Until it happens to them, a close family member, or somebody they know, people rarely think about their chances of becoming disabled in their lifetime. But statistics show that as many as 25% of all 20 year-olds today will become disabled before they reach retirement at age 67.

That number may surprise you and while it isn’t something you need to worry about too much, it does pay to do a little homework to see how your life could be impacted if you do become disabled at some point. Aside from the medical issues you’ll face, you will also need to understand the financial implications as well.

You may have a pension, savings, investments and other financial instruments to protect you, but you may also qualify for Social Security Disability Insurance (SSDI) as a benefit, if you qualify. Here’s what you need to know about how Social Security Administration (SSA) determines SSDI benefits and the process for collecting them in the event you do become disabled.

SSA administers two disability benefit programs that are sometimes confused with each other. SSDI is a benefits program that allows people to collect disability payments if they have been employed and paid into Social Security through payroll deductions during their work life. It is based on a worker’s lifetime earnings, not on how severely disabled someone is or what their current household income is. Supplemental Security Income (SSI) is the other disability benefit program and it is based strictly on need. It is generally reserved for people with few assets and very low household income who meet disability requirements.

Qualifying for Social Security Disability benefits

A portion of your SSA deductions are directed into the Disability Insurance Trust Fund which pays for disability claim benefits. In general, SSA requires that you accumulate 40 credits of paying Social Security taxes over your working life. A credit is defined as one quarter of a year, so you can earn up to 4 credits a year. Of these, SSA requires that 20 work credits must be earned in the past 10 years, ending with the date that you are claiming you became disabled. In addition to meeting the credits requirement, you must also meet the standards SSA requires for claiming you are disabled. Proving you are disabled is part of an extensive disability benefits application process.

The disability benefits application process can take a minimum of three to five months, but can extend out to a much longer timeframe, as much as two years or more, depending on whether or not you are initial approved for disability benefits. If you’re not approved, then you must go through an appeals process to qualify for SSDI.

The disability benefits application process can take a minimum of three to five months, but can extend out to a much longer timeframe, as much as two years or more, depending on whether or not you are initial approved for disability benefits. If you’re not approved, then you must go through an appeals process to qualify for SSDI.

Calculating your SSDI benefits amount

SSDI benefits are based on your lifetime earnings amount and will vary due to a number of factors. In 2018, the average disability benefits amount for SSDI recipients was $1,197 per month, but some SSDI benefits will be less and other monthly benefit amounts could range up to $2,788.

One of the key factors in how much you will receive in benefits is whether or not other family members will also qualify based on your record. Benefits can also be paid to a spouse, a divorced spouse, your children, a disabled child, or an adult child who was disabled before they turned 22 years old. A family benefit can be as much as 150% to 180% of the individual disabled worker’s benefit. Social Security does put a cap on the amount of benefits that can be paid to a family, and if this amount is exceeded, your benefit will not be affected, buy your family benefits will be reduced.

It’s important to note that while your SSDI benefits payments are not impacted by regular income, your benefits may be reduced is you are getting disability payments from other sources, such as workers’ compensation. Benefits made from a private insurance company or those paid as part of veterans’ benefits do not affect your SSDI amount.

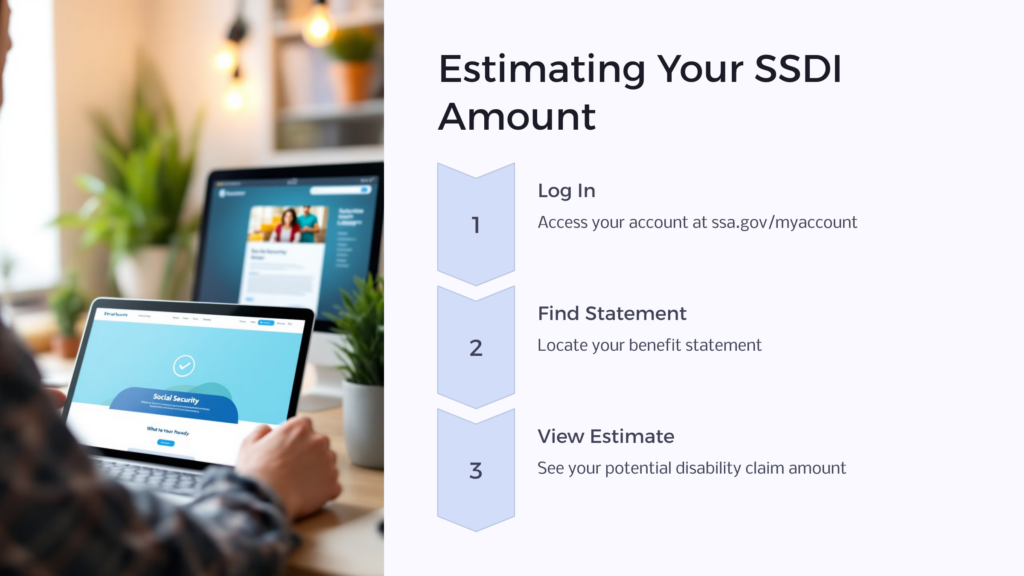

Social Security uses a complicated formula to calculate disability insurance benefits that involves using a worker’s Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA) to determine how much you will receive. However, the vast majority of people will not attempt to use the formulas that SSA uses because Social Security has already done the hard work and will provide an estimate to those who are interested.

To find out your disability benefits amount, log in to your account on the Social Security website and to ssa.gov/myaccount. When you access your benefit statement, it will show you the amount of money you will get on a disability claim.

Another important piece of information you should know is that Social Security has a five-month waiting period for people to collect SSDI benefits from the date they became disabled. What this means is that you should apply for benefits as soon as you think you are disabled. The application process generally takes three to five months, and if you are approved as part of your initial application, this application process will count as part of the waiting period.

What you should know about back pay

Because the application process can take a long time, especially for those who must appeal, by the time they are approved for disability insurance benefits, beneficiaries are also eligible for some form of back pay. The number of months you qualify for back pay will depend on when you applied for SSDI and when SSA decided that you qualified as being disabled. This date is known as an established onset date (EOD). SSDI back pay is disbursed in one lump sum.

You can get payments going back to the date you first applied, but if you can also prove you had an EOD prior to your application date, you can also qualify for up to 12 additional months of retroactive back pay as well.

One other thing to note is that all Social Security benefits, including SSDI payments, are recalculated every year. Cost-of-living increases are made annually based on the Consumer Price Index.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.