Retroactive disability pay, also known as back pay, is a crucial benefit for veterans who have been awarded disability compensation. It’s the money owed to veterans from the effective date of their claim to the date they were granted those benefits. This compensation is designed to cover the period when a veteran was eligible for benefits but had not yet received them due to processing delays or other factors.

For many veterans, retroactive pay can be a significant amount of money. It’s not uncommon for the VA to take months or even years to approve a claim, and during this time, the back pay continues to accumulate. Understanding how this pay is calculated and what factors influence it is essential for veterans seeking to ensure they receive the full compensation they’re entitled to.

Retroactive pay is particularly important because it acknowledges the financial hardship many veterans face while waiting for their claims to be processed. It’s a way for the VA to make up for the time spent reviewing and deciding on a claim, ensuring that veterans aren’t penalized for administrative delays.

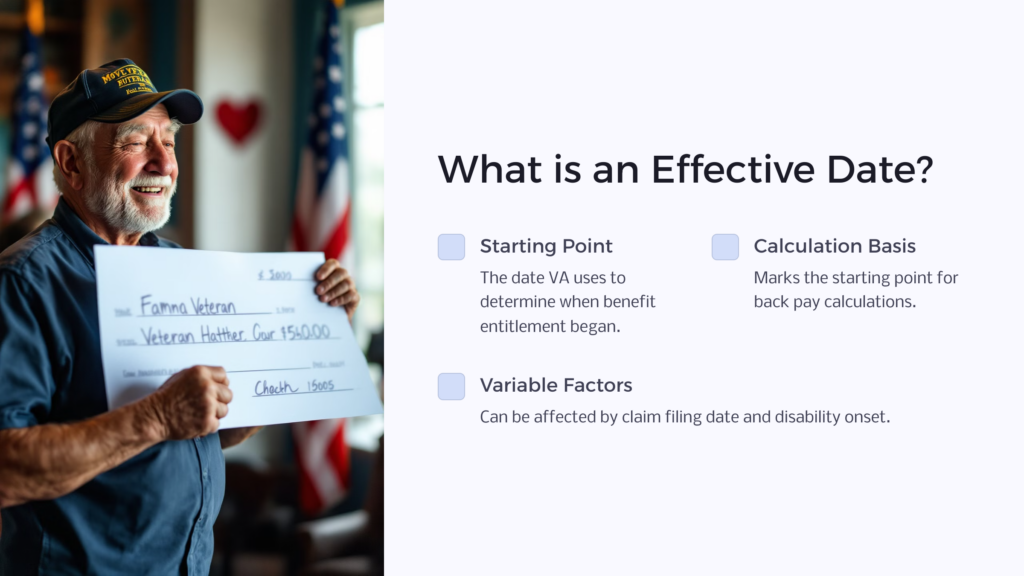

What is an Effective Date?

The effective date is a critical concept in calculating retroactive disability pay. It’s the date the VA uses to determine when a veteran’s entitlement to benefits began. This date is crucial because it marks the starting point from which back pay is calculated.

An effective date is typically the earliest date that the VA can legally pay benefits for a particular claim. It’s not always the same as the date a veteran became disabled or the date they filed their claim. The VA assigns effective dates based on various factors, including when the claim was received and when the evidence shows the disability began.

Understanding your effective date is key to estimating how much retroactive pay you might receive. It’s the anchor point for all calculations and can significantly impact the total amount of back pay awarded.

How VA Determines Effective Dates

The VA has specific rules for determining effective dates, which can sometimes be complex. Generally, the effective date is the later of two dates: the date the VA received the claim or the date entitlement arose (when the veteran became disabled).

For original claims filed within one year of discharge from military service, the effective date can be as early as the day following discharge. This is why it’s often beneficial for veterans to file their claims as soon as possible after leaving the service.

For claims filed more than a year after discharge, the effective date is typically the date the VA received the claim. However, there are exceptions. For instance, if a veteran can prove that their disability began before they filed their claim, they might be able to get an earlier effective date.

It’s important to note that for increases in disability ratings, the effective date is usually the date the VA receives the claim for increase or the date the evidence shows the disability worsened, whichever is later.

