Supplemental Security Income (also known as SSI disability benefits) is reserved for adults and children who meet the Social Security Administration’s eligibility guidelines.

SSI for children falls under many of the same guidelines as SSI for adults. The child must have a qualifying disability and the household must meet income limits. SSI for children is only for kids under age 18–or under 22 if they are attending school.

21 Common Questions About SSI

- What is SSI?

- Can a child qualify for Social Security disability benefits?

- What are SSI benefits for children?

- How does the SSA decide if a child is disabled?

- How does Social Security choose which children get SSI?

- What are the eligibility requirements for child SSI benefits?

- How does income affect SSI?

- How is a child’s SSI payment supposed to be spent?

- What is a representative payee?

- Can disabled children in foster care qualify for SSI?

- Can children of members of the U.S. Armed Forces qualify for SSI?

- How do you apply for child SSI benefits?

- What is the application process for child SSI benefits?

- What is a child disability report?

- How does deeming work for a child?

- What is the Medical and School Worksheet?

- What happens during the disability interview?

- How long does it take for a decision from Social Security?

- Are teenagers on SSI allowed to work?

- What happens when a child reaches age 18?

- What other services may be available for disabled children?

SSI for children can help a family with a disabled child afford essentials like food, housing, clothing, and medical equipment. The Social Security Administration (SSA) pays this monthly benefit to an SSI child based on the child’s and parent’s income and assets. An eligible child must have a qualifying disability that falls within the SSA’s guidelines with proof from a physician or medical specialist to prove the child’s diagnosis or symptoms.

SSI for children or adults should not be confused with other Social Security benefits, like Social Security Disability Insurance (SSDI). They are completely separate programs.

21 Common Questions About SSI for Children

As a parent or caregiver who is just learning about this Social Security benefit for a child, it can be helpful to get your questions about SSI eligibility and the SSI application answered. The following frequently asked questions about SSI for children can help.

1. What is SSI?

Supplemental Security Income (SSI) is one of two Social Security disability benefits that the SSA allocates to disabled individuals. SSDI is the other one, but that benefit is strictly for adults who have paid into the Social Security system through their jobs. In contrast, SSI is for adult and child beneficiaries who are disabled.

For those with SSI benefits, the SSA pays a monthly benefit based on the household’s income. SSI for children counts the child’s and their parent’s income and assets to determine the monthly payment amount. SSI disability income is intended to help families buy essentials for the disabled individual.

The SSA partners with states to administer the SSI program. Each state runs its own SSI program based on federal guidelines, but income eligibility may vary by state due to cost of living differences. The funds used to pay SSI recipients come from the U.S. Treasury’s personal and business tax collections.

2. Can a child qualify for Social Security disability benefits?

Yes, children may qualify as SSI beneficiaries. For children to receive SSI benefits, the SSA says that the child’s disability must seriously inhibit their daily activities, like going to school or eating. Additionally, the child’s condition should be expected to last at least a year rather than being a short-term condition.

The SSA pays SSI for children who are under 18 years old or under 22 years old if they’re still attending school regularly. A minor child’s SSI benefit gets managed by a representative payee — usually, a parent or caregiver — who oversees and spends the money as needed for the child’s benefit.

The SSA and each state have strict guidelines on how representative payees can use SSI for children, but the primary goal of the disability benefit is to ensure that a disabled child’s basic needs are met.

3. What are SSI benefits for children?

SSI for children is for a disabled child who is under age 18, or under age 22 if attending school. The child must be blind or disabled in another way. This list of child disabilities explains the many categories of potential disabilities, like mental conditions and failure to thrive in children, that may qualify a child to receive SSI benefits.

Although the SSA, a federal government agency, manages and oversees the SSI program, parents can apply and receive communication about their child’s case through their local Social Security Office. This office may ask parents or guardians to provide information about how they’ve spent their child’s money and income information to determine their child’s monthly benefit amount.

An adult child who once received SSI disability benefits may transition into the adult program if the SSA determines that their disability hinders their daily activities.

