A 100% disability rating from the Department of Veterans Affairs (VA) signifies a service-connected condition that severely limits a veteran’s ability to work or live independently. Veterans with this rating receive various benefits, including financial assistance, medical care, and educational support, for themselves and their families.

When these veterans pass away, their benefits aren’t automatically passed on to the surviving spouse. However, the VA offers a program called Dependency and Indemnity Compensation (DIC) to provide some level of financial security for eligible spouses who have lost their partner.

In this post, we’ll go over the DIC system, additional benefits surviving spouses may qualify for, and how to apply for them.

What Is Dependency and Indemnity Compensation?

DIC is a tax-free financial benefit administered by the VA. It’s designed to provide ongoing financial support to eligible surviving spouses and dependents of veterans who served our country.

Base Benefit for Surviving Spouses of 100% Disabled Veterans

In 2024, the base rate of DIC for surviving spouses is $1,612.75 per month. This applies to surviving spouses of veterans who died on or after January 1, 1993.

However, the VA also considers the veteran’s pay grade to determine the base rate. Use the VA’s monthly pay rates table to determine your base DIC pay rate.

DIC Eligibility Requirements

For surviving spouses of veterans with a 100% VA disability rating due to a service-connected condition, DIC eligibility depends on several factors.

Marital Status and Living Situation

To be eligible for DIC compensation, you need to meet a set of requirements about your marital status and living situation.

Marital status requirements include (at least one must apply):

- You were married to the veteran for at least one year.

- You and the veteran had a child together.

- You were married to the veteran within 15 years of discharge from their service period with the qualifying disability (if separated, it wasn’t your fault)

Living situation requirements include (at least one must apply):

- You lived with the veteran continuously until their death.

- You were separated from the veteran, but the separation wasn’t your fault.

To be eligible, you need to meet one of the conditions for marital status and one of the conditions for living situation. For example, if you were married to the veteran for at least one year (marital status), but you were separated at the time of their death (living situation), you wouldn’t be eligible for DIC unless the separation wasn’t your fault.

Length of the Disability Rating Before Death

If your spouse had a 100% VA disability rating, DIC eligibility also requires you to provide evidence of the following:

- At least 10 years: If your spouse maintained a totally disabled rating for at least 10 continuous years immediately before their death, you are likely eligible for DIC benefits.

- Since release and 5+ years: If your spouse was rated totally disabled since their release from active duty and for at least five continuous years immediately before death, you may qualify for DIC.

- Former POWs: For former prisoners of war (POWs) who were totally disabled for at least one year before death (after September 30, 1999), surviving spouses may be eligible for DIC.

Remarriage and DIC Eligibility

If you remarried after your spouse’s death, you can still receive or continue to receive DIC benefits if one of the following applies:

- You remarried on or after December 16, 2003, and you were 57 years of age or older at the time you remarried.

- You remarried on or after January 5, 2021, and you were 55 years of age or older at the time you remarried.

Additional DIC Benefits

In 2024, the base rate of DIC for surviving spouses is $1,612.75 per month (for veterans who died on or after January 1, 1993). While this is the starting point, you may be eligible for additional va survivor benefits depending on certain factors.

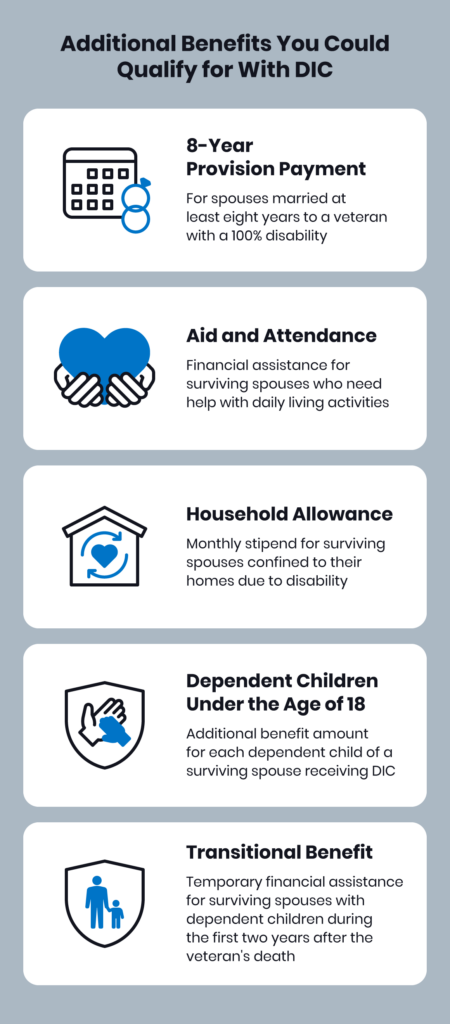

8-Year Provision Payment

This benefit increases the base DIC amount for surviving spouses whose veteran spouse had a 100% disability rating for at least eight years continuously before death, and the surviving spouse was married to the veteran for those same eight years.

