Receiving a Social Security overpayment can be stressful, but there are steps you can take to resolve the issue. Whether the overpayment was due to an error or a change in your circumstances, it’s essential to take action to avoid future overpayments and potential penalties. In this article, we’ll explore what to do after a Social Security overpayment, how to identify the cause, repay the amount owed, and appeal the decision if necessary.

Why did I get a notice of overpayment?

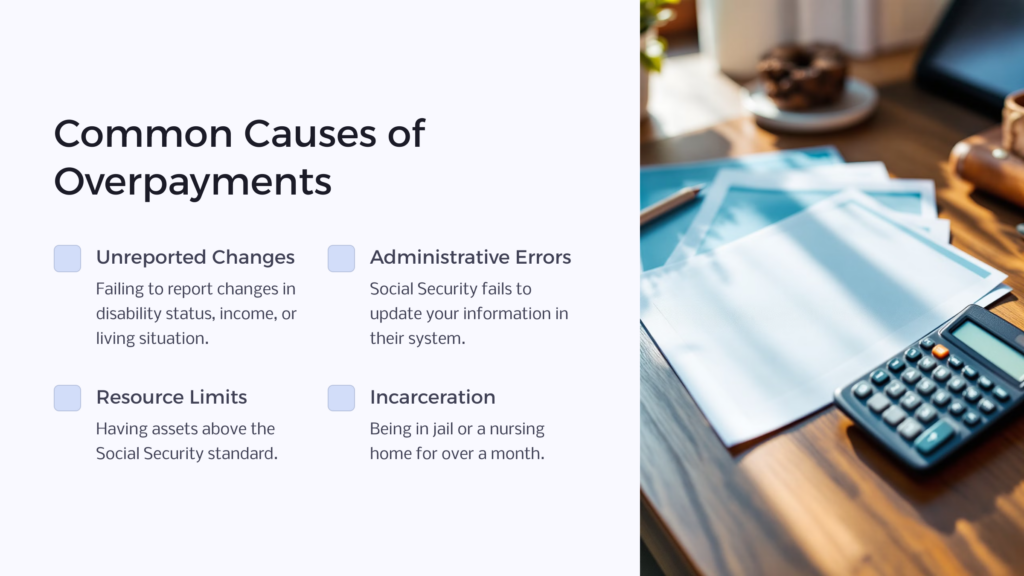

Here are some factors that may be responsible for overpayment:

- You were no longer disabled but kept receiving SSI payments.

- You fail to report your income to the social security Administration.

- You got married, or a spouse moved in with you, and you failed to inform social security.

- You got in jail or a nursing home for over a month.

- You informed social security of your change in the situation, but they didn’t update your information in their system.

- You earned a lot of money.

- You had a lot of resources (also known as assets) above the social security standard.

What steps should I take if social security claims that I was overpaid?

When social security claim that you were overpaid, you have three options:

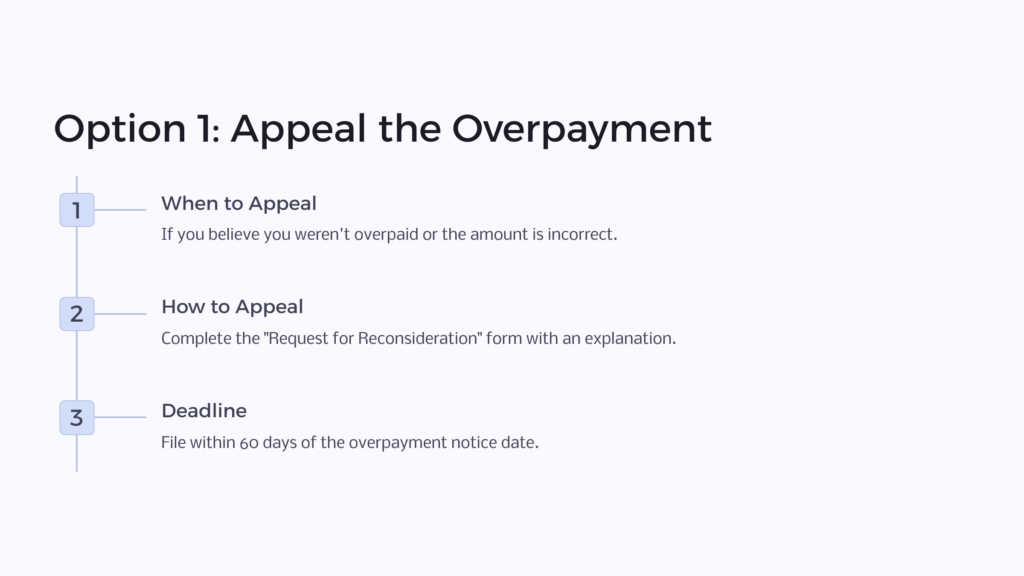

Option 1 Appeal

When should you appeal?

You can appeal if you think you were not overpaid or the overpayment amount is higher.

How do I appeal?

- Complete the appeal form (a “Request for Reconsideration”).

- Attach another page to the form. On this second page, explain why you think the social security administration overpaid you, or the acclaimed overpaid amount is wrong.

Is there a deadline for appeal?

Yes. Be sure to file your appeal within 60 days of the date you were issued the overpayment notice. Failure to file an appeal for Social Security Disability hearing within this period cancels your right to appeal.

