The world of Social Security Disability Insurance (SSDI) can be complex and uncharted territory for many individuals. To navigate through it confidently, it becomes vital for recipients to understand how Social Security disability benefits work and, most importantly, its tax implications. It’s not enough to just be receiving the payments; knowing the financial obligations that these benefits might carry can help in preparing and planning one’s financial future efficiently.

SSDI Implications

In the increasingly complex landscape of personal finance management, understanding the tax implications associated with SSDI becomes critically important for the recipients. This knowledge not only enables the recipients to budget more efficiently but can also help them avoid unwanted surprises during tax seasons. Additionally, understanding these tax implications can potentially open doors to tax deductions and credits that many SSDI recipients might unintentionally overlook.

About SSDI

Social Security Disability Insurance (SSDI) is a federal insurance program managed by the Social Security Administration (SSA). It provides income support to people who are unable to work due to a disability that is expected to last at least a year or result in death. The SSDI benefits are funded by payroll taxes, ensuring a financial safety net for such individuals and their families.

To be eligible for SSDI, an individual must have worked in jobs covered by Social Security and accumulated enough ‘work credits.’ Additionally, one must have a medical condition that meets the Social Security’s definition of a disability.

SSDI and Taxes

While many people often mistaken SSDI benefits as non-taxable, the fact may surprise you – SSDI benefits can be taxable, depending on specific income-related factors. This largely depends on whether an individual or a couple filing jointly has another substantial income source apart from the SSDI benefits.

If your only source of income is from SSDI benefits and it falls under the set base amounts, it is generally non-taxable. However, if you have additional substantial income, a portion of your SSDI benefits might be considered taxable income.

Criteria Determining Taxable Portion of SSDI

The taxable portion of SSDI largely depends on the ‘provisional income’ of an individual or couple filing jointly. Provisional income is defined by the IRS as your adjusted gross income (AGI), non-taxable interest, and half of your Social Security benefits.

The IRS has set base amounts for tax purposes: $25,000 for individuals, $25,000 for heads of households, $25,000 for qualifying widow(er)s with dependent children, and $32,000 for couples filing jointly. If your provisional income exceeds these base amounts, up to 50% of your SSDI benefits might be considered taxable. If your provisional income exceeds $34,000 for an individual or $44,000 for a couple filing jointly, up to 85% of your SSDI benefits may be considered taxable.

Factors Affecting SSDI Taxation

Several key factors play a role in determining the taxability of SSDI benefits. SSDI recipients must consider their individual income tax return, joint income tax return, and the applicable tax rates.

Individual income and joint income tax returns have different base amounts set by the IRS. For instance, if the sum of a couple’s adjusted gross income, non-taxable interest, and 50% of SSDI benefits exceeds $34,000, up to 50% of their SSDI benefits may be subject to federal income tax.

It’s important for SSDI recipients to understand these factors and the associated tax brackets which dictate the percentage of SSDI benefits that might be taxable. Doing so will empower them to make informed decisions and prepare adequately for their tax obligations.

