine the compounded employer-contracted COLA percentage.

The example below is based on a 3% contracted COLA percentage.

First year: COLA factor is 0.03 or 3%

Second year: 1.03 x 1.03 = 1.0609 – 1 = 0.0609 or 6.1%

Third year: 1.0609 x 1.03 = 1.092727 – 1 = 0.092727 or 9%

Fourth year: 1.092727 x 1.03 = 1.126 – 1 = 0.126 or 12.6%

Fifth year: 1.126 x 1.03 = 1.160 – 1 = 0.16 or 16%

Step 3

CalPERS applies the lesser of the two figures from steps 1 and 2 to determine your cost-of-living adjustment factor.

Step 4

Determine COLA

Use this equation to determine your COLA: Base allowance in your retirement year x COLA factor = COLA)

Understanding CalPERS COLA 2025

The Cost of Living Adjustment (COLA) is an increment made to Supplemental Security Income (SSI) and Social Security benefits to offset the effects of increasing inflation.

COLA is an annual increase that starts the second year after one retires. It helps your retirement compensation keep up with the inflation rate. Eligible persons, like retirees, survivors, and beneficiaries, receive COLA with their May 1 retirement check. COLAs aren’t viewed as merit increases resulting from promotions or good job performance.

Cost-of-living adjustments help retirees and public employees maintain their purchasing power. Typically, employers determine the amount of a COLA pay rise using the CPI-W calculated by the BLS. This price index calculates the rise in consumer prices for homes where at least 50% of income is from urban or clerical workers and at least one of the income earners has been employed for at least 37 months in the past year.

COLA often equals the percentage increment in the Consumer Price Index (CPI-W) for Clerical Workers and Urban Wage Earners for a given period. The CPI equals the average price of a basket of products and measures the rising prices of goods.

For 2025, the COLA is 2.5%. Thus, if someone received $20,000 in Social Security benefits last year, their 2024 annual compensation would be $20,250. Eligible retirees receive COLA increases on their May 1 retirement checks.

The cost-of-living adjustment is based on the lesser of two numbers: the compounded COLA provision contracted by the employer or the inflation rate. Further, if a member’s COLA increment is less than 1% in a year, CalPERS won’t apply any COLA increase in their retirement income that year. Retirees with a 2% COLA provision can’t have an adjustment of more than 6% of their base allowance. At the moment, 95% of CalPERS members have a 2% COLA provision, and the other 5% have a 3%, 4%, or 5% COLA provision.

CalPERS retirees are eligible for cost-of-living adjustments and will collect more benefits as inflation persists. But pensions like CalPERS limit the increment. CalPERS caps COLA to a maximum of 2%, compounded yearly for school and state retirees. But public companies can contract for a higher CalPERS COLA.

Besides COLA, some CalPERS retirees receive a purchasing power protection allowance (PPPA) adjustment. This is a supplemental benefit created to maintain the initial purchasing power of CalPERS members to a specific limit when COLA hasn’t kept pace with the inflation rate.

The Retirement Law stipulates for the payment of a cost-of-living adjustment to be paid every May. CalPERS COLA helps retirees manage rising prices of essential products like energy, housing, and food. A cost of living adjustment for retirees isn’t based on promotions or job performance. Instead, the income and Social Security increase are given to counteract inflation rates and help retirees maintain their purchasing power.

With inflation rates continuing to impact the economy in 2024 significantly, CalPERS and other retirement systems have seen a need to implement cost-of-living increases.

