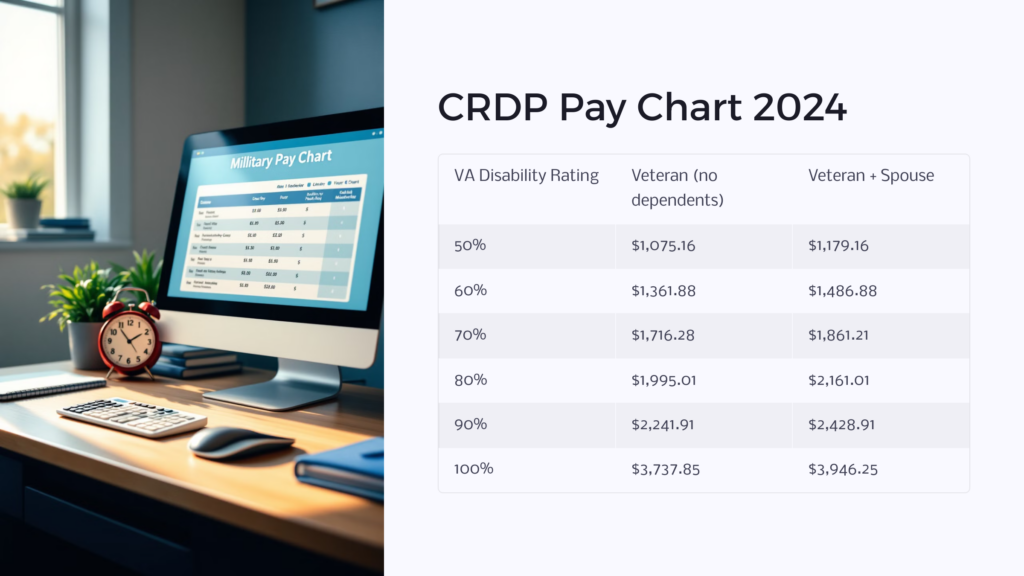

Here’s what a monthly military pay chart roughly looks like for VA disability ratings. To find your CRDP rate, add the monthly VA compensation pay to your retirement rate (which varies on several factors, including the time of year you retired). Although there’s no definitive chart for CRDP pay, your disability rating (which must be 50% or higher) factors into the final portion.

See more about VA disability pay.

Estimated CRDP Pay Chart 2024

| VA Disability Rating | Veteran (no dependents) | Veteran + Spouse (no dependents) |

| 50% | $1,075.16 | $1,179.16 |

| 60% | $1,361.88 | $1,486.88 |

| 70% | $1,716.28 | $1,861.21 |

| 80% | $1,995.01 | $2,161.01 |

| 90% | $2,241.91 | $2,428.91 |

| 100% | $3,737.85 | $3,946.25 |

If you’ve served 20+ years and have a 50%+ VA disability rating, CRDP enrollment happens automatically without a formal application.

What is CRDP?

Concurrent Retirement and Disability Pay allows eligible military retirees to receive a full military retirement pension and VA disability benefits from the Department of Veterans Affairs. Previously, military retirees’ retirement pay was reduced by the amount of VA disability payments under rules for VA disability offset. CRDP payment eliminates this offset and permits veterans to receive both payments in full.

The CRDP program was established by the National Defense Authorization Act of 2004. It went into effect on January 1, 2004, in response to lobbying efforts by military retiree advocacy groups who argued that veterans were being unfairly penalized by not being able to concurrently receive full retirement and VA benefits. Legislators agreed that eligible retirees should be able to receive both forms of compensation concurrently.

CRDP Eligibility Requirements

To qualify for CRDP, veterans must meet several criteria related to length of service and VA rating:

- Have 20+ years of creditable military service

- Be eligible for retired military pay

- Have a VA disability rating of 50% or higher

Veterans who meet all these requirements qualify for the CRDP program. This program allows them to receive full military retired pay and VA disability compensation with no offset. If eligible, veterans do not need to apply for CRDP—enrollment is automatic.

How Long Does It Take to Get Into CRDP?

A military retiree who meets the eligibility criteria should enter the CRDP program immediately upon receiving a VA rating of 50% or higher. In some cases, payments may take 1-2 months to begin coming in full after a rating change. Remember, veterans don’t need to apply separately for CRDP if they qualify based on their retirement and disability status.

Difference Between CRDP and CRSC

Combat-Related Special Compensation (CRSC) has more narrow eligibility focused on combat injuries, while CRDP is available to more retirees based on years served and disability rating. However, CRSC offers better tax savings for eligible veterans.

Eligibility

- CRDP requires 20+ years of creditable service time. CRSC does not.

- CRDP requires at least a 50% VA disability rating. CRSC requires a 10% rating.

- CRSC covers more combat-related disabilities. CRDP eligibility is broader.

Tax Differences

- CRSC payments are tax-exempt. CRDP payments are taxed.

- CRDP offers more dependency benefits than CRSC

Four Main Benefits of CRDP

The most significant benefit of the CRDP program is that it allows eligible veterans to receive their full military retirement pension and VA disability benefits concurrently. Key benefits include:

- No Offset of Retired Pay

Under CRDP, veterans do not have their military retirement pay reduced by any portion of their VA disability compensation. This avoids the unfair penalty that previously prevented veterans from receiving full compensation for their years of service and any disability sustained.

- Dependents Can Receive Benefits

Unlike some other programs, CRDP permits eligible dependents to continue receiving benefits. For example, upon a veteran’s death, their surviving spouse can still receive CRDP dependency and indemnity compensation.

