The first question most people ask once they’re approved for Social Security Disability (SSD aka SSDI) or SSI benefits is when will I start receiving benefits? That depends on when your state’s Disability Determination Services (DDS) decides your disability actually began. For example,

If—based on information you or your doctor provided—the DDS decides your disability “officially” began on, say, January 15, then your first monthly SSDI disability benefit would be paid for the month of July in the month of August. Why so much later?

Because, initially, there’s a five-month delay, during which time the benefits accumulate as “back pay.” Then benefits are paid in the month following the month for which they are due. So your July benefit would be paid in August…your August benefit would be paid in September…and so on.

Or, for example, if your disability began on, say, June 10, then your first disability benefit would be paid for the month of December, and you would receive it the following month—in January.

Note: If your family members are eligible for benefits based on your work, they would receive a separate Award Notice. Also, if you believe that any benefit amount is not correct, you’ll need to contact the SSA within 60 days.

How You Will Receive Your Social Security Disability Payments

SSI is always paid on the first of the month. If you receive both SSDI and SSI, your SSDI benefit will arrive on the third of each month. If you do not receive SSI, your SSDI payment date is based on your day of birth as follows:

- Birth date on 1-10 = 2nd Wednesday of each month

- Birth date on 11-20 = 3rd Wednesday of each month

- Birth date on 21-31 = 4th Wednesday of each month

Individuals who started receiving Social Security before pay dates were spread out over the month receive their SSDI benefits on the third, regardless of their date of birth.

When a payment date falls on a Saturday, Sunday or national holiday, the benefit will be paid on the preceding work day.

How your disability payments will be paid to you

For decades, the SSA mailed benefit checks to recipients once a month, at a gigantic cost for check printing, envelopes and postage. But countless benefit checks were stolen from mailboxes or in other ways before the intended recipients ever saw them, and there were additional expenses, plus delays for investigations and for issuing duplicate checks. But all that changed in 2011.

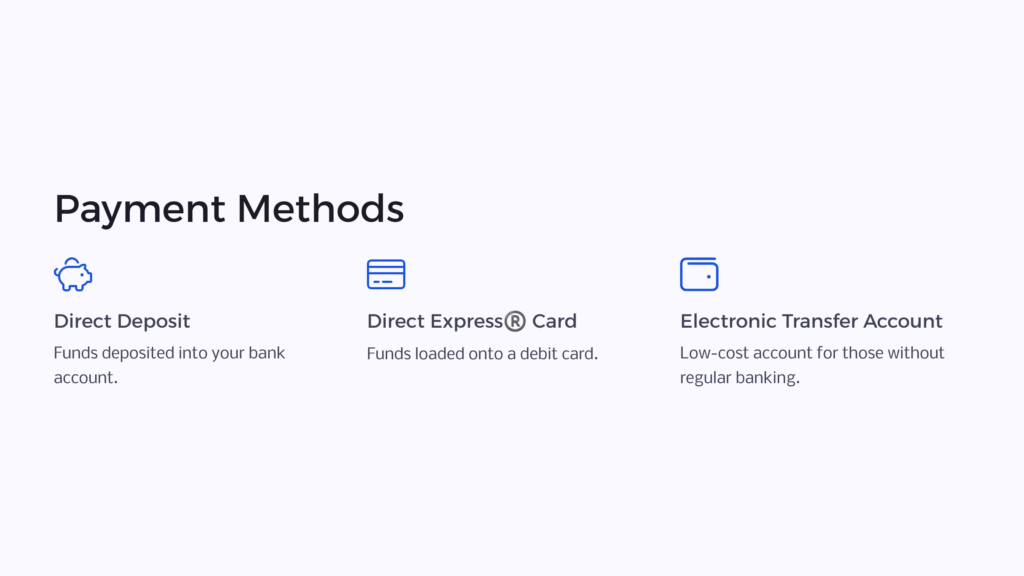

Now, the SSA gives recipients a choice of 3 more secure options, and the funds are available the same day they’re deposited:

Electronic payments: You can receive your monthly payments via direct deposit right into your checking or savings account at your bank, savings & loan, or credit union.

Direct Express® debit card.