4. How does the SSA decide if a child is disabled?

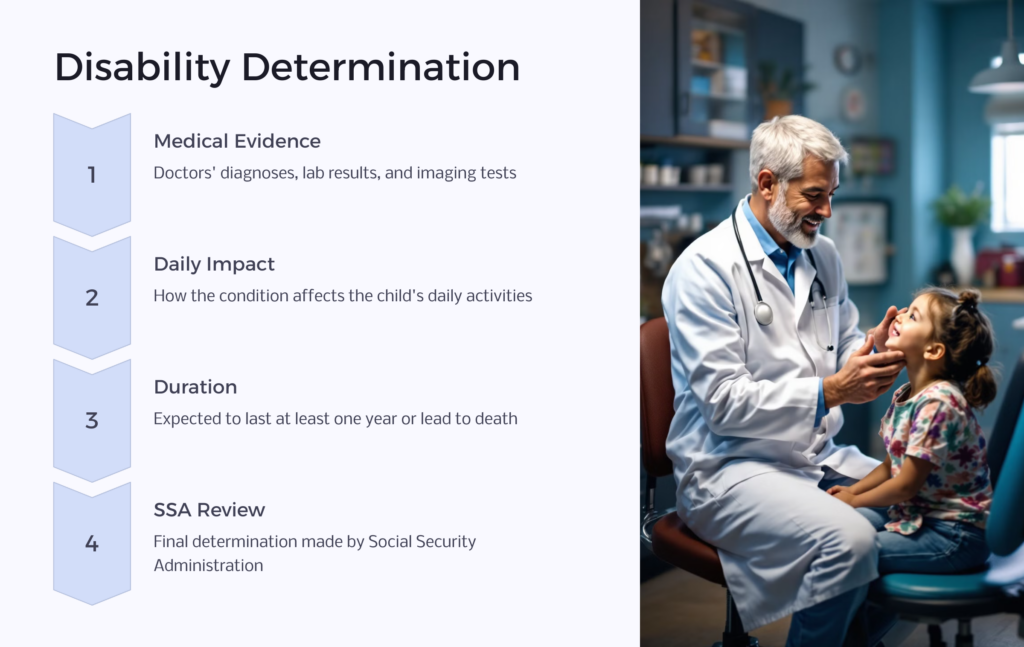

Disability determination for a child looks a bit differently depending on the child’s medical condition. The SSA has set guidelines for each type of disability based on the category in which it falls, like respiratory disorders, congenital disorders that affect multiple body systems, and cancer.

The parent or guardian must furnish as much information about the child’s medical condition as possible in most cases. This includes written statements of the child’s daily symptoms, medical diagnoses from doctors and specialists, and results of lab or imaging tests.

The SSA also considers whether a child is working, has severe limitations due to their disability, and has a disability that is expected to last at least one full year or lead to death.

5. How does Social Security choose which children get SSI?

The SSA reserves SSI for those who are severely impacted daily by their disability. Any disabled child who meets the SSA’s qualifications for SSI based on family income, disability determination, and age may qualify for SSI.

Once the SSA reviews all submitted information, it contacts the family with a disability determination. Parents or guardians can choose to appeal a decision if it’s not what they were hoping for. Although they can tackle the appeals process themselves, it typically benefits families to seek a disability lawyer to guide them through the process.

6. What are the eligibility requirements for child SSI benefits?

Children who are under 18 years of age, or under 22 if enrolled in school, may receive a monthly SSI payment. However, other conditions apply for a child to receive income from SSI.

First, a child must qualify based on their disability. The SSA considers all medical evidence of the disability along with written statements regarding the child’s condition and how their symptoms affect necessary daily tasks. If the SSA requires any more information about the condition, it may request tests or exams, which the agency pays for.

Families must also qualify by income. The SSA considers only countable income, which is any earned income or unearned income that’s excluded from being considered as part of the family’s income. Non-countable income includes rent subsidies, state assistance, and income tax refunds.

Families must have a limited income that fits within the SSA’s maximum income guidelines for the child to qualify for benefits each month.

7. How does income affect SSI?

One of the most important elements the SSA considers to qualify a child for SSI benefits is income. The SSA considers the household’s income as a whole, so the child’s and their parent’s income is included in its calculations. Typically, the SSA considers the annual income of the household. In households with varying incomes, the SSA may require families to submit monthly income documentation.

The SSA updates its income guidelines regularly, usually annually, to meet financial fluctuation. Each state has different guidelines based on the cost of living and average incomes. You can check with your local SSA office to ask about income guidelines.

When considering income, the SSA does not count some household cash flow, including the first $20 of monthly income, home energy assistance, repayable loans, and scholarships and grants used toward education. In contrast, child support, alimony, and other unearned income may be counted as household income.

8. How is a child’s SSI payment supposed to be spent?

SSI for children is meant to help families pay for necessities for a disabled child. It’s similar to child support payments in that SSI can pay for the child’s food, clothing, entertainment, and educational needs. Parents and guardians can also use the benefit to help pay for the child’s housing costs, such as a portion of rent and utilities. Of course, families can also use SSI benefits to buy medical-related items or services for the child.

The person in charge of allocating the child’s SSI payments may also set aside a portion of each payment to the child’s savings account or to pay off debts, such as past-due medical or rent bills. SSI back pay works a bit differently, though, as it must go into a dedicated account and can only be spent on specific things, like medical expenses and specialized equipment to assist the child.

9. What is a representative payee?

A representative payee is a responsible person that handles a child’s SSI payment. Because the child is a minor, their SSI payments must be managed by a representative payee. This is usually a parent or guardian of the child, but it also could be an adult sibling or another family member who assists with the child. The representative payee is responsible for spending or saving SSI payments in ways that benefit the child.

