Can mental illness serve as the basis for Social Security Disability payments?

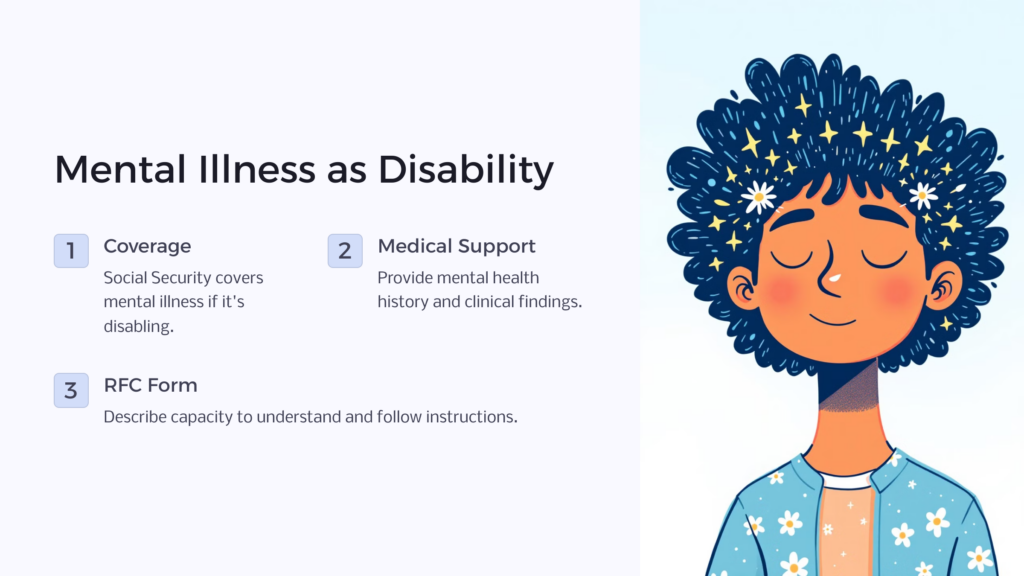

Social Security’s definition of disability includes coverage for mental illness; therefore, you can be approved for Social Security disability payments based on a mental illness if your illness is disabling.

Mental Illness as Disability

You can also potentially qualify based on a combination of physical and mental limitations.

Medical Support for Your Mental Illness Claim

You and your physicians will need to provide documentation of any impairments that you have due to a mental illness. Your treating physician or psychologist or licensed clinical psychiatric social worker will be asked to provide a report that includes your mental health history and clinical findings including mental status examinations and psychological testing. If you are seeing a therapist or counselor, who does not have the licensing listed above, find out whether the counselor works under the supervision of a psychiatrist, for example, and ask that the counselor’s statement be co-signed by the psychiatrist.

The report should include a description of your capacity to understand; to remember and carry out any instructions; and to respond appropriately to supervision, co-workers, and work pressures. Information is also needed about medications you have taken, about their effectiveness, and about any side effects you’ve experienced with the medication. This information can be provided on a Mental Health Residual Functional Capacity (RFC) form of the type available on this site at https://www.benefits.com/forms/rfc-mental.pdf.

If you have been hospitalized, Social Security may request your admit and discharge summaries.

Mental health records often contain very private information, so it is good to know that all information gathered by Social Security is confidential and cannot be released to a third party without your written consent. Additionally, information in your claim file, including your mental health records, will be seen only by those responsible for evaluating your claim.

Other Statements to Support Your Disability Claim

If you had problems related to your mental illness before leaving your last job, a statement from your employer or supervisor could be quite helpful to your claim. If you are having trouble taking care of your daily needs or engaging in social interaction, be sure to describe these problems when you file your claim. You can also submit statements from caseworkers, relatives or friends who are aware of how your symptoms interfere with your ability to take care of yourself and interact with others.

When and Why Social Security Will Request You See a Doctor

If Social Security does not receive enough information from you, your treating physicians and psychologists, and others who know how your illness limits you, they may ask you to attend a Consultative Examination. Social Security will pay for the exam, which is for evaluation only, not for treatment. If you are asked to go to a Consultative Exam, it is extremely important for you to attend and cooperate fully. If you do not, your claim for Social Security Disability payments may be denied.

Does Social Security recognize fibromyalgia as a disability?

Social Security recognizes fibromyalgia to be a medical condition. To qualify for benefits based on fibromyalgia, your condition—like any other medical condition for which people claim disability—must be severe enough to be disabling and must be supported by medical evidence.