Factors Influencing Retroactive Pay

Several factors can influence the amount of retroactive pay a veteran receives. The most significant of these is the length of time between the effective date and the date benefits are granted. The longer this period, the more back pay a veteran may be entitled to.

Another crucial factor is the disability rating assigned by the VA. Higher ratings generally result in larger monthly payments, which in turn leads to more substantial back pay. If a veteran’s rating changes during the appeal process, this can also affect the retroactive pay calculation.

The presence of dependents can also impact retroactive pay. Veterans with a spouse, children, or dependent parents may be eligible for additional compensation, which would be included in the back pay calculation.

Changes in VA compensation rates over time can also influence retroactive pay. The VA adjusts these rates annually to account for cost-of-living increases, so back pay calculations may need to factor in different rates for different years.

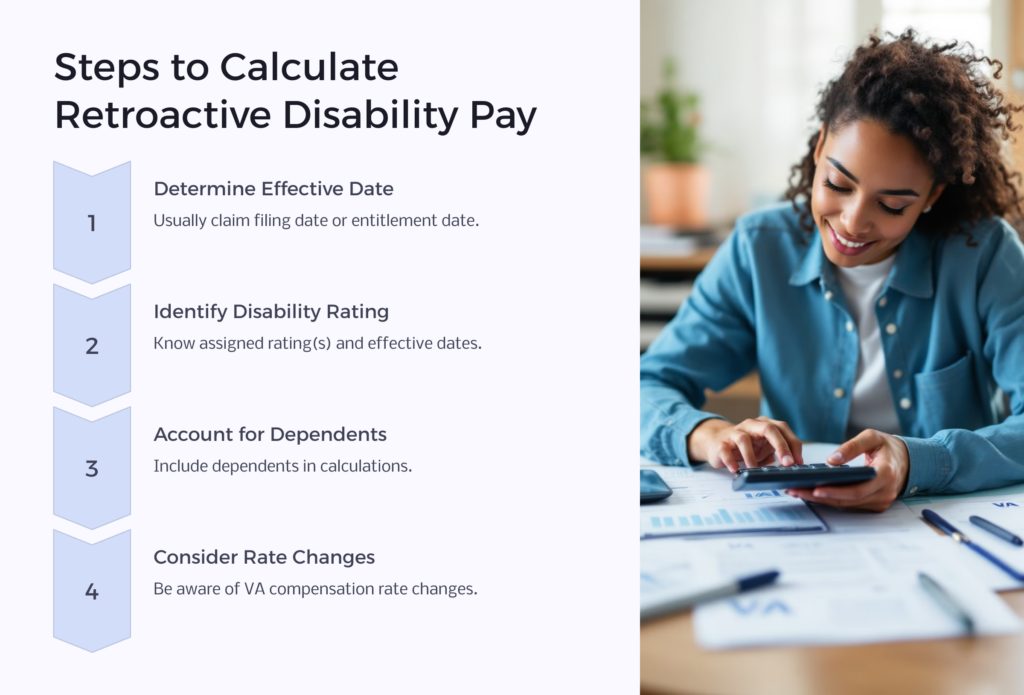

Steps to Calculate Retroactive Disability Pay

Calculating retroactive disability pay can be a complex process, but breaking it down into steps can make it more manageable:

1. Determine your effective date: This is usually the date you filed your claim or the date entitlement arose, whichever is later.

2. Identify your disability rating(s): Know what rating(s) the VA assigned and when they became effective.

3. Account for dependents: If you have dependents, make sure to include them in your calculations as they can increase your monthly payment.

4. Consider rate changes: Be aware of any changes in VA compensation rates that occurred during your back pay period.

5. Calculate the total: Multiply your monthly rate by the number of months from your effective date to the date benefits were granted, taking into account any changes in rating or dependents during that time.

It’s important to note that this calculation can become quite complex, especially if there are multiple ratings or changes over time. In many cases, seeking assistance from a Veterans Service Organization or a VA-accredited attorney can be helpful.

Using Online Calculators for Estimation

Online calculators can be valuable tools for estimating retroactive disability pay. These calculators, such as the ones provided by CCK Law, Hill & Ponton, and VA Disability Group, offer a user-friendly way to get a ballpark figure of potential back pay.

To use these calculators, you typically need to input information such as your effective date, disability rating, and details about dependents. The calculator then uses this information along with historical VA compensation rates to estimate your retroactive pay.