If a child gets back paid SSI benefits for six months or more, the representative payee must put that back pay into a dedicated account. Money in the dedicated account can only be used for specific expenses related to the child’s disability and education. The SSA monitors how the representative payee uses the fund every year.

10. Can disabled children in foster care qualify for SSI?

If a child in foster care receives foster care benefits through the Title IV-E federal program, they typically cannot qualify for SSI benefits too. These federal benefits last until the child turns 18, but the SSA allows SSI applications for the child to be sent up to 180 days before their 18th birthday or before the payments are expected to stop to get the process started.

Some states allow extended eligibility for children in foster care, meaning that they can continue to receive federal foster care benefits past age 18 if needed. If the adult child still receives foster care benefits past age 18 due to their state’s extension, they may not qualify for SSI benefits due to income.

11. Can children of members of the U.S. Armed Forces qualify for SSI?

Children of members of the U.S. Armed Forces can qualify for SSI if the household does not go over income guidelines for the program. The child’s eligibility will depend on deemed income, like parental income and the child’s assets, just like any other child who applies for SSI benefits.

Children may also qualify for SSI if they move overseas due to a parent’s military requirements. This differs from adults on SSI, who are ineligible to receive payments if they live overseas. For a child to be eligible, they must be a U.S. citizen and live with the parent who has been assigned to a duty station outside of the United States.

However, unlike other recipients of SSI for children, children of parents in the military living overseas may not receive Medicaid benefits to help with healthcare costs.

12. How do you apply for child SSI benefits?

Parents and legal guardians may apply for SSI for children online or through their local SSA office. If applying online, they can use the Child Disability Starter Kit to walk through the process step-by-step. The Child Disability Starter Kit includes information about applying, a Child Disability Interview, and a Medical and School Worksheet to help parents and guardians prepare for the application.

Parents should fill out a Child Disability Report before the application. This report gives the SSA important information about the child’s medical condition and how it affects them. The SSA will then contact the family within a few business days with the following steps to apply.

13. What is the application process for child SSI benefits?

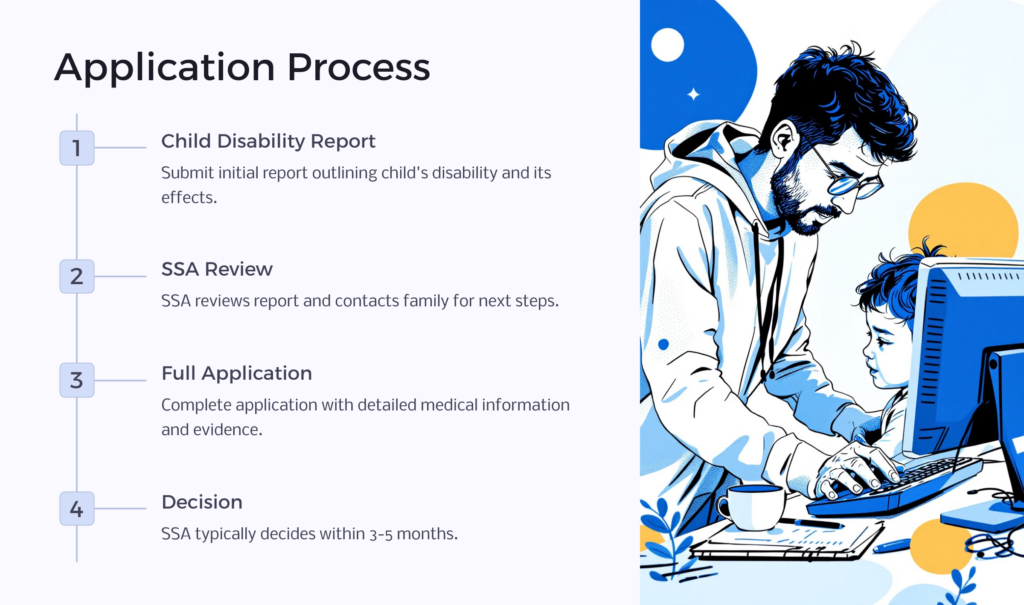

First, parents must submit a Child Disability Report to the SSA outlining the child’s disability and how it affects their ability to complete daily tasks. The SSA reviews this information before contacting the family with the next steps to complete the full application.

The application asks more questions about the child’s medical condition, symptoms, and types of treatment tried or currently being used. Then, the state’s SSA office reviews the information to determine whether the child is considered disabled based on SSA guidelines.

From here, your child’s medical doctors and specialists may need to provide medical evidence in the form of lab results, imaging tests, exam observations, etc. You can also send information from your child’s school if their disability interferes with learning or their school experience. Finally, your state’s SSA office reviews the information to give a ruling on SSI disability benefits.