CalPERS COLA 2025: Key Changes and Updates

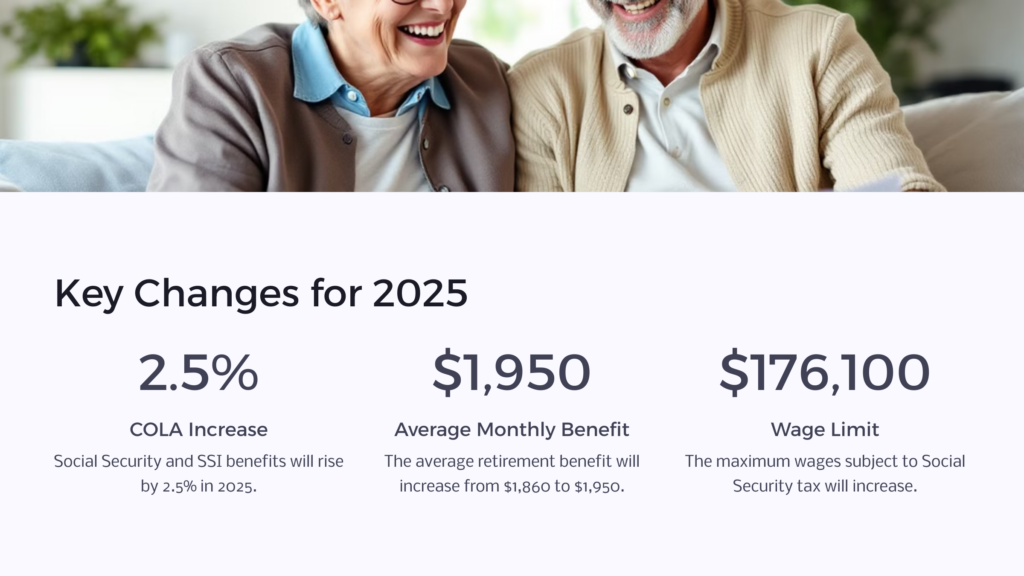

In 2025, the Social Security and SSI benefits for nearly 71 million Americans will be 2.5% more. The 2.5% COLA will start with compensation payable to over 66 million Social Security beneficiaries in 2025. According to the Social Security Administration (SSA), that will increase the average monthly benefits by over $50. The average monthly retirement compensation for employees will increase from $1,860 in 2024 to $1,950 in 2025.

The maximum wages subject to Social Security tax will rise to $176,100 from $168,600 in 2025. The wage limit for employees below the “full” retirement age will reach $23,400.

The wage limit for retirees reaching their “full” retirement age in 2025 will rise to $62,160.

There’s no limit on income for employees who are at their “full” retirement age or older for the whole year.

Many Social Security COLA beneficiaries will notice an increase in their monthly benefits starting January 2025. SSI beneficiaries will see an increase in their December 2024 checks.

However, the 2025 COLA increase is lower than the 3.2% COLA in 2024, as well as the 8.7% COLA for 2023, the biggest increase in forty years.

Factors Affecting the CalPERS COLA Adjustment

The reason a COLA might be lower than the current inflation rate depends on how SSA calculates the figure.

First, the SSA relies on the inflation index, which differs from the consumer price index that economists and the Federal Reserve use to determine pricing trends. Instead, the agency bases its COLA on the Consumer Price Index for Clerical Workers and Urban Wage Earners (CPI-W), which some argue doesn’t accurately mirror the spending of elderly Americans.

CPI is one of the critical factors that affect CalPERS COLA adjustments. It determines the inflation rate and is calculated annually. CalPERS uses it when you retire to determine what your value of compensation will be when adjusted for COLA. The BLS calculates CPI, the standard estimate CalPERS uses to calculate the cost-of-living adjustment.

Next, CalPERS bases its COLA on the employer-contracted COLA percentage. Many schools and all state agencies use a COLA of 2% yearly, while public agencies can use a COLA of 2%, 3%, 4%, or 5% annually. If the inflation rate since your retirement is more than the employer-contracted COLA percentage, then CalPERS uses the lesser of the two.

Ultimately, COLA relies on two factors: the employer-contracted cost-of-living adjustment percentage and the CPI-W. CPI determines the inflation rate and is compared per year. If consumer prices decline or inflation is low enough to warrant a COLA increase, beneficiaries don’t receive COLA. If the CPI-W doesn’t increase, then there’s no COLA increase.

Comparing CalPERS COLA 2025 with Previous Years

Because of high inflation rates in the 1970s, real estate contracts, compensation-related contracts, and government compensation used COLAs to cushion employees and retirees against inflation. The BLS determines the CPI-W, which SSA and CalPERS use to calculate COLAs.

COLA is determined by applying the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers from the third quarter of the year to the third quarter of the following year.

Congress updated a COLA provision to provide automatic annual COLAs based on the yearly increase in the CPI-W, which took effect in 1975. Before 1975, Social Security payments increased when Congress passed special legislation. The 1975 COLA was based on the CPI-W from the second quarter of 1974 to the first quarter of 1975.