Added monthly amount: $342.46

Aid and Attendance (A&A)

This benefit provides financial assistance to surviving spouses who need help with daily living activities due to illness or age. It can be used to cover the cost of in-home care or assisted living facilities. This benefit is not automatic and requires a separate application process with specific eligibility criteria.

Added monthly amount: $399.54

Housebound Allowance

This benefit may be available to surviving spouses who are confined to their homes due to a permanent disability. It provides a small monthly stipend to help offset additional expenses. This benefit might be renamed to “Improved Surviving Spouse Pension Rate” in the future.

Added monthly amount: $187.17

Dependent Children Under the Age of 18

Surviving spouses with dependent children under 18 may qualify for an additional benefit amount added to their base DIC payment.

Added monthly amount: $399.54 for each eligible child

Transitional Benefit

Surviving spouses with dependent children under 18 are also eligible for this temporary financial assistance during the two-year period following the veteran’s death.

Added monthly amount: $342 for the first two years after the veteran’s death

Applying for DIC Benefits as a Surviving Spouse of a 100% Disabled Veteran

Losing a spouse is incredibly difficult, and navigating the application process for benefits can add to the stress — but it doesn’t have to. Here’s a simple breakdown of the steps you can take to apply for DIC benefits:

1. Notify the VA

The VA should be informed of your spouse’s death as soon as possible to help avoid any delays in receiving benefits. You can call the VA at 1-800-827-1000 or notify them online through their secure messaging system.