14. What is a child disability report?

The Child Disability Report is a form required by the SSA for parents or legal guardians to fill out prior to completing an application for SSI for children. This report can be filled out on paper or online.

The purpose of this report is to give the SSA an overview of your child’s disability. The report can include medical records, written statements, and other evidence that proves your child’s condition and how it affects the child’s quality of life.

The SSA uses this information as preliminary data to help it review your child’s case. Once the SSA reviews the Child Disability Report, it will contact you to complete the full application, for which you may need to provide more information and medical evidence.

15. How does deeming work for a child?

Deeming is the process the SSA uses to determine how much of a parent’s and other household members’ incomes should count toward the child’s income and resources. The SSA typically considers some of the parents’ income and some of a stepparent’s income as deemed income for disability benefits determination.

However, the SSA also excludes some parental income and deducts some expenses, income, and resources from a child’s deemed income. For example, Temporary Assistance for Needy Families and some cash assistance payments are not considered when deeming income.

Deeming income also applies to students who are away at sc

ool for most of the week but return home on weekends or school holidays.

16. What is the Medical and School Worksheet?

The Medical and School Worksheet is a free worksheet provided by the SSA to help parents and guardians prepare to complete the Child Disability Report. The worksheet asks basic questions about the child applying for SSI, such as testing at school the child has had related to their disability and the hospitals or specialists the child has seen for testing, exams, and consultations.

Parents and guardians can use the worksheet to gather necessary information about their child. Then, when they complete the online Child Disability Report or call the SSA to apply for SSI benefits, they can use the information on the worksheet to answer questions.

17. What happens during the disability interview?

The disability interview for SSI eligibility can happen online or over the phone. In either case, you’ll need to provide in-depth information about your child’s medical condition, diagnosis, tests and procedures, and symptoms. You can use the information from the Medical and School Worksheet to help you answer questions.

To prepare for the interview, be sure to have the Medical and School Worksheet completely filled out with accurate information in each section. Also, have the names, addresses, and phone numbers of all medical specialists and doctors your child sees regularly or has seen related to their condition.

Parents and guardians should also have information about:

- The child’s school(s)

- Medications the child takes

- Proof of income for the child and household

- Medical and other government assistance the child or family receives

- Names and social security numbers of all household members

- Name and address of an adult who cares for the child in addition to a parent or guardian, if any

- The school’s Individualized Education Program (IEP) for the child

18. How long does it take for a decision from Social Security?

The SSA typically takes several weeks to review all information you’ve turned in about your child. After gathering more information from specialists and reviewing all written statements you’ve provided, the SSA usually sends a letter to parents or guardians to determine SSI benefits within three to five months.

The letter will explain SSI for children and how much your child is entitled to each month based on your household income. It will also explain the process of appealing a decision, if necessary, which you can do on your own or with the help of a disability attorney.

19. Are teenagers on SSI allowed to work?

Yes, teenagers with SSI for children can usually work if they want to. However, some of their income counts toward the countable income and assets for disability benefit determination. Still, the SSA counts only a portion of a child’s income, especially if they’re still in school.

Additionally, children over 15 years of age can create a Plan to Achieve Self-Support (PASS). PASS allows them to save money toward a goal to help them when they reach adulthood, and the SSA will not count this income.

20. What happens when a child reaches age 18?

When a child who receives SSI benefits turns 18, they will be considered an adult under the program. That means that they can continue to receive SSI benefits if they still qualify as an adult.

However, the SSA considers income a bit differently for adults receiving SSI. Similarly, the adult definition of disability differs from the child definition of disability according to SSA guidelines. Therefore, the adult child would need to reapply under the adult program to determine whether they can continue to receive benefits.

21. What other services may be available for disabled children?

Other government-funded programs may assist children with disabilities and their families in addition to SSI for children. One program that most SSI recipients can automatically qualify for is Medicaid, which pays for health care services, including diagnostic and treatment services and durable medical equipment.

The Children’s Health Insurance Program (CHIP) is offered to children under 19 who may not qualify for Medicaid based on income. It’s almost like an extended Medicaid program that offers similar services to those just over Medicaid’s income guidelines.

Many SSI recipients may also receive Supplemental Nutrition Assistance Program (SNAP) benefits, which help low-income families pay for food. Cash assistance from Temporary Assistance for Needy Families (TANF) may also be available.

Call or visit your local health department for more information about applying.

Understanding SSI for Children

SSI for children can provide necessary financial assistance for a disabled child in a low-income family. The benefits can cover health care, food, clothing, housing, and other essential costs for the child. SSI recipients qualify based on their disability, income, and resources.

To apply for SSI benefits for a child, reach out to a disability advocate or visit SSA.gov to find worksheets and guides to help you prepare for the disability interview and apply online.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.