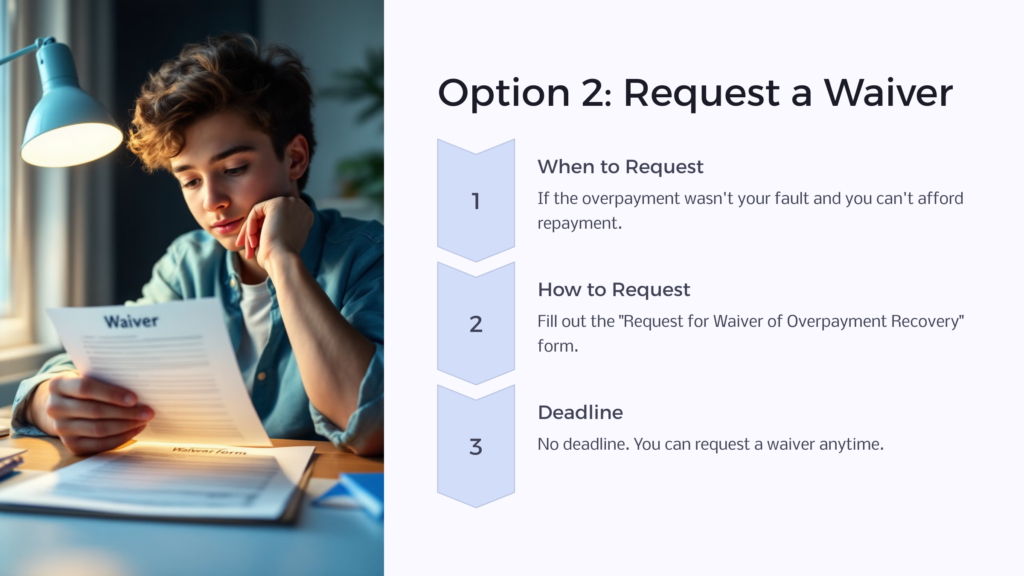

Option 2: Request for a Waiver

When should you request a waiver?

Ask for a waiver if the overpayment occurred due to no fault of your own, and you cannot afford to repay the money.

How do you ask for a waiver?

Fill out the “Request for waiver of Overpayment recovery” form. When it comes to waiving a repayment, you have to prove that the overpayment was due to no fault of your own and that you cannot afford to repay the money.

Is there a deadline to request a waiver?

No. There’s no deadline. Feel free to ask for a waiver anytime.

Option 3: Ask for a payment plan

When should you ask for a payment plan?

Ask for a payment plan if you cannot repay the overpayment.

How do you ask for a payment plan?

Write a letter to social security. Inform them of how much you can afford to pay monthly.

Complete the “Request for change in Overpayment Recovery Rate” form. This indicates how much you’re able to pay every month.

What should I do if I cannot pay anymore after agreeing to a payment plan?

There are many reasons to repay an overpayment. However, If an issue arises and you cannot continue to pay the same amount anymore, contact the SSDI and request a change in the payment plan.

Helpful tips

- Take a step. If you don’t do anything, the social security Administration will start deducting the money from your benefits.

- File a waiver, an appeal, or a payment request. Plan now. Doing this will stop SSA from deducting your full benefits. But if they reject your waiver, appeal, or payment plan, you’ll have no choice but to pay it back.

- Provide your papers to the social security office physically.

- Keep a copy of the papers for yourself. When giving them your papers, request a receipt should SSA lose your paper.

- Write down what the admin tells you when discussing it in the social security office.

- That way, if what they tell you is different, you should ask questions.

How do I prevent overpayment from occurring in the future?

SSDI beneficiaries as well as any SSI recipient, must inform social security of any change in employment, income, marital status, or loving situation.

Most overpayments are due to the SSI beneficiary failing to keep up with reports. Therefore, update SSA on these changes to avoid troubles and costly overpayments.

To avoid an SSDI overpayment, keep a detailed record of your resources and income, and inform social security of any changes to your condition.

If you’re currently working, even if it’s in the Ticket to Work program, be sure to inform social security about how much you earn. Always keep a record and pay stub of your monthly income.

Inform social security about:

- The change to your address

- The money you made from working

- Every payment you receive ( including child support and worker’s compensation)

- Money received from inheritance or court cases, and assistance from someone buying your food or paying your rent.

The golden rule is that you must inform social security about the changes to your situation.

This includes changes to your:

- Resources

- Income

- Address

- Home Living Conditions.

Add a copy of your proof (checks, pay stub, or anything displaying your updated address) to the letter.

Send the actual letter by email and request a return receipt. Keep the receipt from the office. Be sure to keep the receipt.

Put a call through to social security to report your monthly earnings, by the 10th of each month.

Lastly, don’t be worried if you receive an overpayment notice. Now you know how social security will handle an overpayment, you’ll be much more prepared.

How Benefits.com can help

Are you struggling with overpayments of social security benefits or wondering how to repay social security? We at benefits.com are to help you get back on track!

We understand that receiving social security overpayments can be a stressful and overwhelming experience. That’s why our team of experts at benefit.com is dedicated to helping you navigate this difficult situation.

Our online resource provides you with the necessary information and tools to understand the process of managing social security overpayments. In addition, we offer step-by-step guidance on correcting the overpayment, creating a payment plan, and even requesting a waiver.

At benefits.com, we know that every situation is unique, and we work with you to find the best solution to any issue with your SSDI benefits. Our team is committed to helping you get back on your feet, and we’ll work with you every step of the way to ensure your financial stability.

So, if you’re dealing with a social security benefit overpayment, don’t let it stress you out any longer. Contact us today to learn more about our services and how we can help you overcome this hurdle.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.