2. Gather Evidence for Your Claim

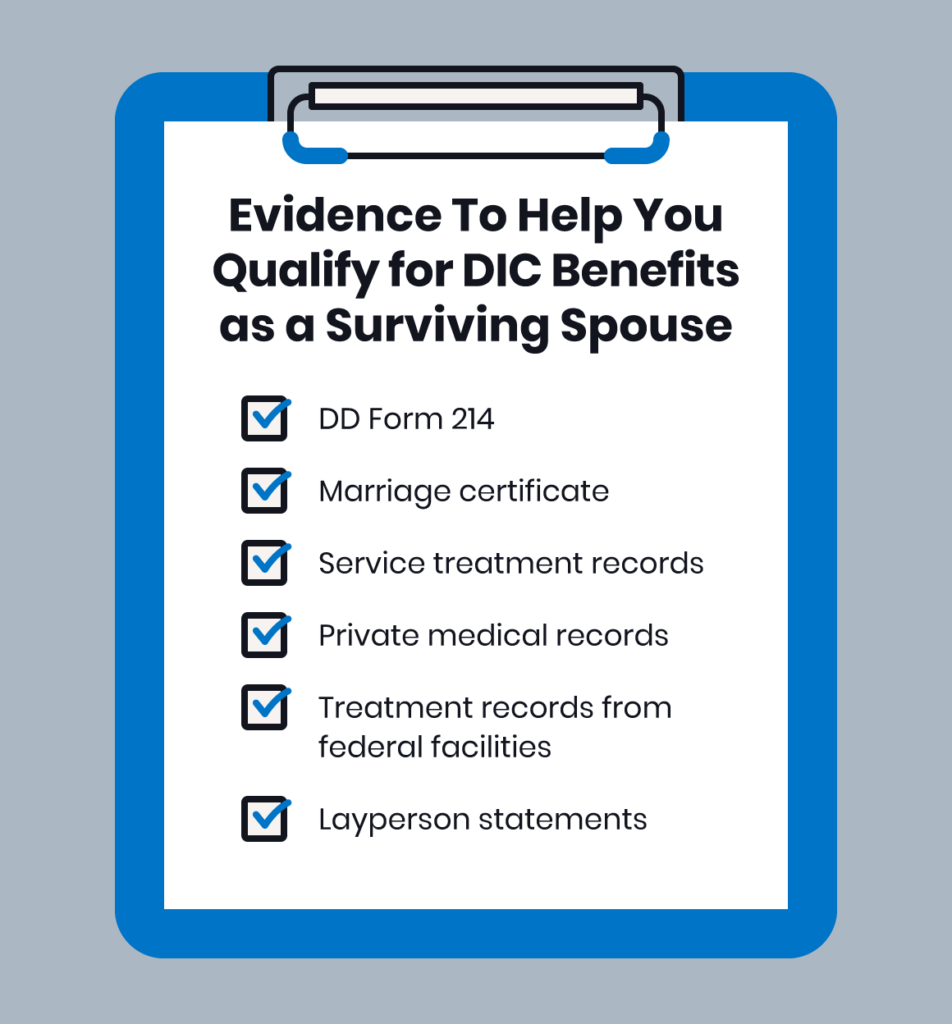

Before you apply for benefits, you’ll need to gather evidence to support your claim, including:

- Veteran’s discharge papers (DD Form 214): These documents verify your spouse’s military service and discharge details.

- Marriage certificate: You’ll need this to prove your marital status.

- Service treatment records: These document your spouse’s service-connected disability and treatment history from the National Guard or Reserve unit.

- Private medical records: If your spouse received private medical treatment for their disability, gather those records.

- Treatment records from federal facilities: Medical records from VA medical centers or other federal facilities can support the diagnosis and treatment of the disability.

- Layperson statements: While the VA gives less weight to these, written statements from people who witnessed your spouse’s chronic disability symptoms can be helpful.

3. Apply for Benefits

There are several ways to apply for VA benefits, including:

- Online: The VA offers an online application system through eBenefits.

- By phone: You can call the VA at 1-800-827-1000 to speak with a representative and start the application process.

- In person: Contact your local VA regional office to schedule an appointment and apply in person.

During the application process, you’ll provide or give the VA permission to gather the evidence needed to show your eligibility.

Understand the Resources Available

While you wait for your application to be approved, here are some additional resources that can support you:

- VA regional offices: Staff at your local VA regional office can answer questions and guide you through the application process.

- VA Survivors Pension Helpline: This helpline offers specialized assistance for surviving spouses. Call 1-800-669-8477 to speak with a representative.

- Veteran Service Organizations (VSOs): These organizations, staffed by veterans and families, can provide support and guidance on accessing benefits. Find a VSO near you through the National Association of Veteran Service Organizations (NAVSO) website.

- Benefits.com: We offer information and guidance on government-funded benefit programs so you get the help you need. Call 888-416-1240 to speak with one of our team members.

Frequently Asked Questions

When a 100% Disabled Veteran Dies, Does the Spouse Get Benefits?

In many cases, yes. The spouse may be eligible for DIC benefits, but it depends on several factors, including marital status, living situation, and the duration of the veteran’s disability rating before death.

How Much Does VA Disability Pay for Widows?

The base rate of DIC for surviving spouses in 2024 is $1,612.75 per month (for veterans who died on or after January 1, 1993). However, additional benefits can increase this amount depending on your situation, such as having dependent children or qualifying for the 8-Year Provision.

Am I Automatically Eligible for DIC Benefits if My Spouse Was a 100% Disabled Veteran?

No, there is no automatic eligibility. You must meet specific criteria related to your marital status, living situation with the veteran, and the duration of their disability before death. The VA offers a benefits eligibility guide to help you determine if you qualify.

What Happens to My DIC Benefit if I Remarry?

In most cases, remarrying after your spouse’s death will stop your DIC payments. However, there are exceptions for remarriages that occurred on or after December 16, 2003, if you were 57 years of age or older at the time, or for remarriages on or after January 5, 2021, if you were 55 years of age or older.

How Long Does it Take To Receive DIC Benefits After Applying?

Processing times can vary depending on the complexity of your application and whether the VA requires additional information. Generally, plan to allow several months for processing.

Benefits.com Can Help You Navigate Your Eligibility

We understand that losing a loved one, especially a spouse who served our country, is incredibly difficult. You don’t have to navigate the complexities of the VA benefits process alone. Here at Benefits.com, we’re dedicated to helping you understand your eligibility and secure the benefits you deserve. Take our Benefits Quiz to see how you qualify.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.