Social Security recipients that exceed more than $25,000/year filing individually or $32,000/year jointly; will need to pay federal income taxes on their benefits. The recipient can submit a request to pay taxes throughout the year instead of paying a large bill at tax time.

You can pay the IRS directly or withhold taxes from your payment. You may choose to withhold 7%, 10%, 12%, or 22% of your monthly payment. There are a couple of options to do this:

- Call 1-800-772-1213 and tell the representative what percent of your monthly payment you want to withhold for taxes.

- Or fax or mail documents to your local office. Download Form W-4V: Voluntary Withholding Request from the IRS’ website. Then, find the Social Security office closest to your home and fax or mail us the completed form.

- After you submit a request, SSA will mail you a letter confirming your tax withholding.

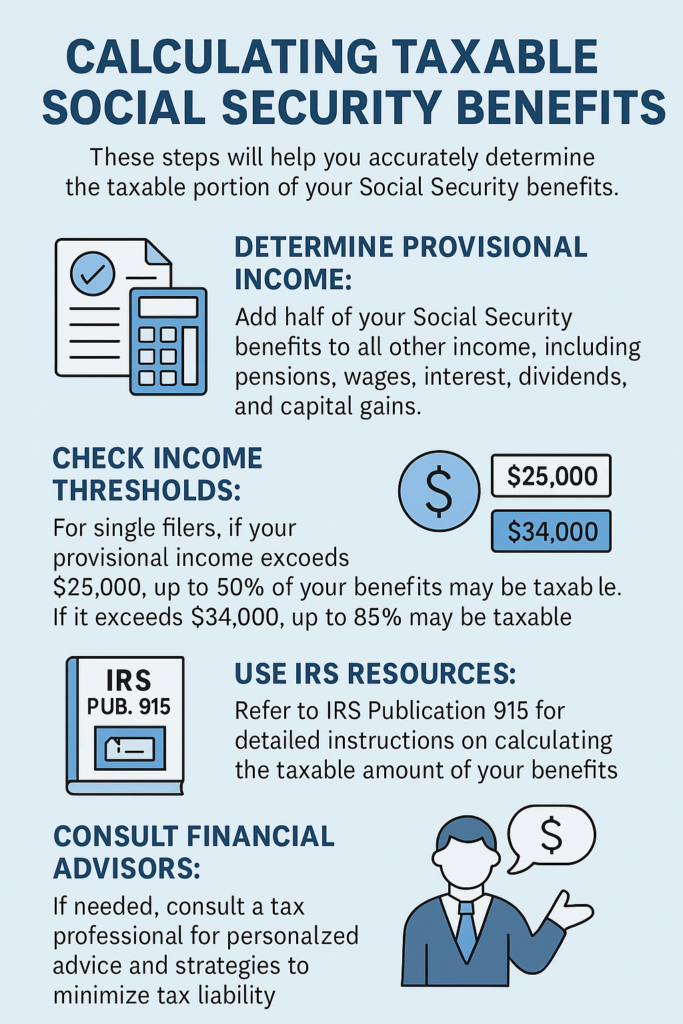

Calculating Taxable Social Security Benefits

- Determine Provisional Income: Add half of your Social Security benefits to all other income, including pensions, wages, interest dividends, and capital gains.

- Check Income Thresholds: For single filers, in your provisional income exceeds $25,000, up to 50% of your benefits may be taxable. If it exceeds $34,000, up to 85% may be taxable.

- Use IRS Resources: Refer to IRS Publication 915 for detailed instructions on calculating the taxable amount of your benefits.

- Consult Financial Advisors: If needed, consult a tax professional for personalized advice and strategies to minimize tax liability.

These steps will help you accurately determine the taxable portion of your Social Security benefits.

Understanding the Underpayment Penalty and How to Avoid It

If you paid at least 90% of the tax on your current-year return or 100% of the tax shown on the prior year’s return, you can avoid the underpayment penalty for estimated taxes.

Another way to avoid an underpayment penalty in the future is to adjust your withholdings on your W-4, if you have an employer. Reducing your number of dependents or adding an extra withholding amount on line 4(c) can help ensure you’re having enough tax withheld from your paycheck to cover your tax bill. You can use the IRS withholding estimator to check whether you’re on track.

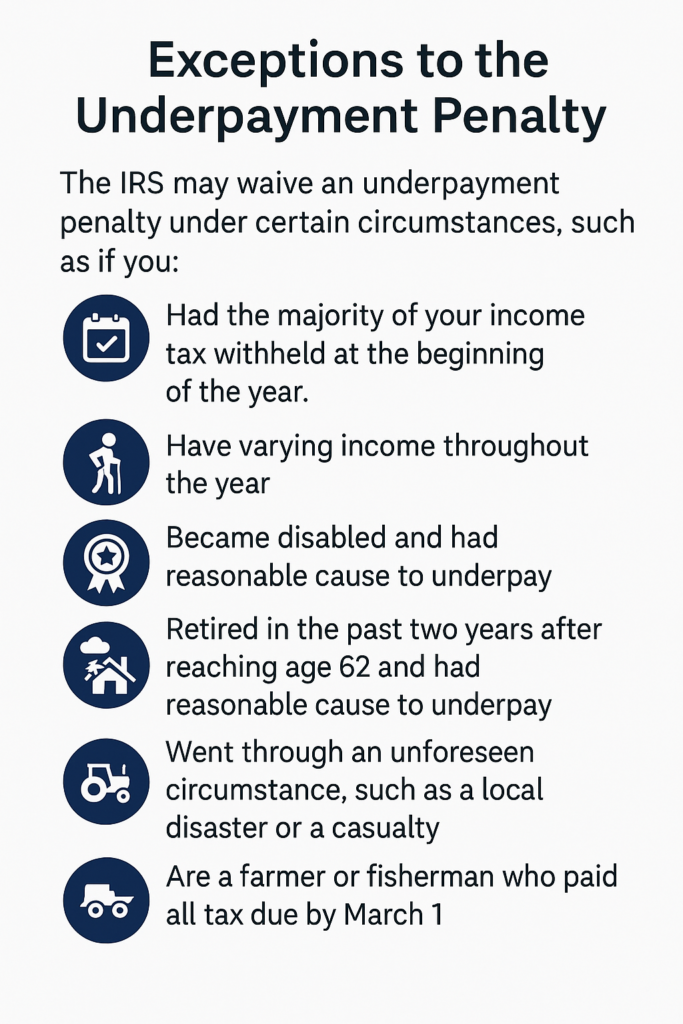

Exceptions to the Underpayment Penalty

The IRS may waive an underpayment penalty under certain circumstances, such as if you:

- Had the majority of your income tax withheld at the beginning of the year.

- Have varying income throughout the year.

- Became disabled and had reasonable cause to underpay.

- Retired in the past two years after reaching age 62 and had reasonable cause to underpay.

- Went through an unforeseen circumstance, such as a local disaster or a casualty.

- Are a farmer or fisherman who paid all tax due by March 1.

Check us out at Benefits.com and take our quiz so we can get started helping you on your path to receiving benefits.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.