Each month, the SSA will deposit funds electronically into your Direct Express account (available on request) and you can use your card (it’s free) as you would any debit card, to pay for purchases or withdraw money from ATMs. (There may be ATM fees.)

Electronic Transfer Account (ETA)

This is a low-cost (to you) account you can set up at any participating, federally-insured bank, S&L or credit union. It was designed for recipients who don’t have, or don’t qualify for, a regular checking or savings account. (Your benefits are protected, under federal law, from attachments or garnishments by creditors to satisfy any obligations you may owe, except for child support or alimony obligations.)

Before or after you’re approved for SSD or SSI benefits, you’ll need to tell the SSA which of these 3 options you prefer, since (with rare exceptions) they are no longer sending out paper benefit checks.

Important Facts About Your Social Security Disability Payments

Are SSD benefit payments taxable?

That depends on your total income for the year from other sources, such as wages, self-employment, interest, dividends and/or other taxable income.

If you file an individual federal tax return and your total adjusted annual income is more than $25,000 or if you and your spouse file a joint return and your combined adjusted gross income is over $32,000, you will have to pay taxes on a portion of your SSD benefits. Adjusted gross income between over $25,00 up to $34,000 (over $32,000 and $44,000 for joint filing) results in up to 50% of your Social Security being taxed. Income above those amounts results in a greater portion of Social Security being taxed with a maximum percentage of 85% of Social Security being taxed. Some states with income tax do not tax Social Security and others do. Supplemental Security Income (SSI) benefits, as a public welfare income, is not taxable.

The Social Security Administration may contact you

Yes, especially when they need to verify that you are still eligible for SSD benefits. They may send you a letter or phone you. If someone phones you, don’t reveal your entire SSN; only verify the last four digits, because the caller may not really be with the SSA. Or someone claiming to be an SSA representative may show up at your door and display ID (which is easy to counterfeit these days). So it’s a good idea, for security reasons, to call your local SSA office (keep their number by your phone) and ask if someone was actually sent to see you. Or, if there’s an SSA office near you, and you’re able to travel, you might make an appointment and go there to verify that you’re still eligible for benefits.

Will you lose your SSD benefits if you work and earn money?

That depends on several factors. The SSA has special rules that may make it possible for you to work and still receive your monthly SSD benefits.

A trial work period allows you to test your ability to work for at least nine months. During this period, you’ll receive your full benefits regardless of how much you earn, as long as you report your work activity and continue to have a disabling impairment.

Currently, a trial work month is any month in which your total wages are more than $910; OR, if self-employed, your net profit is more than $910; OR if in your first two years of disability, you work over 80 hours in your own business. The trial work period is nine months of work, not necessarily consecutive months, at the trial work period earnings level that may spread over a 60-month period.

Then, after your trial work period, you’ll have 36 months during which you can work and still receive benefits for any month your earnings are not “substantial,” typically meaning less than $1,260/month or $2,110/month if you are blind.

No new application or disability decision is needed to receive an SSD benefit during this period.

What should you know about the SSA’s Ticket to Work program?

If it’s possible, the SSA would much rather have you working (even if just a little) than for you to do nothing all day. Of course, working will bring in additional income and maintain your work skills or help you learn new ones.

That’s why they created Ticket to Work—an employment support program for people with disabilities who are interested in going to work or increasing the work they already do. Its goal is to increase opportunities and choices for SSD beneficiaries to obtain vocational rehabilitation, part- or full-time employment, and other support services from public and private providers, employers (including even one-person firms) and other organizations. Each provider is called an Employment Network (EN) and receives government funding.

If the SSA notifies you that you’re eligible to participate in the program as a ticket-holder (you’re given a voucher), you’re encouraged to contact the Ticket to Work Operations Support Manager to learn about the various EN’s in your area and to select one.

That EN, if it decides to accept your ticket—after considering your work experience, skills, disability, age, address, etc.—will coordinate and provide appropriate services to help you find and maintain employment and/or the other services you may need. However, ENs are not required to serve everyone who selects them. They can select which specific services they want to offer, which people they are capable of serving, and in which geographical area they will work. At any time, you can switch to another EN (or) the EN can end its agreement with you.

