The Social Security Income (SSI) benefits program is the only source of federal income support that assists families caring for children with disabilities. This program only helps those with very low income and severely impaired children.

Supplemental Security Income is funded by general tax revenues instead of Social Security taxes. SSI beneficiaries often also receive medical assistance through Medicaid and special education. Even so, SSI can help families taking care of disabled children pay rent, buy food, and maintain a stable home environment.

In addition to this, these benefits help families pay for disability-related expenses that are not covered by insurance or offered by schools. These expenses include specialized therapies, diapers for older children, home modifications to improve accessibility, and medically prescribed diets.

[category-in-content-cta]

In some cases, SSI funds could allow a parent to cut down on their work hours or stop working to dedicate more time to caring for a disabled child.

Can I Receive Social Security Disability Benefits for My Disabled Child?

In April 2022, about 1 million Supplemental Security Income beneficiaries were children. This number makes up about 13% of all SSI beneficiaries and just under 2% (1.7%) of all children under the age of 18 living in the United States.

Social Security recognizes someone under the age of 18 or under 22 and a student regularly attending school who is neither married nor the head of a household as being a “child.” A child could receive SSI disability benefits from the date of birth.

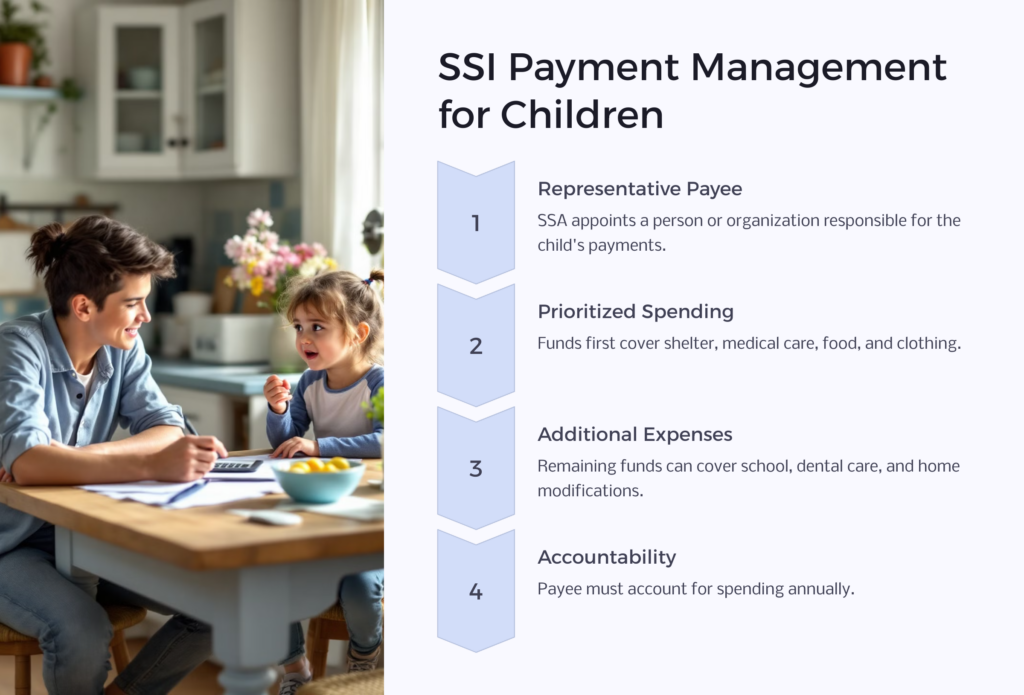

In cases where children are the beneficiaries of SSI payments, the Social Security Administration (SSA) usually makes the cash payments to a person or organization that is responsible for the child. This person or organization is known as the child’s representative payee.

In most instances, the payee would be a parent or other relative with whom the child lives. In cases where a parent or family member cannot serve as a payee, the SSA will appoint an organization to be the child’s payee. The payee must use any benefits that are allocated to the child by the SSI for the benefit of the child and ensure that their needs are met.

Any money received from SSI should first go to provide the child recipient with shelter, medical care, food, clothing, and any other items to make them comfortable. If there is money left over, it can be spent on school expenses, dental care, medical equipment, furniture for the child, life insurance and burial arrangements, and any renovations to make the child’s home more accessible and safer.

Any money that is left over after these expenses should be saved. The payee will have to account for how they spent the child’s SSI benefits each year.