While these calculators can be incredibly helpful, it’s important to remember that they provide estimates, not guaranteed amounts. They may not account for all the nuances of your specific case, such as multiple rating changes or complex effective date situations.

Using online calculators can give you a good starting point for understanding your potential retroactive pay. However, for a more accurate calculation, especially in complex cases, it’s advisable to consult with a VA-accredited representative or attorney.

Common Pitfalls in Calculating Retroactive Pay

When calculating retroactive disability pay, there are several common pitfalls that veterans should be aware of:

1. Misunderstanding effective dates: Many veterans assume their effective date is the day they became disabled or the day they left service. However, it’s often the date the VA received the claim.

2. Overlooking rating changes: If your rating changed during the appeal process, this needs to be factored into the calculation.

3. Forgetting about dependents: Adding or removing dependents can change your monthly payment amount and affect your back pay.

4. Not accounting for rate changes: VA compensation rates change annually, which can impact retroactive pay calculations spanning multiple years.

5. Assuming all disabilities have the same effective date: If you have multiple service-connected disabilities, they may have different effective dates.

Avoiding these pitfalls requires careful attention to detail and a thorough understanding of how the VA calculates benefits. When in doubt, it’s always best to seek professional assistance to ensure you’re not leaving any money on the table.

How to Appeal Incorrect Back Pay Amounts

If you believe the VA has incorrectly calculated your retroactive pay, you have the right to appeal. The first step is to carefully review your award letter and compare it with your own calculations. If you find a discrepancy, you can file a Notice of Disagreement (NOD) with the VA.

When filing an appeal, it’s crucial to provide clear evidence supporting your claim for additional back pay. This might include medical records, service records, or other documentation that shows why you believe you’re entitled to an earlier effective date or a higher rating for the period in question.

Remember, there are time limits for filing appeals. Generally, you have one year from the date of the decision to file a NOD. Missing this deadline can result in losing your right to appeal, so it’s important to act promptly if you believe there’s an error.

During the appeal process, it can be extremely helpful to work with a Veterans Service Organization or a VA-accredited attorney. These professionals can help you navigate the complex appeals process and present the strongest possible case for correcting your back pay amount.

Legal Assistance for Calculating Retroactive Pay

While it’s possible to calculate retroactive pay on your own, many veterans find it beneficial to seek legal assistance, especially in complex cases. VA-accredited attorneys and Veterans Service Organizations specialize in navigating the intricacies of VA benefits and can provide valuable expertise.

These professionals can help ensure that all factors are considered in your back pay calculation, including effective dates, rating changes, and dependent status. They can also assist in gathering necessary evidence and documentation to support your claim for retroactive pay.

If you decide to seek legal assistance, look for an attorney or organization that specializes in veterans’ benefits law. Many offer free initial consultations, allowing you to discuss your case before committing to representation.

Remember, while legal assistance can be invaluable, it’s important to work with accredited professionals who are authorized to assist with VA claims. The VA maintains a list of accredited attorneys, claims agents, and Veterans Service Organizations that you can trust.

FAQs on Retroactive Disability Pay

1. Q: How far back can retroactive pay go?

A: For most claims, retroactive pay can go back to the effective date of the claim, which is typically the date the VA received the claim. However, for claims filed within one year of discharge, the effective date can be as early as the day after discharge.

2. Q: Do I need to apply separately for retroactive pay?

A: No, retroactive pay is automatically calculated and awarded when your disability claim is approved. You don’t need to file a separate application.

3. Q: How long does it take to receive retroactive pay after approval?

A: Typically, retroactive pay is processed within 1-2 weeks after the award letter is issued. However, it can sometimes take up to a few months, especially for large amounts.

4. Q: Is retroactive pay taxable?

A: No, VA disability compensation, including retroactive pay, is not taxable income.

5. Q: Can I get retroactive pay for secondary conditions?

A: Yes, if a secondary condition is service-connected, you can receive retroactive pay back to the effective date of the claim for that condition.

Remember, while these FAQs cover common questions, every veteran’s situation is unique. If you have specific questions about your retroactive pay, it’s best to consult with a VA representative or accredited attorney for personalized advice. Check us out at Benefits.com to see if you qualify for benefits today.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.