In the 1970s, inflation rates ranged between 3% and 11%. In the year 1975, the inflation rate was 9.1%, and the COLA increase was at 8%. In 1980, the COLA increase reached an all-time high of 14.3%, whereas the inflation level was 13.5%. In the 1990s, significantly lower inflation levels led to small COLA increases ranging between 2% and 3%.

This continued into the early 2000s when lower inflation levels led to no COLA adjustments in 2010, 2011, and 2016. In 2022, COLA was 5.9%, and in 2023, it shot up to 8.7% because of the high inflation rates experienced in 2022. The COLA increase for 2024 was lower, standing at 3.2%.

Impact of Economic Trends on CalPERS COLA 2025

In 2021, the SSA announced a 5.9% COLA for 2022, the biggest increase since 1982. The inflation rate quickly outpaced that adjustment, though, and in 2022, the Social Security Administration enacted an even higher COLA.

Typically, the COLA is close to the same annual inflation.

However, the last two COLAs have been out of sync with the rate of inflation. For instance, the 2023 COLA was too big, while the 2022 COLA was too small.

The rate of inflation rose to 7.8% in 2021, yet the cost-of-living adjustment for 2022 was just 5.9%. And that was because the administration was looking backward. Then, the rate of inflation declined to 6.3% in 2022, and yet that year, we got a high COLA because the administration was looking back on the quarters or months when inflation was relatively high.

2025’s COLA of 2.5% is on par with the current annual inflation rate. Thus, Social Security COLA benefits will maintain their value even as prices fluctuate.

Although a 2.5% COLA is lower than the 8.7% implemented in 2023, the highest cost-of-living adjustment in more than forty years, it’s right around the average COLA in the last two decades—which was 2.6%.

A minor adjustment isn’t bad. A big COLA shows there was a ton of inflation, and you’re being compensated for a year and a quarter after the fact. But you’ve suffered a lot in the meantime. Thus, a minor adjustment means there is minimal disruption in terms of price fluctuation, which is good news.

This year’s adjustment is an accurate reflection of the easing inflation rate in the post-pandemic economy, ensuring consumers’ purchasing power.

It’s an accurate thing where the adjustment reflects the increase in the rate of inflation for that year. That means the benefits the beneficiaries will receive will allow them to maintain the same purchasing power so they won’t be worse or better off.

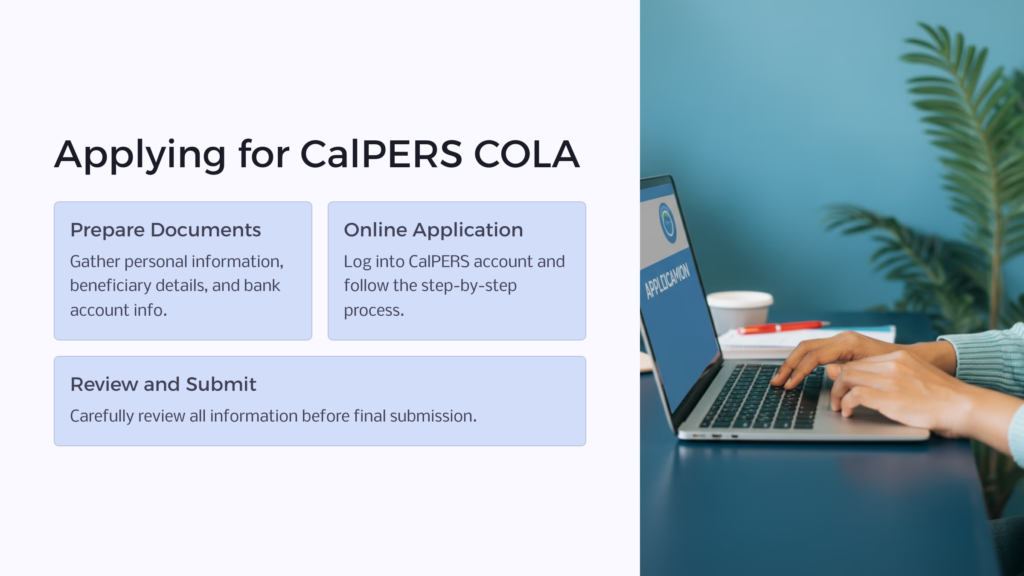

Navigating the Application Process for CalPERS COLA 2025:

There are certain things you should have ready before completing your application. These include complete mailing addresses, beneficiaries’ dates of birth, and Social Security numbers. Also, you should have your bank account details to set up direct deposit. However, if you don’t want direct deposits, you can submit a paper application instead of an online application.