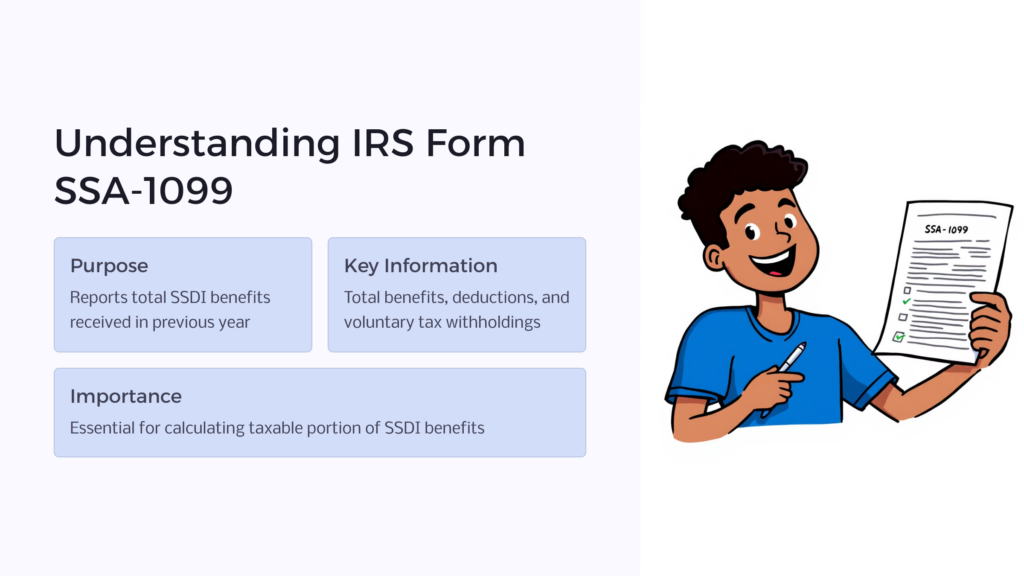

Understanding the IRS Form SSA-1099

IRS Form SSA-1099 is a tax form sent every January to people who receive Social Security benefits, including SSDI. This form reports the total amount of benefits you received from Social Security in the previous year, making it an essential document for filing your federal income tax return.

Interpreting the information on Form SSA-1099 is straightforward as long as you understand its different components. Firstly, Box-3 reports the total SSDI benefits you received during the taxable year. If any previous year’s benefits were received in the current year, the amount will be displayed in Box-4. Certain deductions like Medicare premiums or voluntary tax withholdings are reported in other boxes.

The relationship between SSA-1099 and SSDI lies in the tax requirements. If a portion of your SSDI benefits are taxable, the information on this form will help calculate the taxable amount and report it on your tax return.

Calculating Taxable SSDI Benefits

Determining the taxable amount of SSDI benefits involves a two-step process. Firstly, sum up your adjusted gross income (AGI), any non-taxable interest, and 50% of your SSDI benefits. If the total exceeds the base amount set by the IRS for your filing status, part of your benefits will likely be taxable.

If it doesn’t exceed, your benefits aren’t taxable. If it exceeds, 50% of the difference is your taxable SSDI benefit. If it exceeds your adjusted base amount, 85% of the difference, or the amount of your SSDI benefit plus your AGI and nontaxable interest minus $20,000 for individuals or $32,000 for couples, whichever is lower, is your taxable SSDI benefit.

Tips to Minimize Tax on SSDI Benefits

There are ways to legally reduce tax on SSDI benefits. One such way is through tax deductions and credits. Some medical and health care costs can be offset by tax deductions. Likewise, tax credits help reduce the overall tax liability on a dollar-for-dollar basis and can lower the amount of income tax you owe. Therefore, consult with a tax professional to ensure you are utilizing all your eligible tax credits and deductions.

Offsets like the Workers’ Compensation Offset (WCO) or the Public Disability Benefit (PDB) can also impact the taxation of your SSDI benefits; therefore, their impact should be considered in your overall tax planning.

Final Thoughts

Understanding the tax implications of SSDI is crucial for beneficiaries. Knowledge of certain factors such as eligibility for SSDI, taxable portion criteria, impacts of filing as an individual versus joint, IRS Form SSA-1099, and ways to legally minimize the tax burden can help maximize benefits while minimizing the surprise of unexpected obligations.

As an SSDI recipient, it’s essential to conduct proper tax planning so that you’re not surprised when tax season rolls around. Given the potential complexity of SSDI taxation, professional advice could be invaluable.

Don’t hesitate to consult with a tax professional if you’re uncertain how to calculate your taxable SSDI benefits. And, do share the insights from this article with others who might benefit.

Ensuring you understand your tax obligations, and planning accordingly can contribute to a more secure financial future. Don’t forget, knowledge and planning equate to power and preparedness when it comes to managing your SSDI benefits and their tax implications.

Ensuring you understand your tax obligations, and planning accordingly can contribute to a more secure financial future. Don’t forget, knowledge and planning equate to power and preparedness when it comes to managing your SSDI benefits and their tax implications.

Begin today with your benefits journey by taking our free eligibility quiz at Benefits.com.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.