The program is voluntary and performance-based. ENs receive payments when you, the ticket-holder, achieve certain employment-related milestones or outcomes.

Will your SSD benefit amount increase if your disability gets worse or you have additional health problems?

No. It stays the same since it’s based on your lifetime earnings (those covered by Social Security) before your disability began—not on the severity of your disability. However, if you go back to work after you start receiving your disability benefits, you may be eligible for a higher benefit amount based on those new earnings being added to your former lifetime average.

Will the SSA ever review your medical condition, to see if you still qualify for SSD benefits?

Yes, as mentioned above. They need to make sure their limited funds go to those who really need them.

How often will the reviews be?

It depends on how severe your condition is and the likelihood it will improve. Your Award Notice will tell you when to expect your first review.

- If your condition is expected to improve within a specific time, your first review may be six to 18 months after you start getting disability benefits.

- Then, if improvement is still considered possible, your case may be reviewed about every three years.

- However, if your condition is unlikely to improve, your case may be reviewed only about once every five to seven years.

Your SSDI benefits will continue… unless there is strong proof that your condition has improved medically and you are able to return to work.

What happens during a review?

After the SSA sends you a letter telling you to expect a review, your local SSA office will contact you to explain the review process and your appeal rights (if needed). The representative will ask you to provide information about your current medical treatment and any work that you may have done or are doing.

Next, a “team”—a disability examiner and a doctor—will review your file and request your medical reports. You may be asked to have a special examination, which the SSA will pay for (along with some travel expenses).

When a decision is made, you’ll be notified by mail. If they decide you still are disabled, your benefits will continue. If they decide you’re no longer eligible for SSD benefits, you can appeal their decision.

Will you receive a Cost of Living Adjustment (COLA) each January?

If the official cost-of-living index has gone up during the previous year, your SSD benefit amount will be increased by the same percentage. If not, your benefit amount will remain the same.

What will happen when you reach “full retirement age”?

The SSA’s official “full retirement age”—aka “normal retirement age”—for retirement benefits has been 65 for decades. However, it’s gradually increasing to 67, because people are living longer and the SSA needs to reduce their financial obligations. If you become 67 while receiving SSD benefits, you’ll start receiving the regular SSA retirement benefits instead.

You’ll be automatically enrolled in Medicare after you’ve received SSD benefits for 24 months, regardless of your age.

Or you may qualify for Medicare coverage almost immediately, if you have permanent kidney failure requiring regular dialysis or a transplant or if you have amyotrophic lateral sclerosis (ALS or “Lou Gehrig’s disease”).

Your Medicare coverage will have three parts:

Hospital insurance (Part A) – Helps pay for inpatient hospital bills and some follow-up care. It’s free. [The taxes you paid while you were working financed this coverage.]

Medical insurance (Part B) – Helps pay doctors’ bills, outpatient hospital care and other medical services. You’ll need to pay a monthly premium (via automatic deductions) for this coverage if you want it.

Medicare insurance (Part D) – Helps pay for prescription medications.

Premiums are required for Parts B and D.

Reporting Responsibilities

Once you (or family members who receive benefits based on your work record) start receiving SSD benefits you’ll be responsible for promptly telling the SSA of any changes that could affect your benefits.

Be prepared to give the date of any events you report and (if different) the name of the person about whom the change report is made. If you do not report a change, it may result in your being overpaid. If so, you will have to repay the excess money. Also, if the SSA considers it fraudulent, your benefits will be stopped.

Know your SSD claim number; use it whenever contacting the SSA

It will be on the Award Notice you’ll receive when the SSA approves your claim or appeal. If you receive benefits based on your own work, your claim number will be the same as your Social Security number (SSN) followed by the letters “HA.” If you receive benefits based on someone else’s work, it will be the other person’s SSN followed by a different letter.

Note: Information you or family members give to another government agency (federal, state or local) may be provided to the SSA by the other agency, but you must report changes directly to the SSA in case it isn’t.

Warning: If the SSA learns that you purposely gave them incomplete or false information, your benefits will be stopped. For the first violation, your benefits will be stopped for six months; for the second violation, 12 months; and for the third, 24 months.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.