It’s crucial to note that CalPERS won’t accept your paper or online application more than 120 days before your retirement date.

To start your online application:

- Log into your CalPERS account. Select the Retirement dropdown, and then select Apply for Retirement. Alternatively, click on the Apply for Retirement links in the blue Retirement block.

- Select the type of application you wish to submit.

- Select the radio button for the type of application you want to submit:

- Disability Retirement

- Service Retirement

- Service Retirement Pending Disability Retirement

- Save and continue

- Select the radio button for the type of application you want to submit:

- Your Details. First, review your details, and if anything is incorrect, contact your employer immediately so they can make corrections. Next, fill in your relationship status. If you’re married, choose Yes and enter the Date of Marriage or Registered Domestic Partnership. If you aren’t married, select No and select divorced, never married, or widowed. Then, Save your information and continue.

- Enter your retirement date. Your retirement date should be at least one day after your last payroll date with your employer.

- Enter information about your retirement. If you’re retiring with another system, choose Yes and fill in your Retirement Date with the other system. And, if you’re a member of another alternative California public retirement system, choose Yes and then use the dropdown menu to select the name of that retirement system. If you wish to include a temporary annuity, choose Yes. Next, enter the age you want the temporary annuity to end and fill in the dollar amount.

- Your health coverage. If you’re enrolled for health benefits, you can decline the continuation of your CalPERS health coverage. Select this box only if you want to decline your CalPERS health coverage. After completing this section, save and continue.

- Select your retirement options. Pick one retirement option in this step and then save and continue. There are eight retirement options, including:

- Return of Remaining Contributions Option 1

- Unmodified Allowance

- 100% Beneficiary Option 2

- 50% Beneficiary Option 3

- 100% Beneficiary Option 3 with Benefit Allowance Increase

- 50% Beneficiary Option 3 with Benefit Allowance Increase

- Flexible Beneficiary Option 4 Specific Dollar Amount

- Flexible Beneficiary Option 4 Specific Percentage

- Add your beneficiaries. The Beneficiaries Overview page only shows the benefits the named beneficiaries will receive.

- Pick your lifetime beneficiary. You will see this page if you select an option that includes monthly benefits for lifetime beneficiaries. The retirement system will generate any existing relationships, or you can add new beneficiaries. To select from the existing relationships, choose the beneficiary’s name and then select Continue. To add the name of a beneficiary that isn’t listed, click the Add a Beneficiary link. You’ll have to enter their

- Name

- Gender

- Date of birth

- Relationship to you

- Social Security number

- Address

- Pick your lifetime beneficiary. You will see this page if you select an option that includes monthly benefits for lifetime beneficiaries. The retirement system will generate any existing relationships, or you can add new beneficiaries. To select from the existing relationships, choose the beneficiary’s name and then select Continue. To add the name of a beneficiary that isn’t listed, click the Add a Beneficiary link. You’ll have to enter their

- Add your survivors. If your employer contracts for survivor continuance, you must state if you have an eligible survivor.

- Tax withholding. Pensions are taxable; thus, you must choose how you want CalPERS to withhold California and federal taxes.

- Select your payment option. Select how you would like to get your direct deposit, either via a trust or personal account.

- Review your application. If there is anything you want to add or change, click on the blue Edit link to do that.

- Sign and submit your application. If your application is complete, click on the Sign & Submit button.

- Submit the necessary documents. You’ll get a message that you’ve successfully submitted your application. If you need to submit any documents, you’ll also get a message stating the due date.

For more on CalPERS COLA, check out the CalPERS retirement FAQs here.