Suppose the child is eligible for a sizeable past-due payment that includes more than six months of benefits. In that case, the money should be paid into a separate account in a financial institution. This separate account is called a dedicated account, and the funds in this account can only be used by the representative payee or recipient child for expenses related to the child’s disability or education. This account should remain separate from any other savings or checking accounts that might be set up for the child. Social Security will monitor how the funds in the dedicated account are spent every year.

How do I Know If My Child is Eligible?

The Social Security Administration (SSA) will consider two sets of eligibility criteria when you apply for Supplemental Security Income for a disabled child. The first criterion is based on your child and family’s income and resources. The second criterion looks at your child’s medical conditions and considers their impairment or combination of impairments.

Your local Social Security office will decide whether a child’s income and resources fall within the SSI limits. When doing so, they will consider the income and resources of the parent(s) who are living in the same household as the child.

Incomes that they will look at include Social Security checks, pensions, and any other non-cash benefits like shelter, clothing, and food that you and your family receive.

To establish your family’s financial situation, the Social Security office will also look at your resources. These include any stocks, bonds, property you own, and bank accounts. Personal belongings, your family home, and your car aren’t usually considered when the Social Security looks at your family’s resources.

The child’s financial status will be determined based on their income or the income and family members living in the same household as the child. The rules regarding the child’s financial situation apply whether the child stays at home or is away at school but returns home now and then, like during holidays or over weekends, and are under their parents’ control.

Suppose an applicant is eligible for receiving SSI benefits based on their financial situation. In that case, the SSA will refer their case to the Disability Determination Services (DDS). The Disability Determination Services will investigate the child’s medical information and determine whether they are eligible to claim for benefits. The DDS uses the SSA guidelines to do this for the Social Security Administration (SSA). A DDS team is made up of a disability examiner along with a medical or psychological consultant.

In order to qualify for SSI benefits, a child needs to meet strict criteria. The child’s condition should match or be as severe as conditions on a list of disabilities compiled by the Social Security Administration.

How Does the SSA Define Disability in a Child?

A qualifying disability is either a mental or physical disorder severe enough to limit the child’s functioning.

A child is legally considered disabled in terms of SSI if they meet the following criteria:

- They have a physical or mental impairment or a combination of impairments that are medically determinable.

- The child’s impairment(s) causes severe and marked functional limitations.

- The child’s impairment(s) have lasted or are expected to last for at least one year or to result in death.

For a child’s condition to be medically determined, the anatomical, physiological, or psychological abnormalities should be provable by medically acceptable clinical and laboratory diagnostic techniques. The evidence of the impairment should be supported by laboratory findings or signs (abnormalities that can obviously be observed).

Once it is determined that a child has a medically determinable impairment(s), additional evidence from other medical and non-medical sources can be used to establish the severity of the impairment(s) and how it affects the child’s functioning. These sources could include naturopaths, chiropractors, and therapists, among others. Non-medical sources may include schoolteachers, daycare center workers, counselors, public and private social welfare agency personnel, caregivers, and relatives.

Someone like a licensed physician, psychologist, optometrist, podiatrist, speech-language pathologist, audiologist, advanced practice registered nurse, or licensed physician assistant should provide the evidence to show that a child has a medically determinable impairment(s).

The physician can be a medical or osteopathic doctor. The licensed physician assistant can provide evidence for impairments that fall within their licensed scope of practice.

A licensed psychologist can be a licensed or certified psychologist in private practice or a licensed or certified school psychologist. When determining impairments related to intellectual disability, learning disabilities, and borderline intellectual functioning, a licensed or certified individual who does the same work as a school psychologist in a school setting could provide evidence of the child’s impairment.

Licensed podiatrists can only provide evidence of impairments if they relate to either the foot only or the foot and ankle. Some states limit the treatment of podiatry to the foot only. If you reside in such a state and your child has an impairment that affects their ankle, you may need to consult a physician instead.

Only a qualified speech-language pathologist can provide evidence for speech or language impairments. The speech-language pathologist must be licensed by the state professional licensing agency, or they need to be fully certified by the state education agency in the state in which they practice. Alternatively, they could hold a Certificate of Clinical Competence in Speech-Language Pathology from the American Speech-Language-Hearing Association.

A licensed audiologist can provide evidence of impairments of hearing loss, auditory processing disorders, and balance disorders that fall within their scope of practice. Balance impairments that involve other body systems like muscles, nerves, heart, blood vessels, bones, joints, and vision should be observed and reported by a more suitable health care provider.