- Higher Overall Compensation

Between full military retirement and VA disability payments, CRDP retirees receive substantially higher income than they would if the two programs offset each other. This increased compensation helps improve the quality of life.

- Better Tax Treatment Than CRSC

While CRSC offers tax-exempt disability payments, CRDP provides higher overall compensation with more generous dependent benefits. A qualifying military retiree may get higher total benefits with CRDP.

How Do Payments Work?

CRDP-eligible retirees receive two separate payments—one from their military retirement, and one from the VA for disability compensation. These payments are made directly into the veteran’s bank account through direct deposit. Retirees receiving CRDP do not need to re-certify eligibility or check in—the payments happen automatically based on meeting age and time-in-service retirement criteria.

The amount of each monthly payment is determined by the individual’s military retirement calculation and VA disability rating percentage. So a retiree with 75% VA disability would receive their full military pension payment, plus 75% of the VA’s disability compensation amount for a single veteran with no dependents. These amounts adjust with the cost of living increases each year.

Can I Work While on CRDP?

Yes, CRDP does not limit a veteran’s ability to have other employment or earned income. The concurrent payments are considered property earned through previous military service and disability, so they do not impact workforce participation.

What Happens if I Move? Does the Amount Change?

Where retirees live doesn’t impact the amount of CRDP retirement pay or disability compensation they receive. The payments are based on years of military service and disability rating only. To prevent issues with payment delivery, you should notify the Defense Finance Accounting Service (DFAS) and VA whenever you change your address.

Do I Have to Reregister if I Move?

Retirees receiving CRDP do not need to re-certify eligibility if they change addresses. It is important to provide updated contact information to DFAS and VA for payment purposes and tax documentation.

In summary, CRDP payments equal full military retired pay plus VA disability compensation with no offset or reductions. These amounts are fixed based on a retiree’s circumstances and do not change with relocation or additional work.

How to Apply for CRDP

Since enrollment in CRDP is automatic based on meeting retirement and disability criteria, no formal application is required. But veterans must complete several steps to establish the underlying qualifications:

1. Ensure 20+ Years of Creditable Service Time

Retirees must have two full decades of service time that counts towards armed forces retirement eligibility. Not all time in uniform may be creditable, so veterans should verify they meet armed forces retirement eligibility before separation.

2. File VA Disability Claim Paperwork

To enter CRDP, veterans must have a VA disability rating of 50% or higher. Submitting thorough claim paperwork with evidence supporting all service-connected conditions is key to achieving a high rating.

3. Review Potential Payment Amounts

Before separation, armed forces members can estimate CRDP payment amounts based on expected military retirement and possible VA ratings. Understanding these projections helps set expectations.

4. Consult Your Retirement Services Officer With Questions

Well before retirement, servicemembers with questions about CRDP qualifications should meet with their designated retirement services officer to ensure they meet the criteria. These officers can also advise members on increasing disabled retirement income.

Impact of CRDP on Military Retirees

The ability to receive full military retirement pay and disability benefit payments concurrently through CRDP delivers major lifestyle impacts for eligible veterans and their families:

Greater Financial Security

CRDP can mean thousands of additional dollars per year without any offset, improving veterans’ ability to cover healthcare, housing, nutrition, transportation, dependent education, and other costs.

Increased Flexibility & Control

Veterans report far greater life flexibility thanks to CRDP enhancing their economic empowerment. Higher and more reliable income reduces stress and uncertainty.

Higher Standard of Living

The increased buying power enabled by CRDP payments without reduction allows qualifying retirees to afford more comfortable housing, reliable vehicles, leisure activities, and other higher living standards.

Reduced Financial Hardship

Eliminating the unfair penalty of getting retirement pay reduced by VA disability funds helps relieve economic hardship for thousands of veteran families. CRDP prevents difficult trade-offs.

In essence, the consolidated retirement and disability compensation facilitated by CRDP provides veterans with greater financial means to live life on their terms. This elevated economic foundation improves tranquility and satisfaction throughout retirement.

Future Implications of CRDP

While CRDP currently can provide a valuable benefit for a disabled veteran, the future direction of the program involves some uncertainty:

Potential Budget Adjustments

If deemed excessively costly overall, legislators could attempt to scale back CRDP. But major changes risk intense political backlash from a powerful voting bloc.

Continued Pressure to Expand Eligibility

Veterans advocacy groups continue lobbying to extend CRDP eligibility to those with disability ratings under 50%. Granting access down to even a 10% rating would grow the budget tremendously.

Disability Rating System Changes

VA modifications to the disability rating process could allow more veterans into CRDP at higher rates. But evidence requirements may also tighten.

FAQs About CRDP

Despite over 15 years since CRDP’s inception, some misconceptions still surround this disabled veterans’ retirement income program:

Myth: CRDP is temporary and has an expiration date

Fact: There is no end date or sunset provision to CRDP. It was created without time limitations as an earned veteran benefit.

Myth: CRDP amounts can change or be taken away

Fact: CRDP payments equal full military retirement and VA disability. By law, they cannot be reduced or taken away. Once you’re eligible, the only changes will be annual cost of living increases.

Myth: CRDP stops if you start working

Fact: CRDP concurrent payments are earned benefits that do not change based on retirees having jobs or other income sources. Work freely without payment impacts!

Myth: Spouses lose CRDP eligibility after divorce

Fact: Former spouses married to retirees for 20+ years retain CRDP-dependent benefits even after divorce, though rules vary by state.

Myth: You must reapply for CRDP annually

Fact: Once established, CRDP eligibility extends automatically throughout retirement without any need to re-establish medical status, disability rating, etc. Payments continue for life barring legal status changes.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.