Potential Benefits and Drawbacks of CalPERS COLA 2025:

CalPERS COLA is an increase in one’s monthly retirement payment to account for fluctuating prices. The Cost-of-living adjustment ensures that your purchasing power remains the same no matter how quickly prices may rise and how long you might live.

For instance, if your retirement benefit is $2,000 a month, you can buy a certain amount of products or services with that money. But if the price of those items and services increases by, let’s say, 5% every year, you can buy fewer items with that $2,000 compensation because your purchasing power has decreased.

If you receive CalPERS COLA benefit based on that increase in prices, however, then this year’s benefit will increase to $2,050 per month. This way, your COLA will afford you the same ability to buy those same items—that you purchased last year with your $2,000 benefit.

COLAS might seem insignificant, and you may wonder how vital is just $50 per month. Yet inflation and rising prices can quickly eat away at your retirement benefit, making your retirement income inadequate over time.

Again, a rise in prices of 5% a year might initially seem insignificant. However, your purchasing power could be eroded drastically over time because of even relatively small inflation rates if you don’t have a cost-of-living adjustment.

For instance, suppose a man retires at age 63 with a retirement benefit of $1,000 per month. In that case, let’s say inflation averages 5% a year after he retires. With no form of COLA, this man’s purchasing power may decline to about $500—a 50% decline—by age 70. By the time he reaches 85, his purchasing power may drop to $250—nearly a quarter of the value of his initial retirement income. Once again, that means that he will only be able to buy a quarter of the items he was able to buy when he retired. And if he lives past 85, his purchasing power will decline further.

Thankfully, most state and local retirement systems offer COLA to cushion against the damaging effects of inflation.

COLAs are also an essential aspect of the pension benefits for workers and retirees who don’t receive Social Security Disability Insurance (SSDI) and other Social Security benefits because they have no other retirement benefits that vary with inflation. Without CalPers COLA and Social Security COLA, their purchasing power will gradually decline as they age. That means that middle-class retirees may struggle to afford basics, like healthcare, food, transportation, and housing—in their advanced years.

Although COLAs offer essential protections for retirees, they cost money. A key concern about COLAs is the extent to which local and state retirement systems fully account for and pay for their cost-of-living adjustment obligations in advance.

Strategies for Maximizing CalPERS COLA 2025 Benefits:

Three key dates might have a significant effect on your CalPERS COLA 2025 benefits: your birthday quarter, the fiscal year, or the first year of your COLA benefits. To receive maximum employee benefits, you must pick the date that best suits your needs.

Fiscal Year Significantly Affects Service Credit

If you start working in April, you can earn one year of service credit by July (ten months) because employees earn service credit in tenths, not twelfths. A fiscal year runs from July 1 to June 30.

During a fiscal year, to earn a full year of service credit, you have to work at least:

- 215 days for a daily pay employee

- 1,720 hours for an hourly pay worker

- Ten months full-time for monthly pay workers

It’s crucial to note that service credit for retirement purposes might differ from service credits employers use for accrual of leave time.

Birthday Quarters

Your COLA factor increases every three months, depending on your birthday. For instance, you qualify to retire at 50 years old with a multiplier of 1.1%, based on the State Miscellaneous and Industrial member’s 2 percent at 55 formula. This multiplier increases each quarter after your birthdate and reaches the maximum of 2.5% at age 63. So, if you’re below 63, your birthday quarter can help increase your CalPERS COLA benefits.

COLA: January 1 vs. December 31

The exact COLA percentage depends on the annual calculation of the Consumer Price Index for All Urban Workers. It starts the second year of your retirement, up to a specific limit, depending on your contract.

For example, if you retire on December 31, 2024, your COLA payment will depend on the CPI for 2024, and you’ll get your first COLA benefits on May 1, 2026. But if you retire on January 1, 2025, the one-day difference can delay your first eligibility for COLA by up to a year, and you won’t receive your first COLA payment until May 1, 2027. Retirees get an annual COLA compensation on May 1 every year.

To maximize your retirement benefits, you should retire on your birthday or a subsequent birthday quarter to increase your benefit factor. However, if you plan to retire at the beginning of the year, you should consider the COLA when picking a retirement date. CalPERS applies COLA yearly to the retirement allowance on May 1st retirement checks, beginning with the second year after the retirement date.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.