A licensed advanced practice registered nurse (APRN), known as an advanced practice nurse (APN) or advanced registered nurse practitioner (ARNP) in some states, could provide evidence for impairments that fall within their scope of practice. There are four main types of APRNs, with a few variations in certain states. These include a certified nurse midwife (CNM), nurse practitioner (NP), certified registered nurse anesthetist (CRNA), and clinical nurse specialist (CNS).

When gathering evidence, the licensed and certified professional will look at how capable a child is to do the following:

- How well they acquire or learn and use information.

- How well they can focus and maintain attention to complete a task.

- How they relate to and interact with others.

- How they move their body from place to place, and how they are able to move and manipulate things.

- How well they are able to look after their own emotional and physical needs or get these needs met in appropriate ways, how well they manage stress, and take care of their health, possessions, and living area.

They will then establish how the physical effects of the child’s physical or mental impairments and the treatment(s) thereof affect the child’s functioning.

The Social Security Administration has a list of disabilities, called the Listing of Impairments – Childhood Listings (Part B) that they use to determine whether your child’s disability makes them eligible for receiving SSI benefits. In order for your child to be considered for SSI benefits, their disability should either be on that list or be as severe as one of the conditions on the list.

Mental conditions that could make a child eligible for SSI benefits include:

- Autism.

- Severe intellectual disability (children aged four or older).

- Schizophrenia.

- Bipolar disorder.

- Neurocognitive disorders.

- Depression or a related disorder.

- Anxiety or obsessive-compulsive disorders.

- Eating disorders.

- Trauma- or stressor-related disorders.

Physical conditions that could make a child eligible for SSI benefits fall into 14 categories. These categories include:

- Low birth weight and failure to thrive.

- Musculoskeletal disorders.

- Special senses and speech.

- Respiratory disorders.

- Cardiovascular system issues.

- Digestive system issues.

- Genitourinary disorders.

- Hematological disorders.

- Skin disorders.

- Endocrine disorders.

- Congenital disorders that affect multiple body systems.

- Neurological disorders.

- Cancer (Malignant neoplastic diseases).

- Immune system disorders.

Specific physical conditions could include:

- Cerebral palsy.

- Muscular dystrophy.

- Down Syndrome.

- Blindness.

- Amputation.

- Asthma.

- Chronic infections of the skin or mucous membranes.

- Burns.

- Cancer.

- Deafness.

- Symptomatic HIV infection.

- Low birth weight (birthweight below two pounds, 10 ounces for infants from birth to age one).

- Failure to thrive in infants and toddlers from birth up to the age of three.

What Benefits are Available for My Disabled Child?

Children who are eligible for Federal SSI cash payments might also be eligible for State supplemental payments, Medicaid, Food Stamps (now known as Supplemental Nutrition Assistance Program), and other social services. These benefits vary from state to state. Contact your local Social Security office for accurate information about the benefits available to you and your family.

Adults who received disability benefits before the age of 22 might be eligible for benefits from the Social Security Disability Insurance (SSDI) program. This benefit is still considered a child’s benefit because it is paid on a parent’s Social Security earnings record.

An adult with a disability could receive this child’s benefit in one of two cases. If one of their parents receives Social Security retirement or disability benefits or if one of their parents has died and worked to earn enough quarters of coverage to qualify for Social Security benefits.

Suppose a minor child receives benefits on a parent’s Social Security record. In that case, they may be eligible to receive continued benefits on their parent’s record when the child turns 18. This is only possible if it is determined that the child still has a disability. In these cases, the disability rules for adults are used to confirm the adult child’s disability.

SSDI Disabled Adult Child (DAC) benefits continue as long as the individual has the disability. They do not need to have worked to get these benefits, but their eligibility may be affected if they get married.

Social Security Income beneficiaries are automatically eligible for Medicaid in most states. In other states, you will need to sign up for it. Sometimes a child might qualify for Medicaid coverage even if they are not eligible for SSI. Your state Medicaid agency or county Social Services office could provide you with more information.

The Medicaid program covers home- and community-based services (like personal and attendant care services) and devices like wheelchairs, lifts, and supportive housing services.

A Disabled Adult Child who has been receiving Social Security Disability Insurance benefits for at least two years could be eligible for receiving Medicare cover. Disabled Adult Children who have end-stage renal disease (permanent kidney failure requiring maintenance dialysis or a kidney transplant) or Lou Gehrig’s disease (Amyotrophic Lateral Sclerosis) could receive Medicare cover immediately.

The Children’s Health Insurance Program allows states to provide health insurance to children whose parents earn too much for the child to qualify for Medicaid but too little to afford private health insurance. The Children’s Health Insurance Program is available in all 50 states and the District of Columbia and provides cover for the following:

- Prescription drugs.