Challenges to Getting Social Security Disability Based on Fibromyalgia

Claims for disability caused by fibromyalgia are complicated by three factors. First, many of the symptoms are subjective; that is, there isn’t a test or observation that can prove the symptoms or their severity. For this reason, sometimes disability due to fibromyalgia can be hard to prove. A further complication is that a diagnosis of fibromyalgia may be hard to substantiate because some of the symptoms, such as joint and muscle pain, fatigue, and mental fuzziness can stem from other diagnoses. Receiving care from a rheumatologist who has diagnosed you with fibromyalgia can be helpful in supporting the diagnosis and the level of limitations that you have. A third challenge in establishing disability is that many people with fibromyalgia are able to work, especially in sedentary or light work.

Lawyers for Social Security Disability

For all these reasons, it would be a good idea to hire a Social Security attorney who has experience with fibromyalgia claims to help you file your original Social Security Disability claim or your appeal if your claim has been denied, especially if you have worked in sedentary or light work in the past. If you already have a claim or appeal pending, it is not too late to enhance your chances for approval by retaining legal representation.

Do people with heart problems usually get their Social Security claim approved on their first try?

There are many different kinds of cardiac problems, everything from an occasional rapid heartbeat to heart attacks to congestive heart failure. Some heart patients are approved on their initial claims, others are approved when they appeal, and still others don’t qualify because their conditions are not disabling as Social Security defines disability or disability does not last twelve months.

Whatever the type of cardiac problem you have, your Social Security claim will be evaluated under Social Security’s usual five-step disability evaluation process.

Denials for Short-Term Disability

In addition to determining whether your heart problems are disabling, the disability examiner will also make a determination about how long you will be disabled. Because cardiac conditions can improve with time or treatment, sometimes claims are denied because disability isn’t expected to last twelve months.

If your claim is denied because your disability is expected to be short term, but your disability has continued to be limiting, be sure to file a request for reconsideration within the sixty-day appeal period, even if you haven’t yet been disabled twelve months. This will protect your right to appeal again if you are denied again and your disability extends twelve months. If you have not already hired a Social Security disability lawyer, this would be the time to do so.

Can alcoholics and drug addicts get a Social Security benefit for disability?

A number of years ago, Congress passed a law that prohibits payment of a Social Security benefit for disabilities caused by drug or alcohol addiction, including addiction to prescription medications. However, if you are addicted to drugs or alcohol and you have a disability that is due to an injury or a separate physical or mental illness, you could be approved for disability benefits based on the other condition. For example, you may be able to qualify if in addition to an addiction and also have a disabling mental illness or disabling back condition.

What About Social Security Retirement?

It is worthwhile to note that addiction does not affect your eligibility for a Social Security benefit based on retirement including early reduced retirement benefits.

Can I get disability from Social Security if I have low vision, but am not totally blind?

You can get disability from Social Security for complete blindness and statutory blindness if you are not working too much to meet the definition of disability.

Statutory blindness is defined as either having visual acuity for distance of 20/200 or worse in your best eye with the use of corrective lenses or having a restricted field of vision in your best eye “such that the widest diameter of the visual field subtends an angle no greater than 20 degrees.”

Social Security’s definition of disability includes “the inability to engage in any substantial gainful activity.” If you are blind or statutorily blind as defined by Social Security law, then when Social Security evaluates your new claim or your continuing eligibility for benefits they will use the benchmark for blind individuals to determine whether you are performing or can perform substantial work. The earnings level for substantial work by a blind worker is higher than for a non-blind worker. For example, in 2020, it is $2,110 as compared to $1,260 for non-blind workers. This means that you could have gross wages or net profit from self-employment up to (not including) $2,110 per month in 2020 and still potentially be considered disabled. Additionally, your countable earnings can be reduced by the cost of Impairment-Related Work Expenses (IRWEs). Finally, if you blind and self-employed, Social Security looks only at your self-employment net earnings and not at the services you perform for the business in determining whether you are performing substantial gainful activity.

Social Security Disability Based on Low Vision

It is worthwhile to note, that if you have low vision but are not statutorily blind, you may still be disabled under Social Security’s definition of disability, which considers your past work experience and your education, training and experience to determine whether you are disabled. You might qualify because your eyesight is too poor to do work you have done in the past or any other work for which you have transferable skills. Another possibility is that you might get disability benefits because you have limitations from multiple conditions—your low vision and other medical or psychological conditions. If you are working while applying for disability, Social Security will use the substantial work benchmark for non-blind workers, $1,220 in 2019, when applying its definition of disability to your claim.

Let an Attorney Help

Sometimes it is hard to determine the cause of disabling symptoms, so getting the help of a lawyer who is knowledgeable in Social Security Disability law could make a difference in the outcome of your claim.

At Benefits.com, we are here to help you navigate the process and receive the benefits you deserve. Begin today by taking our free eligibility quiz.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.