- Vision.

- Hearing.

- Mental health services.

How Much SSI Could You Receive if Your Child is Disabled?

The amount of SSI benefits that a person receives each month depends on their monthly income. With children, Social Security assumes that a portion of the parents’ income would be used to take care of the child. This income will be taken into account when SSI benefits are calculated.

Some types of income get subtracted from the total amount of SSI benefits paid. This is called countable income. The definition of income is any income that you receive in a calendar month that could be used to purchase food or pay for shelter.

In relation to SSI, income is only payment (in cash or kindness) if it can be used to purchase food or secure shelter. Any other payments, like if someone else pays for your (or your child’s medical bills), should not have an influence on your SSI benefit payment amounts.

Some other types of income are also excluded. Unearned income that is excluded from influencing includes:

- The first $20 you receive each month.

- Income you set aside to assist your child in becoming more self-supporting.

- State or local assistance based on need that is entirely funded by the state or your local area.

- Rent subsidies under HUD programs and the value of Supplemental Nutrition Assistance (Food Stamps).

- The first $60 irregular or infrequent income received in a quarter.

Earned income that is excluded are:

- The first $65 per month and any unused portion of the $20 unearned income exclusion, plus one-half of the remainder.

- Any work expenses related to an impairment.

- Income you set aside to assist your child in becoming more self-supporting.

- The first $30 of irregular or infrequent income received in a quarter.

The amount you may receive in SSI benefits also varies from state to state because some states add funds to the SSI payment.

In general, the maximum monthly SSI benefit for 2022 is $841 for an individual. That is the most that SSI will pay out each month.

When Does this Financial Aid End? Will My Child Still Receive to Help into Adulthood?

Social Security will periodically review your case to establish that your child (or any other disability recipient) is still disabled, meets the eligibility criteria, and receives the correct amount of benefits each month.

Cases where children who are younger than the age of 18 and whose conditions are expected to improve or where improvement is possible Will be reviewed at least every three years.

Babies receiving SSI payments because of low birth weight will have their case reviewed by age one unless it is not expected that their medical condition will improve by their first birthday.

The SSI recipient (or their payees) are responsible for reporting any changes in their situation that could affect their eligibility for SSI benefits. Changes in your (or your child’s) income, resources, school attendance, marital status, household composition, or medical condition should be reported to your local Social Security office.

In some instances, the financial, medical, and rehabilitation support that children receive enables them to improve their level of functioning. This, in combination with work incentives specifically provided by the disability program, could provide older children a level of independence where they no longer need to receive disability benefits.

Once a child turns 18, their impairments will be evaluated based on the Social Security’s definition of disability for adults. The review to establish continued SSI benefits is usually done during the one-year period starting on the child’s 18th birthday.

In some cases, individuals who were not eligible for SSI benefits before they turned 18 might become eligible on their 18th birthday. This could be true if the child’s parents’ income was too high or they had too many resources

How Can I Access These Benefits?

In 2018-2019 about 40% of individuals who applied for SSI were found to be eligible. That means only four people out of every 10 people who applied for child disability benefits through SSI were successful.

Just under a third of applicants (29%) were successful the first time they applied. 3% were successful after requesting reconsideration, and 8% after appealing to an administrative law judge.

45% of applicants were denied for medical reasons, while 15% were denied for technical reasons.

When you apply for SSI or SSDI benefits, you need to complete an application form. This should be accompanied by a Child Disability Report.

The Child Disability Report gathers information about your child’s disabling condition and how it influences their daily life. This report can be completed online, and a Social Security representative will be in touch once it is submitted.

If you are applying for SSI, you will need your child’s Social Security number and birth certificate. You will also need to provide records detailing your and your child’s income and resources. The Social Security representative will likely ask about your child’s disabling condition and how it affects them. They might also request the names of teachers, daycare providers, and family members, along with any school records that could provide information on how your child works.

If you are applying for SSDI, you need the same documentation as applying for SSI. In addition, you need to have your own Social Security number, the Social Security number of a retired parent receiving disability benefits, or a deceased parent on whose record you are filing the claim.

To assist with your claim, it is recommended that you provide the following information to the Social Security representative:

- As much information about your child’s condition as possible. Include copies of medical reports and any other medical documents you have.

- Include dates of visits to doctors or hospitals. Include any information that could assist Social Security in obtaining your child’s medical records. This includes patient account numbers for doctors and hospitals.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.